Kevin Carmichael of the Centre for International Governance Innovation writes a piece in the Globe titled Canada’s monetary authority lacks American commitment to transparency:

The Bank of Canada believes transcripts and minutes would degrade the quality of debate by making policy makers conscious of an external audience. There also is a belief that since the Governing Council exists by convention, and that it is the governor who is responsible for monetary policy under the Bank of Canada Act, an official record of the policy committee’s meetings is unnecessary. “There are no votes; instead, the Governing Council works toward a consensus viewpoint,” Rebeca Ryall, a media relations officer at the Bank of Canada, said in an e-mail. “This process allows for a frank discussion where Governing Council members are free to challenge one another and push the boundaries of the debate in order to arrive at a decision they are all comfortable with.”

In other words, the members of Governing Council are such pathetic little twerps they will burst into tears if they are contradicted in public. Though I will admit there are other possibilities: the meetings either don’t happen at all, or are closely supervised by a few functionaries from the Ministry of Finance casually wielding rubber hoses.

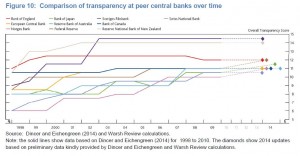

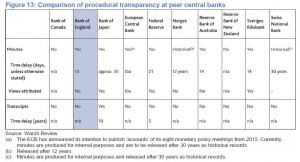

Mr. Carmichael’s article references a paper by Kevin Warsh titled Transparency and the Bank of England’s Monetary Policy Committee which includes the following three charts:

I will be pleased to concede that the scoring is highly subjective and I will also cheerfully admit that it will be very difficult to prove to a determined skeptic that transparency is a good proxy or predictor for quality of the Bank’s decisions or the effectiveness of its implementation of policy.

After all, the main reason for transparency is to improve the public’s confidence in, and ability to predict the future course of, the process. If, for instance, one section of the minutes, released after three weeks, were to include the statement “If housing prices go up any more we’re gonna have to kick some ass (growls of approbation)“, then I suggest that would probably count as pretty good jawboning and result in very good transmission of monetary policy – particularly should housing prices go up, followed by a 50bp hike in policy rates at the next meeting.

And, given that the Bank of Canada is out of step with its peers (ranking just above the bottom on the current scoring, whereas in 1998 it ranked just below the top), I suggest that the onus of explanation for the variance from international trends is now with the Bank. If they’ve got a better reason for secrecy than cowardice and total lack of intellectual talent, let’s hear it.

Anyway, Assiduous Readers will recognize this as a long-term PrefBlog gripe, last voiced October 30, 2014, when the CDHowe Institute advocated the publication of minutes with particular emphasis on disclosure of dissenting views.

A reliable source advises me that 12,501,577 shares (of 22-million outstanding, or 57%) of TRP.PR.A have been converted to TRP.PR.F, its corresponding FloatingReset. I can’t confirm this on the company site, SEDAR, or the TSX site as yet, but will issue a full post when the company decides to let its investors know what’s going on.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts off 5bp, FixedResets gaining 15bp and DeemedRetractibles flat. Volatility continued to be both high and dominated by familiar issues, with ENB issues prominent on the upside, continuing a recovery from the probably credit induced downturn experienced earlier this month. Volume was many adjectives low.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

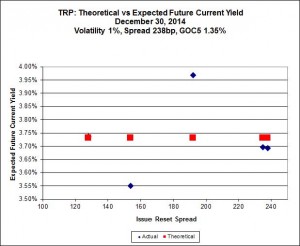

Here’s TRP:

So according to this, TRP.PR.A, bid at 20.58, is $1.36 cheap, but it has already reset (at +192). TRP.PR.C, bid at 20.35 and resetting at +154bp on 2016-1-30 is $0.98 rich.

