Willem Buiter of Citibank is predicting a bail-out of Portugal:

“Now that the Irish government has reached an agreement with the EU/IMF on a financial support package and associated conditionality, the market’s attention will turn to Portugal, whose sovereign, at current levels of interest rates and growth rates, we judge to be less dramatically, but quietly insolvent,” Buiter wrote in a research note Friday.

“We consider it likely that Portugal, too, will need to access the EFSF/EFSM soon.” Buiter said.

Buiter said the current size of the liquidity facilities in place within the European Union is sufficient to deal with another speculative attack or as he puts it “even fund Spain completely for three years”

I don’t normally report brokerage analysis on considerations of quality – but I was quoting Buiter before he got the cushy job, so why not?

But Portugal’s not shut out just yet:

The Portuguese government issued 1 billion euros ($1.29 billion) of 2.5-year notes through a private placement as the nation seeks to narrow its budget gap.

Portugal sold zero-coupon debt due July 2012 in a transaction led by Deutsche Bank AG, according to data compiled by Bloomberg. The Finance Ministry confirmed the medium-term note offering in an e-mail today without providing more details.

…

Portugal sold 500 million euros of six-month bills on Jan. 5, according to the country’s debt agency. The yield on the bills jumped to 3.686 percent from 2.045 percent at a sale of similar-maturity securities in September. A year ago, the country paid just 0.592 percent to borrow for six months.

The FDIC’s attempt to risk-weight deposit insurance premia, discussed in the post FDIC Addresses Systemic Risk is having some interesting knock-on effects:

Increased FDIC fees may cut into banks’ interest income and drive money market rates lower, the strategists said. The volume weighted average for overnight fed funds, the so-called effective rate, may slide by as much as 0.1 percentage point if the FDIC change is implemented, according to Wrightson ICAP LLC, a Jersey City, New Jersey research unit of ICAP Plc.

…

Even lower short-term interest rates will potentially make it even harder for the $2.8 trillion money-market fund industry to retain customer assets. The FDIC changes will add to catalysts for lower money-market rates, chiefly the Fed siphoning of about $1 trillion in Treasuries from the market through its debt purchases by June, according to New-York based Brian Smedley, a strategist at Bank of America Merrill Lynch, a unit of Bank of America Corp.“The Fed will likely achieve lower short-term rates even without lowering the 25 basis points it currently pays on banks’ excess reserve balances,” said Smedley, a former senior trader at the Federal Reserve Bank of New York. With short-term interest rates likely to decline this year, “it will make money- market mutual fund managers lives more difficult and could lead to further consolidation of the industry.”

Deborah Cunningham, chief investment officer in Pittsburgh for taxable money markets at Federated Investors Inc., which manages more than $336 billion in money-market investments, said a fall in overnight rates would at most be only about five basis points and wouldn’t be sufficient to speed any consolidation of the money-fund industry.

OSFI reports that Jean-Claude Ménard, Chief Actuary, gave a speech on mortality and the CPP:

The actuarial report on the Canada Pension Plan is based on the projection of its revenues and expenditures over a long period of time. Under a set of best-estimate assumptions, the most recent actuarial report confirms that the legislated contribution rate of 9.9% is sufficient to pay future expenditures and accumulate assets of $275 billion in 2020, or 4.7 times the expenditures. Having said that, both the length of the projection period and the number of assumptions required ensure that actual future experience will not develop precisely in accordance with the best-estimate assumptions. For the second time, in the most recent actuarial reports, many of the sensitivity tests are determined based on stochastic modeling techniques that estimate the probability distribution of the outcome for each of the main assumptions.

