The Globe & Mail reports that new rules for retail bond desks are coming:

Many investors would for the first time find out exactly how much commission they are paying to buy and sell bonds. Industry convention is to hide the commission in the purchase or sale price of the bond, but the new rules would force it to be broken out.

The rules would also require better disclosure of the bond’s yield – the real interest rate based on the price.

Perhaps most importantly, and contentiously, IIROC plans a “fair pricing rule” to enable regulators to punish dealers who trade bonds at prices far from the true market price.

Thoroughly precious and idiotic. There are some fine alternatives available for retail investors who don’t know what they’re doing: funds. I have no idea what this “yield disclosure” thingy might mean; perhaps it simply means that dealers will be required to print the yield on their confirms, as they are for Money Market instruments.

Look for retail bond offerings at brokerages to be even more sharply reduced than they are now. When you buy your GIC, you’ll know you’re getting best execution on the price!

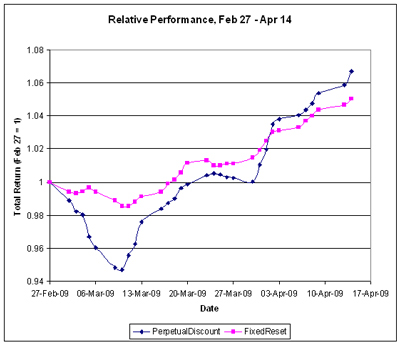

The market continued its rally today with heavy volume. Performance for the past two weeks has been impressive:

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.4599 % | 929.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.4599 % | 1,503.9 |

| Floater | 5.25 % | 5.28 % | 64,517 | 15.04 | 2 | 1.4599 % | 1,161.7 |

| OpRet | 5.16 % | 4.56 % | 141,674 | 3.88 | 15 | 0.0407 % | 2,107.9 |

| SplitShare | 6.76 % | 10.43 % | 45,700 | 5.65 | 3 | 0.8944 % | 1,710.6 |

| Interest-Bearing | 6.12 % | 8.99 % | 27,769 | 0.69 | 1 | -0.3052 % | 1,947.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.7653 % | 1,601.3 |

| Perpetual-Discount | 6.81 % | 6.92 % | 146,539 | 12.68 | 71 | 0.7653 % | 1,474.8 |

| FixedReset | 5.99 % | 5.50 % | 659,594 | 7.51 | 35 | 0.3595 % | 1,880.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.A | Perpetual-Discount | -2.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.41 Evaluated at bid price : 17.41 Bid-YTW : 6.72 % |

| BAM.PR.J | OpRet | -1.79 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 19.75 Bid-YTW : 8.95 % |

| PWF.PR.F | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.81 Evaluated at bid price : 18.81 Bid-YTW : 7.01 % |

| CIU.PR.B | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 26.41 Bid-YTW : 5.55 % |

| POW.PR.D | Perpetual-Discount | -1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.63 Evaluated at bid price : 17.63 Bid-YTW : 7.15 % |

| BNS.PR.J | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.60 % |

| SLF.PR.D | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 15.86 Evaluated at bid price : 15.86 Bid-YTW : 7.10 % |

| BMO.PR.L | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 21.37 Evaluated at bid price : 21.37 Bid-YTW : 6.92 % |

| BNS.PR.L | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.18 Evaluated at bid price : 17.18 Bid-YTW : 6.58 % |

| RY.PR.C | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.99 Evaluated at bid price : 17.99 Bid-YTW : 6.51 % |

| RY.PR.I | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.58 Evaluated at bid price : 23.62 Bid-YTW : 4.29 % |

| IAG.PR.C | FixedReset | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.05 Evaluated at bid price : 23.10 Bid-YTW : 5.92 % |

| CM.PR.P | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.83 Evaluated at bid price : 19.83 Bid-YTW : 6.97 % |

| SLF.PR.A | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.66 Evaluated at bid price : 16.66 Bid-YTW : 7.21 % |

| GWO.PR.F | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.77 Evaluated at bid price : 20.77 Bid-YTW : 7.19 % |

