This would have been a better post yesterday, but I’ve never claimed to be much good at market timing!

The IMF has published its World Economic Outlook, October 2008, Financial Stress, Downturns, and Recoveries. There’s some very interesting data in Chapter Four, discussing “The Current Financial Crisis in Historical Context”.

The global nature of the crisis as illustrated by this report has been discussed on FT-Alphaville on November 3, so I won’t repeat that stuff. Instead, I’ll show a chart of XIU vs. the S&P 500 for the past year:

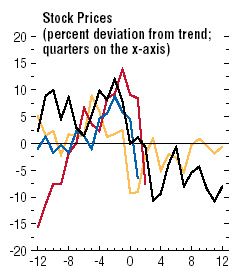

… and the IMF chart of equity returns …

… and a table from Stock Market Bubbles: Some Historical Perspective, by Achla Marathe and Edward Renshaw:

Declines of Three Percent or More in the S&P 500 Stock Price Index After it

Has Achieved a New All Time High Since September 7, 1929

% Change S&P

Date of Value S&P Index ----------------------------------------- Trading

------------------- --------------- Peak to Peak to Day

Peak Trough Peak Trough Peak Trough Duration

(1) (2) (3) (4) (5)n

9/ 7/29 6/ 1/32 31.92 4.40** --- -86.2

10/ 6/54 10/29/54 32.76 31.68 2.6 - 3.3 10

1/ 3/55 1/17/55 36.75 34.58 12.2$ - 5.9# 40H

3/ 4/55 3/14/55 37.52 34.96 2.1$ - 6.8 19

4/21/55 5/17/55 38.32* 36.97 2.1 - 3.5 7

7/27/55 8/10/55 43.76 41.74 14.2 - 4.6# 37

9/23/55 10/11/55 45.63 40.80 4.3 -10.6 13

11/14/55 1/23/56 46.41 43.11 1.7$ - 7.1 0

3/20/56 5/28/56 48.87 44.10 5.3$ - 9.8 7

8/ 2/56 10/22/57 49.74 38.98** 1.8 -21.6 13

11/17/58 11/25/58 53.24 51.02 7.0 - 4.2# 37

1/21/59 2/ 9/59 56.04 53.58 5.3$ - 4.4# 27

5/29/59 6/10/59 58.68 56.36 4.7 - 4.0# 61H

8/ 3/59 10/25/60 60.71* 52.30** 3.5 -13.9 22

4/17/61 4/24/61 66.68 64.40 9.8 - 3.4# 54H

5/17/61 7/18/61 67.39E 64.41D 1.1 - 4.4 2

9/ 6/61 9/25/61 68.46E 65.77D 1.6 - 3.9 22

12/12/61 6/26/62 72.64E* 52.32D** 6.1 -28.0 35

10/28/63 11/22/63 74.48 69.61 2.5 - 6.5 39

5/12/64 6/ 8/64 81.16 78.64 9.0 - 3.1# 101H

7/17/64 8/26/64 84.01 81.32 3.5 - 3.2# 15

11/20/64 12/15/64 86.28* 83.22 2.7 - 3.5 17

5/13/65 6/28/65 90.27 81.60 4.6 - 9.6 81

2/ 9/66 10/ 7/66 94.06 73.20** 4.2 -22.2 94

5/ 8/67 6/ 5/67 94.58 88.43 .6 - 6.5 2

8/ 4/67 8/28/67 95.83 92.64 1.3 - 3.3 4

9/25/67 3/ 5/68 97.59 87.72 1.8$ -10.1 8

7/11/68 8/ 2/68 102.39* 96.63 4.9 - 5.6 44H

11/29/68 5/26/70 108.37 69.29** 5.8 -36.1 38

4/12/72 5/ 9/72 110.18 104.74D 1.7 - 4.9 24

5/26/72 7/20/72 110.66 105.81D .4 - 4.4 2

8/14/72 10/16/72 112.55 106.77D 1.7 - 5.1 4

12/11/72 12/21/72 119.12* 115.11D 5.8 - 3.4# 26H

1/11/73P 10/ 3/74 120.24 62.28D** .9 -48.2 6

8/22/80P 8/28/80 126.02 122.08 4.8$ - 3.1# 26H

9/22/80P 9/29/80 130.40 123.54 3.5$ - 5.3 13

10/15/80P 10/30/80 133.70 126.29 2.5$ - 5.5 7

11/28/80P 8/12/82 140.52* 102.42** 5.1$ -27.1 11

11/ 9/82 11/23/82 143.02 132.93 1.8$ - 7.1 4

1/10/83 1/24/83 146.78 139.97 2.6$ - 4.6 2

6/22/83 8/ 8/83 170.99 159.18 16.5 - 6.9# 94H

10/10/83 7/24/84 172.65* 147.82** 1.0$ -14.4 0

2/13/85 3/15/85 183.35 176.53 6.2$ - 3.7# 17

