The Bank of America takes wealth destruction seriously:

Bank of America Corp. (BAC), faced with a glut of foreclosed and abandoned houses it can’t sell, has a new tool to get rid of the most decrepit ones: a bulldozer.

The biggest U.S. mortgage servicer will donate 100 foreclosed houses in the Cleveland area and in some cases contribute to their demolition in partnership with a local agency that manages blighted property. The bank has similar plans in Detroit and Chicago, with more cities to come, and Wells Fargo & Co. (WFC), Citigroup Inc. (C), JPMorgan Chase & Co. (JPM) and Fannie Mae are conducting or considering their own programs.

…

The lender will pay as much as $7,500 for demolition or $3,500 in areas eligible to receive funds through the federal Neighborhood Stabilization Program. Uses for the land include development, open space and urban farming, according to the statement

Speaking of wealth destruction, S&P downgraded Greece:

Greece will partially default on its debt once European officials push through a plan that will see bondholders foot part of the bill of a second bailout agreed to last week in Brussels, Standard & Poor’s said.

The rating company also cut its ranking for Greece to CC, two steps above default, from CCC, according to a statement published in London today. The outlook on the debt is negative.

“The proposed restructuring of Greek government debt would amount to a selective default under our rating methodology,” S&P said. “We view the proposed restructuring as a ‘distressed exchange’ because, based on public statements by European policy makers, it is likely to result in losses for commercial creditors.”

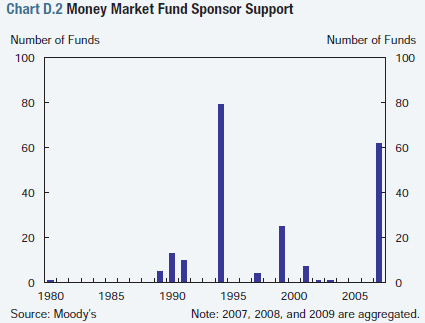

But stupid people can relax – the authorities are taking steps to ensure that nobody will ever lose money in the PPN market:

These are a way for banks to get cheap funding by packaging an unsecured debt security with an equity/credit/commodity/whatever derivative and selling it to customers who don’t have ISDAs or otherwise aren’t down with OTC derivatives. They’re called “principal protected” because even if the linked index goes down, you still get all your money back (albeit at zero yield). But that only happens if the issuer doesn’t go bankrupt – if they go bankrupt, you’re hosed just like other noteholders.

Which, duh, or so we thought. The notes after all said that they were Lehman’s unsecured obligations and that “an investment in the Notes will be subject to the credit risk of Lehman Brothers Holdings Inc, and the actual and perceived creditworthiness of Lehman Brothers Holdings Inc. may affect the market value of the Notes.” But that wasn’t enough for these plaintiffs, or for the judge, who is going to let the structured notes claims go to trial:

…

So the advice to structured notes desks is (1) put everything on the first page and (2) don’t assume that your customers are “careful and intelligent readers.”

Canadians, on the other hand, are indeed “careful and intelligent readers.”. I proved this on January 5:

Click for Big

Click for BigIn the States, though the SEC must be vigilant:

Among other things, the staff observed that broker-dealers might have:

- recommended unsuitable structured securities products to retail investors;

- traded at prices disadvantageous to retail investors;

- omitted material facts about structured securities products offered to retail investors;

- engaged in questionable sales practices with customers.

YLO will release 11Q2 results on August 4.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts losing 6bp, FixedResets off 2bp and DeemedRetractibles up 10bp. Volatility was muted (but all negative); volume was average, but with massive volume in BNS.PR.Z (which had a “last” quote with a gigantic spread) on the back of some very nice tickets by RBC.

