I’m becoming more and more convinced that the Credit Crunch has evolved from its fundamental role as Reducer of Excesses to a new position as Political Football.

My thoughts on this are influenced by many things. For instance, compare the sub-prime credit loss estimates of the Bank of England with those of the IMF. These estimates are, as has been noted, not just wildly at variance with each other, but prepared without even taking note of each other. For all my respect for these two institutions, this smacks of intellectual dishonesty – and in my book, there is no greater crime.

Quite frankly, I believe the methodology of the IMF report (which leaned heavily on the paper by Greenlaw et al.) to be deeply flawed; and not just deeply flawed but deliberately skewed. So why would the IMF adopt it? They have a lot of smart people on staff; I won’t be the only person in the world to have noticed the dicey bits; why was this methodology used holus-bolus instead of simply providing the top end of a range of estimates?

My hypothesis is that it’s simply politics. The two basic factions in the investment world are those who want lots of regulation to save us from the evil Bonfire of the Vanities and those who feel that over-regulation is simply promoting inefficiency of the capital markets. These opposing forces are not comprised exclusively of idealogically pure crusaders, either! In Canada, for instance, the banks can be counted upon to promote wise regulation, not too much, not too little …. as long as whatever happens favours capital markets players who have deep, deep pockets.

There will be members of both factions on staff at the IMF, and at any regulatory group or ultimately responsibile government. Sometimes you win, sometimes you lose, in general things proceed in an ultimately half-way reasonable manner, albeit with one step back for each two steps forward. Forecasting the effects of regulation is no easier than forecasting markets … and at least when you attempt to forecast the market you have a pretty good idea of your ultimate objective!

The hard-liners in either faction are never satisfied, however – and the more cynical players, taking whatever position best serves their business will always be looking for more. Thus, every development in the capital markets is carefully examined to determine its value as a weapon in the struggle.

Canadian ABCP? It’s been used to justify a call for higher pay for regulators, to justify calls for the OSFI to expand its mandate to ensure nobody ever loses money on anything and to justify a federal regulator. The Bank of Canada has brought forth some rules to ensure that the banks never again have to worry about competition in the ABCP market from snot-nosed small corporation scum.

And so it is with Bear Stearns. I wrote about the Econbrowser post yesterday. The Econbrowser piece wanted Bernanke (i.e., the Fed) to Do Something about leverage in the brokerage industry … which is not the Fed’s purview at all, it’s in the SEC’s bailiwick. There was a note from Dave Altig of the Atlanta Fed in the Econbrowser comments, drawing attention to the Fed’s preventative measures … and still, not a word about the SEC. You can find inumerable instances of hand-wringing on the web, bewailing the fact that the Fed is (sort-of) forced to backstop a system over which it has no direct supervisory function – although, as I have pointed out, separation of lending/monetary functions and bank supervision functions are more standard throughout the world than otherwise.

The more I think about it, the more convinced I am that most of the discussion of Bear Stearns has absolutely nothing to do with a genuine desire for better regulation (you want more margin and less leverage? OK, how much more margin and how much less leverage? Let’s discuss it!) and a lot more to do with a desire to change the identities of the regulators. It’s a world-wide bureaucratic turf fight; the credit crunch, sub-prime and Bear Stearns are merely the latest weapons of convenience.

For the record, my position at the moment is that supervisory responsibility for the brokerage sector should remain with the SEC. Assiduous Readers will by now be sick and tired of reading this, but I believe the brokerages should represent a riskier and less constrained layer surrounding a banking core in the financial system. If the Central Bank has supervisory functions, there will be both a higher degree of expectation of emergency assistance in times of stress and a higher probability as well, since staff at the Central Bank – however upright and angelic their characters – will be somewhat more inclined to double-down with assistance from the discount window than to admit a possible failure of regulation and let an insolvent firm go bankrupt.

I might work this up into a formal article at some point. Remember, you read it on PrefBlog first!

