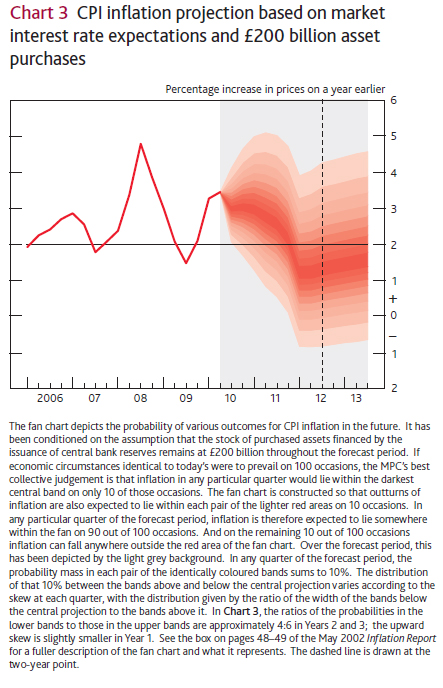

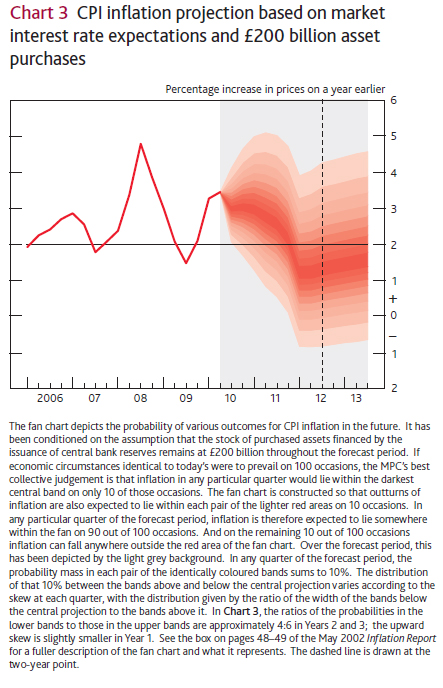

The FOMC was gloomy yesterday; the BoE is gloomy today:

Bank of England Governor Mervyn King said inflation will probably slow below the bank’s target in 2012 and growth will be weaker than previously forecast, signaling the U.K. economy may need more emergency stimulus.

Inflation will be about 1.5 percent in two years, below the 2 percent goal, the central bank said in its quarterly Inflation Report today. Inflation will undershoot the target even if the bank keeps its benchmark interest rate at the current 0.5 percent, the forecasts show. Growth may peak at a 3 percent annual pace instead of the 3.6 percent rate forecast in May.

The full inflation report uses the highly-touted fan charts that were recommended for central bank communications a few years back.

Click for big

Click for bigAn Assiduous Reader draws my attention to the 3Q10 Report of the Treasury Borrowing Advisory Committee:

The bulk of the reduction in coupon issuance should continue to be in the two-year, three-year, five-year and seven-year maturities. Although this is broadly consistent with the Committee’s desire to increase the average maturity of the outstanding debt, some felt that given the meaningful progress thus far, reductions in ten-year notes and thirty-year bonds could be justified.

…

Finally, the Committee felt that growing TIPS from roughly $80 billion gross issuance in fiscal year 2010, to over $100 billion in fiscal year 2011, was still appropriate.

…

The presentation (see attached) highlights that municipal bonds outstanding rose over the last decade by $1 trillion to $2.8 trillion. Despite some of the recent headline risks and the challenging economic outlook, the member concluded the municipal market appears to be in reasonably good condition. Broadly, municipalities still have a low probability of default, historically high recoveries, low absolute cost of funds, access to a broader investor base via the Build America Bonds program, and a largely unlevered existing retail investor base. Implicit in this analysis is the Federal government’s willingness to intervene in the event the municipal market ceases to function.

…

…the presentation (see attached) highlights the absence of mortgage hedging needs as a stabilizing force underpinning long term yields. In addition, the member referenced the secular increase in demand for long duration assets from asset managers, insurance companies, and pension funds. Furthermore, cyclically, the member showed that investor confidence in the path of central bank policy rates tends to anchor long term yields.