6/ 6/85 6/13/85 191.06 185.33 4.2 - 3.0# 29

7/17/85 9/25/85 195.65 180.66 2.4 - 7.7 13

1/ 7/86 1/22/86 213.80* 203.49 9.3$ - 4.8# 37

3/27/86 4/ 7/86 238.97 228.63 11.8 - 4.3# 37

4/21/86 5/16/86 244.74 232.76 2.4$ - 4.9 3

5/29/86 6/10/86 247.98 239.58 1.3$ - 3.4 2

7/ 2/86 7/15/86 252.70 233.66 1.9 - 7.5 5

9/ 4/86 9/29/86 253.83 229.91 .4$ - 9.4 6

12/ 2/86 12/31/86 254.00 242.17 .1$ - 4.7 0

3/24/87 3/30/87 301.64 289.20 18.8 - 4.1# 53H

4/ 6/87 5/20/87 301.95 278.21D .1 - 7.9 0

8/25/87 12/ 4/87 336.77 223.92** 11.5 -33.5 50

9/ 1/89 9/14/89 353.73 343.16 5.0$ - 3.0# 27H

10/ 9/89 1/30/90 359.80 322.98 1.7$ -10.2 4

6/ 4/90P 6/26/90 367.40 352.06 2.1$ - 4.2 4

7/16/90P 10/11/90 368.95* 295.46** .4 -19.9 0

4/17/91 5/15/91 390.45 368.57 5.8 - 5.6# 43

8/ 6/91 8/19/91 390.62 376.47 .0$ - 3.6 0

8/28/91 10/ 9/91 396.64 376.80 1.5 - 5.0 4

11/13/91 11/29/91 397.41E* 375.22 .2 - 5.6 1

1/15/92 4/ 8/92 420.77E 394.50 5.9 - 6.2 14

8/ 3/92 8/24/92 425.09E 410.72 1.0$ - 3.4 3

9/14/92 10/ 9/92 425.27E 402.66D .0$ - 5.3 0

2/ 4/93 2/18/93 449.56E 431.90 5.7 - 3.9# 51

3/10/93 4/26/93 456.33E 433.54D 1.5$ - 5.0 2

2/ 2/94 4/ 4/94 482.00E 438.92D 5.6 - 8.9 116

12/13/95 1/10/96 621.69 598.48D 29.0 - 3.7# 210H

2/12/96 4/11/96 661.45 631.18D 6.4 - 4.6# 10

5/24/96 7/24/96 678.51 626.65D 2.6$ - 7.6 9

11/18/96 12/16/96 757.03 720.98D 15.1G$ - 4.8# 51

2/18/97 816.29 D 7.8G ? 26

Footnotes for Table 20.1

(5)n. Number of additional trading days after the recovery to a first new

high to the last new high or peak date.

* Fourth new high to be followed by a three percent decline for the bull

market in question.

**A major bear market low.

$ identifies cases where the first new high was associated with a daily gain

of 1.1 percent or more.

#Cases where the peak to trough decline in column (4) is less than the

preceding peak to peak increase in column (3).

D identifies cases where the first new high occurred after a month when the

dividend yield for the S&P index was equal to 3.0 percent or less.

E identifies cases where the first new high occurred after a quarter when

the P/E ratio for the S&P index was equal to 20.50 or more.

G identifies peak to peak gains that may have encouraged Fed Chairman Alan

Greenspan to warn investors about the possibility of irrational exuberance.

H identifies the trading day duration record, without a cumulative decline

of three percent or more, for each bull market separated by cumulative

declines of 13 percent or more.

P identifies declines of three percent or more that occurred during years

containing a recessionary peak designated by the National Bureau of Economic

Research.

Source of basic data: The Practical Forecasters’ Almanac(Burr Ridge,

Illinois: Irwin, 1992), Table 3.05 and Standard and Poor’s Security

Price Index Record.

Update: See also this source:

S&P 500 Index:

March 24, 2000 closes at 1527.46 (Peak)

July 23, 2002 closes at 797.70 (Trough)

Percentage decline from Peak to Trough: 47.78%

and

from FAC Wealth Management.