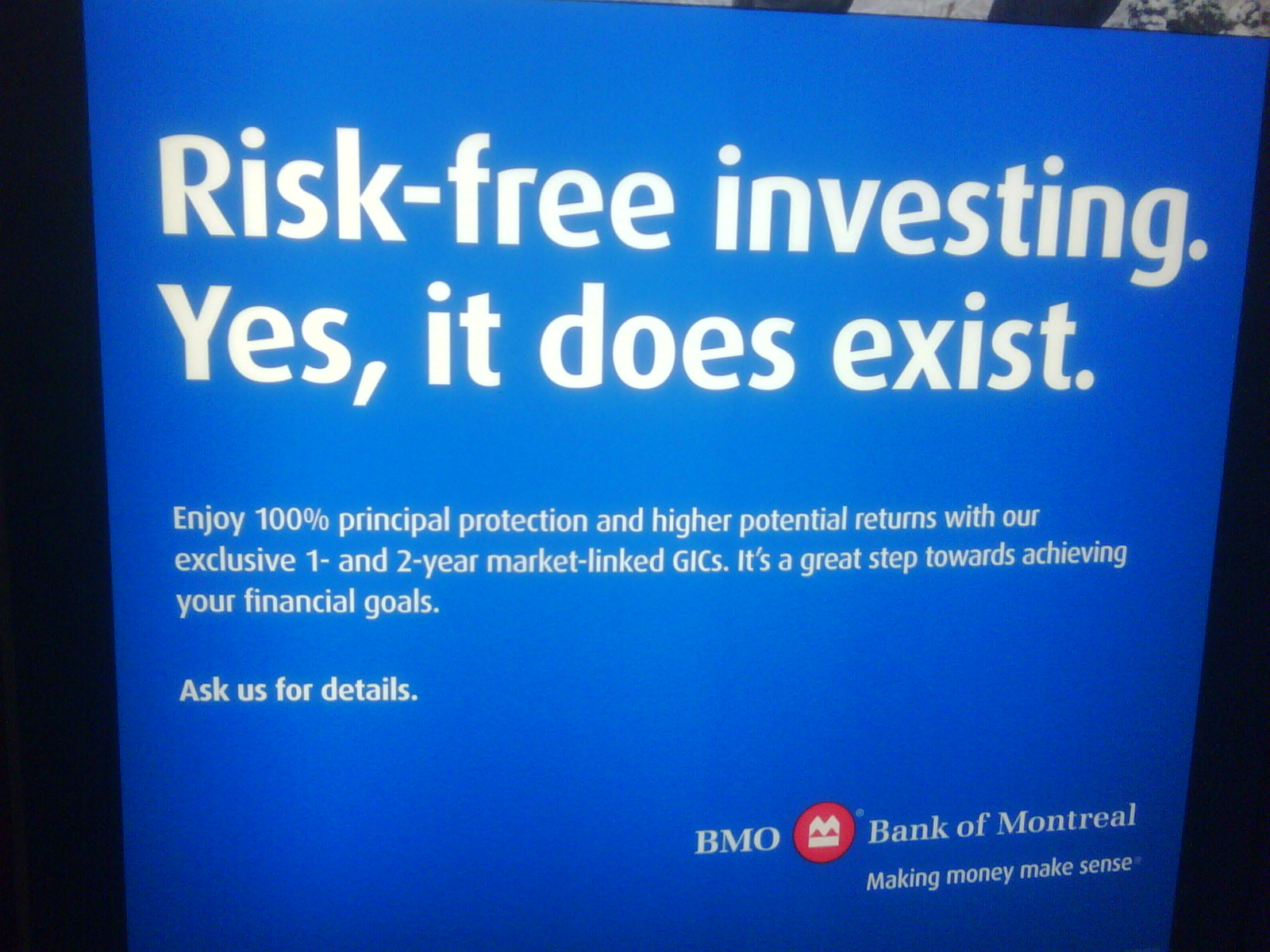

SEC Commissioner Luis A. Aguilar managed to deliver notice of his own incompetence and a slap in the face to Canadian regulators simultaneously:

Now let’s talk about one particular type of complex security known as structured notes — which has now become a $45 billion market — and where the registered offerings are targeted at retail investors.[22] In fact, recent data shows that an estimated 99% of all purchasers of these products are retail investors.[23] These securities are issued by large financial institutions and offer returns that are linked to the performance of a reference asset or index.[24] In their most basic form, structured notes are investment products that typically have a fixed maturity that includes a bond component and an embedded derivative.[25] What isn’t always made clear are the risks of these debt look-alikes — of which there can be many. As the SEC recently pointed out in an Investor Bulletin, the risks of these products include, among others, the products’ complex payoff structures, market risk on the reference asset or index, high fees, a lack of a liquid secondary market, opaque pricing, credit risk, and complicated payoff structures that can make it difficult to assess value, risk, and potential for growth.[26] Moreover, there are a wide variety of structured notes that have different risk profiles — some of these examples include principal protected notes, reverse convertible notes, enhanced participation or leveraged notes, and hybrid notes that combine multiple characteristics.[27]

Structured notes grabbed widespread public notoriety in 2008 when Lehman Brothers filed the biggest bankruptcy in U.S. history.[28] Lehman Brothers had sold unsecured debt called “principal protected notes” that became worthless when the firm collapsed, and investors lost billions of dollars as a result.[29] In essence, the securities sold as “principal protected” were really not “protected;” in fact, the “protection” that was offered was tied to the creditworthiness of the issuer, which cratered along with Lehman Brothers. These products have been referred to as “Trojan horses” that ultimately enter into an investment portfolio and destroy people’s life savings.[30]

Well, yeah. A guarantee is only as good as the guarantor. Since when is that news? Meanwhile, here in Canada:

There’s an interesting story about emerging battery technologies and players on Bloomberg.

$500 sounds like an awful lot to pay to store $0.20 (tops) worth of electricity, but:

[MIT Professor Donald] Sadoway, a 65-year-old Canadian, defies the nerdy inventor mold. He’s been known to teach his class in a tuxedo while serving champagne. Yet he’s all science when explaining batteries. He says Ambri can top lithium-ion on price and longevity with tricky chemistry that he and a former student have finally perfected. The battery combines two metals Sadoway won’t disclose that have different weights and melting points. He separates them with a salt layer. Electric currents heat the metals to as much as 700 degrees Celsius (1,292 degrees Fahrenheit) to pass electrons through the molten salt. That helps the metals hold more energy. Unlike the lithium-ion in laptops, which can take about 400 charges and last four years, Sadoway says his batteries can take 10,000 charges and work for at least a decade.

So if you do it 10,000 times, that’s $0.05 per cycle in capital cost, and the arbitrage over time just got a lot more interesting.

Sadoway is one of the first out of the gate. This year, he plans to ship six 10-ton prototypes packed with hundreds of liquid metal cells to wind and solar farms in Hawaii, a microgrid in Alaska, and a Consolidated Edison substation in Manhattan. Ambri’s battery will store power Con Ed offloads when demand is low. Then, rather than cranking up another coal- or gas-fired plant, the utility will drain the battery when New Yorkers want more juice

It is of great interest to learn that AltaGas has issued 2-Year USD FRNs at USD 3-Month LIBOR + 85bp. 3-Month LIBOR will generally be roughly equal to 3-Month Treasuries plus a spread, the famous TED Spread, currently about 25bp, where it is most of the time. So, for the sake of round-figures, say these notes have been issued at 3-Month Treasuries +125.

Now compare this with, for instance, ALA.PR.A, which currently pays $1.25 p.a. and will become exchangeable into a FloatingReset paying 3-Month bills+317bp at the end of October and is bid today at 19.35 to yield 4.51% to perpetuity (assuming a yield on the underlying Canada of 0.78%. That’s quite the difference!

