Lasse Heje Pedersen writes a good review piece on VoxEU, Liquidity risk and the current crisis:

the meaning of liquidity risk is clear.

- Market liquidity risk is the risk that the market liquidity worsens when you need to trade.

- Funding liquidity risk is the risk that a trader cannot fund his position and is forced to unwind.

For instance, a levered hedge fund may lose its access to borrowing from its bank and must sell its securities as a result. Or, from the bank’s perspective, depositors may withdraw their funds, the bank may lose its ability to borrow from other banks, or raise funds via debt issues.

…

If we have learned one thing from the current crisis, it is that trading through organised exchanges with centralised clearing is better than trading over-the-counter derivatives because trading derivatives increases co-dependence, complexity, counterparty risk, and reduces transparency. Said simply, when you buy a stock, your ownership does not depend on who you bought it from. If you buy a “synthetic stock” through a derivative, on the other hand, your ownership does depends on who you bought it from – and that dependence may prevail even after you sell the stock (if you sell through another bank). Hence, when people start losing confidence in the bank with which they trade, they may start to unwind their derivatives positions and this hurts the bank’s funding, and a liquidity spiral unfolds.

…

Banning short selling is a bad idea

…

Tobin taxes are a bad idea

TD Bank pre-announced some losses that will show up in the fourth quarter:

Credit trading losses of approximately $350 million (after-tax) for the quarter in Wholesale Banking, leading to a net loss of $228 million on an adjusted basis for that segment

…

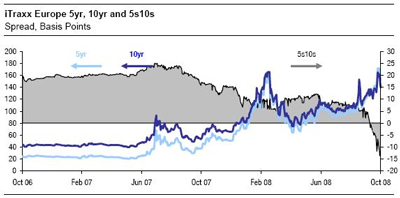

The first significant item relates to the credit trading business in TDBFG’s Wholesale Banking segment. As previously disclosed, due to global liquidity issues, the widening in the pricing relationship between asset and credit protection markets (basis) has negatively impacted credit trading-related revenues for the first three quarters of 2008. The dramatic absence of liquidity in global credit markets in September and October has produced an unprecedented widening of the basis, causing larger losses in Wholesale Banking in the fourth quarter.

Hmmm … basis widening? It sounds like the Credit Default Swap Basis they’re talking about. So – I think – what happened is this:

- TD has a large corporate bond inventory (that they trade)

- The hedge it by buying protection (via Credit Default Swaps) … not necessarily on each individual name, it might be, f’rinstance IG 11)

- TD might even have deliberately put on a big negative basis trade

- Funding cash bonds has become a chancy thing. Liquidity is NIL (or close enough). The CDS basis becomes even more negative.

- On a mark-to-market basis, TD Bank loses money

Like I said, maybe. There’s not a lot of detail in the press release.

Teck Cominco eliminated its dividend. The market wasn’t very happy.

Preferred share investors shaken by the carnage can console themselves that they have a front-row seat on history while avoiding the brunt of the unwind. I will lift two quotes from the excellent Across the Curve today … Treasuries & Swaps:

The Long Bond is trading at a yield of 3.43 percent and the dollar price has exploded 9 points today. I have done this for nearly 30 years. I have never witnessed this before. Even more incredible is the 30 year swap spread and swap rate. The 30 year swap rate is 2.84. It has dropped about 80 basis points on the day and is about 60 basis points rich to the 30 year Treasury.I just spoke with an options trader about this historic move. He said that there structured product trades buried in trading books all over the world which are melting. There is a massive short in the 30 year sector (in Treasury paper and in the swap market) which resulted from sales of cheap volatility. Some of these positions have been on the books of various entities for years and it is only recently that the chickens have come home to roost. Each time the spread turns more negative, that movement forces some one to receive in swaps to hedge there position. There are short the long end trades in every permutation and combination along the curve. The receiving creates a self fulfilling prophecy which compels someone else to receive. He had no opinion on when this would end.

… and CMBS:

Cash AAAs widened 325 basis points. The email author wanted to put the recent carnage into stark relief for the non aficionados in the room. He noted that GSMS 07-GG 10- A4 is a benchmark deal. Two weeks ago it traded at 83. Today it traded at 48.

CMBX AAAs wider by 130 basis points.

Look at the CMBS basis move! Cash moved 325bp … the CDS index moved by 130. The basis moved nearly 200bp! While I am not a specialist in the field, I would suggest that a move of 2 (two) basis points in the basis would be a pretty good day … in normal times.

