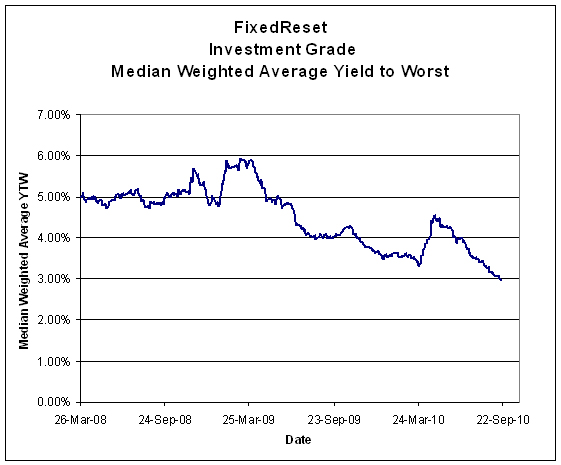

It seems like only yesterday that I was excited that the FixedReset Index YTW had hit an all-time low of 3.26% … but no, that happened on August 19. It only took another month to hop over the next milestone, as the median weighted average Yield-to-Worst of the FixedReset index is now firmly below 3.00%.

To celebrate, I am publishing the FixedReset index constituent list, sorted three ways:

Short corporates now yield about 2.7%, so one can certainly make a case for the idea that a yield below 3.0% for FixedResets is fair and reasonable – that allows 150bp for extension and credit risk on a pre-tax interest-equivalent basis – but I don’t think the market thinks like that and I think the market will receive a rude shock when the issuers start calling these things.

I was interviewed today by a reporter for a major Canadian newspaper and talked about what I liked for 15 minutes … then told her ‘wait a minute, you have to put something about FixedResets in this article or you’ll get about 100 eMails following publication, because a lot of people love these things.’ Not to worry – apparently the other experts she interviewed for the piece strongly recommended FixedResets. Hopefully, I’ll get a look at the article later this week.

How about that PWF.PR.P, eh? It’s a 4.40%+160 FixedReset issued in June …. now trading at 26.23-34, but given a 5-Year GOC yield of 2.11%, it’s not expected to be called 2016-1-31.

Ah, good, for a moment I thought you had forgotten (see my comment on your other post).

So drinks are on you tonight James?

So drinks are on you tonight James?

If you can find me, you win a drink!