The Canadian Securities Administrators have brought in proposals to maximize the risk of single-point failure in Canada, titled Consultation Paper 91‐401 on Over‐the‐Counter Derivatives Regulation in Canada. One of the risks outlined is the potential for doing business in a productive manner:

Regulatory inaction is not an option given the commitments Canada has made as part of the G20. Notwithstanding Canada’s G20 commitments, there are compelling reasons to introduce regulation. Because OTC derivatives trading takes place across borders, if other countries adopt stringent regulations, and Canada does not act, it may gain a reputation as a haven, resulting in regulatory arbitrage and a flight of risky trading to Canada.

Mind you, the scare factor of “risky trading” is inflammatory bullshit. The proposals are all about central clearing, not “risky trading”.

The Canadian Securities Law blog advises:

CNSX Markets Inc., the operator of the Canadian National Stock Exchange and Pure Trading has proposed amendments to its Policy 2 that would extend listing eligibility to certain prospectus-exempt debt securities. The amendments to Policy 2 would mirror language contained in its Restated Order. Comments are being accepted on the amendments for 30 days from today.

OSC Notice 2010-006 specifies:

The prospectus-exempt debt securities that CNSX Markets seeks to list are currently distributed to the public in Canada under the exemptions set out in the Restated Order, following which the securities are freely traded over-the-counter with settlement through FundServ.

This might mean simply GICs: FundSERV is making a push in this market:

FundSERV announces the launch of GICSERV, an industry wide network for automating brokered GIC transactions. The first release of industry standards are now available for comment.

“We saw the brokered GIC market as a perfect chance for FundSERV to utilize its business and technical capabilities to further support our existing distribution customers and other participants in this financial services segment,” said Brian Gore, president and chief executive officer at FundSERV. “Our goal is to allow our existing network to facilitate standards and automation in the brokered GIC market.”

It will be most interesting to see how the CNSX proposal unfolds. Will it be strictly a new issue market – for instance, if you bid 2.55% for a five year GIC and somebody hits you, will you get a brand new GIC with a 2.55% coupon? Probably not, since that would restrict the sellers to issuers only. Perhaps there will be conversion formulas and such, so that when you get hit on your 2.55% bid, you get whatever the seller wants to deliver … a higher (lower) coupon with a lower (higher) price. In such a case, I will be fascinated to see whether the brokerages start showing account statments with the price of the GIC marked to market.

However, PPNs might be the securities in question:

Treatment of Deposit Products

SSI commented that clarification is required to address the treatment of deposit products held in dealer client accounts, such as Guaranteed Investment Certificates (“GICs”) or Principal Protected Notes (“PPNs”) and asked how accrued interest is to be addressed in determining market values.

MFDA Response

The market value of GICs should be reported as the principle amount plus accrued interest earned as at the end of the account statement period.

With respect to reporting the value of PPNs, certain PPNs have market values that are available on FundSERV. However, for PPNs that do not have a reliable market value, the book value should be reported.

Political manoeuvering over the Volcker Rule was mentioned briefly on November 4. Jim Hamilton’s World of Securities Regulation has more details and supporting documentation, and a post detailing support for the Rule. There is also some reason to hope that US Covered Bonds will be forthcoming.

Pam Martens writes an entertaining, if paranoid, account of the Flash Crash titled The “Flash Crash” Cover-Up:

The official report does not break out the wealth destruction to the small investor on May 6, but Ms. Schapiro shared that information on September 7 with the Economic Club of New York: “A staggering total of more than $2 billion in individual investor stop loss orders is estimated to have been triggered during the half hour between 2:30 and 3 p.m. on May 6. As a hypothetical illustration, if each of those orders were executed at a very conservative estimate of 10 per cent less than the closing price, then those individual investors suffered losses of more than $200 million compared to the closing price on that day.”

A stop-loss order is the dull Boy Scout knife with which the small investor attempts to protect himself from the star wars gang. It is an order placed with an unlimited time frame that sits in the system and says if my stock trades down to this level, sell me out. Unfortunately, most of these orders are placed as market orders rather than indicating a specific “limit” price that the investor will accept. (That alternative order is called a stop-loss limit order.) Stop-loss market orders go off on the next tick after the designated price is reached. In a liquid and orderly market, that should be only a fraction away from the last trade. On the day of the Flash Crash during that pivotal half hour, the next tick was frequently 10 to 60 per cent away from the last trade.