The seeds of something very interesting may have been planted in Greece:

Slovakia’s parliament rejected the nation’s participation in a loan for Greece after the month-old government overturned the previous Cabinet’s policy and said poor countries shouldn’t pay for the profligacy of richer peers.

Of the 84 lawmakers present in the Bratislava-based assembly, one voted in favor while 69 were against and 14 abstained, reversing a decision by the previous Cabinet to lend Greece 816 million euros ($1.1 billion). The funds were to be part of a loan package pledged by the European Union to help Greece avoid a default. The current Slovak government of Iveta Radicova, which took office last month, is against the aid.

The vote breaks the euro region’s unity in handling the sovereign-debt crisis, though the decision won’t prevent Greece from drawing the loan.

Assiduous Readers will remember the whispers that Lehman failed in part because its peers wouldn’t give it emergency relief, which in turn was because it did not participate in the Long Term Capital Management bail-out of 1998. Now, I like to think that the full story is a little more hard-nosed and a little less school-girlish than that … but I will agree it may have had some influence.

The SEC/CFTC inquiry into the Flash Crash is continuing:

As part of the SEC and CFTC review of market events on May 6, we are pursuing two related courses of inquiry. The first is empirical and data driven. SEC staff have been reviewing raw transaction and order data, order book “snapshots,” trade summaries, information about broken trades, and information related to initiation of LRPs and self-help. The second is focused on extensive interviews with market participants — their first-hand accounts of what occurred on May 6 and their responses to those events. These efforts will culminate in an SEC-CFTC joint report that will be presented to this Committee for its consideration next month and, of course, shared with the public, as well.We are considering, as well, whether other steps are appropriate to reduce the risk of sudden disruptions and clearly erroneous trades, including deterring or prohibiting the use of “stub” quotes by market makers.

The comments have been published. BlackRock wants:

We believe those reforms should include:

- Uniform “circuit breakers” for stocks and ETFs across all exchanges;

- Making exchange trade error cancellation rules less arbitrary and more transparent in a manner that does not discourage liquidity providers from providing liquidity at times of market stress

- Clearer guidelines for inter-market order routing rules

- Replacing “stop loss” orders with “stop loss limit” orders to specify a limit price; and

- Expanding the role of lead market makers to ensure orderly market functioning.

TD Ameritrade makes the startling revelation:

The firm has noted previously that the May 6th market event demonstrated that today’s markets contain many players who use their liquidity opportunistically – applying it when in their favor, but pulling it during times of market duress.

… and defends stop orders without any quantification:

Finally, as to the specific allegation that retail market orders and stop orders contributed to the downturn, I can tell you from TD Ameritrade’s perspective, such orders are important to our clients, and looking at our own data, we do not believe there is any factual basis to assert that these types of orders contributed to the problem. In fact, TD Ameritrade clients’ market and stop orders were within average daily volume, on a percentage basis. Prohibiting market and stop orders would be a significantly adverse, misguided, and unnecessary over-reaction to the underlying causes of the May 6th market event, which would unduly deny to retail investors the access to the markets that they enjoy today.

Knight Capital, on the other hand, highlights stop orders:

When the S&P 500 traded at 1120, stop orders were triggered and the market traded lower. When the market did not promptly bounce back, buyers became sellers and the market traded down another 5% -6%. During this period, the NYSE triggered its liquidity refreshment points (LRPs) in a number of securities. Orders were then routed away from the NYSE to other destinations where liquidity in certain stocks was thinner and prices wider.

Invesco has a different view:

As an institution, we have long understood the significant risk of using market orders particularly as the market has become more fragmented. We abandoned their use many years ago in favor of marketable limit and limit orders. In light of the events of May 6 and the continuing issues small market orders have had in the market (i.e., electing newly imposed single-stock circuit breakers on WPO, CSCO, C, APC), Invesco strongly supports the examination of the current practices surrounding the use of market orders, particularly the use of “stop loss” orders. We would recommend at the very least that exchanges or broker dealers who continue to use market orders do so using collars on the market orders they submit. A collared market order should only allow execution of the order within a certain percentage of the reference price (i.e., 3% from the last sale). This would give their clients some level of protection from the impact market orders can have in the current environment and would likely reduce or altogether eliminate the issue of small share amounts triggering circuit breakers.

