Click for Big

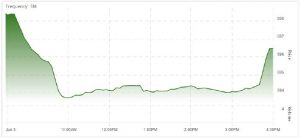

Click for BigTXPR closed at 598.47, down 0.63% on the day. Volume was 2.39-million, high but nothing special in the context of the past thirty days.

Click for Big

Click for BigA mid-afternoon wave of selling changed a sub-par day into a bad one. Note that TXPR’s 52-week low is 596.56 – that’s not too far off!

CPD closed at 11.97, down 0.25% on the day. Volume of 351,301 was by far the highest of the past thirty days – second place belongs to May 13 with 168,630.

ZPR closed at 9.58, down 0.62% on the day, hitting a new 52-week low. Volume of 261,689 was the highest of the past thirty days, edging May 31 and its volume of 254,910

Five-year Canada yields were up 5bp to 1.34% today, but the increase didn’t help the Canadian preferred share market! Where are the GIC refugees?

Meanwhile, Powell suggested policy rates might ease:

The Federal Reserve chairman, Jerome H. Powell, said on Tuesday that the central bank was prepared to act to sustain the economic expansion if President Trump’s trade war weakened the economy. His remarks sent stocks soaring as investors predicted a cut in interest rates.

“We do not know how or when these issues will be resolved,” Mr. Powell said of the United States’ trade disputes with Mexico, China and other nations. “We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.”

Mr. Powell did not explicitly say that the Fed would cut interest rates, but his comments sent a signal that the central bank was watching Mr. Trump’s trade wars warily, ready to fend off any economic damage. While the Fed has been closely monitoring the effects of Mr. Trump’s trade war on the economy, Mr. Powell’s comments were his first since the president escalated his dispute by threatening tariffs on all Mexican goods.

…

The rebound in stock markets coaxed some investors out of the safety of government bonds, pushing prices down and yields — which move in the opposite direction — up. The rise in yields reversed some of a sharp decline in recent days that had reflected growing investor concern about the outlook for economic growth and inflation. The yield on the 10-year Treasury note was 2.12 percent at 3 p.m., according to Bloomberg data.

But in signaling that it is prepared to limit economic damage from the trade war, the Fed could perpetuate the feedback loop that has developed among financial markets, the central bank and Mr. Trump — and could embolden the president to continue his fight.

Bullard of the St. Louis Fed said much the same thing yesterday.

However, Senate Republicans took up a collection today and were able to scrape together a pair of balls:

Mr. Trump’s latest threat — 5 percent tariffs on all goods imported from Mexico, rising to as high as 25 percent until the Mexican government stems the flow of migrants — has riled Republican senators who fear its impact on the economy and their home states. They emerged from a closed-door lunch in the Capitol angered by the briefing they received from a deputy White House counsel, Patrick F. Philbin, and Assistant Attorney General Steven A. Engel on the legal basis for imposing new tariffs by declaring a national emergency.

…

Senator Ron Johnson, Republican of Wisconsin, said he warned the lawyers that the Senate could muster an overwhelming majority to beat back the tariffs, even if Mr. Trump were to veto a resolution disapproving them. Republicans may be broadly supportive of Mr. Trump’s push to build a wall and secure the border, he said, but they are almost uniformly opposed to the imposition of tariffs on Mexico.

There was some good drone news today:

Shares of Drone Delivery Canada Corp. surged as much as 18 per cent in trading Tuesday after the company announced a 10-year contract with Air Canada that sees the cargo division of the country’s largest airline market and sell the Toronto-based company’s drone delivery services in Canada.

Analysts and investors say the agreement adds credibility to the pre-revenue startup company, known as DDC, which has developed a system for autonomous cargo delivery through unmanned aerial vehicles, known as drones.

I want to order pizza at 4am and I want to do it yesterday!

