The US Budget squabbling has begun:

President Barack Obama’s budget proposal would generate bigger deficits than advertised every year of the next decade, with the shortfalls totaling $1.2 trillion more than the administration estimated, according to the Congressional Budget Office.

The nonpartisan agency said today the deficit will remain above 4 percent of the nation’s gross domestic product for the foreseeable future while the publicly held debt will zoom to $20.3 trillion, amounting to 90 percent of GDP by 2020.

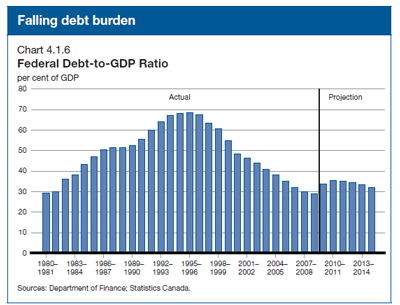

A rise of debt to 70% of GDP in 1994 was nearly enough to trigger failure of bond auctions in 1994. Of course, the CAD is not a reserve currency, but 90% still looks scary! That implies that about 5% of GDP has to be taxed away just to pay interest!

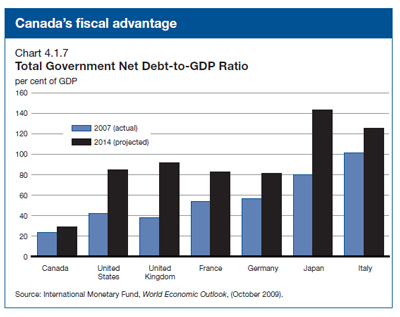

It should be remembered, when looking at the above graph for international comparisons, that it does not include provincial debt, which serves as an effective constraint on how much income can be taxed away for federal interest payments. Total Net Debt is a better figure, but I don’t have a time-series for that:

The CBO projection does not include another recession:

CBO does not try to project business-cycle fluctuations in the economy beyond the short term (in this case, beyond 2014) but instead identifies and projects trends in the factors that underlie potential output, including growth in the labor force, the rate of capital accumulation, and the growth of productivity. During the first half of the 10-year projection period, real GDP is expected to grow rapidly enough to close the substantial gap that existed in 2009 between it and potential GDP. Then, during the remainder of the projection period, real GDP is projected to grow at about the same rate as potential GDP. That approach does not preclude the possibility of recession in the latter years of the projection period; instead, it assumes that the likelihood of booms or recessions in the future is about the same as it was in the past.

I’m pretty suspicious of medium-term budget projectionst that don’t include a recession – at least as a scenario. Averages aren’t much good, frankly.

I mocked MLEC when it was suggested and I mocked PPIP when its turn came around. So far, PPIP looks like a fizzle.

The Icelandic terrorists have rejected the IceSave shakedown. There is no word on whether this is causing a reconsideration of the Basel rules whereby bank debt is risk-weighted according to the credit rating of its sovereign.

The Europeans are musing about a possible European Monetary Fund:

German Finance Minister Wolfgang Schaeuble said the Greek crisis shows the euro region should consider creating an organization with powers similar to the International Monetary Fund.

“For the internal stability of the euro zone, we need an institution that has the powers and know-how of the IMF,” he said in an interview with Welt am Sonntag published today. “We shouldn’t rule anything out, including the creation of a European Monetary Fund.”

…

The comments come after proposals for a European Monetary Fund were put forward last month by Deutsche Bank AG Chief Economist Thomas Mayer and Daniel Gros, director of the Centre for European Policy Studies in Brussels. Countries could draw on funds equivalent to the money deposited at the EMF and exceed that amount if they agreed to a “tailor-made adjustment program” supervised by the European Commission and governments, they said.The EMF could also ease the disruption caused by the default of a member state by offering investors new EMF bonds in exchange for the defaulted bonds, they said. Bond holders would be required to take a “haircut.”

Meanwhile, Papandreou is worried about speculators:

Greek Prime Minister George Papandreou, drawing parallels with the 1947 fight to contain communism in Europe, called for trans-Atlantic cooperation to combat “unprincipled speculators” who threaten to bring a new global financial crisis.

“Europe and America must say ‘enough is enough’ to those speculators who only place value on immediate returns, with utter disregard for the consequences on the larger economic system,” he said in a speech today in Washington. “An ongoing euro crisis could cause a domino effect, driving up borrowing costs for other countries with large deficits and causing volatility in bond and currency rates across the world.”

Oh, golly! We wouldn’t want countries with large deficits to incur higher borrowing costs, would we?

Marc Auboin of the WTO is concerned that Basel III may choke trade finance:

There was a time when trade finance received favourable regulatory treatment. It was viewed as one of the safest, most collateralised, and self-liquidating forms of finance. This was reflected in the moderate of capitalisation for cross-border trade credit in the form of letters of credit and similar securitised instruments under the Basel I regulatory framework put in place in the late 1980s and early 1990s. The Basel I text indicates that “Short-Term self-liquidating trade-related contingencies (such as documentary credits collateralised by the underlying shipments)” would be subject to a credit conversion factor equal or superior to 20% under the standard approach. This meant that for unrated trade credit of $1,000,000 to a corporation carrying a normal risk-weight of 100% and hence a capital requirement of 8%, the application of a credit conversion factor of 20% would “cost” the bank $16,000 in capital.