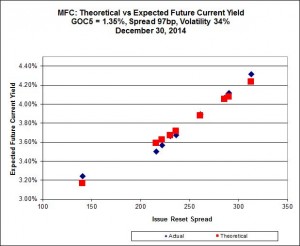

MFC.PR.F has wandered off into its own little cheap world again, bid at 21.30 to be $0.50 cheap according to the calculation. It resets 2016-6-19 at +141bp. Implied Volatility continues to be a conundrum. It is far too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

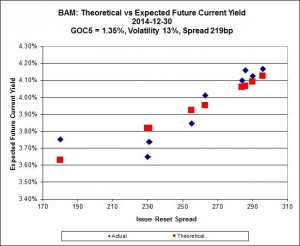

There continues to be cheapness in the lowest-spread issue, BAM.PR.X, resetting at +180bp on 2017-6-30, which is bid at 20.99 and appears to be $0.72 cheap, while BAM.PR.R, resetting at +230bp 2016-6-30 is bid at 25.00 and appears to be $1.10 rich.

It seems clear that the higher-spread issues define a curve with significantly more Implied Volatility than is calculated when the low-spread outlier is included.

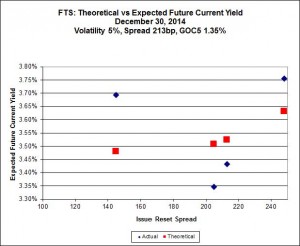

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 18.95, looks $1.16 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp, and bid at 25.40, looks $1.17 expensive and resets 2019-3-1

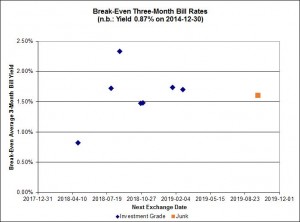

The average break-even rate has declined from 1.80%-2.00% at the time recent conversion decisions were made to a current very wide range of (mostly) 1.50%-1.70%. This decline means that the estimated profit on TRP.PR.A conversion has declined from $0.48 to a mere $0.16 (at the lower end of the range, 1.50%).

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2439 % | 2,522.2 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2439 % | 3,993.2 |

| Floater | 3.01 % | 3.09 % | 64,530 | 19.48 | 4 | 0.2439 % | 2,681.3 |

| OpRet | 4.41 % | -2.45 % | 23,304 | 0.08 | 2 | 0.0000 % | 2,752.0 |

| SplitShare | 4.26 % | 3.82 % | 35,583 | 3.67 | 5 | 0.1600 % | 3,207.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 2,516.4 |

| Perpetual-Premium | 5.45 % | -4.62 % | 67,395 | 0.08 | 20 | -0.0118 % | 2,488.5 |

| Perpetual-Discount | 5.17 % | 5.06 % | 107,827 | 15.32 | 15 | -0.0538 % | 2,667.9 |

| FixedReset | 4.20 % | 3.59 % | 239,893 | 8.34 | 77 | 0.1462 % | 2,556.8 |

| Deemed-Retractible | 4.95 % | 0.27 % | 91,755 | 0.16 | 40 | -0.0010 % | 2,627.9 |

| FloatingReset | 2.55 % | 1.89 % | 63,753 | 3.41 | 5 | 0.2435 % | 2,551.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.F | FixedReset | -1.97 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.91 Bid-YTW : 4.61 % |

| FTS.PR.J | Perpetual-Discount | -1.90 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 23.85 Evaluated at bid price : 24.25 Bid-YTW : 4.93 % |

| GWO.PR.H | Deemed-Retractible | -1.42 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 5.21 % |

| GWO.PR.P | Deemed-Retractible | -1.35 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : 5.10 % |

| TRP.PR.E | FixedReset | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 23.24 Evaluated at bid price : 25.21 Bid-YTW : 3.69 % |

| CU.PR.D | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 24.06 Evaluated at bid price : 24.48 Bid-YTW : 5.04 % |

| RY.PR.L | FixedReset | -1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.21 Bid-YTW : 3.13 % |

| ENB.PF.G | FixedReset | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 23.00 Evaluated at bid price : 24.65 Bid-YTW : 4.16 % |

| MFC.PR.C | Deemed-Retractible | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.58 Bid-YTW : 5.28 % |

