There is some indication that the Europeans are beginning to realize that their voluntary debt exchange idea is stupid:

Opposition to payouts on Greek credit-default swaps from European Union policy makers is softening as disputes over a voluntary debt exchange threaten to push the nation into default.

Any agreement between the Greek government and the Washington-based Institute of International Finance on debt writedowns will only bind 50 percent of investors in the 206 billion euros ($270 billion) of notes being negotiated, Barclays Capital estimates. Hedge funds may resist a deal, seeking to get paid in full or compensated from insurance contracts.

…

“Politicians seem less concerned than before about CDS triggers,” said Michael Hampden-Turner, a credit strategist at Citigroup Inc. in London. “Having a payout on Greek CDS is probably better than the alternative: a loss in market faith of the product’s ability to provide a hedge against sovereign risk.”Officials, including former European Central Bank President Jean-Claude Trichet, have insisted that a swaps trigger was unacceptable because traders would be encouraged to bet against indebted nations and worsen the crisis.

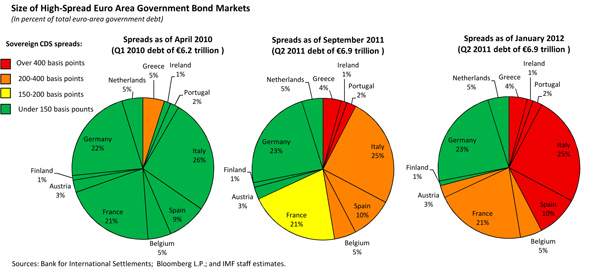

Spain, Italy, Belgium, Cyprus and Slovenia had their debt ratings cut by Fitch Ratings, which said these nations do not accure [sic] “the full benefits of the euro’s reserve currency status.”

Ireland had its ratings affirmed by Fitch. The outlook on all six nations is negative.

But fear not! Soon credit rating agencies in Canada will have a lot more forms to fill out and boxes to tick and regulatory employment will increase so everything will be fine!

Canadian securities regulators are preparing to impose new rules on agencies that assess the creditworthiness of the millions of dollars in debt issued by corporations, governments and other instructions.

The Canadian Securities Administrators said Friday that credit ratings agencies in this country who want their opinions to be eligible for use under securities laws will need to apply to become a “designated rating organization.”

The Volcker Rule continues re-shuffle the deck:

Citigroup Inc. (C), the third-biggest U.S. lender, will close a proprietary-trading desk that makes bets with the firm’s own money and most of the unit’s staff will leave before rules banning the practice take effect.

Citigroup is shutting the Equity Principal Strategies business and most staff will leave the bank after Feb. 6, according to a memo by Derek Bandeen, head of equities for the New York-based bank, and obtained by Bloomberg News.

…

“Pursuant to various regulatory initiatives and changes, we have made the strategic decision to exit the Principal Strategies business,” Bandeen said in the memo. “The team, led by Sutesh Sharma, have been aware of this for some time and have worked diligently to wind down the positions over the last few months.”Sharma intends to form a hedge fund, two people familiar with the matter said in August. His Citigroup team managed about $2 billion, one of the people said.

It was another mixed day for the Canadian preferred share market, as the (relatively tiny) PerpetualDiscounts index shot ahead 54bp, FixedResets lost 6bp and DeemedRetractibles gained 9bp. Volatility was good, skewed to the upside; volume was above average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5933 % | 2,371.6 |

| FixedFloater | 4.71 % | 4.08 % | 42,119 | 17.25 | 1 | 0.5982 % | 3,312.4 |

| Floater | 2.82 % | 2.98 % | 63,870 | 19.77 | 3 | 0.5933 % | 2,560.7 |

| OpRet | 4.93 % | 1.29 % | 69,731 | 1.30 | 7 | 0.0601 % | 2,508.9 |

| SplitShare | 5.31 % | -0.28 % | 70,419 | 0.87 | 4 | -0.3196 % | 2,633.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0601 % | 2,294.1 |

| Perpetual-Premium | 5.41 % | -5.67 % | 94,185 | 0.09 | 23 | 0.0498 % | 2,212.8 |

| Perpetual-Discount | 4.99 % | 4.98 % | 180,463 | 15.50 | 7 | 0.5416 % | 2,426.9 |

| FixedReset | 5.03 % | 2.74 % | 211,302 | 2.34 | 65 | -0.0562 % | 2,383.3 |

| Deemed-Retractible | 4.89 % | 3.56 % | 202,525 | 1.68 | 46 | 0.0889 % | 2,309.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.R | FixedReset | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-27 Maturity Price : 23.51 Evaluated at bid price : 26.04 Bid-YTW : 3.78 % |

| BNA.PR.E | SplitShare | -1.18 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.31 Bid-YTW : 5.58 % |

| RY.PR.A | Deemed-Retractible | 1.03 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-24 Maturity Price : 25.00 Evaluated at bid price : 25.57 Bid-YTW : 3.63 % |

| ELF.PR.G | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-27 Maturity Price : 22.60 Evaluated at bid price : 23.00 Bid-YTW : 5.18 % |

| PWF.PR.A | Floater | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-27 Maturity Price : 21.00 Evaluated at bid price : 21.00 Bid-YTW : 2.49 % |

| BAM.PR.J | OpRet | 1.31 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-31 Maturity Price : 26.00 Evaluated at bid price : 27.16 Bid-YTW : 3.25 % |

| POW.PR.D | Perpetual-Discount | 1.66 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.07 Bid-YTW : 4.99 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.G | Deemed-Retractible | 78,380 | Nesbitt crossed 60,000 at 25.25. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.26 Bid-YTW : 4.86 % |

| RY.PR.A | Deemed-Retractible | 63,595 | Desjardins crossed 25,000 at 25.57. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-24 Maturity Price : 25.00 Evaluated at bid price : 25.57 Bid-YTW : 3.63 % |

| MFC.PR.B | Deemed-Retractible | 58,743 | Nesbitt crossed 50,000 at 23.95. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.80 Bid-YTW : 5.37 % |

| BNS.PR.N | Deemed-Retractible | 54,015 | TD crossed 50,000 at 26.71. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-01-29 Maturity Price : 26.00 Evaluated at bid price : 26.68 Bid-YTW : 2.35 % |

| PWF.PR.F | Perpetual-Premium | 52,900 | TD crossed 49,900 at 25.42. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-26 Maturity Price : 25.00 Evaluated at bid price : 25.35 Bid-YTW : -12.17 % |

| HSB.PR.D | Deemed-Retractible | 33,000 | TD crossed 30,000 at 25.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-12-31 Maturity Price : 25.25 Evaluated at bid price : 25.66 Bid-YTW : 4.28 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.A | Floater | Quote: 21.00 – 22.10 Spot Rate : 1.1000 Average : 0.7107 YTW SCENARIO |

| BAM.PR.R | FixedReset | Quote: 26.04 – 26.67 Spot Rate : 0.6300 Average : 0.4015 YTW SCENARIO |

| BAM.PR.I | OpRet | Quote: 25.52 – 25.99 Spot Rate : 0.4700 Average : 0.3172 YTW SCENARIO |

| ENB.PR.B | FixedReset | Quote: 25.72 – 25.99 Spot Rate : 0.2700 Average : 0.1586 YTW SCENARIO |

| BAM.PR.O | OpRet | Quote: 26.10 – 26.49 Spot Rate : 0.3900 Average : 0.2812 YTW SCENARIO |

| BNA.PR.E | SplitShare | Quote: 24.31 – 24.70 Spot Rate : 0.3900 Average : 0.2889 YTW SCENARIO |