The housing bubble blame game continues:

The FOMC in June heard presentations from staff economists, with some raising alarms about housing markets, the transcript shows. Those warnings didn’t translate into a more aggressive policy. The committee raised the benchmark lending rate a quarter-point at that meeting and said “policy accommodation can be removed at a pace that is likely to be measured.”

“An estimated 4 percent of borrowers are highly leveraged and could lose all of their home equity if house prices were to fall 10 percent,” Andreas Lehnert, now the deputy director of the Office of Financial Stability Policy and Research at the Board, told the committee. “One might wonder if financial institutions and investors have, in the face of the continuing housing boom, dropped their defenses against the mortgage losses that would accompany a house-price bust.”

New York Fed researcher Richard Peach dismissed press reports describing a bubble in housing markets.

“Hardly a day goes by without another anecdote-laden article in the press claiming that the U.S. is experiencing a housing bubble that will soon burst, with disastrous consequences for the economy,” Peach told the committee.

“Housing-market activity has been quite robust for some time now, with starts and sales of single-family homes reaching all-time highs in recent months and home prices rising rapidly, particularly along the East and West coasts of the country,” he said. “But such activity could be the result of solid fundamentals.”

Greenspan followed the presentation with questions about the effect of underlying land prices in housing indexes, and the quality of data on whether home purchases were for investment or residences.

This question has been discussed extensively on PrefBlog and will be discussed extensively world-wide for the next hundred-odd years. Two posts of interest are Subprime! Problems forseeable in 2005? and FRBB: Bubbles Happen.

Manulife is redeeming some sub-debt at an operating subsidiary:

The Manufacturers Life Insurance Company (“Manulife”) today announced it has exercised its right to redeem, on February 16, 2011, all of the outstanding $550,000,000 principal amount of 6.24% Subordinated Debentures due February 16, 2016 (CUSIP No. 564835AB2) at par plus accrued and unpaid interest to the date fixed for redemption. Formal notice of redemption has been delivered to the registered holder of the Subordinated Debentures in accordance with the terms of the trust indenture made as of February 16, 2001.

Another day, another loss of freedom. Your family doctor is a paid informer:

“Alcohol dependence” is one of 16 specific medical conditions – including certain heart conditions, unstable mental illness and uncontrolled diabetes – that must be reported in most Canadian provinces if, in a doctor’s opinion, it “may make it dangerous for the person to operate a motor vehicle.”

Only Alberta, Nova Scotia and Quebec leave such reporting to physicians’ discretion.

…

The province’s mandatory reporting requirement under the Highway Traffic Act appears to date back to 1990, but the number of doctors actually doing it began to “steadily increase” only after the province’s health ministry began paying physicians to do it in 2006, Bob Nichols, senior media officer for the transport ministry, told The Globe in an e-mail.The province pays doctors, who are protected by statute for what otherwise would be a breach of patient confidentiality, $36.25 for each report.

The older I get, the less surprised I am when I learn that many people in a position of trust are for sale. I do, however, sometimes get surprised at how cheap they are.

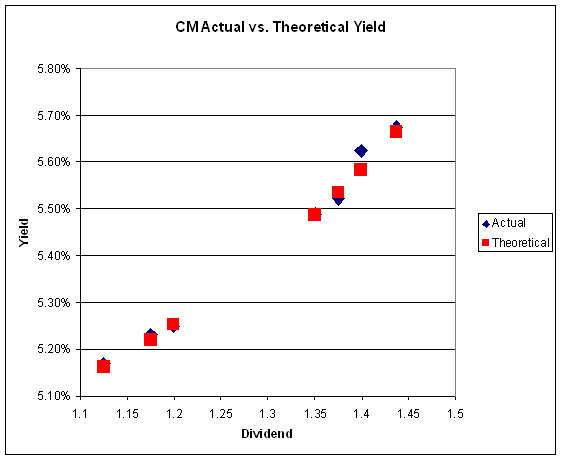

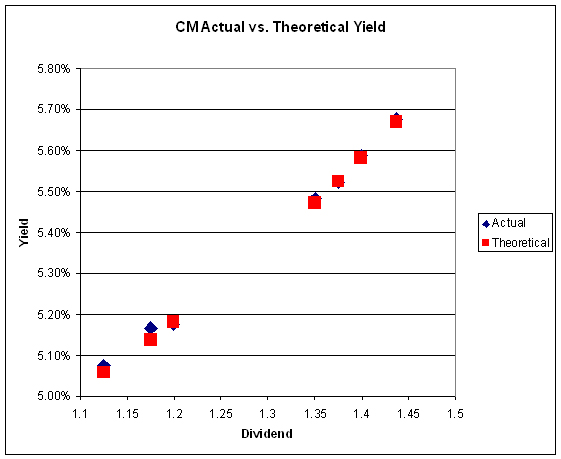

It was another day of startlingly good returns on the Canadian preferred share market, probably due to expectations that everything will get redeemed – which doesn’t explain why FixedResets did well, but since when has this market been either consistent or logical? PerpetualDiscounts gained 61bp (with a continued increase in implied volatility, as discussed yesterday) and FixedResets were up 21bp. Volume was high.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0123 % | 2,323.5 |

