Americans are paying their bills:

Loans at least 30 days overdue, a signal of future write- offs, dropped for the 13th consecutive month to 4.38 percent, the lowest since December 2007, Moody’s said today in a report. Loans delinquent 30 to 59 days, the earliest sign of trouble, declined to 1.14 percent, near an all-time low. Write-offs for loans deemed uncollectible, a lagging indicator, fell to 8.58 percent from October’s 8.79 percent.

The drop in new delinquencies bolsters the firm’s “expectation that charge-offs will ultimately break below the 7 percent mark later in 2011,” Jeffrey Hibbs, a Moody’s analyst, wrote in the report.

The S&P / Experian indices show the improvement to be broadly based – and dramatic!

There’s an interesting twist in the Goldman / Greece derivative imbroglio:

The notes show how Greece used swaps to hide its borrowings, according to a March 3 cover page attached to the papers obtained by Bloomberg News.

ECB President Jean-Claude Trichet withheld the documents after the EU and International Monetary Fund led a 110 billion- euro bailout ($144 billion) for Greece. The dossier should be disclosed to stop governments from employing the derivatives in a similar way again and to show how EU authorities acted on information they had on the swaps, according to the suit, filed by Bloomberg Finance LP, the parent of Bloomberg News.

Ha-ha! The notes will show, I’ll bet a nickel, that everybody knew about it and ignored it.

TD is still looking for deals:

Toronto-Dominion’s bid for the auto-finance company “doesn’t really alter” the Toronto-based bank’s appetite for smaller transactions, Chief Executive Officer Edmund Clark said.

“We’re not deal junkies, but we keep saying what we’re looking for,” Clark said yesterday in a telephone interview. “We want $10 billion (in assets) or less deals; tuck-ins that add to our franchise and meet our strategy.”

Near-zero equity returns and slight increases in interest rates translated into stable pension funding in November. The Towers Watson Pension Index remained unchanged for the month at 68.3. The index remains down 4.6% for the year.

They have also published Towers Watson–Forbes Insights 2010 Pension Risk Survey:

There is a strong desire on the part of plan sponsors to reduce the risk of their pension plans. Many plans are signifi cantly underfunded in the aftermath of the financial crisis, and their sponsors have experienced the resulting pressure on corporate cash flows. Rather than rushing to seek higher investment returns to close this funding gap, however, the majority of sponsors attach greater importance to reducing risk. The most favored strategy is to seek a better alignment of assets with liabilities — for example, through liability-driven investment programs. Executives expect to increasingly utilize swaps, options and other hedging derivatives to achieve better risk management. More plan sponsors today are setting formal funding policies in place of ad hoc decisions. Over time, lump sum payments and annuity purchases are also expected to be vehicles for settling DB obligations on a wholesale basis.

There is trouble in the state of Denmark:

Denmark says the Basel Committee on Banking Supervision’s rules will force the country’s lenders to dump top-rated mortgage debt to meet new requirements on holdings and may destroy the world’s third-biggest covered-bond market.

The Nordic country is planning to challenge the rules, published on Dec. 16. and Economy Minister Brian Mikkelsen has already taken Denmark’s grievances to the European Commission.

…

Denmark’s lenders, which hold more than half the country’s $490 billion of mortgage bonds, would be forced to sell off holdings to comply with Basel’s 40 percent cap on using the securities as liquid assets, [director of the Association of Danish Mortgage Banks] Arnth Jensen said.

…

Denmark’s mortgage bond market is about 1 1/2 times the size of the country’s economy and more than seven times the size of the government bond market, according to the central bank.

The regulation of Money Market Funds is attracting renewed notice:

Federal Reserve Chairman Ben S. Bernanke said investor speculation over which money market mutual funds are likely to be bailed out by their parent companies during a crisis can undermine the stability of the industry that manages $2.79 trillion.

Bernanke, in a Dec. 9 letter to Anthony J. Carfang, partner in Chicago consulting firm Treasury Strategies, said market developments that reinforce speculation whether money funds may be bailed out are a “concern” and sponsor support should be addressed in the context of planned reforms of the industry.

Carfang in November criticized a proposal by Moody’s Corp. that its ratings of money funds take into account the likelihood of a parent bailout in the event of losses. Bernanke, in the letter, encouraged Carfang to submit his views of the Moody’s proposal to the Securities and Exchange Commission.

…

Carfang has called the Moody’s proposal “fundamentally disruptive,” saying the ratings firm would have no objective way of gauging whether a money manager would prop up a fund in trouble.

Well, no. A credit rating is a prediction about probabilities, inherently subjective on two counts. CRAs are paid to use their judgement; and when they’re wrong, all the backseat drivers can point out they’re being paid by the issuers. That’s the way the game is played.

I woule much prefer explicit credit support, but the industry prefers boxticking; regulators so far have endorsed boxticking, becaue it requires more manpower to check.

The rally in the Canadian preferred share market continued today, on easing but still elevated volume. PerpetualDiscounts gained 31bp, while Fixed Resets were up 25bp.

PerpetualDiscounts now yield 5.42%, equivalent to 7.59% interest at the standard equivalency factor of 1.4x. Long corporates yields have plumetted to about 5.4% (maybe just a bit over) so the pre-tax interest-equivalent spread now stans at about 220bp, a significant widening from the 210bp reported on December 15, as the improvement in tone in the bond market has not been matched by the preferred market.

