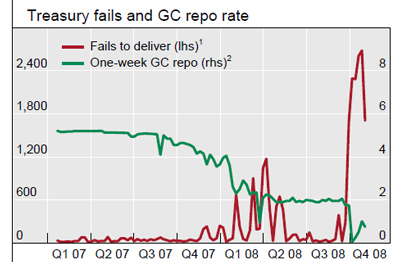

With all this rate-cutting, here’s a little bit of history for you: Four-Week US T-Bills were auctioned off at 0% today. A big fat zero, to three decimal places.

Preferred share volume remained heavy today (well … heavy for the preferred market, I mean!) while prices eased off after yesterday’s gains.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 7.19% | 7.52% | 90,573 | 13.08 | 6 | -1.2930% | 735.2 |

| Floater | 9.85% | 10.16% | 69,970 | 9.28 | 2 | -2.9216% | 359.9 |

| Op. Retract | 5.50% | 6.88% | 145,387 | 4.04 | 15 | +0.5511% | 983.5 |

| Split-Share | 6.93% | 13.28% | 72,752 | 3.95 | 14 | +0.3167% | 888.7 |

| Interest Bearing | 9.67% | 21.42% | 56,961 | 2.82 | 3 | -5.0826% | 758.1 |

| Perpetual-Premium | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Perpetual-Discount | 7.80% | 7.92% | 209,091 | 11.50 | 71 | -0.4855% | 709.4 |

| Fixed-Reset | 6.05% | 5.41% | 1,106,660 | 14.44 | 16 | +0.3609% | 990.8 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| FIG.PR.A | InterestBearing | -8.5308% | Asset coverage of 1.0+:1 as of December 4, based on Capital Unit NAV of 0.39 according to Faircourt and 0.71 Capital Units per preferred. Now with a pre-tax bid-YTW of 18.60% based on a bid of 5.79 and a hardMaturity 2014-12-31 at 10.00. Closing quote of 5.79-09, 2×2. Day’s range of 5.02-6.21. |

| STW.PR.A | InterestBearing | -5.1592% | Asset coverage of 1.3-:1 as of December 4 according to Middlefield. Assiduous Reader erikd advises that there has been a rather large stealth-redemption; as of 4:30 pm, Middlefield’s Investor Relations department was unable to confirm or deny the report. A note on the November 30 NAV states “(Redemption Price Payable December 12, 2008)” Now with a pre-tax bid-YTW of 22.27% based on a bid of 8.64 and a hardMaturity 2009-12-31. Closing quote of 8.64-87, 60×1. Day’s range of 8.79-83. |

| BAM.PR.B | Floater | -4.0761% | |

| DFN.PR.A | SplitShare | -4.0586% | Asset coverage of 1.7+:1 as of November 28 according to the company. Now with a pre-tax bid-YTW of 8.58% based on a bid of 8.51 and a hardMaturity 2014-12-1 at 10.00. Closing quote of 8.51-06, 3×1. Day’s range of 8.72-85. |

| GWO.PR.G | PerpetualDiscount | -4.0219% | Now with a pre-tax bid-YTW of 8.30% based on a bid of 15.75 and a limitMaturity. Closing quote 15.75-17, 7×5. Day’s range of 15.67-48. |

| FBS.PR.B | SplitShare | -3.6765% | Asset coverage of 1.0+:1 as of December 4 according to TD Securities. Now with a pre-tax bid-YTW of 13.71% based on a bid of 7.86 and a hardMaturity 2011-12-15 at 10.00. Closing quote of 7.86-00, 32×17. Day’s range of 7.76-00. |

| SBN.PR.A | SplitShare | -3.0879% | Asset coverage of 1.7-:1 as of December 4 according to Mulvihill. Now with a pre-tax bid-YTW of 9.48% based on a bid of 8.16 and a hardMaturity 2014-12-1 at 10.00. Closing quote of 8.16-39, 3×1. Day’s range of 8.28-30. |

| BCE.PR.G | FixFloat | -2.9375% | |

| GWO.PR.I | PerpetualDiscount | -2.7465% | Now with a pre-tax bid-YTW of 8.19% based on a bid of 13.81 and a limitMaturity. Closing quote 13.81-90, 4×12. Day’s range of 13.61-25. |

| SLF.PR.A | PerpetualDiscount | -2.6756% | Now with a pre-tax bid-YTW of 8.20% based on a bid of 14.55 and a limitMaturity. Closing quote 14.55-65, 1×8. Day’s range of 14.27-19. |

| ALB.PR.A | SplitShare | -2.6366% | Asset coverage of 1.2-:1 as of December 4 according to Scotia Managed Companies. Now with a pre-tax bid-YTW of 14.56% based on a bid of 20.31 and a hardMaturity 2011-2-28 at 25.00. Closing quote of 20.31-48, 46×1. Day’s range of 20.31-86. |