Invesco also wants examination of HFT:

Additionally, regulators should act to address the increasing number of order cancellations in the securities markets. It has been theorized that as many as 95% of all orders entered by high frequency traders are subsequently cancelled. Incentives that currently exist for market participants to route orders to particular venues, such as liquidity rebates, and any related conflicts of interest that may arise due to these incentives also need to be examined.

Dow Jones has a report focussing on market-making obligations titled DJ New Obligations For Market Liquidity Providers Questioned:

Getco LLC, Virtu Financial LLC and Knight Capital Group Inc. (KCG) have proposed to the SEC a range of new rules for market makers. The rules under consideration could include a requirement for market makers to provide quotes to buy or sell a stock no more than 10% above or below the current price.

Mendelson said new market making obligations would increase costs for retail and institutional investors. “On those rare occasions when markets are severely disrupted, market-maker obligations will accomplish nothing,” he said. “Let’s not do it here. It will just add a burden for investors.”

Me, I think the whole concept of allowing special privileges to market makers in exchange for obligations of any type really needs to be examined. It is at least generally accepted as ludicrous that the obligations can be met with a stub-quote.

But to get total insanity, you need a politician and Senator Charles Schumer fills the void:

Many institutional investors and trading firms left the market that day as volatility peaked during the session, according to an SEC investigation detailed Wednesday during a joint hearing held by the SEC and the Commodity Futures Trading Commission. A final report on the flash crash is due in September.

Sen. Schumer said in his letter that any trader or firm making markets in 25 or more stocks or exchange-traded funds ought to bear trading obligations, according to a draft seen by Dow Jones Newswires.

His recommendations for market makers closely align with several proposals made last month by trading firms Knight Capital Group Inc., Getco LLC and Virtu Financial LLC.

Market makers are traders who stand ready to take the other side of an incoming order. The evolution of markets has seen the practice evolve into a competitive industry dominated by computer-driven trading systems.

The SEC must update its definition of market makers to account for this shift, Sen. Schumer said. He proposed requiring such participants to quote prices between the highest bid and lowest offer for a certain period of the trading day, depending on the stock.

I don’t see anything remotely like this proposal in the Knight Capital letter on the Flash Crash, it’s in another letter entirely, Comment Letter on File No. S7-02-10, which is the Concept Release on Equity Market Structure. I wish journalists would realize that their beloved quill pen era has gone for good, and start footnoting their damn stories.

I’ve suggested Dubai on occasion as an alternative financial centre for hedge funds et al. Well, they’ll have to reform their justice system a little:

In all, about 40 percent of the 1,200 people in Dubai Central Prison have been convicted of defaulting on bank loans, Human Rights Watch said in a report in January. Even after completing their sentences, the New York-based group said, prisoners are likely to remain in jail until their debt is paid off, unlike in the U.S. or the U.K., where debtors’ prisons were abolished in the 19th century.

Over-lengthy sentences and insufficiently developed laws for prosecuting financial crime threaten to discourage investment in Dubai, said Habib al-Mulla, the former chairman of the Dubai Financial Services Authority, an industry regulator. The U.S. State Department said in a March report that while the country’s constitution guarantees an independent judiciary, the U.A.E. court system remains “subject to review by the political leadership.” Defendants can spend months without being charged and are often unfairly denied bail, according to lawyers.

The European sovereign debt crisis is bad enough for Spain, but the regions are being hit worse:

Catalonia, which accounts for a fifth of Spanish gross domestic product, has been shut out of public bond markets since March and the extra yield it pays over national government debt has almost tripled this year. Galicia, in the northwest, has asked to freeze payments of debt it owes the central government and the Madrid region postponed a bond sale last month.

