Total confusion in the news today about the duration of perpetual annuities, a subject dear to the hearts of preferred share investors. Bloomberg reports (hat tip: Assiduous Reader MP):

The gilts, known as perpetuals because they have no maturity date, have a coupon of 3.5 percent compared with the U.K.’s 4.5 percent inflation rate. Investors hold about 1.9 billion pounds ($2.9 billion) of the securities that still pay interest 90 years after the end of the Great War, according to the U.K.’s Debt Management Office.

…

The “Jolly Long Bond,” as Hendry calls the war loan, will be the most reactive to deflation because not having a maturity means it has long duration, said Charles Diebel, head of European interest-rate strategy at Nomura International Plc in London. A bond with a higher duration will increase more in value than one with a shorter duration for a given decline in yield.“His philosophy behind it makes a lot of sense,” Diebel said. “If you have an extended period of time where inflation is not a problem, you get no yield at the front end of the curve and people will be forced out the yield curve. You can’t be forced out further on the yield curve than a perpetual.”

Assiduous Readers will instantly recognize this as highly suspicious, at best. The duration of a perpetual annuity is the inverse of the interest rate. Long Gilts are currently yielding about 4.5% … assuming that the Gilt Perpetuals are trading around there, the modified duration is (1 / 0.045) = 22.2 years.

The Macaulay Duration of a strip is equal to its term. The Modified Duration is equal to Macaulay Duration divided by (1+r). Assuming a 5% yield on long gilt strips, we arrive at the conclusion that any Gilt Strip with a term of 25+ years will have a higher duration than the perp.

Sometimes I despair.

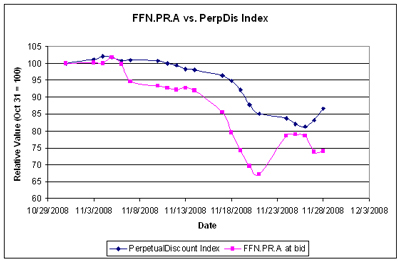

Well, things settled down a little today, but I’m still cutting off the price changes table a +- 3%!

PerpetualDiscounts now yield 8.13%, equivalent to 11.38% pre-tax interest at the standard conversion factor of 1.4x. Long corporates look to have settled in at around the 7.50% mark, so the Pre-Tax Interest-Equivalent spread is now 382 … massive, massive, massive!

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 6.78% | 7.12% | 78,621 | 13.52 | 6 | -1.9692% | 776.3 |

| Floater | 10.00% | 10.30% | 58,326 | 9.19 | 2 | +1.0949% | 353.8 |

| Op. Retract | 5.53% | 6.92% | 137,363 | 4.16 | 15 | -0.4293% | 975.8 |

| Split-Share | 7.59% | 16.15% | 70,290 | 3.71 | 12 | -0.0120% | 816.8 |

| Interest Bearing | 9.37% | 20.25% | 58,415 | 2.93 | 3 | -2.3755% | 779.4 |

| Perpetual-Premium | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Perpetual-Discount | 8.01% | 8.13% | 191,315 | 11.31 | 71 | -0.1284% | 689.4 |

| Fixed-Reset | 6.13% | 5.59% | 1,120,172 | 14.21 | 12 | -0.2914% | 973.9 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| GWO.PR.G | PerpetualDiscount | -7.1031% | Now with a pre-tax bid-YTW of 8.67% based on a bid of 15.04 and a limitMaturity. Closing quote 15.04-50, 3×1. Day’s range of 15.30-16.59. |

| LFE.PR.A | SplitShare | -6.1475% | Asset coverage of 1.6-:1 as of November 14 according to the company. Now with a pre-tax bid-YTW of 16.34% based on a bid of 6.87 and a hardMaturity 2012-12-1 at 10.00. Closing quote of 6.87-20, 10×3. Day’s range of 6.50-20. |

| PWF.PR.L | PerpetualDiscount | -5.8380% | Now with a pre-tax bid-YTW of 8.66% based on a bid of 15.00 and a limitMaturity. Closing quote 15.00-63, 38×4. Day’s range of 15.00-16.90. |

| BAM.PR.I | OpRet | -5.5556% | Now with a pre-tax bid-YTW of 15.12% based on a bid of 17.00 and a softMaturity 2013-12-30 at 25.00. Closing quote of 17.00-75, 15×7. Day’s range of 17.70-00. |

| CM.PR.J | PerpetualDiscount | -5.1429% | Now with a pre-tax bid-YTW of 8.63% based on a bid of 13.28 and a limitMaturity. Closing quote 13.28-59, 5×5. Day’s range of 13.10-03. |

| CM.PR.H | PerpetualDiscount | -5.1110% | Now with a pre-tax bid-YTW of 8.67% based on a bid of 14.11 and a limitMaturity. Closing quote 14.11-25, 3×5. Day’s range of 14.01-99. |

| BNA.PR.A | SplitShare | -4.4737% | Asset coverage of 1.7-:1 based on BAM.A at 17.36 and 2.4 BAM.A per unit. Now with a pre-tax bid-YTW of 26.19% based on a bid of 18.15 and a hardMaturity 2010-9-30 at 25.00. Closing quote of 18.15-40, 2×17. Day’s range of 18.05-90. |

