TXPR closed at 515.55, up 0.78% on the day. Volume today was 1.92-million, slightly below average in the context of the past thirty days.

CPD closed at 10.36, up 0.58% on the day. Volume was 72,755, slightly below the average of the past 30 trading days.

ZPR closed at 8.07, up 0.88% on the day. Volume of 88,873 was well below average in the context of the past 30 trading days.

Five-year Canada yields were unchanged at 0.42% today.

Don’t look to inflation to drive up 5-year bond yields, says the Bank of Canada:

The Bank of Canada thinks there is likely to be downward pressure on inflation once coronavirus-related shutdowns are lifted, a senior official said on Wednesday, a sign the Bank is in no rush to raise near-record low interest rates.

…

Deputy governor Timothy Lane said Canada would likely emerge with both demand and supply weaker than before. The scarring associated with the shutdown could lower productivity, which tends to result in higher inflation.“But the Bank’s analysis suggests that the decline in demand stemming in part from weaker business and consumer confidence is likely to have a larger effect. On balance, there is likely to be downward pressure on inflation,” he said in a speech to a Winnipeg business audience via video.

Lane reiterated that the bank expected second quarter growth to plunge anywhere between 15 and 30 percent from its level in late 2019.

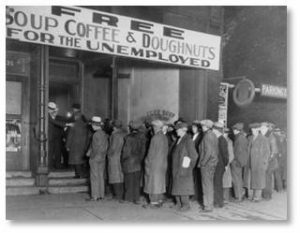

Gloom about the immediate future is widespread:

Only one in five Americans expects overall business conditions to be “very” or “somewhat” good over the next year, according to a poll conducted this month for The New York Times by the online research platform SurveyMonkey. Sixty percent said they expected the next five years to be characterized by “periods of widespread unemployment or depression.”

Those numbers are little changed from a month earlier, and may even reflect a slight decline in outlook, signaling that the reopenings and federal and state political moves to deal with the pandemic have had little impact on confidence.

Other data tells a similar story. A survey from the University of Michigan last week found that consumers’ assessment of current economic conditions had improved modestly in early May, but that their view of the future had continued to darken.

PerpetualDiscounts now yield 6.06%, equivalent to 7.88% interest at the standard equivalency factor of 1.3x. Long corporates now yield 3.38%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) has narrowed slightly (and perhaps spuriously), to 450bp from the 455bp reported May 13. We are still above the pre-2020 record of 445bp briefly touched in 2008.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.0143 % | 1,434.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.0143 % | 2,632.9 |

| Floater | 5.38 % | 5.61 % | 30,666 | 14.42 | 4 | 1.0143 % | 1,517.4 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3645 % | 3,386.9 |

| SplitShare | 4.90 % | 5.29 % | 77,232 | 3.87 | 7 | 0.3645 % | 4,044.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3645 % | 3,155.8 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5121 % | 2,899.5 |

| Perpetual-Discount | 5.80 % | 6.06 % | 84,789 | 13.80 | 35 | 0.5121 % | 3,110.0 |

| FixedReset Disc | 6.45 % | 5.38 % | 190,978 | 14.63 | 83 | 0.4574 % | 1,766.1 |

| Deemed-Retractible | 5.48 % | 5.79 % | 90,710 | 13.92 | 27 | 1.0218 % | 3,094.1 |

| FloatingReset | 4.99 % | 4.93 % | 53,015 | 15.56 | 3 | 3.1660 % | 1,770.4 |

| FixedReset Prem | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4574 % | 2,442.4 |

| FixedReset Bank Non | 2.02 % | 4.17 % | 169,776 | 1.66 | 2 | 0.0000 % | 2,733.7 |

| FixedReset Ins Non | 6.71 % | 5.50 % | 122,093 | 14.36 | 22 | 0.7933 % | 1,770.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| NA.PR.G | FixedReset Disc | -3.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.51 Evaluated at bid price : 15.51 Bid-YTW : 5.79 % |

| BAM.PF.B | FixedReset Disc | -3.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.41 Evaluated at bid price : 13.41 Bid-YTW : 6.46 % |

| TRP.PR.A | FixedReset Disc | -3.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 11.26 Evaluated at bid price : 11.26 Bid-YTW : 6.03 % |

| GWO.PR.N | FixedReset Ins Non | -2.99 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 8.75 Evaluated at bid price : 8.75 Bid-YTW : 5.06 % |

| RY.PR.M | FixedReset Disc | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.01 Evaluated at bid price : 14.01 Bid-YTW : 5.49 % |

| MFC.PR.H | FixedReset Ins Non | -1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 5.69 % |

| RY.PR.S | FixedReset Disc | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 16.70 Evaluated at bid price : 16.70 Bid-YTW : 4.85 % |

| CM.PR.T | FixedReset Disc | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 19.35 Evaluated at bid price : 19.35 Bid-YTW : 5.31 % |

| TRP.PR.E | FixedReset Disc | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 12.95 Evaluated at bid price : 12.95 Bid-YTW : 5.94 % |

