The jobs number on Friday was encouraging:

Payrolls rose by 162,000 workers last month, the third gain in the past five months and the most since March 2007, figures from the Labor Department showed today in Washington.

…

Among the top indicators the group uses is payrolls, according to its Web site. The government revised the January and February job count up by a combined 62,000, putting the March gain at 224,000 after including the updated data.

This knocked Treasuries for loop:

Government securities fell for a second consecutive week ahead of the Treasury’s scheduled offering of $82 billion of notes and bonds next week, including a record-tying $40 billion sale of three-year securities.

…

The 10-year note yield rose 9 basis points, or 0.09 percentage point, to 3.94 percent, according to BGCantor Market Data. The yield touched the highest this week since it reached 4 percent on June 11. Two-year note yields rose 6 basis points to 1.1 percent. Thirty-year bond yields increased to as high as 4.81 percent, also the most since June.

… and over the weak, investors decided that German debt is better than EU promises:

The yield on Germany’s 10-year bund, Europe’s benchmark government security, fell 7 basis points in the week to 3.09 percent as of 5:30 p.m. in London yesterday. It dropped to 3.05 percent on March 23, the lowest this year. The two-year note yield slipped 5 basis points to 0.95 percent.

The Greek 10-year yield advanced 33 basis points to 6.56 percent, and the two-year yield soared 69 basis points to 5.28 percent.

The New York Times has an editorial on taxation of hedge fund fees:

To add insult to injury, some hedge fund managers and, more commonly, private equity fund managers are able to pay a much lower rate of tax than the typical working professional.

The tax disparity results from an outdated rule that lets a money manager in a private partnership treat a chunk of his fees as if they were long-term capital gains, taxed at a special low rate of 15 percent. Fees for managing someone else’s money should be taxed as ordinary income, like wages and salary, at rates as high as 35 percent.

President Obama has included a provision to end that special treatment in his most recent budget. For three years running, the House has passed a bill to close the loophole. In the Senate both Democrats and Republicans have resisted, all for fear of losing lucrative campaign donations.

This has been an issue for quite some time I remember commenting on the issue on the old “Captain’s Quarters” blog (the principal, Ed Morrisey, has now moved to Hot Air) … the idea of fixing the loophole by other commenters as a tax increase. By me, it’a a loophole. Preferential taxation of capital gains – regardless of what it may actually accomplish – should be restricted to those who have skin in the game. A hedge fund manager who achieves a total return of -100% will suffer a loss of capital only to the extent he has invested in the fund: capital gains tax rates should apply only to his earnings on that capital at risk.

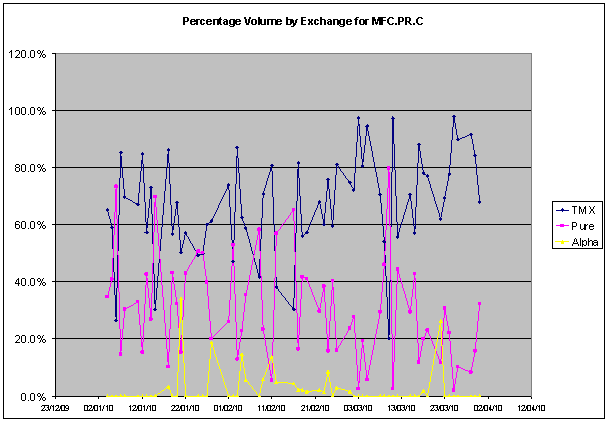

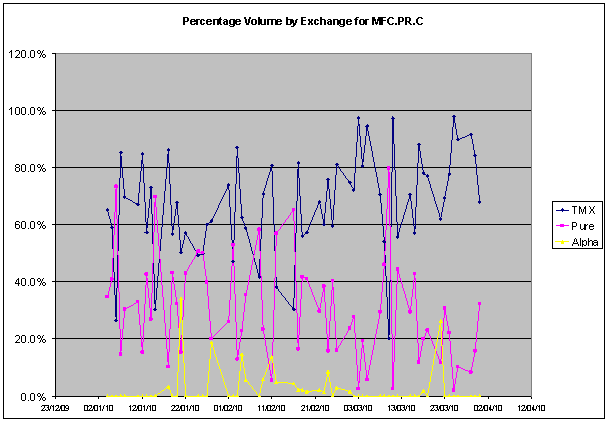

Assiduous Reader GAndreone sends in this chart of Exchange Market Share for MFC.PR.C for your edification:

Click for Big

Click for BigAn interesting trend is corporate bonds that step-up on downgrades:

Bonds with built-in protection against rating cuts are making up a record share of debt issues as investors hedge against a slowdown in the economic recovery.

Anheuser-Busch InBev NV, the brewer of Budweiser and Stella Artois, is among companies issuing so-called step-up bonds, whose interest increases if a borrower is downgraded. Sales surged to $37.3 billion in March, or 12.4 percent of all debt issued, according to data compiled by Bloomberg. Most of the notes are sold in the U.S., where almost half of bonds rated as so-called junk or on the cusp of non-investment grade include the protection.

