Grecian-based multinationals being higher rated than the sovereign is old hat. Japan is another matter:

Toyota Motor Corp. and Canon Inc. are among 13 Japanese companies that will have higher ratings than their home country at Standard & Poor’s after the nation was downgraded.

Japan’s credit rating was cut for the first time in nine years as the world’s most indebted nation staggers under 943 trillion yen ($11 trillion) of borrowings, with the grade lowered one step to AA-. Toyota, the world’s biggest carmaker, and Canon, the largest camera maker, along with companies including mobile phone operator NTT Docomo Inc. and Nippon Telegraph & Telephone Corp., are rated a grade higher.

A nation’s rating doesn’t constitute a ceiling for a corporate rating, which instead depends on analysts’ judgment of inherent creditworthiness, according to S&P’s policy. Exporters that have significant overseas earnings and don’t rely on public authorities may be graded higher than the sovereign, the ratings firm said in a 2002 report.

The Bank of Canada has released a working paper by Garima Vasishtha and Philipp Maier titled The Impact of the Global Business Cycle on Small Open Economies: A FAVAR Approach for Canada:

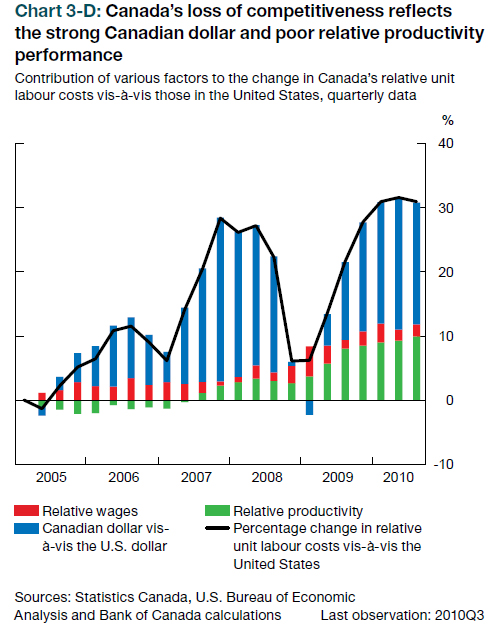

Building on the growing evidence on the importance of large data sets for empirical macroeconomic modeling, we use a factor-augmented VAR (FAVAR) model with more than 260 series for 20 OECD countries to analyze how global developments affect the Canadian economy. We focus on several sources of shocks, including commodity prices, foreign economic activity, and foreign interest rates. We evaluate the impact of each shock on key Canadian macroeconomic variables to provide a comprehensive picture of the effect of international shocks on the Canadian economy. Our findings indicate that Canada is primarily exposed to shocks to foreign activity and to commodity prices. In contrast, the impact of shocks to global interest rates or global inflation is substantially lower. Our findings also expose the different channels through which higher commodity prices impact the Canadian economy: Canada benefits from higher commodity prices through a positive terms of trade shock, but at the same time, higher commodity prices tend to lower global economic activity, hurting demand for Canadian exports.

There were mixed results on the Canadian preferred share market today, as PerpetualDiscounts gained 25bp while FixedResets lost 4bp. Volume returned to average levels.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0360 % | 2,376.5 |

| FixedFloater | 4.79 % | 3.49 % | 26,070 | 19.13 | 1 | 0.0000 % | 3,553.1 |

| Floater | 2.52 % | 2.29 % | 41,709 | 21.54 | 4 | -0.0360 % | 2,566.0 |

| OpRet | 4.81 % | 3.42 % | 66,992 | 2.27 | 8 | 0.3289 % | 2,388.4 |

| SplitShare | 5.28 % | 0.61 % | 385,142 | 0.86 | 4 | -0.0598 % | 2,473.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3289 % | 2,184.0 |

| Perpetual-Premium | 5.64 % | 5.20 % | 138,435 | 5.30 | 20 | 0.1304 % | 2,034.4 |

| Perpetual-Discount | 5.31 % | 5.27 % | 259,148 | 14.99 | 57 | 0.2452 % | 2,085.8 |

| FixedReset | 5.26 % | 3.58 % | 282,906 | 3.02 | 52 | -0.0443 % | 2,270.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BMO.PR.P | FixedReset | -1.91 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.73 Bid-YTW : 3.49 % |

| BAM.PR.R | FixedReset | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 23.34 Evaluated at bid price : 25.70 Bid-YTW : 4.81 % |

| RY.PR.F | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 22.59 Evaluated at bid price : 22.75 Bid-YTW : 4.89 % |

| GWO.PR.M | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.39 Bid-YTW : 5.67 % |

| HSB.PR.D | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 23.62 Evaluated at bid price : 23.87 Bid-YTW : 5.28 % |

| BAM.PR.M | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 5.72 % |

| BAM.PR.N | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 21.05 Evaluated at bid price : 21.05 Bid-YTW : 5.71 % |

| BAM.PR.J | OpRet | 2.07 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 26.18 Bid-YTW : 4.72 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.I | Perpetual-Discount | 125,267 | Nesbitt crossed 100,000 at 23.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 23.19 Evaluated at bid price : 23.40 Bid-YTW : 5.04 % |

| TRP.PR.A | FixedReset | 107,392 | Nesbitt crossed two blocks of 50,000 each, both at 26.23. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 3.47 % |

| HSB.PR.E | FixedReset | 62,360 | RBC crossed 50,000 at 27.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.44 Bid-YTW : 3.84 % |

| BNS.PR.R | FixedReset | 54,599 | Nesbitt crossed 50,000 at 26.08. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-25 Maturity Price : 25.00 Evaluated at bid price : 26.09 Bid-YTW : 3.47 % |

| BNS.PR.X | FixedReset | 53,122 | RBC crossed two blocks of 25,000 each, both at 27.27. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.28 Bid-YTW : 3.41 % |

| TRP.PR.C | FixedReset | 53,001 | Nesbitt crossed 50,000 at 25.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-29 Maturity Price : 25.00 Evaluated at bid price : 25.37 Bid-YTW : 4.08 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | |||

| Issue | Index | Quote Data | Notes |

| GWO.PR.G | Perpetual-Discount | Quote: 23.86 – 24.38 Spot Rate : 0.5200 Average : 0.3092 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 23.57 Evaluated at bid price : 23.86 Bid-YTW : 5.50 % |

| BAM.PR.R | FixedReset | Quote: 25.70 – 26.18 Spot Rate : 0.4800 Average : 0.3317 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 23.34 Evaluated at bid price : 25.70 Bid-YTW : 4.81 % |

| BAM.PR.H | OpRet | Quote: 25.33 – 25.78 Spot Rate : 0.4500 Average : 0.3130 |

YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2012-03-30 Maturity Price : 25.00 Evaluated at bid price : 25.33 Bid-YTW : 4.99 % |

| NA.PR.N | FixedReset | Quote: 26.60 – 26.95 Spot Rate : 0.3500 Average : 0.2428 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-14 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 2.69 % |

| IAG.PR.C | FixedReset | Quote: 26.81 – 27.24 Spot Rate : 0.4300 Average : 0.3256 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.81 Bid-YTW : 3.80 % |

| IAG.PR.A | Perpetual-Discount | Quote: 22.15 – 22.43 Spot Rate : 0.2800 Average : 0.1868 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-28 Maturity Price : 22.01 Evaluated at bid price : 22.15 Bid-YTW : 5.24 % |