| FTN.PR.A | SplitShare | -2.6277% | Asset coverage of 1.6-:1 as of November 28 according to the company. Now with a pre-tax bid-YTW of 12.73% based on a bid of 12.73% based on a bid of 6.67 and a hardMaturity 2015-12-1 at 10.00. |

| BCE.PR.C | FixFloat | -2.5215% | |

| PWF.PR.I | PerpetualDiscount | -2.2857% | Now with a pre-tax bid-YTW of 8.13% based on a bid of 18.81 and a limitMaturity. Closing quote 18.81-00, 4×7. Day’s range of 18.75-25. |

| CM.PR.D | PerpetualDiscount | -2.1476% | Now with a pre-tax bid-YTW of 8.25% based on a bid of 17.77 and a limitMaturity. Closing quote 17.77-99, 3×3. Day’s range of 17.87-30. |

| BCE.PR.Z | FixFloat | -2.0888% | |

| SLF.PR.E | PerpetualDiscount | -2.0863% | Now with a pre-tax bid-YTW of 8.31% based on a bid of 13.61 and a limitMaturity. Closing quote 13.61-75, 2×16. Day’s range of 13.52-90. |

| MFC.PR.A | OpRet | -2.0317% | Now with a pre-tax bid-YTW of 4.71% based on a bid of 24.11 and a softMaturity 2015-12-18 at 25.00. Closing quote of 24.11-66, 3×3. Day’s range of 24.05-99. |

| BNS.PR.N | PerpetualDiscount | -2.0157% | Now with a pre-tax bid-YTW of 7.64% based on a bid of 17.50 and a limitMaturity. Closing quote 17.50-67, 10×9. Day’s range of 17.55-25. |

| RY.PR.F | PerpetualDiscount | +2.0653% | Now with a pre-tax bid-YTW of 7.35% based on a bid of 15.32 and a limitMaturity. Closing quote 15.32-48. Day’s range of 15.03-75. |

| BAM.PR.H | OpRet | +2.2500% | Now with a pre-tax bid-YTW of 13.24% based on a bid of 20.45 and a softMaturity 2012-3-30 at 25.00. Closing quote of 20.45-00, 5×10. Day’s range of 20.20-50. |

| NA.PR.N | FixedReset | +3.1630% | |

| LFE.PR.A | SplitShare | +3.9744% | Asset coverage of 1.7-:1 as of November 28 according to the company. Now with a pre-tax bid-YTW of 11.41% based on a bid of 8.11 and a hardMaturity 2012-12-1 at 10.00. Closing quote of 8.11-23, 7×1. Day’s range of 7.91-24. |

| LBS.PR.A | SplitShare | +4.2802% | Asset coverage of 1.4-:1 as of December 4 according to Brompton Group. Now with a pre-tax bid-YTW of 10.72% based on a bid of 8.04 and a hardMaturity 2013-11-29 at 10.00. Closing quote of 8.04-24, 24×3. Day’s range of 7.70-25. |

| BAM.PR.O | OpRet | +10.3333% | Now with a pre-tax bid-YTW of 16.17% based on a bid of 16.55 and optionCertainty 2013-6-30 at 25.00. Closing quote of 16.55-17.60, 5×1. Day’s range of 15.65-17.25. |

| BNA.PR.B | SplitShare | +13.4089% | Asset coverage of 1.6+:1 as of December 4 based on BAM.A at 16.72 and 2.4 BAM.A per unit. Now with a pre-tax bid-YTW of 11.67% based on a bid of 17.00 and a hardMaturity 2016-3-25 at 25.00. Closing quote of 17.00-50, 10×11. Day’s range of 16.19-18.00. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| WN.PR.B | Scraps (would be OpRet but there are credit concerns) | 386,360 | Desjardins crossed a block of 300,000, then 50,000, then 28,400 all at 25.05. Now with a pre-tax bid-YTW of 6.57% based on a bid of 25.06 and OptionCertainty 2009-6-30. |

| BNS.PR.J | PerpetualDiscount | 247,193 | Nesbitt crossed 110,600 at 18.00. Now with a pre-tax bid-YTW of 7.43% based on a bid of 17.98 and a limitMaturity. |

| RY.PR.N | FixedReset | 109,740 | Nesbitt bought 12,900 from Canaccord at 25.00. Recent new issue |

| MFC.PR.A | OpRet | 53,035 | TD crossed 24,300 at 24.05. See above |

| RY.PR.I | FixedReset | 50,961 | RBC crossed 23,700 at 21.40. |

| RY.PR.B | PerpetualDiscount | 49,197 | Desjardins bought 26,300 from anonymous at 16.15. Now with a pre-tax bid-YTW of 7.39% based on a bid of 16.10 and a limitMaturity. |

There were seventy-four index-included $25-pv-equivalent issues trading over 10,000 shares today