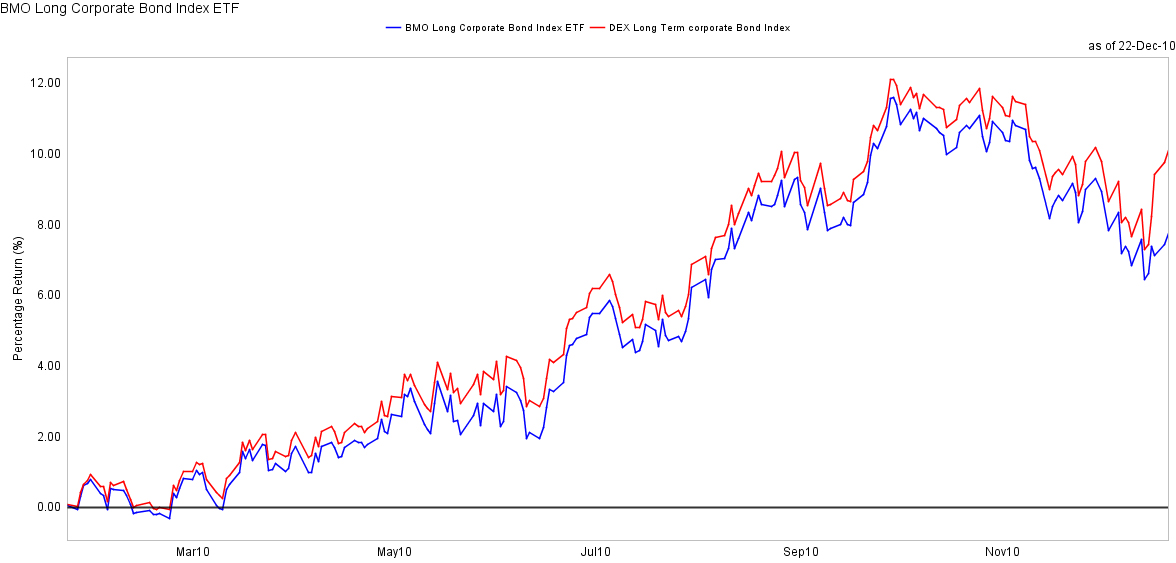

But big rallies can tend to be sloppy affairs, as the guys running the BMO Long Corporate ETF can tell you:

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5837 % | 2,306.1 |

| FixedFloater | 4.75 % | 3.26 % | 31,847 | 18.91 | 1 | 0.4386 % | 3,542.0 |

| Floater | 2.59 % | 2.36 % | 57,166 | 21.33 | 4 | 0.5837 % | 2,490.0 |

| OpRet | 4.79 % | 3.28 % | 72,188 | 2.38 | 8 | -0.0480 % | 2,392.6 |

| SplitShare | 5.35 % | 1.25 % | 917,290 | 0.96 | 4 | 0.1719 % | 2,442.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0480 % | 2,187.8 |

| Perpetual-Premium | 5.70 % | 5.60 % | 156,558 | 5.41 | 27 | 0.1966 % | 2,011.5 |

| Perpetual-Discount | 5.40 % | 5.42 % | 287,802 | 14.71 | 51 | 0.3071 % | 2,020.6 |

| FixedReset | 5.22 % | 3.43 % | 342,724 | 3.08 | 52 | 0.2508 % | 2,264.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -1.68 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2011-01-21 Maturity Price : 25.50 Evaluated at bid price : 25.70 Bid-YTW : -5.66 % |

| MFC.PR.D | FixedReset | -1.60 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 27.05 Bid-YTW : 4.17 % |

| PWF.PR.E | Perpetual-Discount | -1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 23.25 Evaluated at bid price : 24.29 Bid-YTW : 5.70 % |

| FTS.PR.G | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-10-01 Maturity Price : 25.00 Evaluated at bid price : 26.06 Bid-YTW : 3.69 % |

| GWO.PR.H | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 23.07 Evaluated at bid price : 23.30 Bid-YTW : 5.22 % |

| PWF.PR.K | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 22.58 Evaluated at bid price : 22.77 Bid-YTW : 5.51 % |

| TD.PR.O | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 23.79 Evaluated at bid price : 24.05 Bid-YTW : 5.10 % |

| IAG.PR.F | Perpetual-Premium | 1.16 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 5.74 % |

| SLF.PR.A | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 5.55 % |

| TRP.PR.C | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 23.38 Evaluated at bid price : 25.75 Bid-YTW : 3.72 % |

| BMO.PR.L | Perpetual-Premium | 1.36 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-24 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 5.18 % |

| PWF.PR.A | Floater | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 21.86 Evaluated at bid price : 22.10 Bid-YTW : 2.36 % |

| ELF.PR.G | Perpetual-Discount | 1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.06 % |

| MFC.PR.C | Perpetual-Discount | 3.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 5.41 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.I | Perpetual-Discount | 59,025 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 22.10 Evaluated at bid price : 22.23 Bid-YTW : 5.36 % |

| RY.PR.B | Perpetual-Discount | 54,485 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 22.45 Evaluated at bid price : 22.61 Bid-YTW : 5.25 % |

| GWO.PR.I | Perpetual-Discount | 41,460 | TD crossed 20,000 at 21.08. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 5.38 % |

| MFC.PR.D | FixedReset | 35,020 | Desjardins bought 13,400 from Nesbitt at 27.34. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 27.05 Bid-YTW : 4.17 % |

| TD.PR.O | Perpetual-Discount | 31,438 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 23.79 Evaluated at bid price : 24.05 Bid-YTW : 5.10 % |

| BAM.PR.K | Floater | 29,290 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-22 Maturity Price : 18.19 Evaluated at bid price : 18.19 Bid-YTW : 2.88 % |

| There were 44 other index-included issues trading in excess of 10,000 shares. | |||