Jobs, jobs, … well, a few jobs, anyway:

Job growth settled into a more sustainable pace in January and the unemployment rate dropped to an almost eight-year low of 4.9 percent, signs of a resilient labor market that’s causing wage growth to stir.

The 151,000 advance in payrolls, while less than forecast, largely reflected payback for a seasonal hiring pickup in the final two months of 2015, Labor Department figures showed Friday. The jobless rate fell to the lowest level since February 2008. Hourly earnings rose more than estimated after climbing in the year to December by the most since July 2009.

…

Friday’s data showed a much-awaited pickup in wage growth is starting to manifest itself. Average hourly earnings rose 0.5 percent from a month earlier to $25.39. The year-over-year increase of 2.5 percent followed a 2.7 percent jump in the 12 months ended in December, which was the biggest advance since mid-2009.

All in all, the report was somewhat hawkish for the Fed:

Most obviously, the jobless rate dropped in January to 4.9 percent, matching the Fed’s median forecast for the long-run sustainable level of unemployment — or “full employment” — and continuing the most impressive trend in U.S. economic data.

Perhaps even more encouraging was the move in the labor force participation rate. The share of the working-age population that was either employed or looking for a job ticked up to 62.7 percent in January from 62.6 percent the month before. From a year earlier, some 1.31 million people have entered the labor force.

Average hourly earnings rose by a more-than-expected 2.5 percent in January from the year before. Wages for the year through December were revised upward to 2.7 percent, the highest level since July 2009.

Meanwhile, back in the frozen North:

Over all, Canada shed 5,700 jobs in January, pushing the jobless rate up by 0.1 percentage point and missing analyst expectations as energy-related declines offset a spurt in public sector employment.

…

Ontario was the only province to see job expansion, with 20,000 new positions created last month, according to Statscan. Most of the increases were in trade, education, and accommodation and food services.

But we can hope for higher unemployment amongst stock brokers!

Banks are watching wealthy clients flirt with robo-advisers, and that’s one reason the lenders are racing to release their own versions of the automated investing technology this year, according to a consultant.

Millennials and small investors aren’t the only ones using robo-advisers, a group that includes pioneers Wealthfront Inc. and Betterment LLC and services provided by mutual-fund giants, said Kendra Thompson, an Accenture Plc managing director. At Charles Schwab Corp., about 15 percent of those in automated portfolios have at least $1 million at the company.

“It’s real money moving,” Thompson said in an interview. “You’re seeing experimentation from people with much larger portfolios, where they’re taking a portion of their money and putting them in these offerings to try them out.”

… despite the best efforts of their future colleagues:

OSC Notice 33-745 also provided some commentary on what would be expected of a registered advising representative (AR) in the context of an online advisory business:

“The online advice model that we have considered acceptable involves an interactive website used to collect KYC information, which will be reviewed by a registered AR. The AR will communicate with the client by telephone, video link, email or internet chats. The AR must ensure that sufficient KYC information has been gathered to support the PM firm’s obligation to make suitability determinations for the client.

Each of the firms that we have registered to provide online advice operates on a discretionary managed account basis, using portfolios of unleveraged exchange traded funds (ETFs) or low cost mutual funds. In most cases, these are model portfolios which are selected for a client based on a profile generated by the KYC collection process. An AR will review and approve the suitability of the portfolio for the client. The client’s account is periodically rebalanced to the parameters set for their portfolio.

This is not the so-called “robo-advice” model seen in the United States, where online advice has seen rapid growth in the last few years. The online advisers operating in Ontario are offering hybrid services that utilize an online platform for the efficiencies it offers, while ARs remain actively involved in decision making.”

It was a good day for the Canadian preferred share market, with PerpetualDiscounts winning 62bp, FixedResets up 54bp and DeemedRetractibles gaining 8bp. The Performance Highlights table is lengthy. Volume was well below average.

