Nice article on pension derisking:

Such pension “derisking” approaches include lump-sum payouts to vested, terminated employees; liability-driven investment (LDI) strategies that match up plan assets with pension liabilities by moving from equities to long-term bonds; and the one currently making headlines — annuitization, the transfer of a sizable percentage of pension obligations to an insurance company for a paid premium. These tactics join more-traditional approaches, such as freezing and closing pension plans. Taken together, they constitute a sea change in pension-plan treatment.

A good US jobs number had the market in a tizzy:

Employment roared ahead in June, indicating the U.S. economy is poised for faster growth as it shakes off the impact of tax increases and budget cuts.

Payrolls rose by 195,000 workers for a second month, the Labor Department reported today in Washington, exceeding the 165,000 gain projected by economists in a Bloomberg survey. The jobless rate stayed at 7.6 percent, close to a four-year low.

Hourly earnings in the year ended in June advanced by the most since July 2011, giving Americans already buoyed by higher home prices more reason to boost household spending, which accounts for 70 percent of the economy. Stocks climbed, while the yield on 10-year Treasuries rose to the highest in almost two years on expectations the Federal Reserve will start trimming $85 billion in monthly bond purchases in September.

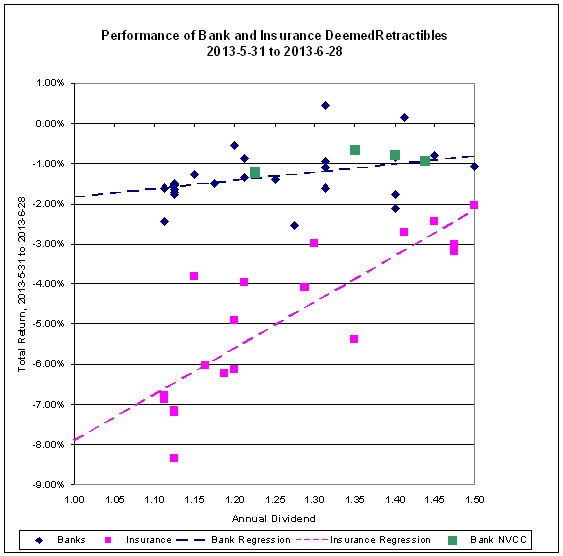

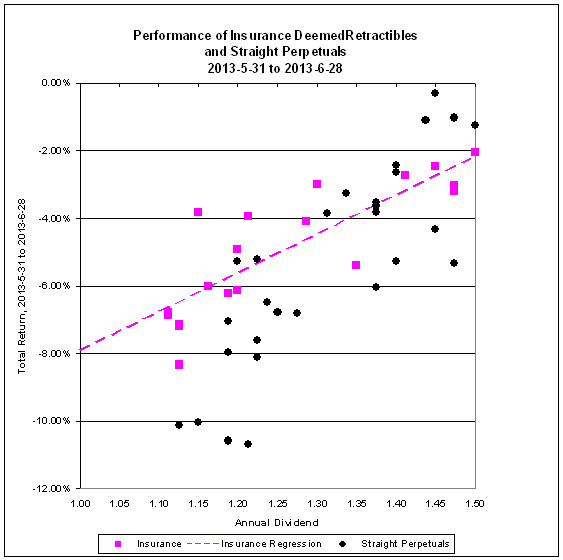

The Canadian preferred share market got knocked back, with PerpetualDiscounts losing 51bp, FixedResets off 20bp and DeemedRetractibles down 35bp. The Performance Highlights table was suitably dismal: very lengthy with only one winner; Brookfield issues led the way downwards. Interestingly, the Volume Highlights table is comprised entirely of Royal Bank issues, led by DeemedRetractibles; volume was above average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.7751 % | 2,566.9 |

| FixedFloater | 4.22 % | 3.56 % | 44,070 | 18.15 | 1 | -2.1304 % | 3,893.0 |

| Floater | 2.73 % | 2.90 % | 79,674 | 20.02 | 4 | -0.7751 % | 2,771.6 |

| OpRet | 4.84 % | 3.30 % | 63,983 | 0.15 | 5 | 0.1483 % | 2,619.1 |

| SplitShare | 4.67 % | 4.27 % | 69,221 | 3.96 | 6 | -0.2030 % | 2,966.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1483 % | 2,394.9 |

| Perpetual-Premium | 5.60 % | 4.12 % | 102,524 | 0.09 | 12 | -0.2568 % | 2,278.7 |

| Perpetual-Discount | 5.35 % | 5.38 % | 141,102 | 14.74 | 26 | -0.5064 % | 2,402.2 |

| FixedReset | 4.96 % | 3.44 % | 241,676 | 3.60 | 83 | -0.2027 % | 2,482.7 |

| Deemed-Retractible | 5.06 % | 4.49 % | 178,207 | 4.87 | 44 | -0.3485 % | 2,390.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.G | FixedFloater | -2.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.82 Evaluated at bid price : 22.51 Bid-YTW : 3.56 % |

