The previously announced Scotia Fixed Resets 6.25%+414 settled today with such success that both Royal and Scotia were convinced to add to the growing pile in the late afternoon. Both issues came with the same 6.25% initial fixed rate, with resets to +450 and +446 respectively … which gives you some idea of what has happend to Canada Five Year yields in the last two weeks!

BNS.PR.T traded 769,327 shares in a range of 24.90-35, to close at 25.00-05, 104×30.

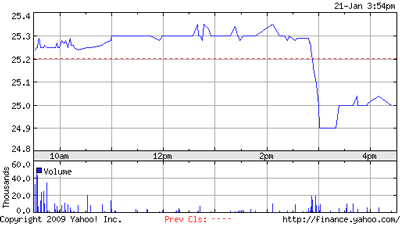

Today’s skill-testing question is: What time were the new issues announced? Hint:

A very successful issue! After announcing an initial size of 8-million shares, Scotia announced on January 8:

that, as a result of strong investor demand for its domestic public offering of non-cumulative 6.25% 5-year rate reset preferred shares Series 26 (the “Preferred Shares Series 26”), the size of the offering has been increased to 10 million shares. The gross proceeds of the offering will now be $250 million and is expected to close on or after January 21, 2009.

The offering was made through a syndicate of investment dealers led by Scotia Capital Inc. on a bought deal basis. The Bank has granted to the underwriters an option to purchase up to an additional 3 million Preferred Shares Series 26 at closing, which option is exercisable by the underwriters any time up to 48 hours before closing.

and has now announced:

that it has completed the domestic offering of 13 million, non-cumulative 5-year rate reset preferred shares Series 26 (the “Preferred Shares Series 26”) at a price of $25.00 per share. The gross proceeds of the offering were $325 million.

And today, of course, Scotia came up with another 8-million share issue with a 2-million share greenshoe, immediately bumped up to 10-million shares with the potential for another 2-million.

BNS.PR.T has been added to the HIMIPref™ Fixed-Reset SubIndex.

[…] Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 5.92 % […]

[…] Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 5.91 % […]

[…] Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-30 Maturity Price : 24.75 Evaluated at bid price : 24.80 Bid-YTW : 6.15 % […]