Every now and then an Assiduous Reader writes in and asks whether the banks will be purchasing thier deeply discounted prefs on the market to save themselves a few bucks …. and every now and then I have to resort to handwaving about leverage, Tier 1 capital, OSFI permissions and all that.

It is something of a relief to see that similar questions are being asked in New York:

The state, without bothering to take advantage of market interest rates, paid face value for auction-rate bonds in February and March when the same debt traded at discounts of as much as 40 percent, Municipal Securities Rulemaking Board prices show. The securities, maturing in 2011 and 2022, are part of $1.13 billion of auction-rate debt New York has remaining, which it might be able to repurchase at a discount of 10 percent, according to Kevin O’Connor, a managing director at New York- based Secondmarket.com.

…

“There are legal and investor relations issues involved, and we are reviewing these issues,” said Jeffrey Gordon a spokesman for the Division of Budget, in an e-mail.

…

Anticipation that government issuers will pay face value is keeping prices higher than they would be otherwise, said O’Connor, a former banker who helped start the auction-rate bond trading desk at New York-based JPMorgan Chase & Co. in 2000.

…

The 2011 and 2022 New York bonds’ indentures, or documents that spell out the rights of issuers and investors, say “the state may from time to time purchase bonds” at the prevailing price and retire them.

There’s no prohibition on local governments buying their bonds in the open market, said Troy Kilpatrick, a managing director at Bank of New York Mellon in Pittsburgh, a trustee of auction-rate bonds. “You just don’t see a lot of it happen.”

My guess? Bureaucratic inertia. Remember, this is the financial world we’re talking about, folks. Today was a short trading day because Monday is a holiday – a feature of the bond market that has irritated me since I first calculated a yield.

The Canadian Life Insurers Assurance Facility (whereby insurers can get a government guarantee for their debt in exchange for a fee) is officially under way.

The Fed has published as special rule allowing TARP preferreds to be part of Tier 1 Capital (as well as sub-debt, for smaller banks who were caught in a legalistic tangle and couldn’t issue preferred). There were problems with the dividend step-up and the issuance limits:

In particular, the Senior Perpetual Preferred Stock issued under the CPP has an initial dividend rate of five percent per annum, which will increase to nine percent per annum five years after issuance. In addition, following the redemption of all the Senior Perpetual Preferred Stock issued under the CPP, a banking organization will have the right to repurchase any other equity security of the organization (such as warrants or equity securities acquired through the exercise of such warrants) held by Treasury.

In the preamble to the interim rule, the Board recognized that some of the features of the Senior Perpetual Preferred Stock issued under the CPP if included in preferred stock issued to private investors would render the preferred stock ineligible for tier 1 capital treatment or limit its inclusion in tier 1 capital under the Board’s capital guidelines for bank holding companies. Bank holding companies generally may not include in tier 1 capital perpetual preferred stock (whether cumulative or noncumulative) that has a dividend rate step-up. Furthermore, the amount of eligible cumulative perpetual preferred stock that a bank holding company may include in its tier 1 capital generally is subject to a 25 percent limit.

In part of his continuing plan to make Dubai the world’s financial centre, Geithner’s about to unveil regulated pay scales:

Treasury Secretary Timothy Geithner called for major changes in compensation practices at financial companies and said the Obama administration’s plan to help realign pay with performance will be rolled out by mid-June.

“I don’t think we can go back to the way it was,” Geithner said in an interview on Bloomberg Television’s “Political Capital with Al Hunt,” to be aired tonight and over the weekend. “We’re going to need to see very, very substantial change.”

He said that Wall Street’s pay practices, which include big year-end bonuses, encouraged excessive risk-taking and helped precipitate the financial crisis. What’s needed is a set of broad standards that financial supervisors can use to make sure that doesn’t happen again, he said.

Typical penis-envy: he can’t negotiate worth a damn himself:

While 17 financial institutions have repaid TARP funds, only two have come to terms with the U.S. on the value of the rights to buy stock that taxpayers received for the risk of recapitalizing the industry. The first was Old National Bancorp in Evansville, Indiana, which gave the Treasury Department $1.2 million last week for warrants that may have been worth $5.81 million, according to the data.