| PWF.PR.E | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.83 Evaluated at bid price : 19.83 Bid-YTW : 6.97 % |

| PWF.PR.H | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.66 Evaluated at bid price : 20.66 Bid-YTW : 6.99 % |

| BNA.PR.A | SplitShare | 1.28 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2010-09-30 Maturity Price : 25.00 Evaluated at bid price : 23.80 Bid-YTW : 10.43 % |

| W.PR.J | Perpetual-Discount | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.68 Evaluated at bid price : 20.68 Bid-YTW : 6.83 % |

| BMO.PR.M | FixedReset | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 22.98 Evaluated at bid price : 23.06 Bid-YTW : 4.11 % |

| BNS.PR.N | Perpetual-Discount | 1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.97 Evaluated at bid price : 19.97 Bid-YTW : 6.61 % |

| CM.PR.I | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 6.97 % |

| BMO.PR.J | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.45 Evaluated at bid price : 17.45 Bid-YTW : 6.57 % |

| CM.PR.G | Perpetual-Discount | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.28 Evaluated at bid price : 19.28 Bid-YTW : 7.04 % |

| BNA.PR.C | SplitShare | 1.68 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 12.72 Bid-YTW : 13.84 % |

| HSB.PR.D | Perpetual-Discount | 1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 7.27 % |

| BAM.PR.I | OpRet | 1.76 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 23.10 Bid-YTW : 7.55 % |

| GWO.PR.H | Perpetual-Discount | 1.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.10 Evaluated at bid price : 17.10 Bid-YTW : 7.17 % |

| POW.PR.A | Perpetual-Discount | 1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 7.24 % |

| TD.PR.Q | Perpetual-Discount | 1.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 21.51 Evaluated at bid price : 21.51 Bid-YTW : 6.54 % |

| GWO.PR.G | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.68 Evaluated at bid price : 18.68 Bid-YTW : 7.04 % |

| MFC.PR.B | Perpetual-Discount | 2.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.37 Evaluated at bid price : 17.37 Bid-YTW : 6.79 % |

| MFC.PR.C | Perpetual-Discount | 2.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.34 Evaluated at bid price : 16.34 Bid-YTW : 6.98 % |

| RY.PR.W | Perpetual-Discount | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 6.37 % |

| TD.PR.Y | FixedReset | 2.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 22.94 Evaluated at bid price : 23.00 Bid-YTW : 4.16 % |

| TD.PR.A | FixedReset | 2.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.25 Evaluated at bid price : 23.29 Bid-YTW : 4.33 % |

| BAM.PR.K | Floater | 2.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 8.35 Evaluated at bid price : 8.35 Bid-YTW : 5.28 % |

| CM.PR.J | Perpetual-Discount | 3.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.55 Evaluated at bid price : 16.55 Bid-YTW : 6.83 % |

| PWF.PR.L | Perpetual-Discount | 3.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 6.87 % |

| POW.PR.C | Perpetual-Discount | 3.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.40 Evaluated at bid price : 20.40 Bid-YTW : 7.17 % |

| ELF.PR.F | Perpetual-Discount | 4.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 8.36 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSB.PR.E | FixedReset | 164,185 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.21 Bid-YTW : 6.52 % |

| RY.PR.T | FixedReset | 140,859 | Nesbitt crossed 48,000 at 25.82. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 5.80 % |

| TD.PR.K | FixedReset | 140,571 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.46 Bid-YTW : 5.92 % |

| RY.PR.X | FixedReset | 133,486 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 5.77 % |

| RY.PR.L | FixedReset | 93,885 | Nesbitt bought 10,000 from National at 24.89; TD crossed 61,500 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 24.92 Evaluated at bid price : 24.97 Bid-YTW : 4.79 % |

| ENB.PR.A | Perpetual-Discount | 74,629 | Desjardins crossed 70,000 at 24.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.96 Evaluated at bid price : 24.21 Bid-YTW : 5.75 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. | |||