The FOMC is feeling a little more cheerful:

Information received since the Federal Open Market Committee met in September suggests that economic activity is expanding at a moderate pace. Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing.

…

Although inflation in the near term will likely be held down by lower energy prices and other factors, the Committee judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat since early this year.The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program. Moreover, the Committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. Accordingly, the Committee decided to conclude its asset purchase program this month.

…

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation.

…

Voting against the action was Narayana Kocherlakota, who believed that, in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level.

As the Fed is a competently run central bank, one of the many statistics it publishes is the Ten-Year Breakeven Inflation Rate:

After a brief wail, equities decided it wasn’t really news:

U.S. stocks pared declines, Treasuries retreated and the dollar rallied after the Federal Reserve confirmed it will end its asset-purchase program amid signs of a strengthening economy.

The Standard & Poor’s 500 Index (SPX) slid 0.1 percent at 4 p.m. in New York. The index fell as much as 0.8 percent after the Fed’s policy statement before trimming the slide. The 10-year Treasury note yield rose three basis points to 2.32 percent. The Bloomberg Dollar Spot Index jumped 0.6 percent, erasing earlier losses. Gold prices headed for the biggest drop in three weeks.

Moody’s downgraded Talisman to Baa3:

The Baa3 senior unsecured rating reflects Talisman’s sizable reserves, production and valuable other assets, tempered by the execution risks of an ongoing major shift in strategy and capital spending and dividends that outstrip internal cash flow generation. While production has declined due largely to asset sales, we expect modest production growth in 2015 from existing assets given the use of development capital in Southeast Asia, the Eagle Ford and Columbia. However, we expect an overall decline in reserves and production, cash flow, debt and negative free cash flow over the next 12 to 18 months as asset sales take place. When the strategic re-positioning is complete, we believe that Talisman will be positioned as a Baa3-rated company, with internally generated cash flow that can largely fund its negative free cash flow in the North Sea and an asset base that can provide growth opportunities and improvements in Talisman’s very high finding and development costs and very weak leveraged full-cycle ratio.

…

The stable outlook reflects our expectation that Talisman will complete its restructuring and have size, leverage and return metrics supportive of a Baa3 rating. The rating could be downgraded if capital productivity fails to improve with a leveraged full cycle ratio of at least 1.0x or if retained cash flow to debt appears likely to decline below 30%. The rating could also be downgraded if the proceeds of asset sales are used for shareholder returns and not debt reduction.A rating upgrade is unlikely in the near term, but possible if Talisman displays a clear focus on core assets that have a positive organic growth profile that can be developed at reasonable costs leading to sustainable sequential growth in production and reserves, and sustainable improvements in both the leveraged full-cycle ratio (above 1.5x) and RCF to debt (above 40%).

Talisman is the proud issuer of TLM.PR.A, which was downgraded to P-3 by S&P earlier this month, and downgraded to Pfd-3 by DBRS in September.

The Canadian preferred share market skyrocketted today, with PerpetualDiscounts winning 45bp, FixedResets up 32bp and DeemedRetractibles gaining 22bp. Volatility was high, with BAM issues prominent in the hightlights. Volume was average, but there were quite a few six-figure volumes; on the other hand, most of those high volumes were due to RBC performing matched pairs of crosses … which may be real, or may indicate that they were mostly ‘internal crosses’ (where the same manager manages both accounts and he’s just rebalancing).

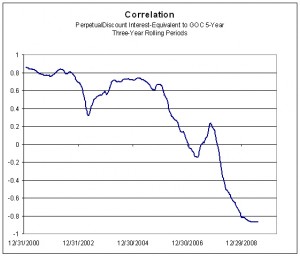

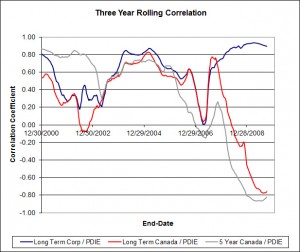

PerpetualDiscounts now yield 5.09%, equivalent to 6.62% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.2%, so the pre-tax interest-equivalent spread is no about 240bp, a significant narrowing from the 270bp reported October 15.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 3.57 % | 3.93 % | 18,511 | 18.74 | 1 | -8.3804 % | 2,345.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1848 % | 3,989.0 |

| Floater | 2.99 % | 3.11 % | 63,575 | 19.43 | 4 | -0.1848 % | 2,678.5 |

| OpRet | 4.03 % | -0.65 % | 104,857 | 0.08 | 1 | 0.0393 % | 2,744.3 |

| SplitShare | 4.27 % | 3.87 % | 69,465 | 3.79 | 5 | 0.2767 % | 3,167.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0393 % | 2,509.4 |