If Geithner makes the same deal for all companies in the rescue program, lenders may walk away with 80 percent of profits taxpayers might have claimed.

All this interference might lead to the death of dealers. There is no reason why a hedge fund can’t make it known that it is willing to call a market on any security it pleases; and creating a trading desk organized on the same principles as an institutional desk. Dealers will be left trading governments. Hell, I’ve been trying to organize such a hedge fund for preferred shares for years; sadly, the pension funds I’ve talked to have advised me that one can’t make any money trading preferred shares as principal.

However, increased importance of hedge funds will make the insurers happy:

The cost of insuring hedge funds against negligence has risen as much as 20 percent in the past six months after Lehman Brothers Holdings Inc.’s bankruptcy and Bernard Madoff’s Ponzi scheme increased the threat of lawsuits.

A fund manager with $200 million of assets running a “straightforward” strategy is typically paying as much as $60,000 a year for $5 million of coverage, up from $50,000 at the end 2008, said Brian Horwell, director of professional risks at London-based Miller Insurance Services Ltd.

The FDIC has approved a proposal to increase the insurance premia charged to banks:

On October 7, 2008, the FDIC established a Restoration Plan for the DIF.2 The Restoration Plan called for the FDIC to set assessment rates such that the reserve ratio would return to 1.15 percent within five years. The plan also required the FDIC to update its loss and income projections for the fund and, if needed to ensure that the fund reserve ratio reached 1.15 percent within five years, increase assessment rates. The FDIC amended the Restoration Plan on February 27, 2009, and extended the time within which the reserve ratio must be returned to 1.15 percent from five years to seven years due to extraordinary circumstances.3 The FDIC also adopted a final rule (the assessments final rule) that, among other things, set quarterly initial base assessment rates at 12 to 45 basis points beginning in the second quarter of 2009.4 However, given the FDIC’s estimated losses from projected institution failures, these assessment rates will not be sufficient to return the fund reserve ratio to 1.15 percent within seven years and are unlikely to prevent the DIF fund balance and reserve ratio from falling to near zero or becoming negative in 2009.

The Designated Reserve Ratio is defined as the reserve fund size divided by insured deposits (which, by the way, makes the charging of premia on assets less Tier 1 capital a little suspicious; they should charge insurance premia only on what they’re insuring).

One may note that back here in Canada:

million.We increased our provision for insurance losses by $50 million to $650 million, a move that reflects CDIC’s increasing insurance risk. This provision, combined with retained earnings, resulted in our ex ante funding reaching $1.6 billion as at March 31, 2008. This represents 35 basis points of insured deposits, below our target range of 40 to 50 basis points.

Well, it’s a good thing our bankers are so smart, that’s all I can say!

PerpetualDiscounts continued their ascent on continued elevated – albeit declining, probably a knock-on effect from the short trading day in the US – volume, while FixedResets were basically unchanged.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.8941 % |