| PWF.PR.E | PerpetualDiscount | -4.3750% | Now with a pre-tax bid-YTW of 9.16% based on a bid of 15.30 and a limitMaturity. Closing quote 15.30-75, 9×1. Day’s range of 15.20-16.25. |

| BSD.PR.A | InterestBearing | -4.2553% | Asset coverage of 0.9-:1 as of November 28, according to Brookfield Funds. Now with a pre-tax bid-YTW of 23.04% based on a bid of 4.50 and a hardMaturity 2015-3-31 at a currently unlikely 10.00. Closing quote of 4.50-95, 1×4. Day’s range of 4.50-70. |

| WFS.PR.A | SplitShare | -3.8462% | Asset coverage of 1.1+:1 as of November 20, according to Mulvihill. Now with a pre-tax bid-YTW of 18.45% based on a bid of 7.50 and a hardMaturity 2011-6-30 at 10.00. Closing quote of 7.50-88, 10×10. Day’s range of 7.60-94. |

| FIG.PR.A | InterestBearing | -3.6641% | Asset coverage of 1.2-:1 as of November 28, based on capital unit value of 2.51 according to Faircourt and 0.71 capital units per preferred. Now with a pre-tax bid-YTW of 16.50% based on a bid of 6.31 and a hardMaturity 2014-12-31 at 10.00. Closing quote of 6.31-66, 5×1. Day’s range of 6.50-70. |

| NA.PR.N | FixedReset | -3.2554% | |

| CM.PR.G | PerpetualDiscount | -3.2105% | Now with a pre-tax bid-YTW of 8.45% based on a bid of 16.28 and a limitMaturity. Closing quote 16.28-80, 7×19. Day’s range of 16.20-01. |

| BCE.PR.A | FixFloat | -3.0787% | |

| MFC.PR.C | PerpetualDiscount | -3.0612% | Now with a pre-tax bid-YTW of 7.94% based on a bid of 14.25 and a limitMaturity. Closing quote 14.25-50, 14×4. Day’s range of 13.85-81. |

| NA.PR.M | PerpetualDiscount | +3.0137% | Now with a pre-tax bid-YTW of 8.09% based on a bid of 18.80 and a limitMaturity. Closing quote 18.80-25, 20×5. Day’s range of 18.25-97. |

| PWF.PR.H | PerpetualDiscount | +3.0303% | Now with a pre-tax bid-YTW of 8.61% based on a bid of 17.00 and a limitMaturity. Closing quote 17.00-50, 3×7. Day’s range of 16.45-20. |

| RY.PR.F | PerpetualDiscount | +3.0928% | Now with a pre-tax bid-YTW of 7.03% based on a bid of 16.00 and a limitMaturity. Closing quote 16.00-50, 10×12. Day’s range of 15.52-16.95. |

| HSB.PR.C | PerpetualDiscount | +3.2511% | Now with a pre-tax bid-YTW of 7.61% based on a bid of 17.15 and a limitMaturity. Closing quote 17.15-50, 5X2. Day’s range of 16.53-50. |

| ELF.PR.G | PerpetualDiscount | +3.3278% | Now with a pre-tax bid-YTW of 9.80% based on a bid of 12.42 and a limitMaturity. Closing quote 12.01-42, 2×8. Day’s range of 12.00-13.20. |

| ENB.PR.A | PerpetualDiscount | +3.3973% | Now with a pre-tax bid-YTW of 6.60% based on a bid of 21.00 and a limitMaturity. Closing quote 21.00-28, 1×5. Day’s range of 19.05-20.10. |

| BNS.PR.O | PerpetualDiscount | +3.5048% | Now with a pre-tax bid-YTW of 7.78% based on a bid of 18.31 and a limitMaturity. Closing quote 18.31-58, 20×5. Day’s range of 18.01-65. |

| BNS.PR.N | PerpetualDiscount | +4.1642% | Now with a pre-tax bid-YTW of 7.62% based on a bid of 17.51 and a limitMaturity. Closing quote 17.51-89, 10×10. Day’s range of 17.20-18.49. |

| BNA.PR.B | SplitShare | +4.9180% | See BNA.PR.A, above. Now with a pre-tax bid-YTW of 12.72% based on a bid of 16.00 and a hardMaturity 2016-3-25 at 25.00. Closing quote of 16.00-64, 11×1. Day’s range of 14.26-16.00. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| MFC.PR.C | PerpetualDiscount | 159,780 | Nesbitt crossed 150,000 at 14.45. Now with a pre-tax bid-YTW of 7.94% based on a bid of 14.25 and a limitMaturity. |

| BNS.PR.N | PerpetualDiscount | 83,867 | Nesbit crossed 10,400 at 17.77. Now with a pre-tax bid-YTW of 7.62% based on a bid of 17.51 and a limitMaturity. |

| BAM.PR.O | OpRet | 48,972 | Anonymous bought 10,000 from Scotia at 18.50, then another 20,000 at the same price. Now with a pre-tax bid-YTW of 13.87% based on a bid of 17.95 and optionCertainty 2013-6-30 at 25.00. |

| GWO.PR.J | FixedReset | 40,100 | New issue settled Nov. 27. |

| BMO.PR.J | PerpetualDiscount | 35,082 | Now with a pre-tax bid-YTW of 7.87% based on a bid of 14.45 and a limitMaturity. |

There were forty-two index-included $25-pv-equivalent issues trading over 10,000 shares today