There are a few new tidbits of information coming out about the arrest of Navinder Singh Sarao, but nothing worth a complete post. I have updated the posts Scapegoat for Flash Crash Isolated! and Flash Crash: Incompetence, Position Limits, Retail. Seems to me to be a case of stupid people attempting to enforce stupid rules in a stupid manner and ending up with a severe case of stupid. So, yeah, the obvious solution is to toss some petty little clown in jail for thirty years or so. That’s justice.

FRBNY President William Dudley gave a speech Monday titled The U.S. Monetary Policy Outlook and its Global Implications which Bloomberg sumamarizes as ‘inflation will pick up due to oil, rent, jobs and expectations’. I was more interested in his endorsement of mission-creep, which I complained about yesterday:

A second area in which we can and must collectively do better is safeguarding global financial stability. Simply put, we failed to act both early enough and decisively enough to stem the credit excesses that spawned the financial crisis and the Great Recession. While the U.S. was not alone in this shortcoming, given our position in the global financial system we especially should have done a better job. We’ve taken important steps through new legislative mandates and a broader effort to rethink our regulatory and supervisory framework. In particular, systemically important banking organizations must now hold higher amounts of capital and liquidity that are better aligned with their risk profiles and the official sector is making progress in ensuring no financial firm will be too-big-to-fail.

Although this remains very much a work in progress, these efforts should help us to avoid repeating the mistakes of the recent past, and enable us to be more proactive in mitigating potential future vulnerabilities. Of course, we at the Fed are not alone here. Since the recent financial crisis, central banks worldwide have been engaged in a broad rethinking of how to better fulfill their mandates.

So it looks like all the central bankers of the world are going to have to go to stockbroker school: ‘Yes, it looks at first glance as if I’ve made some pretty horrible recommendations that have lost you a lot of money. But if you hadn’t done this and then that had happened, it would have been worse!’ Isn’t risk wonderful? There’s always a worse-case scenario you can point at.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts up 8bp, FixedResets gaining 6bp and DeemedRetractibles off 18bp. The Performance Highlights table continues to show extreme volatility. Volume was high.

PerpetualDiscounts now yield 5.11%, equivalent to 6.64% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 3.7%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 295bp,, a slight (and perhaps spurious) uptick from the 290bp reported April 8.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 22.26 to be $0.41 rich, while TRP.PR.B, resetting 2015-6-30 at +128, is $0.39 cheap at its bid price of 14.42.

Another excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.I, resetting at +286 on 2017-9-19, bid at 25.06 to be $0.46 rich, while MFC.PR.K, resetting at +222bp on 2018-9-19, is bid at 21.36 to be $0.69 cheap.

This fit is actually quite good.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 19.15 to be $0.50 cheap. BAM.PF.G, resetting at +284bp 2020-6-30 is bid at 23.50 and appears to be $0.59 rich.

FTS.PR.H, with a spread of +145bp, and bid at 15.73, looks $0.80 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 21.01 and is $0.32 rich.

Investment-grade pairs now predict an average over the next five years of about 0.30%. The DC.PR.B / DC.PR.D pair has reversed yesterday‘s nonsense and has returned to its customary outlier status, with a breakeven rate of -1.41%.

