The United States Government Accountability Office released a September report to Treasury, Treasury Inflation Protected Securities Should Play a Heightened Role in Addressing Debt Management Challenges:

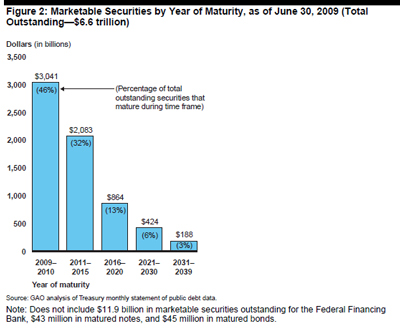

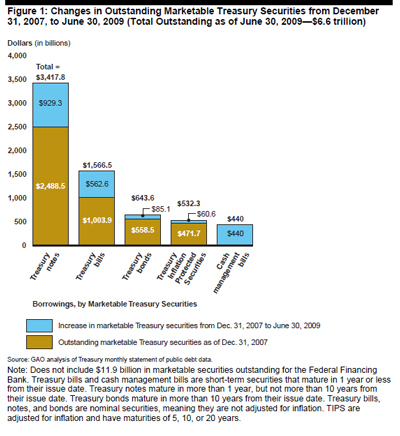

Treasury faces two near-term challenges in managing the growing government debt: the rise in total outstanding debt and the shortening of the average maturity of the debt profile.3 Treasury’s total outstanding debt increased by $2.3 trillion (25 percent increase in federal debt) since the onset of the economic recession in December 2007. In actions Treasury described as in accordance with normal operating procedures, Treasury increased short-term borrowing to address its massive and immediate borrowing needs. As a result, the average maturity of Treasury’s debt decreased as the percentage of marketable debt maturing within 1 year increased from 35.6 percent to 41.1 percent between September 2007 and June 2009.

Another ex-ante study, noted that if the TIPS program were as liquid as the market for off-the-run nominal Treasuries, Treasury would have realized total cost savings from the TIPS program of $22 billion to $32 billion. Over the short run, economists recognize that an assessment of TIPS program’s relative costs depends on whether Treasury or the investor is the beneficiary from differences in expected and actual inflation. The time horizon of the analysis affects the results since, over the long run, the average amount by which actual inflation exceeds expected inflation will roughly equal the average amount when the opposite is true.

…

23William C. Dudley, Jennifer Roush, and Michelle Steinberg Ezer, “The Case for TIPS: An Examination of the Costs and Benefits,” FRBNY Economic Policy Review (July 2009); and Dean Croushore, “An Evaluation of Inflation Forecasts From Surveys Using Real-Time Data,” Federal Reserve Bank of Philadelphia Working Papers (December 2008).

The next part is interesting … I didn’t know that!

In addition, technical market factors closely linked to liquidity effects appear to have contributed to the decline in breakeven inflation rates. Lehman Brothers owned TIPS as part of repo trades or posted TIPS as counterparty collateral. Because of Lehman’s bankruptcy, the court and its counterparty needed to sell these TIPS, which created a flood of TIPS on the market. There appeared to be few buyers and distressed market makers were unwilling to take positions in these TIPS. As a result, the TIPS yields rose sharply.

The conclusion is:

GAO recommends that, in the context of projected sustained increases in federal debt, the Secretary of the Treasury take steps to increase TIPS liquidity and reduce their cost to Treasury: increase issuance, issue longer-dated maturities, and conduct more frequent auctions. Also, the Secretary should continually review the appropriate composition of the TIPS program and consider: the impact of Treasury’s public statements and TIPS issuance on TIPS liquidity, how different analytical perspectives are valuable for evaluating cost, how TIPS can diversify Treasury’s investor base, and how TIPS impact the cost of nominal securities.

However, the Treasury Borrowing Advisory Committee stated in its November 4th Report:

There was lively debate among the Committee members regarding the GAO Report published September 2009 entitled “Treasury Inflation Protected Securities Should Play a Heightened Role in Addressing Debt Management Challenges.” Committee members could not come to broad agreement on the findings of the report. While Committee members acknowledged the benefits of TIPS as a debt management tool, some members reiterated their higher cost to date versus nominal Treasury securities.

So take your choice.

I have previously highlighted the slides for the TBAC presentation.

Ahh, the truth may be revealed! A year ago, US TIP yields were forecasting 10 years of deflation (i.e. CPI would not rise for 10 years and then rise only 1% annually thereafter).

This opportunity lasted more than a month — allowing those of us who doubted such a thing to scoop TIPS (through e.g. the TIP ETF) at bargain prices.

Now inflation expectations have returned to where they used to be before the crisis and it turns out we can thank Lehman Bros for the opportunity!