The SEC has banned stub-quotes:

The new rules address the problem of stub quotes by requiring market makers in exchange-listed equities to maintain continuous two-sided quotations during regular market hours that are within a certain percentage band of the national best bid and offer (NBBO). The band would vary based on different criteria:

- For securities subject to the circuit breaker pilot program approved this past summer, market makers must enter quotes that are not more than 8% away from the NBBO.

- For the periods near the opening and closing where the circuit breakers are not applicable, that is before 9:45 a.m. and after 3:35 p.m., market makers in these securities must enter quotes no further than 20% away from the NBBO.

- For exchange-listed equities that are not included in the circuit breaker pilot program, market makers must enter quotes that are no more than 30% away from the NBBO.

- In each of these cases, a market maker’s quote will be allowed to “drift” an additional 1.5% away from the NBBO before a new quote within the applicable band must be entered.

The new market maker quoting requirements will become effective on Dec. 6, 2010.

For the life of me, I don’t understand why the exchanges and the SEC ever permitted stub quotes in the first place. Market Makers get special privileges – from the SEC’s perspective, exemptions from the various short-sale rules – so why were they allowed to pay for them with debased coin?

Here’s one reason QE2 might not work:

Rather than providing money to businesses and consumers, U.S. commercial banks are increasingly using the cash available at interest rates set by the Federal Reserve that are next to zero and lending it back to the government. Since June, the biggest banks bought about $127 billion of Treasuries, compared with $47 billion in the first half, according to the central bank. Commercial and industrial loans outstanding have fallen by about $68.5 billion this year, central bank data show.

…

The Basel III regulations set by the Bank for International Settlements in Basel, Switzerland, may trim economic growth by 0.1 percent and 0.9 percent, and result in $400 billion of additional Treasury purchases by U.S. commercial banks by 2015, a committee of bond dealers and investors that advises Treasury Secretary Timothy Geithner said in a Nov. 2 report.

…

Lenders are on pace this year to buy the most Treasury and agency debt since the Fed began tracking the data in 1950, adding $186.2 billion of the securities through Oct. 20 and bringing the total to $1.62 trillion. At the same time, commercial and industrial loans fell by 5.3 percent to $1.23 trillion, Fed data show.

Of interest in the November 2 TBAC Report:

Against this economic backdrop, the Committee’s first charge was to examine what adjustments to debt issuance, if any, Treasury should make in consideration of its financing needs. In the near term, given the uncertain economic and fiscal situation, the Committee felt stabilizing nominal coupon issuance at current levels was appropriate. To the extent the Committee has greater clarity, it will likely recommend further reductions to nominal coupon issuance at the February refunding. Consistent with the August meeting, the Committee felt maintaining flexibility was necessary.

There was continued debate regarding the average maturity of outstanding Treasury debt. Although the Committee felt meaningful progress had been made, there was broad agreement that continuing down this path was appropriate. One concerning consequence of raising the average maturity of debt is the decline in T-bills as a percentage of marketable debt. A majority felt that a further lengthening of the average maturity should take precedence.

With regard to TIPS, the Committee suggested an auction every month. To accomplish this, the Committee recommended two 30-year TIPS re-openings, in June and October, and a discontinuation of the 30-year TIPS re-opening in August. Likewise, in five year TIPS, the Committee recommended two re-openings, in August and December, and a discontinuation of the October re-opening. This auction schedule should allow for growth in gross TIPS issuance to approximately $120 billion in calendar year 2011 from approximately $86 billion in calendar year 2010.

Despite the aforementioned recommendation on TIPS issuance, there was continued debate at the Committee regarding the success of the TIPS program. A number of members cited that relative to nominal issuance, TIPS issuance was more expensive, less liquid, and lacked the flight to quality aspect experienced in 2008. One Committee member recommended further detailed analysis into the costs and benefits of the TIPS program.

… and with respect to Basel 3 …

The third charge examined the potential impacts of Basel III (presentation attached). The member documented the tighter definitions of Tier-1 capital, prescribed leverage and liquidity ratios, counter-cyclical capital buffers, additional capital requirements for systemically important firms, and new limits on counterparty credit risk. The member remarked that while institutions had years to comply, markets were pushing institutions to convey and implement adoption plans today. As a result, extension of liquidity, credit, and capital are being curtailed at a time of slow economic growth. The member included estimates of Basel III’s negative impact on growth. Furthermore, members expressed concern that specific U.S. regulatory reforms in conjunction with Basel III adoption may put U.S. financial firms at a competitive disadvantage versus international peers. Lastly, the member pointed out that compliance with liquidity coverage ratios will lead to increased demand by designated institutions for U.S. Treasuries.