We can, and almost certainly will, argue for hours about how much effect there is of tax effects, currency, maturity date and liquidity in the difference between these spreads. But it’s a fascinating contrast anyway.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts down 73bp, FixedResets off 10bp and DeemedRetractibles gaining 1bp. The Performance Highlights table continues to illustrate a high level of volatility. Volume was above average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 23.88 to be $1.66 rich, while TRP.PR.C, resetting 2016-1-30 at +154, is $1.05 cheap at its bid price of 15.45.

Another excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.N, resetting at +230 on 2020-3-19, bid at 23.65 to be $0.51 rich, while MFC.PR.H, resetting at +313bp on 2017-3-19, is bid at 25.16 to be $0.85 cheap. The lowest spread issue, MFC.PR.F, is noticeably off the curve defined by its peers.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 19.25 to be $0.90 cheap. BAM.PF.E, resetting at +255bp 2020-3-31 is bid at 23.10 and appears to be $1.29 rich.

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 15.40, looks $1.12 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 21.77 and is $0.71 rich.

Investment-grade pairs other than TRP.PR.A / TRP.PR.F now predict an average over the next five years of about 0.30%. TRP.PR.A / TRP.PR.F remains an outlier, predicting 1.03%. The DC.PR.B / DC.PR.D pair is still off the charts and now predicts an average bill rate over the next 4 3/4 years of -1.18%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.9471 % | 2,139.5 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.9471 % | 3,740.9 |

| Floater | 3.39 % | 3.50 % | 58,788 | 18.54 | 4 | -1.9471 % | 2,274.5 |

| OpRet | 4.43 % | -1.52 % | 36,854 | 0.13 | 2 | 0.0000 % | 2,762.1 |

| SplitShare | 4.57 % | 4.56 % | 61,508 | 3.42 | 3 | 0.0534 % | 3,225.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 2,525.6 |

| Perpetual-Premium | 5.31 % | 0.73 % | 65,242 | 0.08 | 25 | 0.0126 % | 2,524.6 |

| Perpetual-Discount | 5.15 % | 5.07 % | 150,570 | 14.91 | 9 | -0.7257 % | 2,770.6 |

| FixedReset | 4.55 % | 3.82 % | 263,779 | 16.40 | 85 | -0.0981 % | 2,346.0 |

| Deemed-Retractible | 4.89 % | 1.93 % | 107,614 | 0.12 | 36 | 0.0055 % | 2,657.3 |

| FloatingReset | 2.54 % | 2.95 % | 76,314 | 6.26 | 8 | 0.1232 % | 2,344.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.C | FixedReset | -3.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 15.92 Evaluated at bid price : 15.92 Bid-YTW : 3.54 % |

| PWF.PR.A | Floater | -3.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 16.60 Evaluated at bid price : 16.60 Bid-YTW : 3.03 % |

| BAM.PR.K | Floater | -2.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 13.82 Evaluated at bid price : 13.82 Bid-YTW : 3.63 % |

| BAM.PF.D | Perpetual-Discount | -2.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 22.39 Evaluated at bid price : 22.75 Bid-YTW : 5.41 % |

| TD.PF.B | FixedReset | -2.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 22.73 Evaluated at bid price : 23.78 Bid-YTW : 3.29 % |

| BAM.PF.B | FixedReset | -1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 21.42 Evaluated at bid price : 21.75 Bid-YTW : 4.11 % |

| IFC.PR.C | FixedReset | -1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.30 Bid-YTW : 3.94 % |

| BAM.PR.X | FixedReset | -1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 16.91 Evaluated at bid price : 16.91 Bid-YTW : 4.18 % |

| ENB.PR.N | FixedReset | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 4.58 % |

| ENB.PR.T | FixedReset | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 19.14 Evaluated at bid price : 19.14 Bid-YTW : 4.55 % |