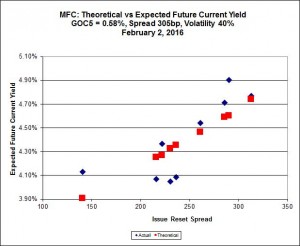

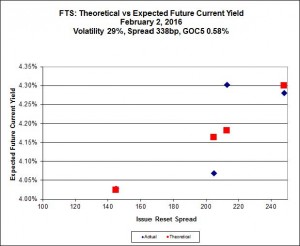

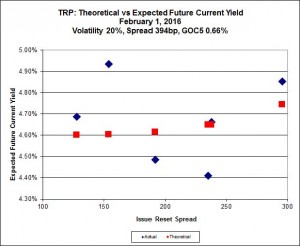

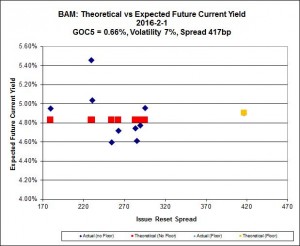

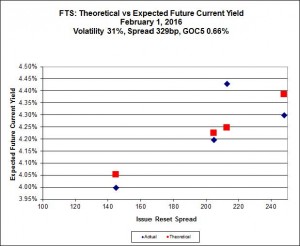

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

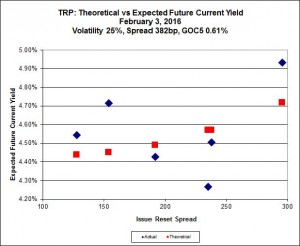

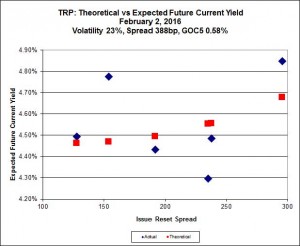

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 17.43 to be $1.04 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $0.76 cheap at its bid price of 18.30.

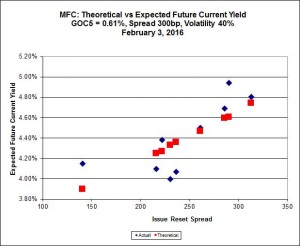

Most expensive is MFC.PR.N, resetting at +230bp on 2020-3-19, bid at 18.30 to be 1.21 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 18.20 to be 1.23 cheap.

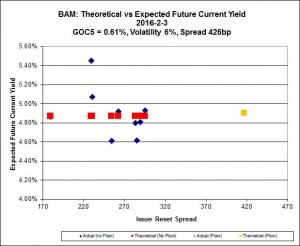

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 13.30 to be $1.65 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 17.30 and appears to be $1.05 rich.

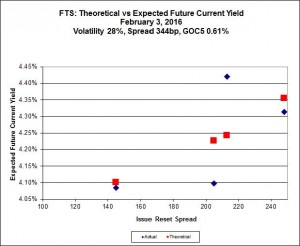

FTS.PR.K, with a spread of +205bp, and bid at 16.15, looks $0.22 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 16.10 and is $0.24 cheap.

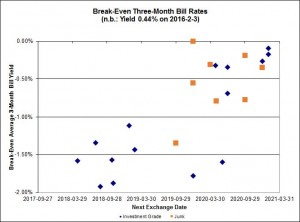

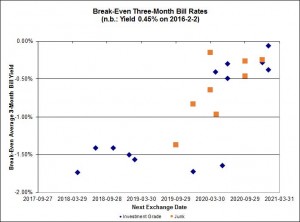

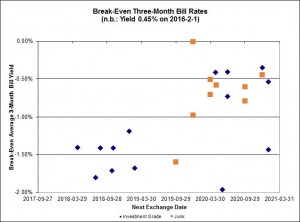

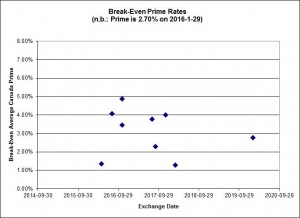

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.92%, with two outliers above 0.00%. There are four junk outliers above 0.00%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.29 % | 6.43 % | 17,535 | 16.15 | 1 | 0.0000 % | 1,474.7 |

| FixedFloater | 7.54 % | 6.59 % | 26,260 | 15.69 | 1 | 0.0000 % | 2,636.9 |

| Floater | 4.57 % | 4.73 % | 76,154 | 15.97 | 4 | 0.5841 % | 1,676.7 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1458 % | 2,707.8 |

| SplitShare | 4.88 % | 6.35 % | 81,687 | 2.70 | 6 | 0.1458 % | 3,168.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1458 % | 2,472.3 |

| Perpetual-Premium | 5.83 % | 5.52 % | 82,594 | 2.51 | 6 | 0.1461 % | 2,533.9 |

| Perpetual-Discount | 5.74 % | 5.77 % | 98,625 | 14.25 | 33 | 0.2292 % | 2,517.0 |

| FixedReset | 5.46 % | 4.80 % | 221,263 | 14.54 | 83 | 0.0119 % | 1,856.9 |

| Deemed-Retractible | 5.24 % | 5.56 % | 130,758 | 5.22 | 34 | 0.0540 % | 2,577.8 |

| FloatingReset | 3.04 % | 4.65 % | 50,430 | 5.56 | 16 | 0.1946 % | 2,022.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TRP.PR.I | FloatingReset | -3.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 11.17 Evaluated at bid price : 11.17 Bid-YTW : 4.48 % |

| BAM.PF.G | FixedReset | -2.95 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 18.10 Evaluated at bid price : 18.10 Bid-YTW : 5.27 % |

| BAM.PF.F | FixedReset | -2.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 18.40 Evaluated at bid price : 18.40 Bid-YTW : 5.15 % |

| HSE.PR.A | FixedReset | -2.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 8.61 Evaluated at bid price : 8.61 Bid-YTW : 7.12 % |

| BAM.PF.E | FixedReset | -2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 5.13 % |

| BAM.PF.B | FixedReset | -2.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 17.05 Evaluated at bid price : 17.05 Bid-YTW : 5.16 % |