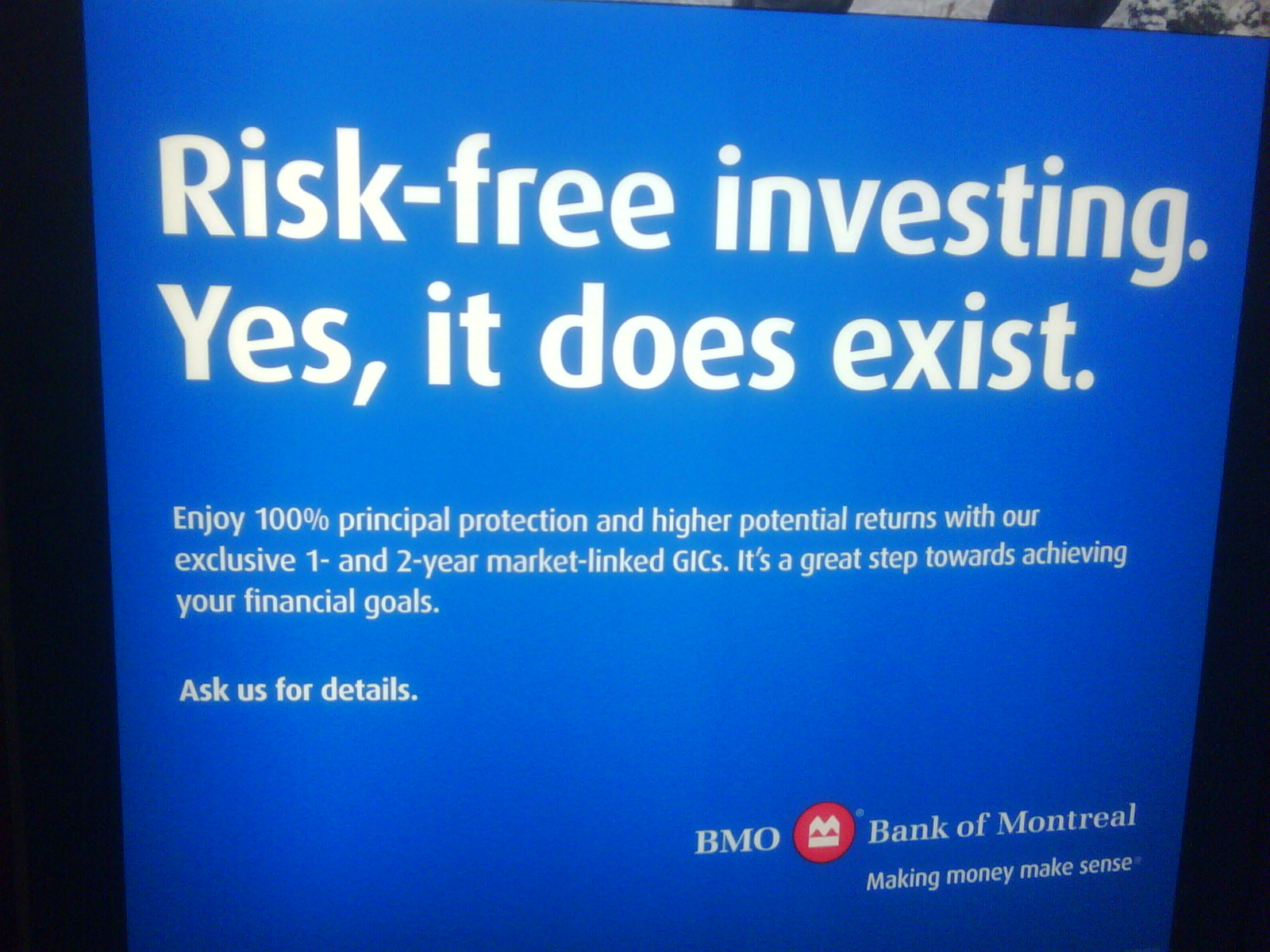

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.7088 % | 2,181.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.7088 % | 3,813.4 |

| Floater | 3.33 % | 3.51 % | 56,651 | 18.50 | 4 | -0.7088 % | 2,318.5 |

| OpRet | 4.43 % | -2.18 % | 39,675 | 0.11 | 2 | -0.0197 % | 2,762.6 |

| SplitShare | 4.56 % | 4.52 % | 64,456 | 3.40 | 3 | 0.0533 % | 3,231.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0197 % | 2,526.1 |

| Perpetual-Premium | 5.33 % | 1.42 % | 66,751 | 0.09 | 25 | -0.0079 % | 2,516.1 |

| Perpetual-Discount | 5.11 % | 5.11 % | 144,618 | 15.05 | 9 | 0.0801 % | 2,794.0 |

| FixedReset | 4.62 % | 3.95 % | 282,657 | 16.14 | 85 | 0.0568 % | 2,312.6 |

| Deemed-Retractible | 4.92 % | 3.52 % | 109,690 | 0.83 | 36 | -0.1800 % | 2,647.0 |

| FloatingReset | 2.58 % | 2.94 % | 74,026 | 6.23 | 8 | 0.0053 % | 2,346.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.Z | FixedReset | -1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 22.66 Evaluated at bid price : 23.31 Bid-YTW : 4.24 % |

| IFC.PR.A | FixedReset | -1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.35 Bid-YTW : 6.28 % |