| ENB.PR.B | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 17.91 Evaluated at bid price : 17.91 Bid-YTW : 4.63 % |

| BAM.PR.C | Floater | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 14.17 Evaluated at bid price : 14.17 Bid-YTW : 3.54 % |

| BAM.PR.N | Perpetual-Discount | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 21.94 Evaluated at bid price : 22.34 Bid-YTW : 5.34 % |

| FTS.PR.M | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 22.95 Evaluated at bid price : 24.36 Bid-YTW : 3.47 % |

| MFC.PR.N | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.65 Bid-YTW : 4.20 % |

| TRP.PR.E | FixedReset | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 22.75 Evaluated at bid price : 23.88 Bid-YTW : 3.44 % |

| ENB.PF.G | FixedReset | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 20.60 Evaluated at bid price : 20.60 Bid-YTW : 4.58 % |

| PWF.PR.P | FixedReset | 1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 17.23 Evaluated at bid price : 17.23 Bid-YTW : 3.59 % |

| BAM.PR.R | FixedReset | 2.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 19.25 Evaluated at bid price : 19.25 Bid-YTW : 4.20 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.I | FixedReset | 148,432 | Nesbitt crossed blocks of 89,600 and 50,000, both at 25.22. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.13 Bid-YTW : 3.61 % |

| IFC.PR.C | FixedReset | 90,676 | Desjardins crossed 12,600 at 24.70. Nesbitt crossed two blocks of 25,000 each at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.30 Bid-YTW : 3.94 % |

| TRP.PR.G | FixedReset | 87,139 | Scotia crossed 25,000 at 25.05, then sold 10,000 to RBC at 25.00. RBC crossed 25,000 at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 23.08 Evaluated at bid price : 24.87 Bid-YTW : 3.68 % |

| TD.PR.R | Deemed-Retractible | 87,009 | TD crossed 45,400 at 25.49. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-30 Maturity Price : 25.50 Evaluated at bid price : 25.48 Bid-YTW : 4.24 % |

| BAM.PF.G | FixedReset | 79,566 | TD crossed blocks of 25,600 shares, 40,000 and 12,000, all at 24.27. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 22.88 Evaluated at bid price : 24.27 Bid-YTW : 3.89 % |

| HSE.PR.E | FixedReset | 63,420 | RBC crossed 40,000 at 25.22. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-04-14 Maturity Price : 23.21 Evaluated at bid price : 25.15 Bid-YTW : 4.28 % |

| There were 39 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| TD.PF.B | FixedReset | Quote: 23.78 – 24.45 Spot Rate : 0.6700 Average : 0.4089 YTW SCENARIO |

| ENB.PR.J | FixedReset | Quote: 20.10 – 20.49 Spot Rate : 0.3900 Average : 0.2363 YTW SCENARIO |

| BAM.PF.D | Perpetual-Discount | Quote: 22.75 – 23.12 Spot Rate : 0.3700 Average : 0.2163 YTW SCENARIO |

| BAM.PR.K | Floater | Quote: 13.82 – 14.30 Spot Rate : 0.4800 Average : 0.3468 YTW SCENARIO |

| CU.PR.G | Perpetual-Discount | Quote: 23.30 – 23.62 Spot Rate : 0.3200 Average : 0.1956 YTW SCENARIO |

| CIU.PR.C | FixedReset | Quote: 15.92 – 16.59 Spot Rate : 0.6700 Average : 0.5566 YTW SCENARIO |

You could also compare the AltaGas “2-Year USD FRNs at USD 3-Month LIBOR + 85bp” to the US$ ALA.PR.U with rate reset formula of “five-year US government bond yield plus 3.58%” trading at $2 under par. The current US five-year yield is 1.34% at which ALA.PR.U would reset to 4.92% on Sep 30, 2017. The rate reset market is significantly underpriced at the moment vs other fixed income markets.