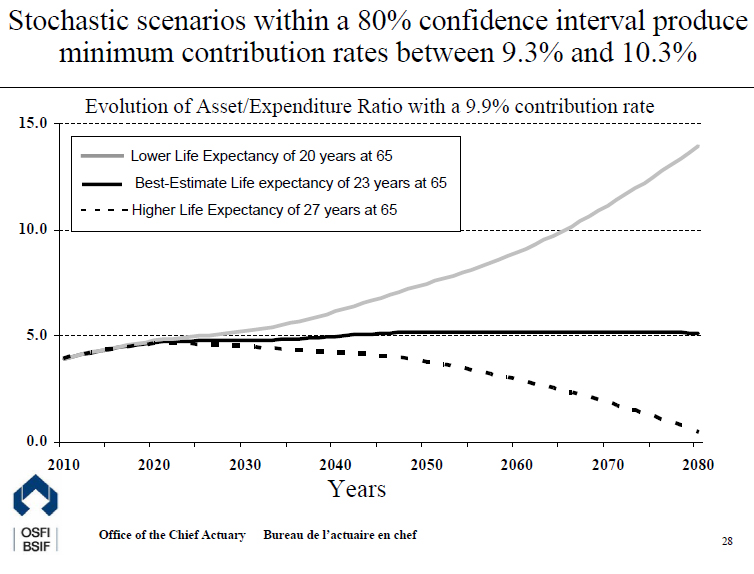

This chart shows the evolution of the asset to expenditure ratio under three scenarios: the best-estimate assumption and the two stochastically determined scenarios based on a 80% confidence interval. The result is that the minimum contribution rate required to finance the plan over a 75-year period could fall between 9.3% and 10.3%.

It was a relatively quiet, but nevertheless profitable day on the Canadian preferred share market, with PerpetualDiscounts up 10bp and FixedResets gaining 5bp on average volume.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1230 % | 2,318.4 |

| FixedFloater | 4.81 % | 3.54 % | 28,332 | 18.91 | 1 | 0.0000 % | 3,497.2 |

| Floater | 2.58 % | 2.37 % | 45,052 | 21.28 | 4 | 0.1230 % | 2,503.2 |

| OpRet | 4.80 % | 3.34 % | 62,055 | 2.33 | 8 | -0.1681 % | 2,393.7 |

| SplitShare | 5.34 % | 1.62 % | 657,951 | 0.92 | 4 | -0.1658 % | 2,449.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1681 % | 2,188.9 |

| Perpetual-Premium | 5.66 % | 5.27 % | 122,584 | 5.06 | 20 | 0.0848 % | 2,025.1 |

| Perpetual-Discount | 5.42 % | 5.45 % | 230,981 | 14.75 | 57 | 0.0987 % | 2,040.7 |

| FixedReset | 5.24 % | 3.44 % | 292,058 | 3.09 | 52 | 0.0476 % | 2,270.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.F | Perpetual-Premium | -1.71 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 5.27 % |

| GWO.PR.L | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-07 Maturity Price : 24.29 Evaluated at bid price : 24.50 Bid-YTW : 5.80 % |

| RY.PR.H | Perpetual-Premium | 1.01 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-23 Maturity Price : 25.00 Evaluated at bid price : 26.06 Bid-YTW : 5.03 % |

| HSB.PR.C | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-07 Maturity Price : 23.25 Evaluated at bid price : 23.50 Bid-YTW : 5.46 % |

| PWF.PR.P | FixedReset | 2.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-07 Maturity Price : 25.05 Evaluated at bid price : 25.10 Bid-YTW : 4.04 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.Q | FixedReset | 114,493 | RBC crossed 14,500 at 26.10. TD crossed blocks of 57,200 and 25,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-11-24 Maturity Price : 25.00 Evaluated at bid price : 26.06 Bid-YTW : 3.28 % |

| TD.PR.I | FixedReset | 109,620 | Nesbitt crossed 99,300 at 27.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.35 Bid-YTW : 3.41 % |

| TD.PR.A | FixedReset | 67,900 | TD crossed 60,000 at 26.25. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.20 Bid-YTW : 3.24 % |

| TD.PR.K | FixedReset | 64,200 | RBC crossed 56,300 at 27.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.45 Bid-YTW : 3.31 % |

| SLF.PR.B | Perpetual-Discount | 49,944 | Desjardins bought 37,000 from RBC at 22.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-07 Maturity Price : 21.82 Evaluated at bid price : 22.17 Bid-YTW : 5.44 % |

| BNS.PR.T | FixedReset | 25,885 | TD crossed 25,000 at 27.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.30 Bid-YTW : 3.29 % |

| There were 26 other index-included issues trading in excess of 10,000 shares. | |||