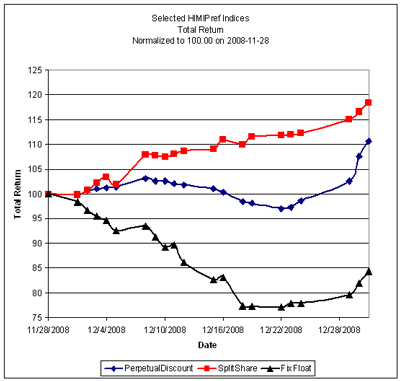

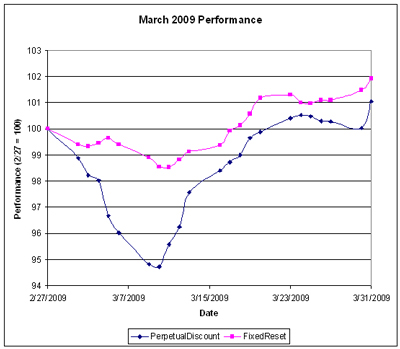

The fund performed well in a volatile month, in which a sharp early drop in values was overtaken by a slow and steady gain:

And … the end of this month marked the eighth full year of operation for Malachite Aggressive Preferred Fund. Since its inception in March, 2001, it has delivered a cumulative return of +100.38% (after expenses, before fees), doubling its money, while the benchmark index has returned a cumulative total of +4.92%.

The fund’s Net Asset Value per Unit as of the close March 31 was $8.8317 after giving effect to a distribution of $0.191322 per unit.

| Returns to March 31, 2009 | |||

| Period | MAPF | Index | CPD according to Claymore |

| One Month | +3.00% | +0.31% | N/A |

| Three Months | +12.14% | +2.72% | N/A |

| One Year | +7.65% | -13.88% | N/A |

| Two Years (annualized) | +2.93% | -10.54% | |

| Three Years (annualized) | +3.77% | -5.86% | |

| Four Years (annualized) | +4.76% | -3.20% | |

| Five Years (annualized) | +5.00% | -2.17% | |

| Six Years (annualized) | +10.18% | -0.10% | |

| Seven Years (annualized) | +8.11% | +0.51% | |

| Eight Years (annualized) | +9.08% | +0.60% | |

| The Index is the BMO-CM “50” | |||

| CPD Returns are for the NAV and are after all fees and expenses. | |||

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.5%, +2.4% and -13.9%, respectively, according to Morningstar after all fees & expenses | |||

| Figures for Jov Leon Frazer Preferred Equity Fund (which are after all fees and expenses) for 1-, 3- and 12-months are N/A, N/A & N/A, respectively, according to Morningstar | |||

Returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit | |||||

| Month | NAVPU | Portfolio Average YTW |

Leverage Divisor |

Securities Average YTW |

Sustainable Income |

| June, 2007 | 9.3114 | 5.16% | 1.03 | 5.01% | 0.4665 |

| September | 9.1489 | 5.35% | 0.98 | 5.46% | 0.4995 |

| December, 2007 | 9.0070 | 5.53% | 0.942 | 5.87% | 0.5288 |

| March, 2008 | 8.8512 | 6.17% | 1.047 | 5.89% | 0.5216 |

| June | 8.3419 | 6.034% | 0.952 | 6.338% | $0.5287 |

| September | 8.1886 | 7.108% | 0.969 | 7.335% | $0.6006 |

| December, 2008 | 8.0464 | 9.24% | 1.008 | 9.166% | $0.7375 |

| March 2009 | $8.8317 | 8.60% | 0.995 | 8.802% | $0.7633 |

| NAVPU is shown after quarterly distributions. “Portfolio YTW” includes cash (or margin borrowing), with an assumed interest rate of 0.00% “Securities YTW” divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings. “Sustainable Income” is the resultant estimate of the fund’s dividend income per unit, before fees and expenses. |

|||||

As discussed in the post MAPF Portfolio Composition: March 2009, the fund has positions in splitShares (almost all BNA.PR.C) and an operating retractible (YPG.PR.B), both of which skew the calculation. Since the yield on thes positions is higher than that of the perpetuals despite the fact that the term is limited, the sustainability of the calculated “sustainable yield” is suspect, as discussed in August.

Additionally, the calculated yield for the fixed-floater in the portfolio, BCE.PR.I, depends on the presumed value of Canada Prime (3.00%) and the percentage of Canada Prime paid on par value (100%); both of these figures may change. Prime is, in fact, now only 2.50% – while this change will affect the calculation of sustainable yield, this issue has a fixed yield until August 1, 2011.

And finally, the yield calculations with respect to FixedReset issues is dependent upon a constant yield of the 5-Year Canada bonds whence the reset rate is calculated. Calculations include the contemporary yield on 5-Year Canada’s; if this value were to be increased, the calculated yield-to-worst on the Fixed-Reset issues held would also increase.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 7.60% shown in the March 31 Portfolio Composition analysis (which is in excess of the 7.29% index yield on March 31). Given such reinvestment, the sustainable yield would be 8.8317 * 0.0760 = $0.6712., an slight decrease from the $0.6850 derived by a similar calculation last month; the decline may be attributed to the increase in credit quality over the month.

Different assumptions lead to different calculations, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.