…

One of the key measures proposed by the Basel Committee to reduce systemic risk is to supplement risk-based capital requirements with a leverage ratio, to reduce incentives for “leveraging”. The intention of reducing such incentives is relatively consensual, and has been shared by economists, regulators, and bankers. The idea, under Paragraph 24 to 27 of the BIS draft proposals, is to impose such a “leverage” ratio, in the form of a flat 100% credit conversion factor to certain off-balance sheet items.

Ranjit Lall has published a working paper titled Why Basel II Failed and Why Basel III is Doomed:

According to conventional wisdom, the Basel II Accord – a set of capital adequacy standards for international banks drawn up by a committee of G-10 supervisors – is essential if we are to avoid another financial crisis. This paper argues that this conclusion is false: Basel II is not the solution to the crisis, but instead an underlying cause of it. I ask why Basel II’s creators fell so short of their aim of improving the safety of the international banking system – why Basel II failed. Drawing on recent work on global regulatory capture, I present a theoretical framework which emphasises the importance of timing and sequencing in determining the outcome of rule-making in international finance. This framework helps to explain not only why Basel II failed, but also why the latest raft of proposals to regulate the international banking system – from the US Treasury’s recent financial white paper to the latest round of G-20 talks in Pittsburgh – are likely to meet a similar fate.

…

Basel II’s failure, I argue, lies in regulatory capture, ‘de facto control of the state and its regulatory agencies by the ‘regulated’ interests, enabling these interests to transfer wealth to themselves at the expense of society’. Large international banks were able to systematically manipulate outcomes in Basel II’s regulatory process to their advantage, at the expense of their smaller and emerging market competitors and, above all, systemic financial stability.

Good volume and mixed performance in the Canadian preferred shares market today: PerpetualDiscounts lost 24bp, but FixedResets gained 8bp, taking their yield down to 3.55%. It will be most interesting to see whether they can edge past the 3.50% boundary … with a Modified Duration of only 3.72, it seems that price gain in the neighborhood of 15-20bp will do it.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.71 % | 2.81 % | 41,009 | 20.59 | 1 | 0.0962 % | 2,037.1 |

| FixedFloater | 5.25 % | 3.36 % | 41,391 | 19.74 | 1 | 0.9756 % | 3,009.4 |

| Floater | 1.91 % | 1.67 % | 46,656 | 23.44 | 4 | 0.1339 % | 2,401.4 |

| OpRet | 4.88 % | 2.36 % | 107,609 | 0.23 | 13 | 0.0446 % | 2,309.3 |

| SplitShare | 6.39 % | 6.40 % | 125,853 | 3.71 | 2 | -0.1101 % | 2,134.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0446 % | 2,111.6 |

| Perpetual-Premium | 5.89 % | 5.89 % | 130,740 | 5.85 | 7 | 0.1080 % | 1,889.9 |

| Perpetual-Discount | 5.88 % | 5.92 % | 175,097 | 13.99 | 71 | -0.2433 % | 1,793.8 |

| FixedReset | 5.40 % | 3.55 % | 313,882 | 3.72 | 42 | 0.0775 % | 2,194.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.D | Perpetual-Discount | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 21.95 Evaluated at bid price : 22.07 Bid-YTW : 5.77 % |

| BNS.PR.J | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 22.29 Evaluated at bid price : 22.88 Bid-YTW : 5.79 % |

| TRI.PR.B | Floater | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 23.69 Evaluated at bid price : 24.00 Bid-YTW : 1.62 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.Q | Perpetual-Discount | 136,425 | Scotia crossed 30,000 at 24.63; RBC crossed 93,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 24.35 Evaluated at bid price : 24.57 Bid-YTW : 5.77 % |

| MFC.PR.D | FixedReset | 85,295 | Desjardins crossed 37,400 at 27.96. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 27.97 Bid-YTW : 3.63 % |

| RY.PR.N | FixedReset | 69,405 | TD crossed 16,800 at 27.76, then another 40,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 27.76 Bid-YTW : 3.38 % |

| GWO.PR.M | Perpetual-Discount | 65,200 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 24.30 Evaluated at bid price : 24.50 Bid-YTW : 5.96 % |

| PWF.PR.E | Perpetual-Discount | 62,200 | National crossed 55,000 at 22.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-08 Maturity Price : 22.24 Evaluated at bid price : 22.68 Bid-YTW : 6.13 % |

| TRP.PR.A | FixedReset | 57,056 | Nesbitt bought 15,400 from Dundee at 26.09. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.12 Bid-YTW : 3.54 % |

| There were 45 other index-included issues trading in excess of 10,000 shares. | |||