The Fed kept the policy rate steady today:

Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 3‑1/2 to 3‑3/4 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Beth M. Hammack; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Anna Paulson. Voting against this action were Stephen I. Miran and Christopher J. Waller, who preferred to lower the target range for the federal funds rate by 1/4 percentage point at this meeting.

The two dissenters who proved their rugged independence, steely eyes flashing above their brown noses, have both been mentioned as being in the running for the chairmanship, once Trump gets a chance to make the appointment.

The eMail notification of the decision was swiftly followed by a note stating that the Statement on Longer-Run Goals and Monetary Policy Strategy has been reaffirmed:

Adopted effective January 24, 2012; as reaffirmed effective January 27, 2026

The Federal Open Market Committee (FOMC) is firmly committed to fulfilling its statutory mandate from Congress of promoting maximum employment, stable prices, and moderate long-term interest rates. The Committee seeks to explain its monetary policy decisions to the public as clearly as possible. Such clarity facilitates well-informed decisionmaking by households and businesses, reduces economic and financial uncertainty, increases the effectiveness of monetary policy, and enhances transparency and accountability, which are essential in a democratic society. The Committee’s monetary policy strategy is designed to promote maximum employment and stable prices across a broad range of economic conditions. Employment, inflation, and long-term interest rates fluctuate over time in response to economic and financial disturbances. Monetary policy plays an important role in stabilizing the economy in response to these disturbances. The Committee’s primary means of adjusting the stance of monetary policy is through changes in the target range for the federal funds rate. The Committee is prepared to use its full range of tools to achieve its maximum employment and price stability goals, particularly if the federal funds rate is constrained by its effective lower bound.

Durably achieving maximum employment fosters broad-based economic opportunities and benefits for all Americans. The Committee views maximum employment as the highest level of employment that can be achieved on a sustained basis in a context of price stability. The maximum level of employment is not directly measurable and changes over time owing largely to nonmonetary factors that affect the structure and dynamics of the labor market. Consequently, it would not be appropriate to specify a fixed goal for employment; rather, the Committee’s policy decisions must be informed by assessments of the maximum level of employment, recognizing that such assessments are necessarily uncertain and subject to revision. The Committee considers a wide range of indicators in making these assessments.

Price stability is essential for a sound and stable economy and supports the well-being of all Americans. The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee can specify a longer-run goal for inflation. The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory maximum employment and price stability mandates. The Committee judges that longer-term inflation expectations that are well anchored at 2 percent foster price stability and moderate long-term interest rates and enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances. The Committee is prepared to act forcefully to ensure that longer term inflation expectations remain well anchored.

Monetary policy actions tend to influence economic activity, employment, and prices with a lag. Moreover, sustainably achieving maximum employment and price stability depends on a stable financial system. Therefore, the Committee’s policy decisions reflect its longer-run goals, its medium term outlook, and its assessments of the balance of risks, including risks to the financial system that could impede the attainment of the Committee’s goals.

The Committee’s employment and inflation objectives are generally complementary. However, if the Committee judges that the objectives are not complementary, it follows a balanced approach in promoting them, taking into account the extent of departures from its goals and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate. The Committee recognizes that employment may at times run above real-time assessments of maximum employment without necessarily creating risks to price stability.

The Committee intends to review these principles and to make adjustments as appropriate at its annual organizational meeting each January, and to undertake roughly every 5 years a thorough public review of its monetary policy strategy, tools, and communication practices.

The press release makes careful note of the fact that

The reaffirmed statement is identical to the version adopted in August 2025.

… which would be hilarious if the necessity of reaffirmation were not so clear.

The BoC also paused:

The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

The outlook for the global and Canadian economies is little changed relative to the projection in the October Monetary Policy Report (MPR). However, the outlook is vulnerable to unpredictable US trade policies and geopolitical risks.

Economic growth in the United States continues to outpace expectations and is projected to remain solid, driven by AI-related investment and consumer spending. Tariffs are pushing up US inflation, although their effect is expected to fade gradually later this year. In the euro area, growth has been supported by activity in service sectors and will get additional support from fiscal policy. China’s GDP growth is expected to slow gradually, as weakening domestic demand offsets strength in exports. Overall, the Bank expects global growth to average about 3% over the projection horizon.