As remarked by Accrued Interest, now that reports are increasing that the credit crunch is over and companies might actually be able to pay back some money, there are also growing concerns that the money we get might not be worth very much:

Bernanke and San Francisco Fed President Janet Yellen, in separate speeches yesterday, said markets remain “far from normal” after some improvement since March. Yellen, Cleveland Fed President Sandra Pianalto, Kansas City Fed President Thomas Hoenig and the Dallas Fed’s Richard Fisher said they’re concerned about rising prices.

…

Yellen, 61, who doesn’t vote on rates this year, also said she anticipates consumer prices will moderate as the labor market weakens and “commodity prices level off.”The Fed can’t be “complacent about inflation,” she told the CFA Institute Annual Conference. Recent measures of price expectations “highlight the risk that our attempts to deal with problems in the real economy could lead to higher inflation expectations and an erosion of our credibility,” she said.

Fisher, speaking in Midland, Texas, said the U.S. may be in for a “prolonged” period of slow growth, which may end with faster-than-desirable inflation.

“How deep that slowdown will be is a question mark,” said Fisher, who voted against the last three rate cuts. “I am not sure it will be very deep at all, but it may be prolonged, because we have to correct the excesses of this credit crisis.”

Naked Capitalism notes a post by Willem Buiter, who burnishes his monetarist credentials:

In a fiat money world, central banks cause inflation, or, more precisely, only central banks are resposible for inflation. Other shocks, real and nominal, can influence the general price level if the central bank does not respond swiftly and determinedly, but these non-central bank-induced changes in the general price level can always be offset by the central bank, given enough time, freedom to act and courage.

But, in the medium and long term (at horizons of two years and over, say) central banks choose the average rate of inflation. Not globalisation; not indirect taxes; not bad harvests; not OPEC and the price of oil; not the Chinese and their exchange rate management. There is no oil inflation, food inflation or cost-push inflation. There is just inflation. Inflation may be accompanied by changes in key relative prices – in the real prices of oil, of food, of oil and of labour for instance – if other relative demand and supply shocks accompany the inflationary impulses created by the central bank. Large increases in the real price of food will be bad news to food importers (including most urban households) and good news to rural food producers and exporters. But don’t confuse it with inflation.

In the petty annoyances department, Andrew Willis discusses the Sprott IPO:

Brokers are using the “anonymous” function on the TSX to do much of their selling, with 1.5 million shares sold this way. Disguising orders by not disclosing the name of the brokerage house doing the transaction fits that segment of the hedge fund and dealer crowd that prefers to be discreet. Dealers are sensitive to the issue of flipping an IPO from a money manager who also counts as a major trading client.

Does Mr. Willis know or care that it would be grossly unethical for Sprott to allow annoyance with IPO selling to influence – in any way – its trading with client money?

From Prefblog’s Out-of-time-here’s-the-links Department:

- What we know and what we would like to know about Central Bank communication

- Fed’s Direct Loans to Banks Climb to Record Level

- Bernanke Urges ‘Hunkering’ Banks to Raise Capital

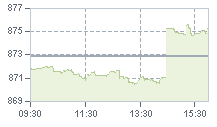

Floaters finally had a bad day … they are now up a mere 8.26% on the month.

BNS issues did well:

| BNS Straight Perpetuals Prices & Performance 5/15 |

|||

| Issue | Bid | Yield | Day’s Return |

| BNS.PR.L | 20.70 | 5.49% | +0.7299% |

| BNS.PR.M | 20.80 | 5.46% | +1.2165% |

| BNS.PR.K | 21.91 | 5.53% | +0.7356% |

| BNS.PR.N | 24.01 | 5.51% | +1.7373% |

| BNS.PR.J | 24.42 | 5.34% | +1.2858% |

| BNS.PR.O | 25.12 | 5.61% | 0.0000% |

In general, volume dropped off a little, but it was a very strong day.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.83% | 4.86% | 48,893 | 15.81 | 1 | 0.0000% | 1,081.9 |