PerpetualDiscounts now yield 5.38%, equivalent to 6.99% interest at the standard equivalency factor of 1.3x. Long corporates now yield 5.15% (!!) so the pre-tax interest-equivalent spread is now about 185bp, a tightening from the 200bp reported on July 20 as the PerpetualDiscounts played catch-up to the prior downward move in bond yields.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.3871 % |

2,451.7 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.3871 % |

3,687.3 |

| Floater |

2.47 % |

2.24 % |

36,117 |

21.68 |

4 |

-0.3871 % |

2,647.2 |

| OpRet |

4.85 % |

2.28 % |

56,903 |

0.18 |

9 |

-0.0512 % |

2,452.9 |

| SplitShare |

5.25 % |

2.14 % |

52,709 |

0.58 |

6 |

-0.0800 % |

2,510.9 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0512 % |

2,243.0 |

| Perpetual-Premium |

5.67 % |

4.94 % |

133,387 |

0.82 |

13 |

0.0791 % |

2,097.3 |

| Perpetual-Discount |

5.41 % |

5.38 % |

111,636 |

14.77 |

17 |

-0.0617 % |

2,214.7 |

| FixedReset |

5.14 % |

3.11 % |

210,351 |

2.63 |

58 |

-0.0196 % |

2,327.3 |

| Deemed-Retractible |

5.05 % |

4.65 % |

269,754 |

7.82 |

47 |

0.0951 % |

2,178.1 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| NA.PR.P |

FixedReset |

-1.15 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-02-15

Maturity Price : 25.00

Evaluated at bid price : 26.69

Bid-YTW : 3.69 % |

| FTS.PR.F |

Perpetual-Discount |

-1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 24.17

Evaluated at bid price : 24.46

Bid-YTW : 5.07 % |

| BAM.PR.N |

Perpetual-Discount |

-1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 21.84

Evaluated at bid price : 22.14

Bid-YTW : 5.41 % |

| TRI.PR.B |

Floater |

-1.06 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 22.98

Evaluated at bid price : 23.25

Bid-YTW : 2.24 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.Z |

FixedReset |

1,402,675 |

RBC crossed blocks of 575,000 shares, 100,000 and 413,300, all at 24.25. TD crossed 300,000 at the same price.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.26

Bid-YTW : 3.89 % |

| BNS.PR.Q |

FixedReset |

81,413 |

RBC crossed 65,000 at 26.05.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-10-25

Maturity Price : 25.00

Evaluated at bid price : 26.01

Bid-YTW : 3.13 % |

| TD.PR.I |

FixedReset |

71,667 |

RBC crossed blocks of 25,000 and 40,000, both at 27.39.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-31

Maturity Price : 25.00

Evaluated at bid price : 27.37

Bid-YTW : 2.93 % |

| TD.PR.O |

Deemed-Retractible |

49,737 |

Desjardins crossed 27,000 at 25.45.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-10-31

Maturity Price : 25.25

Evaluated at bid price : 25.45

Bid-YTW : 4.42 % |

| RY.PR.R |

FixedReset |

41,243 |

Scotia crossed 35,000 at 27.05.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-02-24

Maturity Price : 25.00

Evaluated at bid price : 26.85

Bid-YTW : 3.07 % |

| BMO.PR.L |

Deemed-Retractible |

34,356 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 26.00

Evaluated at bid price : 27.02

Bid-YTW : 3.89 % |

| There were 33 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| BNS.PR.Z |

FixedReset |

Quote: 24.26 – 25.50

Spot Rate : 1.2400

Average : 0.7346

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.26

Bid-YTW : 3.89 % |

| CIU.PR.C |

FixedReset |

Quote: 25.00 – 25.49

Spot Rate : 0.4900

Average : 0.3497

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 23.17

Evaluated at bid price : 25.00

Bid-YTW : 3.39 % |

| TRI.PR.B |

Floater |

Quote: 23.25 – 23.70

Spot Rate : 0.4500

Average : 0.3322

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 22.98

Evaluated at bid price : 23.25

Bid-YTW : 2.24 % |

| PWF.PR.H |

Perpetual-Premium |

Quote: 25.05 – 25.41

Spot Rate : 0.3600

Average : 0.2449

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-12-10

Maturity Price : 25.00

Evaluated at bid price : 25.05

Bid-YTW : 5.04 % |

| BAM.PR.T |

FixedReset |

Quote: 24.87 – 25.20

Spot Rate : 0.3300

Average : 0.2177

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 23.08

Evaluated at bid price : 24.87

Bid-YTW : 4.34 % |

| BAM.PR.N |

Perpetual-Discount |

Quote: 22.14 – 22.47

Spot Rate : 0.3300

Average : 0.2216

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-07-27

Maturity Price : 21.84

Evaluated at bid price : 22.14

Bid-YTW : 5.41 % |