A provocative BIS working paper by by Előd Takáts is titled Ageing and Asset Prices:

The paper investigates how ageing will affect asset prices. A small model is used to show that economic and demographic factors drive asset, and in particular house, prices. These factors are estimated in a panel regression framework encompassing BIS real house price data from 22 advanced economies between 1970 and 2009. The estimates show that demographic factors affect real house prices significantly. Combining the results with UN population projections suggests that ageing will lower real house prices substantially over the next forty years. The headwind is around 80 basis points per annum in the United States and much stronger in Europe and Japan. Based on the analysis, global asset prices are likely to face substantial headwinds from ageing.

…

However, the estimates are still short of the Mankiw and Weil’s (1989) asset price meltdown projection, which would imply around 300 basis points per annum real house price decline.These estimates are not real house price forecasts, but only estimates of the demographic impact on real house prices. As a number of other factors affect these prices, their movements can be very different from those implied by demographics. For instance, both Italy and Korea experienced strong real house price growth in spite of significant estimated demographic headwinds in the past forty years.

Remember Basis Yield Alpha Fund (last mentioned June 9)? They’re the guys who used their well-honed analytical skills and uncanny grasp of macro-economic trends to buy stuff that the dealer said was good, remember? Goldman is applying to have the boo-hoo-hoo dismissed on on jurisdictional grounds:

Goldman Sachs Group Inc. asked a New York judge to dismiss a $1 billion lawsuit by Australian hedge fund Basis Capital, arguing that a June U.S. Supreme Court decision bars the claim.

…

Goldman Sachs argued that the suit is barred by the Supreme Court’s June 24 ruling in Morrison v. National Australia Bank. In that case, the high court held that U.S. securities laws don’t apply to the claims of foreign buyers of non-U.S. securities on foreign exchanges.“This litigation presents a contract dispute between two foreign entities, executed abroad and governed by English law, and Morrison makes clear that it does not belong in this court,” New York-based Goldman said in a filing dated Aug. 2.

Passive/Active nomenclature is going to get even more blurred:

According to the application filed today, BlackRock will offer ETFs based on indexes that invest in some assets, known as long positions, and sell others to create short positions. The firm may later create funds that are based on indexes that exclusively hold short positions, the filing said.

…

BlackRock will initially create a 130/30 fund based on the MSCI USA Barra Earnings Yield index, according to the company’s application. This index uses mathematical models to buy companies with “positive earnings momentum” and sell short those that have negative earnings momentum, the filing said.

A passive fund that uses mathematical models to select securities? Ummmmm….

The Chinese could give the Europeans some lessons on stress-tests:

China’s banking regulator told lenders last month to conduct a new round of stress tests to gauge the impact of residential property prices falling as much as 60 percent in the hardest-hit markets, a person with knowledge of the matter said.

Banks were instructed to include worst-case scenarios of prices dropping 50 percent to 60 percent in cities where they have risen excessively, the person said, declining to be identified because the regulator’s requirement hasn’t been publicly announced. Previous stress tests carried out in the past year assumed home-price declines of as much as 30 percent.

Although mind you, there are persistent worries about Chinese loan quality, with staggering estimates of default risk.

I was going to make the following links into a full post … but that was three months ago! So here are some links on rights issues. Report to HM Treasury on the implementation of the recommendations of the Rights Issue Review Group

See also PRE-EMPTION RIGHTS: FINAL REPORT

If a company proposes to allot any relevant shares or relevant employee shares or grant any rights over them, those shares or rights must first be offered (for a period of at least 21 days) to the existing members in proportion to their existing holdings on terms no less favourable than are being offered to any third party. Where there are differing classes of shares, the relevant shares may first be offered to members of the relevant class if the Memorandum or Articles so require. Any shares not taken up must then be offered to the members of the company as a whole.

This does not apply to: …

I ran across some disturbing censored TV ads yesterday and was prompted to send the publishers an eMail:

Sirs,

I have viewed the videos at http://www.homefrontcalgary.com/tv-spots.html and found them quite disturbing – I am not surprised the authorities prefer images of kittens and bunnies.

However, I am curious regarding the efficiacy of the approach. The main message is addressed to the abuser, who has presumably been preached at many times in his life and will simply shrug off the message or rationalize his actions in some manner.

Would it not be better to address TV spots of this nature towards the abused woman, something along the lines of “You don’t need to tolerate this, your life can be better, here’s what to do:”?

Today I received a standardized response from them – sufficiently general as to indicate it is the response for any letter having to do with the videos. When even the do-gooders brush off your queries, you know you’re in trouble!