| Perpetual-Premium | 5.47 % | -1.27 % | 70,599 | 0.09 | 18 | 0.1311 % | 2,466.4 |

| Perpetual-Discount | 5.26 % | 5.09 % | 100,719 | 15.20 | 18 | 0.4480 % | 2,624.8 |

| FixedReset | 4.19 % | 3.64 % | 171,804 | 8.49 | 75 | 0.3186 % | 2,569.6 |

| Deemed-Retractible | 5.00 % | 2.73 % | 101,295 | 0.32 | 42 | 0.2171 % | 2,578.8 |

| FloatingReset | 2.55 % | 1.85 % | 70,363 | 3.58 | 6 | -0.0261 % | 2,545.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.E | Ratchet | -8.38 % | Not real, since volume on the TSE was a big fat zero. I don’t know whether this Toronto Stock Exchange screw-up is due to horrible market-making or their practice of not selling closing quotes. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 25.00 Evaluated at bid price : 21.01 Bid-YTW : 3.93 % |

| BAM.PF.E | FixedReset | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 23.22 Evaluated at bid price : 25.25 Bid-YTW : 4.00 % |

| BAM.PF.A | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.77 Bid-YTW : 3.77 % |

| BAM.PF.C | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.55 Evaluated at bid price : 21.85 Bid-YTW : 5.60 % |

| BAM.PR.M | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.57 Evaluated at bid price : 21.57 Bid-YTW : 5.57 % |

| MFC.PR.B | Deemed-Retractible | 1.35 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.31 Bid-YTW : 5.62 % |

| FTS.PR.G | FixedReset | 1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 23.27 Evaluated at bid price : 25.00 Bid-YTW : 3.59 % |

| BAM.PF.D | Perpetual-Discount | 1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.72 Evaluated at bid price : 22.00 Bid-YTW : 5.62 % |

| BAM.PR.N | Perpetual-Discount | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.63 Evaluated at bid price : 21.63 Bid-YTW : 5.56 % |

| BAM.PR.X | FixedReset | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.50 Evaluated at bid price : 21.87 Bid-YTW : 3.97 % |

| MFC.PR.C | Deemed-Retractible | 1.88 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.77 Bid-YTW : 5.76 % |

| BAM.PR.R | FixedReset | 1.90 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 23.93 Evaluated at bid price : 25.75 Bid-YTW : 3.71 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.F | FixedReset | 200,005 | Nesbitt crossed 20,000 at 24.83. TD crossed two blocks of 20,000 each, both at the same price. RBC crossed four blocks: 50,000 shares, 25,000 shares, 10,000 and 19,900, all at the same price again. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 23.24 Evaluated at bid price : 24.83 Bid-YTW : 3.97 % |

| TRP.PR.C | FixedReset | 152,779 | RBC crossed two blocks of 75,000 each, both at 21.43. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.39 Evaluated at bid price : 21.39 Bid-YTW : 3.65 % |

| HSE.PR.A | FixedReset | 143,273 | RBC crossed two blocks of 67,500 each, both at 22.53. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 22.22 Evaluated at bid price : 22.60 Bid-YTW : 3.67 % |

| GWO.PR.N | FixedReset | 133,831 | RBC crossed two blocks of 65,000 each, both at 21.82. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.75 Bid-YTW : 4.57 % |

| PWF.PR.P | FixedReset | 111,635 | RBC crossed two blocks of 52,900 each, both at 22.23. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.81 Evaluated at bid price : 22.30 Bid-YTW : 3.52 % |

| NA.PR.W | FixedReset | 110,358 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 23.14 Evaluated at bid price : 25.00 Bid-YTW : 3.67 % |

| TRP.PR.A | FixedReset | 108,823 | RBC crossed two blocks of 42,000 each, both at 21.72. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-10-29 Maturity Price : 21.44 Evaluated at bid price : 21.74 Bid-YTW : 3.96 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.E | Ratchet | Quote: 21.01 – 23.55 Spot Rate : 2.5400 Average : 1.5147 YTW SCENARIO |

| W.PR.H | Perpetual-Premium | Quote: 25.05 – 25.50 Spot Rate : 0.4500 Average : 0.2804 YTW SCENARIO |

| MFC.PR.A | OpRet | Quote: 25.46 – 25.81 Spot Rate : 0.3500 Average : 0.2062 YTW SCENARIO |

| BAM.PR.T | FixedReset | Quote: 24.60 – 24.91 Spot Rate : 0.3100 Average : 0.2079 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 22.33 – 22.75 Spot Rate : 0.4200 Average : 0.3180 YTW SCENARIO |

| TD.PR.P | Deemed-Retractible | Quote: 25.84 – 26.11 Spot Rate : 0.2700 Average : 0.1819 YTW SCENARIO |