| GWO.PR.N | FixedReset | -1.50 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.10 Bid-YTW : 6.79 % |

| BAM.PR.C | Floater | -1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 14.10 Evaluated at bid price : 14.10 Bid-YTW : 3.56 % |

| BAM.PR.K | Floater | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 14.01 Evaluated at bid price : 14.01 Bid-YTW : 3.58 % |

| FTS.PR.J | Perpetual-Premium | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 23.80 Evaluated at bid price : 24.20 Bid-YTW : 4.96 % |

| BAM.PR.B | Floater | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 14.30 Evaluated at bid price : 14.30 Bid-YTW : 3.51 % |

| CM.PR.O | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 22.59 Evaluated at bid price : 23.50 Bid-YTW : 3.49 % |

| PWF.PR.T | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 23.00 Evaluated at bid price : 24.27 Bid-YTW : 3.44 % |

| ENB.PR.Y | FixedReset | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 18.90 Evaluated at bid price : 18.90 Bid-YTW : 4.60 % |

| ENB.PR.H | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 17.44 Evaluated at bid price : 17.44 Bid-YTW : 4.62 % |

| BAM.PF.F | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 22.48 Evaluated at bid price : 23.30 Bid-YTW : 4.17 % |

| SLF.PR.G | FixedReset | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.50 Bid-YTW : 7.24 % |

| RY.PR.H | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 22.79 Evaluated at bid price : 23.93 Bid-YTW : 3.34 % |

| ENB.PF.G | FixedReset | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 20.60 Evaluated at bid price : 20.60 Bid-YTW : 4.67 % |

| CU.PR.G | Perpetual-Discount | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 23.16 Evaluated at bid price : 23.49 Bid-YTW : 4.84 % |

| BAM.PR.X | FixedReset | 1.95 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 16.75 Evaluated at bid price : 16.75 Bid-YTW : 4.35 % |

| BAM.PF.E | FixedReset | 2.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 21.46 Evaluated at bid price : 21.75 Bid-YTW : 4.23 % |

| TRP.PR.B | FixedReset | 2.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 14.42 Evaluated at bid price : 14.42 Bid-YTW : 3.76 % |

| MFC.PR.M | FixedReset | 2.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.00 Bid-YTW : 4.67 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.A | FloatingReset | 376,415 | RBC crossed 372,100 at 24.30. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.30 Bid-YTW : 3.12 % |

| TRP.PR.B | FixedReset | 218,749 | TD crossed blocks of 100,000 and 111,400, both at 14.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 14.42 Evaluated at bid price : 14.42 Bid-YTW : 3.76 % |

| TRP.PR.F | FloatingReset | 129,100 | Scotia crossed blocks of 70,000 and 46,600, both at 18.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 3.54 % |

| FTS.PR.H | FixedReset | 90,100 | TD sold 17,400 to RBC at 15.70, then crossed 41,300 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 15.73 Evaluated at bid price : 15.73 Bid-YTW : 3.74 % |

| BAM.PR.T | FixedReset | 87,416 | RBC crossed 77,800 at 19.58. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 19.55 Evaluated at bid price : 19.55 Bid-YTW : 4.27 % |

| ENB.PR.B | FixedReset | 67,812 | RBC crossed 50,000 at 18.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-22 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 4.69 % |

| There were 47 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BNS.PR.C | FloatingReset | Quote: 24.10 – 24.71 Spot Rate : 0.6100 Average : 0.4216 YTW SCENARIO |

| IAG.PR.A | Deemed-Retractible | Quote: 24.15 – 24.53 Spot Rate : 0.3800 Average : 0.2697 YTW SCENARIO |

| PWF.PR.H | Perpetual-Premium | Quote: 25.35 – 25.60 Spot Rate : 0.2500 Average : 0.1496 YTW SCENARIO |

| TRP.PR.F | FloatingReset | Quote: 18.00 – 18.43 Spot Rate : 0.4300 Average : 0.3321 YTW SCENARIO |

| GWO.PR.N | FixedReset | Quote: 17.10 – 17.49 Spot Rate : 0.3900 Average : 0.2971 YTW SCENARIO |

| CU.PR.G | Perpetual-Discount | Quote: 23.49 – 23.80 Spot Rate : 0.3100 Average : 0.2177 YTW SCENARIO |