Global financial conditions have remained accommodative overall. Recent weakness in the US dollar has pushed the Canadian dollar above 72 cents, roughly where it had been since the October MPR. Oil prices have been fluctuating in response to geopolitical events and, going forward, are assumed to be slightly below the levels in the October report.

US trade restrictions and uncertainty continue to disrupt growth in Canada. After a strong third quarter, GDP growth in the fourth quarter likely stalled. Exports continue to be buffeted by US tariffs, while domestic demand appears to be picking up. Employment has risen in recent months. Still, the unemployment rate remains elevated at 6.8% and relatively few businesses say they plan to hire more workers.

Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up and business investment strengthens gradually, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement.

CPI inflation picked up in December to 2.4%, boosted by base-year effects linked to last winter’s GST/HST holiday. Excluding the effect of changes in taxes, inflation has been slowing since September. The Bank’s preferred measures of core inflation have eased from 3% in October to around 2½% in December. Inflation was 2.1% in 2025 and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply.

Monetary policy is focused on keeping inflation close to the 2% target while helping the economy through this period of structural adjustment. Governing Council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today. However, uncertainty is heightened and we are monitoring risks closely. If the outlook changes, we are prepared to respond. The Bank is committed to ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

The BoC also released its Monetary Policy Report for January 2026, which included the following critical information:

The nominal neutral interest rate in Canada is assumed to be in the estimated

range of 2.25% to 3.25%.

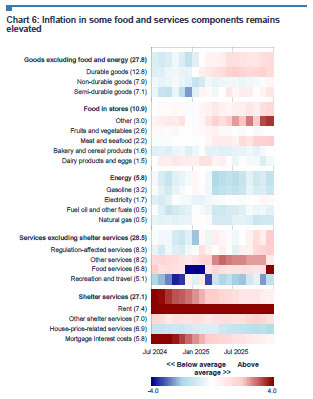

So the neutral range hasn’t changed. Good. And there was a nice chart of inflation by sector:

PerpetualDiscounts now yield 5.68%, equivalent to 7.38% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.92% on 2026-1-28. Therefore the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) has widened to 245bp from the 235bp reported January 21.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1007 % |

2,451.7 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1007 % |

4,648.8 |

| Floater |

5.88 % |

6.10 % |

57,259 |

13.74 |

3 |

0.1007 % |

2,679.1 |

| OpRet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0394 % |

3,661.0 |

| SplitShare |

4.77 % |

4.65 % |

83,888 |

3.07 |

5 |

0.0394 % |

4,372.0 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0394 % |

3,411.2 |

| Perpetual-Premium |

5.70 % |

5.68 % |

87,060 |

14.19 |

9 |

0.3206 % |

3,070.8 |

| Perpetual-Discount |

5.57 % |

5.68 % |

48,983 |

14.38 |

25 |

0.4816 % |

3,391.4 |

| FixedReset Disc |

5.87 % |

5.96 % |

109,223 |

13.74 |

29 |

0.1857 % |

3,166.7 |

| Insurance Straight |

5.51 % |

5.59 % |

64,214 |

14.47 |

22 |

-0.2026 % |

3,303.5 |

| FloatingReset |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1857 % |

3,767.2 |

| FixedReset Prem |

5.98 % |

4.65 % |

93,643 |

2.15 |

19 |

-0.1134 % |

2,643.7 |

| FixedReset Bank Non |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1857 % |