| TRP.PR.D | FixedReset Disc | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.10 Evaluated at bid price : 13.10 Bid-YTW : 5.93 % |

| MFC.PR.J | FixedReset Ins Non | -1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.08 Evaluated at bid price : 15.08 Bid-YTW : 5.50 % |

| CM.PR.P | FixedReset Disc | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.05 Evaluated at bid price : 14.05 Bid-YTW : 5.43 % |

| EML.PR.A | FixedReset Ins Non | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.51 Evaluated at bid price : 23.05 Bid-YTW : 5.95 % |

| NA.PR.C | FixedReset Disc | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 17.28 Evaluated at bid price : 17.28 Bid-YTW : 5.76 % |

| GWO.PR.P | Deemed-Retractible | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.70 Evaluated at bid price : 22.94 Bid-YTW : 5.97 % |

| PVS.PR.F | SplitShare | 1.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2024-09-30 Maturity Price : 25.00 Evaluated at bid price : 24.81 Bid-YTW : 5.28 % |

| PWF.PR.T | FixedReset Disc | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.90 Evaluated at bid price : 13.90 Bid-YTW : 5.69 % |

| POW.PR.D | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 6.05 % |

| CM.PR.O | FixedReset Disc | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.65 Evaluated at bid price : 13.65 Bid-YTW : 5.55 % |

| POW.PR.A | Perpetual-Discount | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 23.11 Evaluated at bid price : 23.37 Bid-YTW : 6.06 % |

| BAM.PR.T | FixedReset Disc | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 11.30 Evaluated at bid price : 11.30 Bid-YTW : 6.38 % |

| NA.PR.W | FixedReset Disc | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.81 Evaluated at bid price : 13.81 Bid-YTW : 5.46 % |

| MFC.PR.C | Deemed-Retractible | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.18 Evaluated at bid price : 20.18 Bid-YTW : 5.58 % |

| GWO.PR.H | Deemed-Retractible | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.85 Evaluated at bid price : 20.85 Bid-YTW : 5.91 % |

| MFC.PR.G | FixedReset Ins Non | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.01 Evaluated at bid price : 15.01 Bid-YTW : 5.63 % |

| POW.PR.C | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 23.69 Evaluated at bid price : 24.00 Bid-YTW : 6.11 % |

| BAM.PR.Z | FixedReset Disc | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.58 Evaluated at bid price : 14.58 Bid-YTW : 6.30 % |

| SLF.PR.E | Deemed-Retractible | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.57 Evaluated at bid price : 20.57 Bid-YTW : 5.56 % |

| ELF.PR.H | Perpetual-Discount | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.56 Evaluated at bid price : 22.85 Bid-YTW : 6.09 % |

| BAM.PF.I | FixedReset Disc | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.85 Evaluated at bid price : 23.21 Bid-YTW : 5.23 % |

| MFC.PR.I | FixedReset Ins Non | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.60 Evaluated at bid price : 15.60 Bid-YTW : 5.50 % |

| GWO.PR.Q | Deemed-Retractible | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 21.66 Evaluated at bid price : 22.04 Bid-YTW : 5.92 % |

| GWO.PR.T | Deemed-Retractible | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 21.69 Evaluated at bid price : 22.00 Bid-YTW : 5.93 % |

| GWO.PR.S | Deemed-Retractible | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.03 Evaluated at bid price : 22.40 Bid-YTW : 5.94 % |

| SLF.PR.B | Deemed-Retractible | 1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 21.85 Evaluated at bid price : 22.09 Bid-YTW : 5.51 % |

| CM.PR.S | FixedReset Disc | 1.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.02 Evaluated at bid price : 15.02 Bid-YTW : 5.31 % |

| GWO.PR.M | Deemed-Retractible | 1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 23.93 Evaluated at bid price : 24.17 Bid-YTW : 6.09 % |

| SLF.PR.G | FixedReset Ins Non | 1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 9.13 Evaluated at bid price : 9.13 Bid-YTW : 5.12 % |

| SLF.PR.H | FixedReset Ins Non | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 12.30 Evaluated at bid price : 12.30 Bid-YTW : 5.41 % |

| MFC.PR.M | FixedReset Ins Non | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.08 Evaluated at bid price : 14.08 Bid-YTW : 5.42 % |

| MFC.PR.F | FixedReset Ins Non | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 9.15 Evaluated at bid price : 9.15 Bid-YTW : 5.08 % |

| SLF.PR.A | Deemed-Retractible | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 21.55 Evaluated at bid price : 21.81 Bid-YTW : 5.52 % |

| TD.PF.J | FixedReset Disc | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 5.10 % |

| TD.PF.K | FixedReset Disc | 1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 16.60 Evaluated at bid price : 16.60 Bid-YTW : 5.14 % |

| SLF.PR.D | Deemed-Retractible | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.52 Evaluated at bid price : 20.52 Bid-YTW : 5.51 % |

| IFC.PR.F | Deemed-Retractible | 1.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 22.87 Evaluated at bid price : 23.20 Bid-YTW : 5.79 % |