| TRP.PR.H | FloatingReset | -1.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 9.17 Evaluated at bid price : 9.17 Bid-YTW : 4.77 % |

| BAM.PF.A | FixedReset | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 5.19 % |

| BMO.PR.Z | Perpetual-Discount | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 22.41 Evaluated at bid price : 22.73 Bid-YTW : 5.50 % |

| VNR.PR.A | FixedReset | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 16.77 Evaluated at bid price : 16.77 Bid-YTW : 5.38 % |

| BAM.PR.Z | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 17.87 Evaluated at bid price : 17.87 Bid-YTW : 5.34 % |

| SLF.PR.G | FixedReset | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.87 Bid-YTW : 10.85 % |

| BAM.PR.B | Floater | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 10.10 Evaluated at bid price : 10.10 Bid-YTW : 4.73 % |

| MFC.PR.L | FixedReset | 1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.09 Bid-YTW : 8.54 % |

| W.PR.H | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 22.70 Evaluated at bid price : 22.99 Bid-YTW : 6.04 % |

| ELF.PR.F | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 22.10 Evaluated at bid price : 22.32 Bid-YTW : 5.99 % |

| TD.PF.E | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 19.77 Evaluated at bid price : 19.77 Bid-YTW : 4.57 % |

| HSE.PR.C | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 15.07 Evaluated at bid price : 15.07 Bid-YTW : 6.72 % |

| MFC.PR.H | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.05 Bid-YTW : 7.05 % |

| PWF.PR.K | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 21.37 Evaluated at bid price : 21.64 Bid-YTW : 5.75 % |

| RY.PR.J | FixedReset | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 19.15 Evaluated at bid price : 19.15 Bid-YTW : 4.53 % |

| MFC.PR.F | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.18 Bid-YTW : 11.63 % |

| CCS.PR.C | Deemed-Retractible | 1.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.35 Bid-YTW : 6.70 % |

| W.PR.J | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 22.93 Evaluated at bid price : 23.20 Bid-YTW : 6.09 % |

| HSE.PR.E | FixedReset | 1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 6.86 % |

| CIU.PR.C | FixedReset | 1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 10.45 Evaluated at bid price : 10.45 Bid-YTW : 4.90 % |

| PWF.PR.T | FixedReset | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 21.13 Evaluated at bid price : 21.13 Bid-YTW : 3.83 % |

| HSE.PR.G | FixedReset | 1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 6.76 % |

| W.PR.K | FixedReset | 1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 22.89 Evaluated at bid price : 24.25 Bid-YTW : 5.42 % |

| GWO.PR.O | FloatingReset | 1.99 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.25 Bid-YTW : 11.94 % |

| FTS.PR.I | FloatingReset | 2.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 10.25 Evaluated at bid price : 10.25 Bid-YTW : 4.70 % |

| BNS.PR.F | FloatingReset | 2.76 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.26 Bid-YTW : 7.48 % |

| TRP.PR.C | FixedReset | 3.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 11.76 Evaluated at bid price : 11.76 Bid-YTW : 4.78 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BAM.PR.T | FixedReset | 83,306 | TD crossed 80,000 at 14.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 14.25 Evaluated at bid price : 14.25 Bid-YTW : 5.50 % |

| NA.PR.X | FixedReset | 66,528 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 23.14 Evaluated at bid price : 24.98 Bid-YTW : 5.55 % |

| RY.PR.H | FixedReset | 65,145 | Desjardins crossed 50,000 at 17.58. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 4.47 % |

| TD.PF.G | FixedReset | 54,500 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.48 Bid-YTW : 5.18 % |

| MFC.PR.J | FixedReset | 52,368 | Desjardins crossed 50,000 at 18.15. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.20 Bid-YTW : 7.88 % |

| TRP.PR.G | FixedReset | 45,354 | Desjardins bought 20,700 from National at 18.25. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-05 Maturity Price : 18.30 Evaluated at bid price : 18.30 Bid-YTW : 5.13 % |

| There were 22 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| HSE.PR.C | FixedReset | Quote: 15.07 – 18.50 Spot Rate : 3.4300 Average : 1.8786 YTW SCENARIO |

| GWO.PR.O | FloatingReset | Quote: 11.25 – 13.50 Spot Rate : 2.2500 Average : 1.5421 YTW SCENARIO |

| SLF.PR.J | FloatingReset | Quote: 11.74 – 12.55 Spot Rate : 0.8100 Average : 0.5388 YTW SCENARIO |

| CU.PR.C | FixedReset | Quote: 17.00 – 17.50 Spot Rate : 0.5000 Average : 0.3251 YTW SCENARIO |

| RY.PR.M | FixedReset | Quote: 18.80 – 19.39 Spot Rate : 0.5900 Average : 0.4292 YTW SCENARIO |

| TD.PR.Z | FloatingReset | Quote: 21.85 – 22.45 Spot Rate : 0.6000 Average : 0.4393 YTW SCENARIO |