1,164.8 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.8941 % |

1,883.7 |

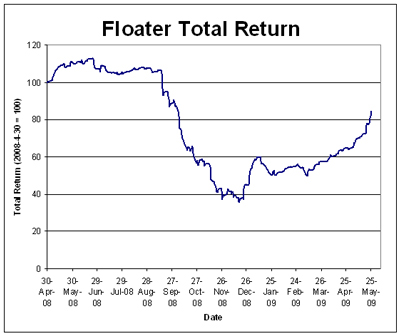

| Floater |

3.23 % |

3.86 % |

85,747 |

17.66 |

3 |

-0.8941 % |

1,455.1 |

| OpRet |

5.04 % |

3.75 % |

128,492 |

2.58 |

15 |

0.0688 % |

2,159.5 |

| SplitShare |

5.93 % |

5.64 % |

55,854 |

4.24 |

3 |

-0.1708 % |

1,827.1 |

| Interest-Bearing |

5.99 % |

6.73 % |

25,849 |

0.59 |

1 |

0.0000 % |

1,991.2 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2222 % |

1,713.8 |

| Perpetual-Discount |

6.38 % |

6.43 % |

159,346 |

13.29 |

71 |

0.2222 % |

1,578.4 |

| FixedReset |

5.72 % |

4.87 % |

496,545 |

4.49 |

37 |

-0.0021 % |

1,983.2 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| TRI.PR.B |

Floater |

-2.97 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 16.02

Evaluated at bid price : 16.02

Bid-YTW : 2.47 % |

| NA.PR.M |

Perpetual-Discount |

-1.26 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 23.34

Evaluated at bid price : 23.51

Bid-YTW : 6.43 % |

| BAM.PR.I |

OpRet |

-1.11 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-12-30

Maturity Price : 25.00

Evaluated at bid price : 24.01

Bid-YTW : 6.76 % |

| CU.PR.A |

Perpetual-Discount |

-1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 23.46

Evaluated at bid price : 23.75

Bid-YTW : 6.12 % |

| TD.PR.G |

FixedReset |

-1.04 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 26.73

Bid-YTW : 4.81 % |

| BNS.PR.J |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 21.63

Evaluated at bid price : 21.63

Bid-YTW : 6.14 % |

| HSB.PR.C |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 19.70

Evaluated at bid price : 19.70

Bid-YTW : 6.59 % |

| BNS.PR.Q |

FixedReset |

1.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 24.50

Evaluated at bid price : 24.55

Bid-YTW : 4.12 % |

| CIU.PR.A |

Perpetual-Discount |

1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 18.90

Evaluated at bid price : 18.90

Bid-YTW : 6.12 % |

| SLF.PR.A |

Perpetual-Discount |

1.11 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 18.16

Evaluated at bid price : 18.16

Bid-YTW : 6.67 % |

| CM.PR.P |

Perpetual-Discount |

1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 21.55

Evaluated at bid price : 21.55

Bid-YTW : 6.46 % |

| PWF.PR.J |

OpRet |

1.14 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-07-30

Maturity Price : 25.00

Evaluated at bid price : 25.70

Bid-YTW : 4.06 % |

| PWF.PR.L |

Perpetual-Discount |

1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 19.21

Evaluated at bid price : 19.21

Bid-YTW : 6.72 % |

| BAM.PR.K |

Floater |

1.48 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 10.30

Evaluated at bid price : 10.30

Bid-YTW : 3.86 % |

| CM.PR.G |

Perpetual-Discount |

1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 20.31

Evaluated at bid price : 20.31

Bid-YTW : 6.73 % |

| CM.PR.H |

Perpetual-Discount |

1.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 19.00

Evaluated at bid price : 19.00

Bid-YTW : 6.39 % |

| CM.PR.E |

Perpetual-Discount |

1.78 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 21.16

Evaluated at bid price : 21.16

Bid-YTW : 6.70 % |

| MFC.PR.B |

Perpetual-Discount |

1.81 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 19.08

Evaluated at bid price : 19.08

Bid-YTW : 6.22 % |

| MFC.PR.C |

Perpetual-Discount |

2.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 18.25

Evaluated at bid price : 18.25

Bid-YTW : 6.18 % |

| GWO.PR.G |

Perpetual-Discount |

2.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 20.51

Evaluated at bid price : 20.51

Bid-YTW : 6.46 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| SLF.PR.E |

Perpetual-Discount |

205,784 |

National Bank crossed 200,000 at 17.30.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 17.16

Evaluated at bid price : 17.16

Bid-YTW : 6.68 % |

| TD.PR.G |

FixedReset |

120,330 |

TD crossed 109,700 at 26.80.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 26.73

Bid-YTW : 4.81 % |

| SLF.PR.F |

FixedReset |

58,505 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-30

Maturity Price : 25.00

Evaluated at bid price : 25.75

Bid-YTW : 5.37 % |

| PWF.PR.M |

FixedReset |

35,640 |

Nesbitt bought 25,100 from National at 26.05.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-05-22

Maturity Price : 23.43

Evaluated at bid price : 25.82

Bid-YTW : 5.19 % |

| BAM.PR.H |

OpRet |

32,042 |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-03-30

Maturity Price : 25.00

Evaluated at bid price : 24.50

Bid-YTW : 6.89 % |

| RY.PR.Y |

FixedReset |

31,425 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-12-24

Maturity Price : 25.00

Evaluated at bid price : 26.15

Bid-YTW : 5.26 % |

| There were 30 other index-included issues trading in excess of 10,000 shares. |