| GWO.PR.R | Deemed-Retractible | 1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.80 Evaluated at bid price : 20.80 Bid-YTW : 5.87 % |

| IFC.PR.G | FixedReset Ins Non | 1.99 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.35 Evaluated at bid price : 15.35 Bid-YTW : 5.53 % |

| SLF.PR.C | Deemed-Retractible | 2.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.58 Evaluated at bid price : 20.58 Bid-YTW : 5.49 % |

| MFC.PR.B | Deemed-Retractible | 2.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 20.85 Evaluated at bid price : 20.85 Bid-YTW : 5.58 % |

| MFC.PR.N | FixedReset Ins Non | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.30 Evaluated at bid price : 14.30 Bid-YTW : 5.22 % |

| BAM.PR.K | Floater | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 7.62 Evaluated at bid price : 7.62 Bid-YTW : 5.71 % |

| BAM.PR.C | Floater | 2.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 7.75 Evaluated at bid price : 7.75 Bid-YTW : 5.61 % |

| TRP.PR.G | FixedReset Disc | 2.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.74 Evaluated at bid price : 14.74 Bid-YTW : 5.79 % |

| IAF.PR.I | FixedReset Ins Non | 2.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.90 Evaluated at bid price : 15.90 Bid-YTW : 5.53 % |

| HSE.PR.A | FixedReset Disc | 3.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 6.20 Evaluated at bid price : 6.20 Bid-YTW : 8.99 % |

| IFC.PR.A | FixedReset Ins Non | 3.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 11.30 Evaluated at bid price : 11.30 Bid-YTW : 5.27 % |

| BAM.PR.R | FixedReset Disc | 3.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 11.15 Evaluated at bid price : 11.15 Bid-YTW : 6.28 % |

| BAM.PR.X | FixedReset Disc | 3.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 9.92 Evaluated at bid price : 9.92 Bid-YTW : 5.89 % |

| BMO.PR.W | FixedReset Disc | 3.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 14.47 Evaluated at bid price : 14.47 Bid-YTW : 5.13 % |

| MFC.PR.L | FixedReset Ins Non | 3.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.45 Evaluated at bid price : 13.45 Bid-YTW : 5.33 % |

| BAM.PF.G | FixedReset Disc | 3.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 13.25 Evaluated at bid price : 13.25 Bid-YTW : 6.28 % |

| TRP.PR.H | FloatingReset | 4.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 7.80 Evaluated at bid price : 7.80 Bid-YTW : 4.93 % |

| HSE.PR.E | FixedReset Disc | 4.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 11.50 Evaluated at bid price : 11.50 Bid-YTW : 9.44 % |

| SLF.PR.J | FloatingReset | 5.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 9.15 Evaluated at bid price : 9.15 Bid-YTW : 4.56 % |

| HSE.PR.G | FixedReset Disc | 6.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 10.80 Evaluated at bid price : 10.80 Bid-YTW : 9.37 % |

| CU.PR.C | FixedReset Disc | 7.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.31 Evaluated at bid price : 15.31 Bid-YTW : 4.74 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.R | FixedReset Disc | 101,025 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 24.47 Evaluated at bid price : 24.80 Bid-YTW : 5.30 % |

| CU.PR.C | FixedReset Disc | 54,225 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.31 Evaluated at bid price : 15.31 Bid-YTW : 4.74 % |

| RY.PR.Q | FixedReset Disc | 44,783 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 23.94 Evaluated at bid price : 24.42 Bid-YTW : 5.11 % |

| MFC.PR.Q | FixedReset Ins Non | 44,782 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.20 Evaluated at bid price : 15.20 Bid-YTW : 5.40 % |

| CM.PR.R | FixedReset Disc | 42,175 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 17.16 Evaluated at bid price : 17.16 Bid-YTW : 5.74 % |

| MFC.PR.I | FixedReset Ins Non | 41,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2050-05-20 Maturity Price : 15.60 Evaluated at bid price : 15.60 Bid-YTW : 5.50 % |

| There were 29 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| HSE.PR.G | FixedReset Disc | Quote: 10.80 – 20.40 Spot Rate : 9.6000 Average : 5.2614 YTW SCENARIO |

| TD.PF.D | FixedReset Disc | Quote: 15.35 – 18.80 Spot Rate : 3.4500 Average : 2.2021 YTW SCENARIO |

| RY.PR.M | FixedReset Disc | Quote: 14.01 – 16.85 Spot Rate : 2.8400 Average : 1.7880 YTW SCENARIO |

| MFC.PR.I | FixedReset Ins Non | Quote: 15.60 – 18.00 Spot Rate : 2.4000 Average : 1.3943 YTW SCENARIO |

| MFC.PR.M | FixedReset Ins Non | Quote: 14.08 – 16.17 Spot Rate : 2.0900 Average : 1.5478 YTW SCENARIO |

| CU.PR.C | FixedReset Disc | Quote: 15.31 – 17.19 Spot Rate : 1.8800 Average : 1.4751 YTW SCENARIO |