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.4025 % |

1,978.3 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.4025 % |

3,630.2 |

| Floater |

5.94 % |

6.38 % |

58,161 |

13.26 |

3 |

0.4025 % |

2,092.1 |

| OpRet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0228 % |

3,301.6 |

| SplitShare |

4.72 % |

4.77 % |

77,489 |

4.26 |

7 |

0.0228 % |

3,942.8 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0228 % |

3,076.3 |

| Perpetual-Premium |

5.64 % |

-3.91 % |

78,680 |

0.08 |

7 |

-0.0169 % |

2,929.2 |

| Perpetual-Discount |

5.51 % |

5.57 % |

70,365 |

14.47 |

26 |

-0.0743 % |

3,058.9 |

| FixedReset Disc |

5.56 % |

5.44 % |

170,684 |

14.68 |

70 |

-0.7970 % |

2,047.0 |

| Deemed-Retractible |

5.32 % |

6.07 % |

95,225 |

8.06 |

27 |

-0.2632 % |

3,050.1 |

| FloatingReset |

4.10 % |

4.88 % |

47,069 |

2.54 |

4 |

-0.1189 % |

2,340.3 |

| FixedReset Prem |

5.17 % |

4.54 % |

224,302 |

1.88 |

16 |

-0.1372 % |

2,549.2 |

| FixedReset Bank Non |

2.00 % |

4.56 % |

159,849 |

2.57 |

3 |

-0.3372 % |

2,610.7 |

| FixedReset Ins Non |

5.35 % |

7.46 % |

102,842 |

8.18 |

22 |

-0.7486 % |

2,128.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| MFC.PR.M |

FixedReset Ins Non |

-2.99 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.20

Bid-YTW : 8.17 % |

| EMA.PR.F |

FixedReset Disc |

-2.85 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.39

Evaluated at bid price : 17.39

Bid-YTW : 5.79 % |

| RY.PR.M |

FixedReset Disc |

-2.77 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.26

Evaluated at bid price : 18.26

Bid-YTW : 5.44 % |

| BAM.PF.G |

FixedReset Disc |

-2.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 16.81

Evaluated at bid price : 16.81

Bid-YTW : 6.40 % |

| BAM.PR.T |

FixedReset Disc |

-2.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 14.50

Evaluated at bid price : 14.50

Bid-YTW : 6.38 % |

| BMO.PR.Y |

FixedReset Disc |

-2.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.75

Evaluated at bid price : 18.75

Bid-YTW : 5.44 % |

| SLF.PR.H |

FixedReset Ins Non |

-2.20 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 15.56

Bid-YTW : 8.89 % |

| BMO.PR.C |

FixedReset Disc |

-2.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 21.54

Evaluated at bid price : 21.92

Bid-YTW : 5.32 % |

| SLF.PR.G |

FixedReset Ins Non |

-2.11 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 13.46

Bid-YTW : 9.77 % |

| BAM.PR.R |

FixedReset Disc |

-2.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 14.35

Evaluated at bid price : 14.35

Bid-YTW : 6.33 % |

| CU.PR.C |

FixedReset Disc |

-2.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 16.75

Evaluated at bid price : 16.75

Bid-YTW : 5.55 % |

| BAM.PR.Z |

FixedReset Disc |

-1.94 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.17

Evaluated at bid price : 18.17

Bid-YTW : 6.17 % |

| BIP.PR.A |

FixedReset Disc |

-1.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.50

Evaluated at bid price : 18.50

Bid-YTW : 6.62 % |

| MFC.PR.L |

FixedReset Ins Non |

-1.73 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 16.51

Bid-YTW : 8.42 % |

| TRP.PR.E |

FixedReset Disc |

-1.60 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 16.00

Evaluated at bid price : 16.00

Bid-YTW : 5.88 % |

| TD.PF.E |

FixedReset Disc |

-1.59 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 19.77

Evaluated at bid price : 19.77

Bid-YTW : 5.34 % |

| BAM.PF.B |

FixedReset Disc |

-1.58 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.41

Evaluated at bid price : 17.41

Bid-YTW : 6.04 % |

| BAM.PR.X |

FixedReset Disc |

-1.46 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 12.85

Evaluated at bid price : 12.85

Bid-YTW : 6.09 % |

| CM.PR.Q |

FixedReset Disc |

-1.44 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.51

Evaluated at bid price : 18.51

Bid-YTW : 5.61 % |

| BIP.PR.C |

FixedReset Disc |

-1.42 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 23.23

Evaluated at bid price : 24.30

Bid-YTW : 6.03 % |

| TD.PF.D |

FixedReset Disc |

-1.41 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 19.55

Evaluated at bid price : 19.55

Bid-YTW : 5.31 % |

| TRP.PR.G |

FixedReset Disc |

-1.38 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.85

Evaluated at bid price : 17.85

Bid-YTW : 6.02 % |

| SLF.PR.I |

FixedReset Ins Non |

-1.32 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 18.70