…

Anheuser-Busch InBev, the world’s largest brewer, sold $3.25 billion of bonds with a step-up coupon on March 24, Bloomberg data show. The conditions require the Leuven, Belgium- based company to pay 25 basis points more in interest for every one rating notch it’s cut below investment grade, up to a maximum of 200 basis points, according to Bloomberg data. The brewer is rated Baa2 by Moody’s and one level higher at BBB+ by S&P.

It’s an interesting problem due to the potential for a cascading decline in credit quality. Quick! You’re the Grand Pooh-Bah of Financial Stability! Can you do anything? Should you do anything?

It has taken over a year, but finally the world is noticing the sheer brilliance and uncanny accuracy of PrefBlog’s commentary. Assiduous Readers will remember that I support internal management for large pension funds; not because of cost but because internal management has a captive customer, can concentrate of achieving good returns and doesn’t have to spend time, effort, and client portfolio positioning on the necessity of bringing in the Assets Under Management. As best as I can recall, I last discussed this on March 31, 2009. Janet McFarland has written a feature for the Globe, Canada’s Pension Funds: stronger returns, at a cost:

Despite the higher salary costs in Canada, internal management has been a bigger advantage than it has been a cost, said pension specialist Keith Ambachtsheer, director of the International Centre for Pension Management at the University of Toronto.

Research shows internal teams not only save money by cutting high external money management fees, but also perform better as investors because they are more closely aligned to the mission of the pension fund, he said.

According to data from CEM Benchmarking, internal management improves returns by 0.5 per cent annually over external management, Mr. Ambachtsheer said.

It is disappointing that the article followed fashionability to the extent it did, by focussing almost exclusively on the aspect of fees. It is far more interesting, and far more important for public policy purposes, to consider the aspect of the effects of structure on gross investment return.

The Globe also had an astonishingly patronizing editorial in today’s print edition (it does not appear to be available on-line) titled “The next complexity”:

The challenge for the future, however, is how to formulate rules that will cover the new mind-bending products that will emerge in the next wave of irrational exuberance and excessive financial ingenuity. In other words, legislators and regulators will need to decide what is too complex for unsophisticated investors.

I have some succinct advice for the Globe’s editorial board: shove it. While wearing my hat as a retail investor, I don’t want any pandering politician or smarmy regulator deciding what is and what is not too complex for unsophisticated investors who haven’t been annointed. Show me somebody – anybody – who got seriously hurt by ABCP and I’ll show you a fool. Canadian ABCP was a good product, of very good credit quality. The market was done in by lack of liquidity, not credit; and the only people who were badly hurt by it were the ones who were overexposed. Ain’t nothing gonna protect anybody from the downside of overexposure, whether it’s to ABCP or securities that have been blessed by the really, really savvy investors on the Globe’s editorial board.

I haven’t been able to find a copy of the report itself on-line. This may mean I’m insufficiently sophisticated at finding things, but it wouldn’t surpise me to learn that access to the report has been restricted to those smart enough to agree with the committee’s conclusions.

What the ABCP and Lehman crises showed was simply that the implicit sponsor guarantee on Money Market Funds needs to become explicit. Full stop.

Crash! Bang! Smash ’em up! PerpetualDiscounts got hit severely today, losing 76bp to bring median yield to 6.22%, while FixedResets were almost precisely flat. The performance highlights indicate that it was the major, high quality banks that bore the brunt of the sell off, although there are a few familiar names amongst the losers. Volume continued to be quite heavy and FixedResets scored a shut-out on the volume highlights table.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.56 % |