| Fixed-Floater | 4.67% | 4.61% | 63,642 | 16.08 | 7 | -0.0175% | 1,069.6 |

| Floater | 4.14% | 4.18% | 61,665 | 17.01 | 2 | -0.4926% | 911.7 |

| Op. Retract | 4.82% | 2.53% | 89,447 | 2.59 | 15 | +0.0724% | 1,055.7 |

| Split-Share | 5.26% | 5.55% | 70,913 | 4.15 | 13 | +0.0620% | 1,053.1 |

| Interest Bearing | 6.13% | 6.09% | 52,905 | 3.81 | 3 | 0.0000% | 1,105.5 |

| Perpetual-Premium | 5.88% | 5.10% | 139,428 | 4.38 | 9 | +0.1151% | 1,022.9 |

| Perpetual-Discount | 5.65% | 5.69% | 304,062 | 13.88 | 63 | +0.3378% | 926.0 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BAM.PR.B | Floater | -1.0345% | |

| WFS.PR.A | SplitShare | +1.1000% | Asset coverage of 1.8+:1 as of May 8, according to Mulvihill. Now with a pre-tax bid-YTW of 5.12% based on a bid of 10.11 and a hardMaturity 2011-6-30 at 10.00. |

| HSB.PR.D | PerpetualDiscount | +1.1416% | Now with a pre-tax bid-YTW of 5.73% based on a bid of 22.15 and a limitMaturity. |

| BNS.PR.M | PerpetualDiscount | +1.2165% | Now with a pre-tax bid-YTW of 5.46% based on a bid of 20.80 and a limitMaturity. |

| BNA.PR.C | SplitShare | +1.2500% | Asset coverage of just under 3.2:1 as of April 30, according to the company. The ex-date of the current dividend is not yet known. Now with a pre-tax bid-YTW of 6.57% based on a bid of 21.06 cum dividend and a hardMaturity 2019-1-10 at 25.00. |

| BNS.PR.J | PerpetualDiscount | +1.2858% | Now with a pre-tax bid-YTW of 5.34% based on a bid of 24.42 and a limitMaturity. |

| BNS.PR.N | PerpetualDiscount | +1.7373% | Now with a pre-tax bid-YTW of 5.51% based on a bid of 24.42 and a limitMaturity. |

| RY.PR.A | PerpetualDiscount | +2.3210% | Now with a pre-tax bid-YTW of 5.40% based on a bid of 20.72 and a limitMaturity. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| FTS.PR.E | Scraps (Would be OpRet, but there are credit concerns) | 200,000 | CIBC crossed two lots of 100,000 shares each at 25.45. Now with a pre-tax bid-YTW of 4.67% based on a bid of 25.38 and a softMaturity 2016-8-31 at 25.00. |

| SLF.PR.B | PerpetualDiscount | 198,300 | Nesbitt bought 77,100 from National Bank at 21.90, TD crossed 50,000 at 21.91, then TD crossed another 40,000 at 21.91. Now with a pre-tax bid-YTW of 5.56% based on a bid of 21.90 and a limitMaturity. |

| TD.PR.P | PerpetualDiscount | 92,638 | CIBC crossed 35,000 at 24.25. Now with a pre-tax bid-YTW of 5.46% based on a bid of 24.20 and a limitMaturity. |

| BMO.PR.J | PerpetualDiscount | 64,995 | Now with a pre-tax bid-YTW of 5.60% based on a bid of 20.13 and a limitMaturity. |

| BMO.PR.K | PerpetualDiscount | 58,235 | Now with a pre-tax bid-YTW of 5.73% based on a bid of 23.00 and a limitMaturity. |

| GWO.PR.I | PerpetualDiscount | 54,725 | Desjardins crossed 15,000 at 20.85, then Nesbitt crossed 30,000 at 21.00. Now with a pre-tax bid-YTW of 5.47% based on a bid of 20.86 and a limitMaturity. |

There were nineteen other index-included $25-pv-equivalent issues trading over 10,000 shares today.