Spain’s regions, which borrowed at similar rates to the central government before the global credit crisis started in 2007, are key players in Zapatero’s drive to get his budget in order and push down the country’s borrowing costs. They control around twice as much spending as the state, employ more than half of all public workers and piled on debt during the recession.

…

The yield on 10-year Spanish government bonds has dropped 78 basis points to 4.102 percent since June 16. The extra return investors demand to hold the debt rather than German equivalents was at 168 basis points yesterday, down from a euro-era high of 221 points two months ago.

Banks are nevertheless charging Catalonia more for loans than the building companies stung by Spain’s construction slump.

The region, which attracts more tourists than any other in Spain, paid 300 basis points more than three-month Euribor for 1 billion euros of four-year bank loans last month, a spokesman said. Fomento de Construcciones & Contratas SA, Spain’s fourth- largest builder, said on Aug. 2 it agreed to pay a 260-basis point spread to extend 1.1 billion euros of loans until 2014.

The Canadian preferred share market edged higher on good volume today, with PerpetualDiscounts gaining 9bp and FixedResets up 6bp.

PerpetualDiscounts now yield 5.82%, equivalent to 8.15% at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.4% (!) so the pre-tax interest-equivalent spread (also called the Seniority Spread) now stands at about 275bp, a small (and perhaps meaningless) widening from the 270bp reported August 4.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1833 % |

2,071.5 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1833 % |

3,138.1 |

| Floater |

2.53 % |

2.14 % |

38,588 |

21.99 |

4 |

-0.1833 % |

2,236.7 |

| OpRet |

4.88 % |

-1.47 % |

105,764 |

0.22 |

9 |

-0.0857 % |

2,356.5 |

| SplitShare |

6.12 % |

-1.47 % |

67,917 |

0.08 |

2 |

-0.1897 % |

2,264.3 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0857 % |

2,154.8 |

| Perpetual-Premium |

5.80 % |

5.50 % |

98,183 |

5.66 |

7 |

0.1927 % |

1,949.5 |

| Perpetual-Discount |

5.79 % |

5.82 % |

175,951 |

14.05 |

71 |

0.0868 % |

1,871.9 |

| FixedReset |

5.31 % |

3.41 % |

281,088 |

3.40 |

47 |

0.0623 % |

2,233.4 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| PWF.PR.P |

FixedReset |

1.25 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2016-03-01

Maturity Price : 25.00

Evaluated at bid price : 25.87

Bid-YTW : 3.80 % |

| GWO.PR.L |

Perpetual-Discount |

1.35 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-08-11

Maturity Price : 23.92

Evaluated at bid price : 24.11

Bid-YTW : 5.94 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| RY.PR.G |

Perpetual-Discount |

89,915 |

RBC crossed blocks of 23,700 and 50,000, both at 20.25.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-08-11

Maturity Price : 20.21

Evaluated at bid price : 20.21

Bid-YTW : 5.59 % |

| IAG.PR.C |

FixedReset |

49,512 |

Desjardins crossed 16,500 at 27.35; RBC crossed 30,000 at the same price.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 27.20

Bid-YTW : 3.72 % |

| BMO.PR.P |

FixedReset |

40,210 |

RBC crossed 29,900 at 27.12.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-03-27

Maturity Price : 25.00

Evaluated at bid price : 27.13

Bid-YTW : 3.33 % |

| TRP.PR.A |

FixedReset |

37,565 |

TD crossed 25,000 at 25.92.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.92

Bid-YTW : 3.85 % |

| CM.PR.H |

Perpetual-Discount |

35,725 |

Nesbitt crossed 10,000 at 20.96.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-08-11

Maturity Price : 20.95

Evaluated at bid price : 20.95

Bid-YTW : 5.78 % |

| GWO.PR.I |

Perpetual-Discount |

31,150 |

TD crossed 21,600 at 19.33.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-08-11

Maturity Price : 19.39

Evaluated at bid price : 19.39

Bid-YTW : 5.89 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. |