| FixedFloater | 4.81 % | 3.49 % | 26,460 | 19.17 | 1 | 0.0000 % | 3,539.0 |

| Floater | 2.57 % | 2.35 % | 41,755 | 21.33 | 4 | -0.0123 % | 2,508.7 |

| OpRet | 4.81 % | 3.33 % | 66,067 | 2.30 | 8 | 0.0386 % | 2,390.3 |

| SplitShare | 5.32 % | 1.77 % | 545,876 | 0.90 | 4 | 0.0603 % | 2,454.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0386 % | 2,185.7 |

| Perpetual-Premium | 5.65 % | 5.26 % | 134,087 | 5.32 | 20 | 0.0079 % | 2,029.2 |

| Perpetual-Discount | 5.32 % | 5.29 % | 244,706 | 14.90 | 57 | 0.6071 % | 2,077.5 |

| FixedReset | 5.23 % | 3.39 % | 289,133 | 3.07 | 52 | 0.2061 % | 2,277.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.B | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 21.95 Evaluated at bid price : 22.30 Bid-YTW : 5.25 % |

| BNS.PR.M | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.78 Evaluated at bid price : 22.95 Bid-YTW : 4.91 % |

| BNS.PR.L | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.89 Evaluated at bid price : 23.07 Bid-YTW : 4.88 % |

| RY.PR.F | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.78 Evaluated at bid price : 22.95 Bid-YTW : 4.91 % |

| BNS.PR.N | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-02-26 Maturity Price : 25.00 Evaluated at bid price : 25.10 Bid-YTW : 5.17 % |

| PWF.PR.P | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-03-01 Maturity Price : 25.00 Evaluated at bid price : 25.83 Bid-YTW : 3.65 % |

| GWO.PR.G | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 24.15 Evaluated at bid price : 24.45 Bid-YTW : 5.35 % |

| IAG.PR.A | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 21.56 Evaluated at bid price : 21.56 Bid-YTW : 5.38 % |

| CM.PR.J | Perpetual-Discount | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.36 Evaluated at bid price : 22.51 Bid-YTW : 5.01 % |

| SLF.PR.C | Perpetual-Discount | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 21.31 Evaluated at bid price : 21.31 Bid-YTW : 5.27 % |

| BAM.PR.P | FixedReset | 1.87 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.81 Bid-YTW : 3.89 % |

| SLF.PR.D | Perpetual-Discount | 1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 5.27 % |

| SLF.PR.B | Perpetual-Discount | 2.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.80 Evaluated at bid price : 23.01 Bid-YTW : 5.25 % |

| GWO.PR.I | Perpetual-Discount | 2.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.43 Evaluated at bid price : 22.60 Bid-YTW : 5.01 % |

| TRP.PR.C | FixedReset | 2.40 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-29 Maturity Price : 25.00 Evaluated at bid price : 26.00 Bid-YTW : 3.50 % |

| MFC.PR.C | Perpetual-Discount | 2.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 21.49 Evaluated at bid price : 21.76 Bid-YTW : 5.21 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.X | FixedReset | 101,672 | RBC crossed blocks of 30,000 and 56,600, both at 27.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.73 Bid-YTW : 3.40 % |

| MFC.PR.E | FixedReset | 89,135 | RBC crossed blocks of 50,000 and 36,500, both at 26.76. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 26.73 Bid-YTW : 3.76 % |

| RY.PR.B | Perpetual-Discount | 84,619 | RBC crossed 39,900 at 23.39, a block of 16,700 at 23.41, and 13,500 at 23.46. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 23.25 Evaluated at bid price : 23.47 Bid-YTW : 5.07 % |

| BNS.PR.R | FixedReset | 83,222 | RBC crossed 70,000 at 26.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-25 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 3.34 % |

| CM.PR.I | Perpetual-Discount | 81,072 | RBC crossed blocks of 39,900 and 22,000, both at 22.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-14 Maturity Price : 22.79 Evaluated at bid price : 22.97 Bid-YTW : 5.12 % |

| TD.PR.E | FixedReset | 77,510 | Scotia crossed 65,000 at 27.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.16 Bid-YTW : 3.50 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||