| ENB.PR.Y | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.97 Evaluated at bid price : 22.46 Bid-YTW : 4.27 % |

| HSE.PR.A | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.54 Evaluated at bid price : 21.54 Bid-YTW : 3.74 % |

| MFC.PR.B | Deemed-Retractible | 1.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.30 Bid-YTW : 5.06 % |

| ENB.PR.J | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.93 Evaluated at bid price : 24.20 Bid-YTW : 4.15 % |

| BAM.PR.M | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.55 Evaluated at bid price : 21.55 Bid-YTW : 5.55 % |

| BAM.PF.C | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.44 Evaluated at bid price : 21.44 Bid-YTW : 5.70 % |

| IAG.PR.A | Deemed-Retractible | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.95 Bid-YTW : 5.17 % |

| ENB.PF.E | FixedReset | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.92 Evaluated at bid price : 24.40 Bid-YTW : 4.20 % |

| ELF.PR.F | Perpetual-Discount | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 24.64 Evaluated at bid price : 24.90 Bid-YTW : 5.33 % |

| ENB.PF.C | FixedReset | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.84 Evaluated at bid price : 24.18 Bid-YTW : 4.23 % |

| ENB.PR.P | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.52 Evaluated at bid price : 23.35 Bid-YTW : 4.18 % |

| ENB.PR.D | FixedReset | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.58 Evaluated at bid price : 23.27 Bid-YTW : 4.08 % |

| ENB.PR.T | FixedReset | 1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.36 Evaluated at bid price : 23.08 Bid-YTW : 4.24 % |

| ENB.PR.N | FixedReset | 1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.77 Evaluated at bid price : 23.80 Bid-YTW : 4.21 % |

| ENB.PR.B | FixedReset | 1.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.58 Evaluated at bid price : 23.11 Bid-YTW : 4.14 % |

| GWO.PR.R | Deemed-Retractible | 1.81 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.74 Bid-YTW : 4.96 % |

| ENB.PR.F | FixedReset | 2.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 22.70 Evaluated at bid price : 23.55 Bid-YTW : 4.15 % |

| TRP.PR.B | FixedReset | 2.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 17.70 Evaluated at bid price : 17.70 Bid-YTW : 3.84 % |

| TRP.PR.C | FixedReset | 4.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 3.57 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.P | FixedReset | 129,200 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 23.11 Evaluated at bid price : 24.86 Bid-YTW : 3.58 % |

| TD.PF.C | FixedReset | 79,440 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 23.13 Evaluated at bid price : 24.92 Bid-YTW : 3.58 % |

| BAM.PF.C | Perpetual-Discount | 17,755 | RBC crossed 10,000 at 21.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.44 Evaluated at bid price : 21.44 Bid-YTW : 5.70 % |

| TRP.PR.C | FixedReset | 15,100 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-30 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 3.57 % |

| HSE.PR.C | FixedReset | 14,300 | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.26 Bid-YTW : 4.35 % |

| BMO.PR.J | Deemed-Retractible | 12,170 | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-25 Maturity Price : 25.25 Evaluated at bid price : 25.75 Bid-YTW : -5.34 % |

| There were 6 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.H | Deemed-Retractible | Quote: 24.35 – 24.95 Spot Rate : 0.6000 Average : 0.3944 YTW SCENARIO |

| FTS.PR.J | Perpetual-Discount | Quote: 24.25 – 24.80 Spot Rate : 0.5500 Average : 0.3638 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 21.91 – 22.38 Spot Rate : 0.4700 Average : 0.3026 YTW SCENARIO |

| GWO.PR.P | Deemed-Retractible | Quote: 25.65 – 26.10 Spot Rate : 0.4500 Average : 0.2936 YTW SCENARIO |

| RY.PR.L | FixedReset | Quote: 26.21 – 26.55 Spot Rate : 0.3400 Average : 0.2103 YTW SCENARIO |

| CU.PR.D | Perpetual-Discount | Quote: 24.48 – 24.90 Spot Rate : 0.4200 Average : 0.2929 YTW SCENARIO |