The longer term moves? Bloomberg reports:

Yields on the safest category of AAA rated commercial- mortgage bonds rose 3.34 percentage points, the biggest gain ever, to a record 15.29 percentage points more than interest- rate swaps, according to Bank of America Corp. data.

…

The spread on the AAA commercial-mortgage securities, which entered this year at 0.82 percentage point, has climbed from 5.88 percentage points on Nov. 4.

The move in basis is indicative that even those who are willing to take some risk and lever up a position in CMBS … can’t get, or can’t trust, funding. So they have to take a synthetic position by selling protection. Lots of money to be made there, buying cash bonds and protecting them … if you can trust your financing … and your counterparties.

So, after a horrible day that was the fourth horrible day in a row (defining “horrible” as a loss of more than 1%), PerpetualDiscounts yield 7.95% as pre-tax dividends, equivalent to 11.13% pre-tax interest. Long Corporates are still at 7.50% so the Pre-Tax Interest-Equivalent Spread is … (drum-roll, please) … 363bp. Incredible.

Holy smokes. On a day like this, what would I do without Dealbreaker?

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 5.06% | 5.00% | 70,972 | 15.62 | 6 | -1.6230% | 1,036.7 |

| Floater | 9.43% | 9.67% | 54,872 | 9.72 | 2 | -4.0215% | 372.8 |

| Op. Retract | 5.35% | 6.35% | 135,628 | 3.90 | 15 | -0.4634% | 994.6 |

| Split-Share | 7.42% | 15.33% | 61,279 | 3.80 | 12 | -7.2657% | 819.7 |

| Interest Bearing | 9.48% | 18.65% | 55,109 | 2.79 | 3 | -8.1449% | 757.3 |

| Perpetual-Premium | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Perpetual-Discount | 7.85% | 7.95% | 179,463 | 11.50 | 71 | -4.7611% | 698.5 |

| Fixed-Reset | 5.60% | 5.27% | 887,144 | 14.83 | 12 | -0.4732% | 1,047.6 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| LFE.PR.A | SplitShare | -40.8235% | Asset coverage of 1.6-:1 as of November 14 according to the company. Now with a pre-tax bid-YTW of 26.33% based on a bid of 5.03 and a hardMaturity 2012-12-1 at 10.00. Retraction formula is (96%NAV) – C [I think] but they want 20 days notice! Capital Units closed at $4 today. Preferred Closing quote 5.03-7.56, 16×9. Day’s range 7.56-45. So the good news is: it’s not as bad as it looks. The bad news is: I had to check. |

| FIG.PR.A | InterestBearing | -19.8473% | See cancellation of rights offering. Now with a pre-tax bid-YTW of 20.72% based on a bid of 5.25 and a hardMaturity 2014-12-31. Closing quote of 5.25-95, 2×3. Day’s range of 5.25-6.55. |

| POW.PR.B | PerpetualDiscount | -14.4082% | Now with a pre-tax bid-YTW of 9.12% based on a bid of 14.97 and a limitMaturity. Closing quote 14.97-49, 10×3. Day’s range 14.90-17.49 (!). |

| BNA.PR.C | SplitShare | -12.2449% | Asset coverage currently 1.5+:1 based on BAM.A at 15.93 and 2.4 BAM.A per preferred. Now with a pre-tax bid-YTW of 15.90% based on a bid of 10.75 and a hardMaturity 2019-1-10 at 25.00. Closing quote of 10.75-11.59, 2×7. Day’s range of 10.01-12.25 (!) |

| ALB.PR.A | SplitShare | -11.3953% | Asset coverage of 1.5-:1 as of November 13 according to Scotia Managed Companies. Now with a pre-tax bid-YTW of 17.39% based on a bid of 19.05 and a hardMaturity 2011-2-28. Closing quote of 19.05-97, 1×1. Day’s range of 19.63-21.5 (!) |

| POW.PR.A | PerpetualDiscount | -11.3866% | Now with a pre-tax bid-YTW of 8.15% based on a bid of 17.51 and a limitMaturity. Closing quote 17.51-19.00, 10×5. Day’s range of 19.50-75. |

| CM.PR.G | PerpetualDiscount | -9.9613% | Now with a pre-tax bid-YTW of 8.43% based on a bid of 16.27 and a limitMaturity. Closing Quote 16.27-74, 4X2. Day’s range of 16.50-18.11. |

| ELF.PR.G | PerpetualDiscount | -9.8746% | Now with a pre-tax bid-YTW of 10.56% based on a bid of 11.50 and a limitMaturity. Closing Quote 11.50-48, 5X5. Day’s range of 11.50-12.75. |