How ’bout that Goldman Sachs, eh? They’ve done a Maple Issue:

Goldman Sachs Group Inc. (GS) raised C$500 million from an issue of five-year, so-called Maple bonds, according to people familiar with the matter.

Maple bonds are debt securities denominated in Canadian dollars that are issued by foreign companies.

The Goldman issue, which matures in November 2015, was priced at 208 basis points over the relevant government of Canada benchmark curve, or at the low end of the guidance, to yield 4.102%.

The bonds carry a coupon of 4.10%.

Goldman’s offering provides the latest evidence of a recovery in the Maple-bond market this year following a slow period in 2009, reflecting a combination of improved credit conditions and larger syndicates underwriting the deals. A larger number of dealers in a syndicate often lends itself to better trading conditions for the securities in the secondary market.

… and an ultralong issue:

The Goldman issue is a poster child for the continuing frenzy in the capital market for long-dated instruments. The Wall Street bank originally hoped investors might have the appetite for $250-million (U.S.) worth of the securities, according to market chatter at the time of the issue last month.

But Goldman sold more than five times as much – $1.3-billion. Ordinary ma and pa investors were the target buyers, signified by Goldman chopping the bonds into minuscule $25 amounts. This is an unusual size. Bonds typically trade in minimum multiples of $1,000.

It’s not clear how many of the small investors who bought Goldman’s bonds realize the fine points of the deal. According to the prospectus, Goldman has reserved for itself the right to redeem the bonds at their face value of $25 on five days’ written notice any time after Nov. 1, 2015.

If interest rates stay low, Goldman, which didn’t respond to a request for comment, will likely call the bonds and pay off investors. Those seemingly high yields will then vanish.

Meanwhile, if market interest rates return to more normal levels because the economy recovers or inflation resumes, it’s likely that the cost of borrowing for extremely long terms could rise well above the 6.125 per cent that Goldman is paying. In that case, Goldman won’t redeem them, and buyers will be stuck with losses because bond prices move inversely to interest rates.

It’s telling that, while Goldman has the right to redeem, buyers weren’t given the same right to force Goldman to buy back the securities if interest rates surge.

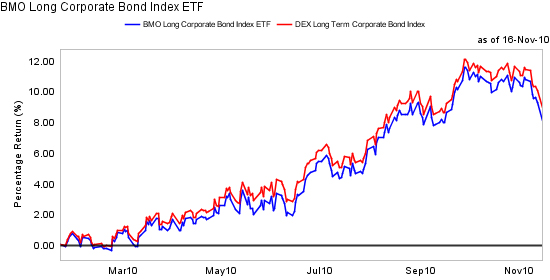

By way of comparison, the Long Term Corporate Bond ETF (VCLT) has a “SEC Yield” of 5.42% … but mind you, the SEC Yield is basically Current Yield, so it doesn’t mean much.

Efforts to destroy banking in the UK continue:

Business Secretary Vince Cable dismissed warnings from U.K. banks of a potential brain drain to Asia if the government follows through on its pledge to crack down on bonuses.

Warnings that banks may quit London are “a familiar negotiating technique and clearly one has to listen to them — one has to take these things seriously,” Cable said in an interview with Bloomberg Television in Beijing yesterday. “But it is clear that you have got to balance that against our national interest. Banks have to be safe and that means that the regulations have to take into account the potential problems created by cash bonuses.”

Royal Bank of Scotland Group Plc Chairman Philip Hampton and Standard Chartered Plc Chief Executive Officer Peter Sands said during a trade mission to Beijing with Cable and Chancellor of the Exchequer George Osborne that tighter bonus rules would drive bankers and traders away from London.

…

In April, the U.K. introduced a new 50 percent tax band for those earning more than 150,000 pounds a year. Osborne said last month he will block the payment of large bonuses unless banks show they are extending credit to households and companies.

HSBC Bank of Canada is redeeming its HaTS-series 2010. This Innovative Tier 1 Capital Issue is described as:

Each Series 2010 unit was issued at $1,000 per unit to provide an effective annual yield of 7.78 per cent to December 31, 2010 and the six month bankers’ acceptance rate plus 2.37 per cent thereafter. The units are not redeemable by the holders. The Trust may redeem the units on any distribution date, subject to regulatory approval.