| BAM.PR.M | Perpetual-Discount | -1.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 21.29 Evaluated at bid price : 21.29 Bid-YTW : 5.62 % |

| BAM.PR.N | Perpetual-Discount | -1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 21.27 Evaluated at bid price : 21.27 Bid-YTW : 5.63 % |

| FTS.PR.F | Perpetual-Discount | -1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 23.86 Evaluated at bid price : 24.20 Bid-YTW : 5.10 % |

| BAM.PF.C | Perpetual-Discount | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 5.68 % |

| CU.PR.G | Perpetual-Discount | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.20 Evaluated at bid price : 22.55 Bid-YTW : 5.04 % |

| TRI.PR.B | Floater | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.98 Evaluated at bid price : 23.25 Bid-YTW : 2.24 % |

| CU.PR.F | Perpetual-Discount | -1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.04 Evaluated at bid price : 22.35 Bid-YTW : 5.08 % |

| BAM.PR.K | Floater | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 17.57 Evaluated at bid price : 17.57 Bid-YTW : 3.00 % |

| SLF.PR.B | Deemed-Retractible | -1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.28 Bid-YTW : 5.66 % |

| BAM.PF.B | FixedReset | -1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 23.04 Evaluated at bid price : 24.76 Bid-YTW : 4.29 % |

| ELF.PR.H | Perpetual-Premium | -1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 24.49 Evaluated at bid price : 24.90 Bid-YTW : 5.53 % |

| IFC.PR.A | FixedReset | -1.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.35 Bid-YTW : 3.68 % |

| ELF.PR.G | Perpetual-Discount | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.15 Evaluated at bid price : 22.15 Bid-YTW : 5.38 % |

| MFC.PR.B | Deemed-Retractible | -1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.08 Bid-YTW : 5.62 % |

| BAM.PR.Z | FixedReset | -1.31 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 4.19 % |

| IFC.PR.C | FixedReset | -1.28 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.52 Bid-YTW : 3.55 % |

| MFC.PR.C | Deemed-Retractible | -1.27 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.51 Bid-YTW : 5.74 % |

| GWO.PR.I | Deemed-Retractible | -1.26 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.65 Bid-YTW : 5.66 % |

| GWO.PR.P | Deemed-Retractible | -1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.01 Bid-YTW : 5.44 % |

| GWO.PR.R | Deemed-Retractible | -1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.15 Bid-YTW : 5.23 % |

| CU.PR.C | FixedReset | -1.11 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.72 Bid-YTW : 3.33 % |

| SLF.PR.D | Deemed-Retractible | -1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.26 Bid-YTW : 5.80 % |

| BAM.PF.D | Perpetual-Discount | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 22.45 Evaluated at bid price : 22.75 Bid-YTW : 5.42 % |

| IAG.PR.A | Deemed-Retractible | -1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.51 Bid-YTW : 5.33 % |

| HSE.PR.A | FixedReset | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 23.24 Evaluated at bid price : 24.50 Bid-YTW : 3.63 % |

| PWF.PR.F | Perpetual-Discount | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-05 Maturity Price : 24.51 Evaluated at bid price : 24.76 Bid-YTW : 5.39 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.D | Deemed-Retractible | 167,769 | Nesbitt crossed 150,000 at 25.20. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.21 Bid-YTW : 4.48 % |

| RY.PR.B | Deemed-Retractible | 162,337 | Nesbitt crossed 155,000 at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-08-24 Maturity Price : 25.00 Evaluated at bid price : 25.32 Bid-YTW : 4.36 % |

| RY.PR.G | Deemed-Retractible | 138,040 | Nesbitt crossed 130,000 at 25.20. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 4.51 % |

| RY.PR.C | Deemed-Retractible | 137,600 | Nesbitt crossed 130,000 at 25.30. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 4.52 % |

| RY.PR.T | FixedReset | 104,233 | Nesbitt crossed 50,000 at 26.30; RBC crossed 48,900 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 26.25 Bid-YTW : 2.43 % |

| RY.PR.I | FixedReset | 67,566 | RBC crossed blocks of 12,500 and 50,000, both at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 25.38 Bid-YTW : 3.49 % |

| There were 38 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.K | Perpetual-Discount | Quote: 23.80 – 24.19 Spot Rate : 0.3900 Average : 0.2633 YTW SCENARIO |

| POW.PR.A | Perpetual-Discount | Quote: 24.71 – 25.05 Spot Rate : 0.3400 Average : 0.2366 YTW SCENARIO |

| BAM.PR.K | Floater | Quote: 17.57 – 17.90 Spot Rate : 0.3300 Average : 0.2270 YTW SCENARIO |

| BMO.PR.J | Deemed-Retractible | Quote: 25.30 – 25.59 Spot Rate : 0.2900 Average : 0.1923 YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 26.08 – 26.51 Spot Rate : 0.4300 Average : 0.3346 YTW SCENARIO |

| RY.PR.P | FixedReset | Quote: 25.60 – 25.85 Spot Rate : 0.2500 Average : 0.1638 YTW SCENARIO |