BCE Inc. has announced that it:

will, on November 1, 2016, continue to have Cumulative Redeemable First Preferred Shares, Series T (“Series T Preferred Shares”) outstanding if, following the end of the conversion period on October 18, 2016, BCE Inc. determines that at least one million Series T Preferred Shares would remain outstanding. In such a case, as of November 1, 2016, the Series T Preferred Shares will pay, on a quarterly basis, as and when declared by the Board of Directors of BCE Inc., a fixed cash dividend for the following five years that will be based on a fixed rate equal to the product of: (a) the average of the yields to maturity compounded semi-annually, determined on October 11, 2016 by two investment dealers selected by BCE Inc., that would be carried by non-callable Government of Canada bonds with a 5-year maturity (the “Government of Canada Yield”), multiplied by (b) a percentage rate determined by BCE Inc. (the “Selected Percentage Rate”) for such period. The “Selected Percentage Rate” determined by BCE Inc. for such period is 390%. The Government of Canada Yield” is 0.774%. Accordingly, the annual dividend rate applicable to the Series T Preferred Shares for the period of five years beginning on November 1, 2016 will be 3.019%.

Holders of BCE.PR.T may convert to BCE.PR.S:

Should you wish to continue receiving a fixed quarterly dividend for the five-year period beginning November 1, 2016, you do not need to take any action with respect to this notice. However, should you wish to receive a floating monthly dividend, you must elect to convert your Series T Preferred Shares into Series S Preferred Shares as explained in more detail in the attached Notice of Conversion Privilege.

In order to convert your shares, you must exercise your right of conversion during the conversion period, which runs from September 16, 2016 to October 18, 2016, inclusively.

Holders of both the Series T Preferred Shares and the Series S Preferred Shares will have the opportunity to convert their shares again on November 1, 2021, and every five years thereafter as long as the shares remain outstanding.

There is always a certain amount of confusion regarding how RatchetRate issues such as BCE.PR.S work, so I’ll quote that part too:

As of November 1, 2016, the Series S Preferred Shares, should they remain outstanding, will continue to pay a monthly floating dividend based on a dividend rate that will fluctuate over time between 50% and 100% of the Prime rate (“Prime”) for each month computed in accordance with the articles of BCE Inc. Accordingly, from November 1, 2016, the holders of Series S Preferred Shares will continue to be entitled to receive floating adjustable cash dividends, as and when declared by the Board of Directors of BCE Inc., to be paid on the twelfth day of the subsequent month. The dividend rate will be adjusted upwards or downwards on a monthly basis by an Adjustment Factor (as described below) whenever the Calculated Trading Price, being the market price of the Series S Preferred Shares computed in accordance with the articles of BCE Inc., is $24.875 or less or $25.125 or more, respectively. The Adjustment Factor for a month will be based on the Calculated Trading Price of the Series S Preferred Shares for the preceding month determined in accordance with the following table:

| If the Calculated Trading Price for the preceding month is: |

The Adjustment Factor as a percentage of Prime shall be: |

| $25.50 or more |

– 4.00% |

| $25.375 and less than $25.50 |

– 3.00% |

| $25.25 and less than $25.375 |

– 2.00% |

| $25.125 and less than $25.25 |

– 1.00% |

| Greater than $24.875 and less than $25.125 |

nil |

| Greater than $24.75 to $24.875 |

+ 1.00% |

| Greater than $24.625 to $24.75 |

+ 2.00% |

| Greater than $24.50 to $24.625 |

+ 3.00% |

| $24.50 or less |

+ 4.00% |

Given that all BCE RatchetRate issues are currently bid in the 14.19-30 range, there is not much chance that the percentage of prime paid will be reduced below 100% any time soon!

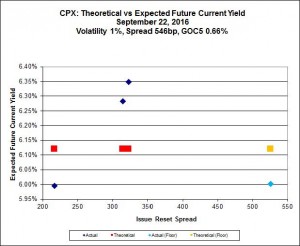

BCE.PR.T and BCE.PR.S form a Strong Pair and can therefore be compared with other Strong Pairs of this form using the Pairs Equivalency Calculator:

Click for Big

Click for BigThe BCE.PR.T / BCE.PR.S pair, at the bids of 14.36 and 14.35, respectively, will have an equivalent total return to the next Exchange Date if the average Prime Rate is 2.81%; this should mean the prices will be about equivalent (although note that this ignores the effect of the last dividend on BCE.PR.S of about $0.055).

Over the medium term I suggest that it is prudent to take the view that Canada Prime is much more likely to increase over the next five years than it is to decrease. Therefore, I recommend that holders of BCE.PR.T convert to BCE.PR.S, and that holders of the latter issue maintain their position.