Hellzapoppin’ on the Canadian preferred share market today, with PerpetualDiscounts rocketting up 55bp and FixedResets soaring 17bp, taking the median weighted average pre-tax yield to worst on the latter index down to 2.86%. Volume continued at elevated levels. All entries in the Performance table are in the black and my snarky remarks about MFC on the weekend appear to have attracted considerable interest … from contrarians.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.9241 % |

2,229.2 |

| FixedFloater |

4.90 % |

3.49 % |

26,665 |

19.20 |

1 |

-0.0900 % |

3,433.8 |

| Floater |

2.67 % |

2.34 % |

61,573 |

21.40 |

4 |

0.9241 % |

2,407.0 |

| OpRet |

4.77 % |

2.71 % |

81,117 |

1.87 |

9 |

0.3562 % |

2,400.9 |

| SplitShare |

5.84 % |

-12.93 % |

67,059 |

0.08 |

2 |

0.0403 % |

2,411.2 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.3562 % |

2,195.4 |

| Perpetual-Premium |

5.62 % |

4.96 % |

164,121 |

3.08 |

24 |

0.2291 % |

2,029.6 |

| Perpetual-Discount |

5.30 % |

5.29 % |

257,807 |

14.87 |

53 |

0.5459 % |

2,059.9 |

| FixedReset |

5.19 % |

2.86 % |

343,587 |

3.21 |

50 |

0.1738 % |

2,297.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BAM.PR.K |

Floater |

1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 17.05

Evaluated at bid price : 17.05

Bid-YTW : 3.10 % |

| BAM.PR.P |

FixedReset |

1.08 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-30

Maturity Price : 25.00

Evaluated at bid price : 28.09

Bid-YTW : 3.82 % |

| PWF.PR.A |

Floater |

1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.88

Evaluated at bid price : 22.12

Bid-YTW : 2.34 % |

| SLF.PR.C |

Perpetual-Discount |

1.33 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.29

Evaluated at bid price : 21.29

Bid-YTW : 5.30 % |

| ELF.PR.G |

Perpetual-Discount |

1.58 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 20.61

Evaluated at bid price : 20.61

Bid-YTW : 5.83 % |

| SLF.PR.D |

Perpetual-Discount |

1.62 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.35

Evaluated at bid price : 21.35

Bid-YTW : 5.28 % |

| SLF.PR.A |

Perpetual-Discount |

1.66 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 22.53

Evaluated at bid price : 22.72

Bid-YTW : 5.29 % |

| BAM.PR.I |

OpRet |

1.81 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-12-08

Maturity Price : 25.50

Evaluated at bid price : 27.00

Bid-YTW : -49.79 % |

| MFC.PR.B |

Perpetual-Discount |

1.87 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.75

Evaluated at bid price : 21.75

Bid-YTW : 5.43 % |

| MFC.PR.C |

Perpetual-Discount |

3.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.45

Evaluated at bid price : 21.45

Bid-YTW : 5.33 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| RY.PR.I |

FixedReset |

227,675 |

National crossed 80,000 at 26.61; RBC crossed 94,200 at 26.62. National crossed two more blocs, of 20,000 and 18,000 shares, both at 26.61.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-26

Maturity Price : 25.00

Evaluated at bid price : 26.60

Bid-YTW : 2.87 % |

| TD.PR.P |

Perpetual-Premium |

196,484 |

Desjardins crossed 175,000 at 25.19.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2016-12-01

Maturity Price : 25.00

Evaluated at bid price : 25.14

Bid-YTW : 5.19 % |

| SLF.PR.E |

Perpetual-Discount |

138,425 |

Nesbitt crossed blocks of 45,000 and 20,000, both at 21.40. RBC crossed 55,400 at 21.51.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-08

Maturity Price : 21.51

Evaluated at bid price : 21.51

Bid-YTW : 5.30 % |

| RY.PR.X |

FixedReset |

114,790 |

RBC crossed 20,200 at 28.10; Scotia crossed 50,000 at the same price; RBC crossed another 10,000 at the same price again.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 28.05

Bid-YTW : 2.86 % |

| CM.PR.D |

Perpetual-Premium |

108,060 |

Nesbitt crossed blocks of 40,000 and 59,800, both at 25.60.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-05-30

Maturity Price : 25.25

Evaluated at bid price : 25.56

Bid-YTW : 3.71 % |

| MFC.PR.E |

FixedReset |

73,900 |

RBC crossed blocks of 25,000 and 16,600, both at 26.90. Nesbitt crossed 20,000 at 27.00.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-19

Maturity Price : 25.00

Evaluated at bid price : 26.85

Bid-YTW : 3.78 % |

| There were 50 other index-included issues trading in excess of 10,000 shares. |