2.62 % |

55,977 |

20.96 |

1 |

-0.2268 % |

2,157.2 |

| FixedFloater |

4.88 % |

3.00 % |

48,787 |

20.16 |

1 |

1.0879 % |

3,242.0 |

| Floater |

1.90 % |

1.67 % |

46,110 |

23.42 |

4 |

-0.0242 % |

2,422.6 |

| OpRet |

4.86 % |

2.37 % |

108,247 |

0.15 |

10 |

0.0814 % |

2,310.9 |

| SplitShare |

6.37 % |

-0.80 % |

137,257 |

0.08 |

2 |

0.1100 % |

2,142.3 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0814 % |

2,113.1 |

| Perpetual-Premium |

5.75 % |

3.11 % |

35,074 |

0.64 |

2 |

-0.0795 % |

1,862.4 |

| Perpetual-Discount |

6.16 % |

6.22 % |

176,015 |

13.60 |

76 |

-0.7632 % |

1,722.9 |

| FixedReset |

5.39 % |

3.58 % |

412,656 |

3.65 |

43 |

0.0009 % |

2,195.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BNS.PR.N |

Perpetual-Discount |

-2.71 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.17

Evaluated at bid price : 21.17

Bid-YTW : 6.22 % |

| BMO.PR.K |

Perpetual-Discount |

-2.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.09

Evaluated at bid price : 21.09

Bid-YTW : 6.32 % |

| TD.PR.P |

Perpetual-Discount |

-2.22 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.90

Evaluated at bid price : 22.00

Bid-YTW : 6.08 % |

| TD.PR.R |

Perpetual-Discount |

-1.70 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 22.99

Evaluated at bid price : 23.15

Bid-YTW : 6.17 % |

| BNS.PR.L |

Perpetual-Discount |

-1.69 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 18.58

Evaluated at bid price : 18.58

Bid-YTW : 6.07 % |

| BAM.PR.N |

Perpetual-Discount |

-1.69 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 16.91

Evaluated at bid price : 16.91

Bid-YTW : 7.09 % |

| BNS.PR.J |

Perpetual-Discount |

-1.59 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.60

Evaluated at bid price : 21.60

Bid-YTW : 6.09 % |

| BMO.PR.H |

Perpetual-Discount |

-1.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.91

Evaluated at bid price : 22.21

Bid-YTW : 6.04 % |

| TCA.PR.X |

Perpetual-Discount |

-1.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 45.63

Evaluated at bid price : 47.65

Bid-YTW : 5.84 % |

| POW.PR.A |

Perpetual-Discount |

-1.52 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 21.75

Evaluated at bid price : 22.00

Bid-YTW : 6.39 % |

| BNS.PR.O |

Perpetual-Discount |

-1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 22.90

Evaluated at bid price : 23.06

Bid-YTW : 6.08 % |

| BAM.PR.M |

Perpetual-Discount |

-1.46 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 16.87

Evaluated at bid price : 16.87

Bid-YTW : 7.11 % |

| BNS.PR.M |

Perpetual-Discount |

-1.42 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 18.70

Evaluated at bid price : 18.70

Bid-YTW : 6.03 % |

| TD.PR.O |

Perpetual-Discount |

-1.39 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 20.52

Evaluated at bid price : 20.52

Bid-YTW : 6.03 % |

| POW.PR.D |

Perpetual-Discount |

-1.36 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 19.58

Evaluated at bid price : 19.58

Bid-YTW : 6.42 % |

| RY.PR.C |

Perpetual-Discount |

-1.34 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 19.08

Evaluated at bid price : 19.08

Bid-YTW : 6.12 % |

| RY.PR.B |

Perpetual-Discount |

-1.31 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 19.52

Evaluated at bid price : 19.52

Bid-YTW : 6.12 % |

| PWF.PR.G |

Perpetual-Discount |

-1.25 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 23.49

Evaluated at bid price : 23.75

Bid-YTW : 6.33 % |

| BMO.PR.J |

Perpetual-Discount |

-1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 19.11

Evaluated at bid price : 19.11

Bid-YTW : 5.98 % |

| CM.PR.I |

Perpetual-Discount |

-1.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 18.72

Evaluated at bid price : 18.72

Bid-YTW : 6.29 % |

| TD.PR.Q |

Perpetual-Discount |

-1.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 23.15

Evaluated at bid price : 23.32

Bid-YTW : 6.12 % |

| MFC.PR.B |

Perpetual-Discount |

-1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 18.41

Evaluated at bid price : 18.41

Bid-YTW : 6.39 % |

| PWF.PR.I |

Perpetual-Discount |

-1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 23.94

Evaluated at bid price : 24.30

Bid-YTW : 6.29 % |

| SLF.PR.D |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 17.63

Evaluated at bid price : 17.63

Bid-YTW : 6.37 % |

| BAM.PR.G |

FixedFloater |

1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 25.00

Evaluated at bid price : 22.30

Bid-YTW : 3.00 % |

| HSB.PR.C |

Perpetual-Discount |

1.17 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-04-05

Maturity Price : 20.84

Evaluated at bid price : 20.84

Bid-YTW : 6.17 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| TD.PR.E |

FixedReset |

311,050 |

Nesbitt crossed 300,000 at 28.10. Nice ticket!

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 28.11

Bid-YTW : 3.39 % |

| RY.PR.T |

FixedReset |

247,850 |

Nesbitt bought 13,200 from CIBC at 28.05 and crossed 120,000 at the same price. Nesbitt then crossed 100,000 at 28.06.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 28.05

Bid-YTW : 3.51 % |

| RY.PR.X |

FixedReset |

116,486 |

TD crossed 30,000 at 28.00; RBC crossed 35,000 at the same price.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 28.01

Bid-YTW : 3.56 % |

| RY.PR.Y |

FixedReset |

77,325 |

National crossed 15,000 and Nesbitt crossed 30,000, both at 28.00; National crossed 15,000 at 28.03.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-12-24

Maturity Price : 25.00

Evaluated at bid price : 28.00

Bid-YTW : 3.54 % |

| TD.PR.K |

FixedReset |

54,627 |

Nesbitt crossed 25,000 at 28.25 and bought 11,000 from anonymous at 28.20.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 28.20

Bid-YTW : 3.40 % |

| TD.PR.G |

FixedReset |

52,432 |

Nesbitt bought 12,500 from CIBC at 28.05.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 28.07

Bid-YTW : 3.43 % |

| There were 51 other index-included issues trading in excess of 10,000 shares. |