| RY.PR.F | PerpetualDiscount | -9.4216% | Now with a pre-tax bid-YTW of 7.39% based on a bid of 15.19 and a limitMaturity. Closing Quote 15.19-16.25, 1×11. Day’s range of 16.50-76. |

| CM.PR.J | PerpetualDiscount | -9.1096% | Now with a pre-tax bid-YTW of 8.62% based on a bid of 13.27 and a limitMaturity. Closing Quote 13.27-50, 5×2. Day’s range of 13.26-14.60. |

| FBS.PR.B | SplitShare | -9.0909% | Asset coverage of 1.4-:1 as of November 13, according to the company. Now with a pre-tax bid-YTW of 18.49% based on a bid of 7.00 and a hardMaturity 2011-12-15 at 10.00. Closing quote of 7.00-40, 20×11. Day’s range of 7.25-90. Monthly retraction formula is (95%NAV) – C – $0.40 = about 7.20 … not supportive yesterday, but supportive now … but NAV has probably changed substantially! |

| W.PR.H | PerpetualDiscount | -9.0303% | Now with a pre-tax bid-YTW of 9.35% based on a bid of 15.01 and a limitMaturity. Closing Quote 15.01-16.49. Day’s range of 16.50-51. |

| POW.PR.C | PerpetualDiscount | -8.6022% | Now with a pre-tax bid-YTW of 8.70% based on a bid of 17.00 and a limitMaturity. Closing Quote 17.00-86, 6×1. Day’s range of 17.30-18.50. |

| PWF.PR.H | PerpetualDiscount | -8.5873% | Now with a pre-tax bid-YTW of 8.85% based on a bid of 16.50 and a limitMaturity. Closing Quote 16.50-00, 10×22. Day’s range of 17.00-18.60. |

| BNS.PR.R | Fixed-Reset | -8.5106% | |

| SLF.PR.D | PerpetualDiscount | -8.4919% | Now with a pre-tax bid-YTW of 8.91% based on a bid of 12.50 and a limitMaturity. Closing Quote 12.50-25, 8×8. Day’s range of 12.50-13.79. |

| RY.PR.G | PerpetualDiscount | -8.2840% | Now with a pre-tax bid-YTW of 7.32% based on a bid of 15.50 and a limitMaturity. Closing Quote 15.50-70, 14×1. Day’s range of 15.12-17.00. |

| BAM.PR.B | Floater | -8.1250% | Poor old BAM floaters can’t seem to catch a break. No matter how highly they’re touted. |

| BNS.PR.L | PerpetualDiscount | -8.1238% | Now with a pre-tax bid-YTW of 8.01% based on a bid of 14.25 and a limitMaturity. Closing Quote 14.25-15.50, 1×27. Day’s range of 15.00-75. |

| W.PR.J | PerpetualDiscount | -8.0048% | Now with a pre-tax bid-YTW of 9.28% based on a bid of 15.40 and a limitMaturity. Closing Quote 15.40-16.47, 1×4. Day’s range of 15.50-16.75. |

| NA.PR.N | FixedReset | +11.8916% | Partial recovery from yesterday’s fiasco. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| BNA.PR.B | SplitShare | 130,650 | Desjardins crossed two blocks of 25,000 each at 18.00, then another 75,000 at the same price. See BNA.PR.C, above. Now with a pre-tax bid-YTW of 10.81% based on a bid of 17.73 and a hardMaturity 2016-3-25. Monthly Retraction formula of $25.00 – 5%NAV – $1 = $25.00 – 5%($38.23) – 1 = $22.09 Extremely Supportive! |

| FTS.PR.C | Scraps (Would be OpRet but there are credit concerns) | -6.4016% | CIBC crossed 49,000 at 25.05, then another 50,000 at the same price. Now with a pre-tax bid-YTW of 6.92% based on a bid of 23.54 and a softMaturity 2013-8-31 at 25.00 |

| TD.PR.C | FixedReset | 88,150 | Scotia crossed 12,000 at 24.95, then another 11,000 at the same price. |

| RY.PR.L | FixedReset | 71,100 | Scotia crossed 15,000 at 24.95. |

| CM.PR.A | OpRet | 62,980 | RBC crossed 57,000 at 25.25. Now with a pre-tax bid-YTW of 5.07% based on a bid of 25.25 and a softMaturity 2011-7-30 at 25.00. |

| BCE.PR.G | FixFloat | 46,012 | CIBC crossed 41,000 at 22.75. |

There were fifty-seven other index-included $25-pv-equivalent issues trading over 10,000 shares today.