3,237.1 |

| FixedReset Ins Non |

5.32 % |

5.45 % |

77,721 |

14.39 |

14 |

-0.0340 % |

3,106.1 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| MFC.PR.B |

Insurance Straight |

-4.88 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 20.68

Evaluated at bid price : 20.68

Bid-YTW : 5.71 % |

| POW.PR.C |

Perpetual-Premium |

-3.68 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 24.64

Evaluated at bid price : 24.90

Bid-YTW : 5.87 % |

| CU.PR.J |

Perpetual-Discount |

-2.82 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 21.01

Evaluated at bid price : 21.01

Bid-YTW : 5.76 % |

| SLF.PR.G |

FixedReset Ins Non |

-2.51 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 19.40

Evaluated at bid price : 19.40

Bid-YTW : 5.60 % |

| FFH.PR.K |

FixedReset Prem |

-1.49 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2027-03-31

Maturity Price : 25.00

Evaluated at bid price : 25.20

Bid-YTW : 4.72 % |

| PWF.PR.F |

Perpetual-Discount |

-1.15 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 22.93

Evaluated at bid price : 23.20

Bid-YTW : 5.68 % |

| PWF.PR.Z |

Perpetual-Discount |

-1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 22.48

Evaluated at bid price : 22.75

Bid-YTW : 5.68 % |

| CU.PR.F |

Perpetual-Discount |

-1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 20.30

Evaluated at bid price : 20.30

Bid-YTW : 5.64 % |

| ENB.PF.E |

FixedReset Disc |

1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 22.16

Evaluated at bid price : 22.73

Bid-YTW : 6.16 % |

| BN.PF.E |

FixedReset Disc |

1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 22.47

Evaluated at bid price : 23.25

Bid-YTW : 5.82 % |

| CU.PR.C |

FixedReset Disc |

1.26 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 23.77

Evaluated at bid price : 24.20

Bid-YTW : 5.55 % |

| MFC.PR.J |

FixedReset Ins Non |

1.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 23.66

Evaluated at bid price : 25.32

Bid-YTW : 5.53 % |

| GWO.PR.G |

Insurance Straight |

3.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 23.20

Evaluated at bid price : 23.50

Bid-YTW : 5.58 % |

| PWF.PR.O |

Perpetual-Premium |

6.79 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2026-02-27

Maturity Price : 25.00

Evaluated at bid price : 25.02

Bid-YTW : 4.08 % |

| CU.PR.G |

Perpetual-Discount |

26.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 20.83

Evaluated at bid price : 20.83

Bid-YTW : 5.50 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| ENB.PR.Y |

FixedReset Disc |

104,500 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 21.25

Evaluated at bid price : 21.53

Bid-YTW : 6.25 % |

| ENB.PR.F |

FixedReset Disc |

102,800 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 21.57

Evaluated at bid price : 21.97

Bid-YTW : 6.29 % |

| PWF.PR.P |

FixedReset Disc |

70,600 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 19.70

Evaluated at bid price : 19.70

Bid-YTW : 5.76 % |

| ENB.PF.C |

FixedReset Disc |

52,100 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 21.98

Evaluated at bid price : 22.43

Bid-YTW : 6.26 % |

| MFC.PR.I |

FixedReset Ins Non |

47,800 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2027-09-19

Maturity Price : 25.00

Evaluated at bid price : 25.56

Bid-YTW : 5.00 % |

| NA.PR.I |

FixedReset Prem |

29,400 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2029-05-01

Maturity Price : 25.00

Evaluated at bid price : 26.14

Bid-YTW : 5.22 % |

| There were 4 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. |

| Issue |

Index |

Quote Data and Yield Notes |

| MFC.PR.B |

Insurance Straight |

Quote: 20.68 – 22.00

Spot Rate : 1.3200

Average : 0.8326

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 20.68

Evaluated at bid price : 20.68

Bid-YTW : 5.71 % |

| POW.PR.C |

Perpetual-Premium |

Quote: 24.90 – 25.90

Spot Rate : 1.0000

Average : 0.5736

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 24.64

Evaluated at bid price : 24.90

Bid-YTW : 5.87 % |

| BIP.PR.E |

FixedReset Prem |

Quote: 25.56 – 26.25

Spot Rate : 0.6900

Average : 0.4423

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2028-03-31

Maturity Price : 25.00

Evaluated at bid price : 25.56

Bid-YTW : 5.84 % |

| POW.PR.G |

Perpetual-Discount |

Quote: 24.11 – 24.96

Spot Rate : 0.8500

Average : 0.6871

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 23.86

Evaluated at bid price : 24.11

Bid-YTW : 5.85 % |

| GWO.PR.Z |

Insurance Straight |

Quote: 25.15 – 26.15

Spot Rate : 1.0000

Average : 0.8501

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 24.74

Evaluated at bid price : 25.15

Bid-YTW : 5.72 % |

| CU.PR.J |

Perpetual-Discount |

Quote: 21.01 – 21.90

Spot Rate : 0.8900

Average : 0.7438

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2056-01-28

Maturity Price : 21.01

Evaluated at bid price : 21.01

Bid-YTW : 5.76 % |