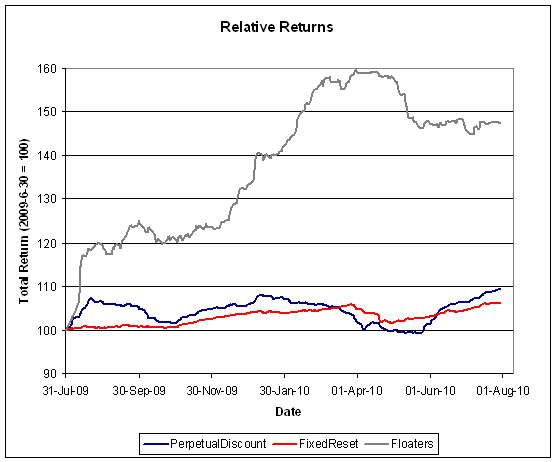

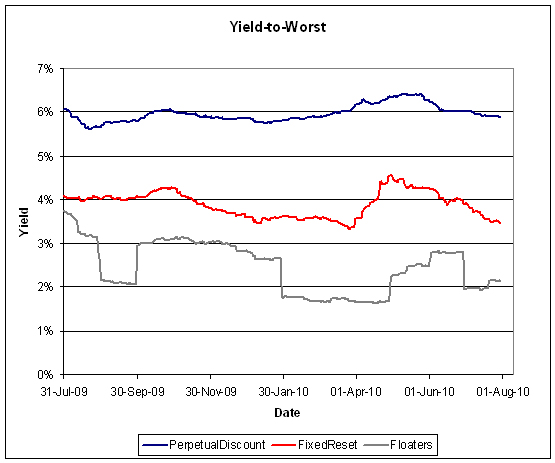

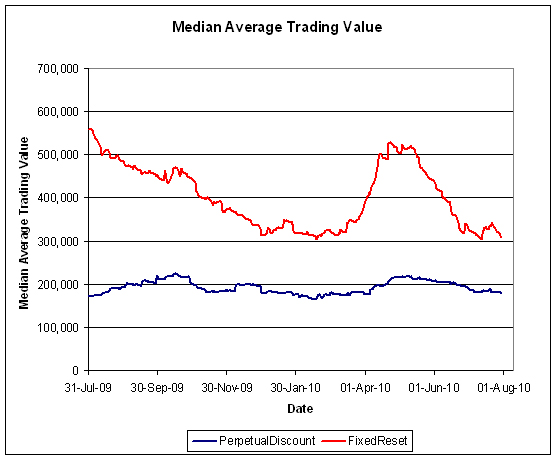

Another day of solid advances on the Canadian preferred share market today, with PerpetualDiscounts up 18bp and FixedResets gaining 5bp. The median weighted average yield on the latter class is now 3.39% … the fifth-lowest on record and within striking distance of the all-time low of 3.31%. Amusingly, the Bozo Spread (Current Yield PerpetualDiscounts less Current Yield FixedResets) remains steady at 50bp.

This is going to end in tears.

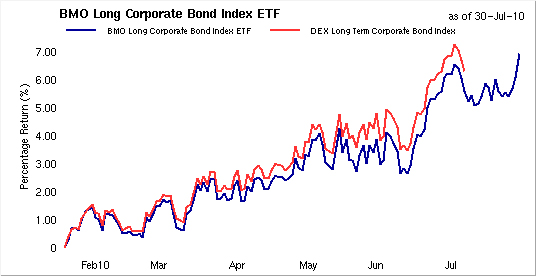

PerpetualDiscounts now yield 5.84%, equivalent to 8.18% interest at the standard equivalency factor of 1.4x. Long corporates now yield about 5.5%, so the pre-tax interest-equivalent spread (aka the Seniority Spread) now stands at about 270bp, a small (and perhaps meaningless) tightening from the 275bp reported on July 30.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0783 % | 2,080.2 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0783 % | 3,151.3 |

| Floater | 2.51 % | 2.13 % | 36,738 | 22.04 | 4 | -0.0783 % | 2,246.1 |

| OpRet | 4.89 % | -0.37 % | 109,713 | 0.24 | 9 | 0.2970 % | 2,353.7 |

| SplitShare | 6.16 % | 1.70 % | 73,424 | 0.08 | 2 | 0.4908 % | 2,251.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2970 % | 2,152.2 |

| Perpetual-Premium | 5.80 % | 5.53 % | 103,216 | 5.68 | 7 | 0.2436 % | 1,943.2 |

| Perpetual-Discount | 5.81 % | 5.84 % | 183,319 | 14.08 | 71 | 0.1761 % | 1,866.1 |

| FixedReset | 5.31 % | 3.39 % | 295,117 | 3.42 | 47 | 0.0529 % | 2,232.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-09-03 Maturity Price : 25.50 Evaluated at bid price : 25.90 Bid-YTW : -7.19 % |

| GWO.PR.H | Perpetual-Discount | 1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-04 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 5.87 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.D | FixedReset | 70,795 | RBC sold two blocks to anonymous: 11,800 at 27.87 and 14,400 at 27.86. RBC then crossed 18,800 at 27.82. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 27.77 Bid-YTW : 3.83 % |

| RY.PR.G | Perpetual-Discount | 36,900 | RBC crossed 30,000 at 20.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-04 Maturity Price : 20.19 Evaluated at bid price : 20.19 Bid-YTW : 5.59 % |

| MFC.PR.A | OpRet | 34,535 | Desjardins bought 10,000 from anonymous at 25.70. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : 3.69 % |

| SLF.PR.A | Perpetual-Discount | 26,981 | National crossed 14,500 at 20.08. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-04 Maturity Price : 20.12 Evaluated at bid price : 20.12 Bid-YTW : 5.99 % |

| PWF.PR.G | Perpetual-Discount | 25,903 | Scotia crossed 25,000 at 24.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-04 Maturity Price : 24.46 Evaluated at bid price : 24.74 Bid-YTW : 6.00 % |

| TRP.PR.B | FixedReset | 24,280 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-08-04 Maturity Price : 24.88 Evaluated at bid price : 24.93 Bid-YTW : 3.72 % |

| There were 25 other index-included issues trading in excess of 10,000 shares. | |||