The Bank of Canada has announced that it has released the January 2009 Update to the Monetary Policy Report:

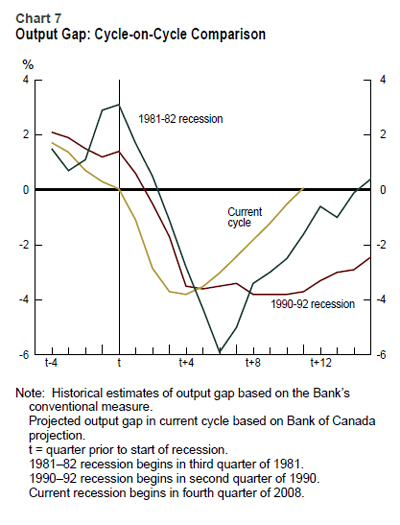

The anticipated normalization of financial conditions, together with the stimulus coming from monetary and fiscal policies, should boost the growth of consumer spending in 2010. Exports are also expected to recover next year as the U.S. economy strengthens and the past depreciation of the Canadian dollar stimulates foreign demand. Excess supply will be gradually reduced, with the economy projected to return to balance by mid-2011. The projected return to balance of the Canadian economy is faster than either of the recoveries following the 1981–82 and 1990–92 recessions (Chart 7). In contrast to these earlier episodes, with an explicit 2 per cent inflation target since 1991 and expectations of inflation well anchored to this target, monetary policy has been able to react in a timely and significant way to help offset the economic downturn and promote conditions to support recovery. In addition, Canada enters this recession with greater fiscal flexibility and stronger corporate balance sheets than in the recession of the 1990s.

It would appear – so far! – that our current recession is unremarkable in terms of either severity or interval since the last one of note. Which, I trust, will explain my anger at the length of time it will take for Spend-Every-Penny’s good-times budgets to cover the projected cost of this rough period.

If we’re lucky, next week’s budget will include a credible projection of how much this recession will cost – including stimulus measures – together with a credible plan of tax increases – effective now – that will pay for it in the ten to fifteen years following recovery. My bet? We won’t be lucky.