Bid-YTW : 7.46 % |

| SLF.PR.C |

Deemed-Retractible |

-1.32 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 20.26

Bid-YTW : 7.00 % |

| RY.PR.J |

FixedReset Disc |

-1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.95

Evaluated at bid price : 18.95

Bid-YTW : 5.41 % |

| BAM.PF.E |

FixedReset Disc |

-1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 15.95

Evaluated at bid price : 15.95

Bid-YTW : 6.28 % |

| MFC.PR.N |

FixedReset Ins Non |

-1.17 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 16.85

Bid-YTW : 8.36 % |

| TRP.PR.K |

FixedReset Disc |

-1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 23.24

Evaluated at bid price : 24.61

Bid-YTW : 5.19 % |

| GWO.PR.N |

FixedReset Ins Non |

-1.15 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 13.70

Bid-YTW : 9.34 % |

| BAM.PF.J |

FixedReset Disc |

-1.12 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 21.82

Evaluated at bid price : 22.15

Bid-YTW : 5.44 % |

| IAF.PR.B |

Deemed-Retractible |

-1.11 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.31

Bid-YTW : 6.54 % |

| TRP.PR.A |

FixedReset Disc |

-1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 13.52

Evaluated at bid price : 13.52

Bid-YTW : 6.06 % |

| MFC.PR.G |

FixedReset Ins Non |

-1.09 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 18.99

Bid-YTW : 7.47 % |

| BMO.PR.S |

FixedReset Disc |

-1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.47

Evaluated at bid price : 17.47

Bid-YTW : 5.31 % |

| TRP.PR.C |

FixedReset Disc |

-1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 12.33

Evaluated at bid price : 12.33

Bid-YTW : 5.81 % |

| POW.PR.A |

Perpetual-Discount |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 24.29

Evaluated at bid price : 24.60

Bid-YTW : 5.77 % |

| CM.PR.O |

FixedReset Disc |

1.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 16.68

Evaluated at bid price : 16.68

Bid-YTW : 5.58 % |

| TD.PF.B |

FixedReset Disc |

1.06 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.20

Evaluated at bid price : 17.20

Bid-YTW : 5.34 % |

| POW.PR.B |

Perpetual-Discount |

1.27 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 23.59

Evaluated at bid price : 23.86

Bid-YTW : 5.68 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| CM.PR.Y |

FixedReset Disc |

1,022,019 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 22.92

Evaluated at bid price : 24.37

Bid-YTW : 5.10 % |

| TD.PF.M |

FixedReset Disc |

680,093 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 23.05

Evaluated at bid price : 24.70

Bid-YTW : 4.96 % |

| HSE.PR.A |

FixedReset Disc |

129,900 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 12.30

Evaluated at bid price : 12.30

Bid-YTW : 6.20 % |

| SLF.PR.A |

Deemed-Retractible |

88,100 |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.51

Bid-YTW : 6.59 % |

| BAM.PR.K |

Floater |

72,600 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 11.03

Evaluated at bid price : 11.03

Bid-YTW : 6.39 % |

| RY.PR.Z |

FixedReset Disc |

47,617 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.74

Evaluated at bid price : 17.74

Bid-YTW : 5.06 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| MFC.PR.M |

FixedReset Ins Non |

Quote: 17.20 – 17.74

Spot Rate : 0.5400

Average : 0.3557

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.20

Bid-YTW : 8.17 % |

| BAM.PR.Z |

FixedReset Disc |

Quote: 18.17 – 18.74

Spot Rate : 0.5700

Average : 0.3995

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 18.17

Evaluated at bid price : 18.17

Bid-YTW : 6.17 % |

| SLF.PR.H |

FixedReset Ins Non |

Quote: 15.56 – 15.98

Spot Rate : 0.4200

Average : 0.2860

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2030-01-31

Maturity Price : 25.00

Evaluated at bid price : 15.56

Bid-YTW : 8.89 % |

| BAM.PR.T |

FixedReset Disc |

Quote: 14.50 – 14.89

Spot Rate : 0.3900

Average : 0.2585

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 14.50

Evaluated at bid price : 14.50

Bid-YTW : 6.38 % |

| EMA.PR.F |

FixedReset Disc |

Quote: 17.39 – 17.90

Spot Rate : 0.5100

Average : 0.3898

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 17.39

Evaluated at bid price : 17.39

Bid-YTW : 5.79 % |

| TRP.PR.K |

FixedReset Disc |

Quote: 24.61 – 24.89

Spot Rate : 0.2800

Average : 0.1645

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2049-06-04

Maturity Price : 23.24

Evaluated at bid price : 24.61

Bid-YTW : 5.19 % |