The fund performed well as the preferred share recovery now looks pretty solid. As noted in the report of Index Performance, July 2009, both the FixedReset and PerpetualDiscount posted strong gains, particularly in the latter half of the month following the TXPR Revision.

The fund’s performance was helped by its overweighting in PerpetualDiscount issues, as discussed in the post MAPF Portfolio Composition, but managed to outperform even the pure measure of PerpetualDiscount total return due to security selection and frequent trading. This has been accomplished while remaining fully invested in a portfolio with an overall composition that did not change much through the month – which is exactly what I seek to accomplish in managing the fund.

The fund’s Net Asset Value per Unit as of the close July 31 was $11.8181.

| Returns to July 31, 2009 |

| Period |

MAPF |

Index |

CPD

according to

Claymore |

| One Month |

+7.59% |

+4.46% |

+3.35% |

| Three Months |

+21.95% |

+11.49% |

+8.96% |

| One Year |

+56.59% |

+6.50% |

+5.24% |

| Two Years (annualized) |

+20.61% |

-0.79% |

|

| Three Years (annualized) |

+15.38% |

-0.30% |

|

| Four Years (annualized) |

+12.58% |

+0.54% |

|

| Five Years (annualized) |

+11.51% |

++1.43% |

|

| Six Years (annualized) |

+12.76% |

+2.16% |

|

| Seven Years (annualized) |

+12.85% |

+2.75% |

|

| Eight Years (annualized) |

+12.65% |

+2.91% |

|

| The Index is the BMO-CM “50” |

| MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. |

| CPD Returns are for the NAV and are after all fees and expenses. |

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +4.2%, +10.5% and +4.9%, respectively, according to Morningstar after all fees & expenses |

| Figures for Jov Leon Frazer Preferred Equity Fund (which are after all fees and expenses) for 1-, 3- and 12-months are N/A, N/A & N/A, respectively, according to Morningstar and the Globe and Mail |

| Figures for AIC Preferred Income Fund (which are after all fees and expenses) for 1-, 3- and 12-months are +2.5%, +4.1% & N/A, respectively |

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page.

I am very pleased with the returns, but implore Assiduous Readers not to project this level of outperformance for the indefinite future. The past year in the preferred share market has been filled with episodes of panic and euphoria, together with many new entrants who do not appear to know what they are doing; perfect conditions for a disciplined quantitative approach.

All I can say about the fund’s relative returns in the past year is … sometimes everything works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There have been a lot of strongly motivated market participants in the past year, generating a lot of noise! Things won’t always be this good … but for as long as it lasts the fund will attempt to make hay while the sun shines.

A good example of “selling liquidity” is the fund’s accumulation of a position in SLF.PR.B during the month.

Trades Contributing to

the Accumulation of SLF.PR.B

July, 2009 |

| Date |

SLF.PR.C |

SLF.PR.E |

SLF.PR.B |

6/30

Bid |

16.76 |

17.03 |

18.46 |

| 7/20 |

Sold

17.61 |

|

Bought

18.65 |

| 7/22 |

Sold

18.06 |

|

Bought

18.98 |

| 7/23 |

Sold

18.25 |

Sold

18.87 |

Bought

19.00 |

7/31

Closing Bid |

18.31 |

18.51 |

19.52 |

Dividends

Ex-Date |

|

|

|

| This is an attempt to show fairly the effect of numerous trades in tabular form. The trades shown are not necessarily precise dollar-for-dollar swaps. Trade details will be released on the main MAPF web page in the future. |

It may also be noted that SLF.PR.B still has an elevated yield relative to the average level for the Sun Life PerpetualDiscount issues:

SLF PerpetualDiscounts

Comparison, 2009-7-31

At Closing Bid |

| Ticker |

YTW |

| SLF.PR.A |

6.23% |

| SLF.PR.B |

6.24% |

| SLF.PR.C |

6.16% |

| SLF.PR.D |

6.15% |

| SLF.PR.E |

6.16% |

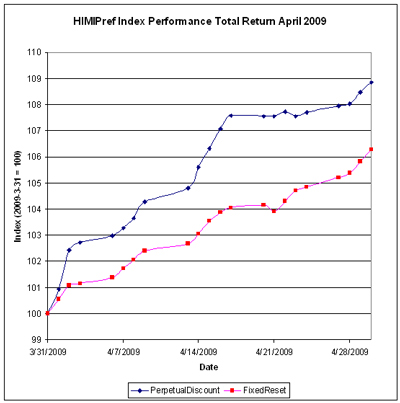

I believe that the trading opportunities amongst the SLF PerpetualDiscounts were triggered by a major seller of SLF.PR.A, which had an influence on the other issues that propogated at different rates while also influenced by a broad general demand for PerpetualDiscounts. In support of this hypothisis, I have uploaded three graphs (prepared by my firm’s analytical software, HIMIPref™):

This is mere explanation after the fact, however. At the time of trade, all that really mattered was that the fund could pick up yield by swapping between issues with identical credit quality and almost identical terms.

Another example of profitable trading was discussed as part of the post on portfolio composition.

There’s plenty of room for new money left in the fund. Just don’t expect the current level of outperformance every year, OK? While I will continue to exert utmost efforts to outperform, it should be borne in mind that beating the index by 500bp represents a good year, and there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit |

| Month |

NAVPU |

Portfolio

Average

YTW |

Leverage

Divisor |

Securities

Average

YTW |

Sustainable

Income |

| June, 2007 |

9.3114 |

5.16% |

1.03 |

5.01% |

0.4665 |

| September |

9.1489 |

5.35% |

0.98 |

5.46% |

0.4995 |

| December, 2007 |

9.0070 |

5.53% |

0.942 |

5.87% |

0.5288 |

| March, 2008 |

8.8512 |

6.17% |

1.047 |

5.89% |

0.5216 |

| June |

8.3419 |

6.034% |

0.952 |

6.338% |

$0.5287 |

| September |

8.1886 |

7.108% |

0.969 |

7.335% |

$0.6006 |

| December, 2008 |

8.0464 |

9.24% |

1.008 |

9.166% |

$0.7375 |

| March 2009 |

$8.8317 |

8.60% |

0.995 |

8.802% |

$0.7633 |

| June |

10.9846 |

7.05% |

0.999 |

7.057% |

$0.7752 |

| July 2009 |

11.8181 |

6.44% |

0.993 |

6.485% |

$0.7664 |

NAVPU is shown after quarterly distributions.

“Portfolio YTW” includes cash (or margin borrowing), with an assumed interest rate of 0.00%

“Securities YTW” divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings.

“Sustainable Income” is the resultant estimate of the fund’s dividend income per unit, before fees and expenses. |

As discussed in the post MAPF Portfolio Composition: July 2009, the fund has positions in splitShares (almost all BNA.PR.C) and an operating retractible, both of which have high yields that are not sustainable: at some point they will be called or mature and the funds will have to be reinvested. Therefore, both of these positions skew the calculation upwards.. Since the yield on these positions is higher than that of the perpetuals despite the fact that the term is limited, the sustainability of the calculated “sustainable yield” is suspect, as discussed in August, 2008.

Significant positions were also held in Fixed-Reset issues on July 31; all of which currently have their yields calculated with the presumption that they will be called by the issuers at par at the first possible opportunity. It is the increase in exposure to the lower-yielding Fixed-Reset class that accounts for the apparent stall in the increase of sustainable income per unit in the past seven months. In December 2008, FixedReset exposure was zero; it is now 11.3%. Exposure to the extraordinarily high-yielding SplitShare class has also been reduced since December due to credit concerns.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 6.14% shown in the July 31 Portfolio Composition analysis (which is in excess of the 6.06% index yield on July 31). Given such reinvestment, the sustainable yield would be 11.8181 * 0.0614 = $0.7256, an increase from the $0.7228 derived by a similar calculation last month.

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.