Not quite so many links as has been the case lately, thank heavens, but those that I am going to put up are of exceptional interest … so read carefully!

Coventree was able to roll $600-million worth of paper today, which is good news, but noted:

“This ABCP was purchased primarily by investors who elected to renew or roll over their ABCP that matured (Tuesday),” Coventree stated.

I suspect there’s something of Mexican standoff implicit in the above remarks … if Coventree had to enter CCAA Protection it would be worse for both the company and the creditors.

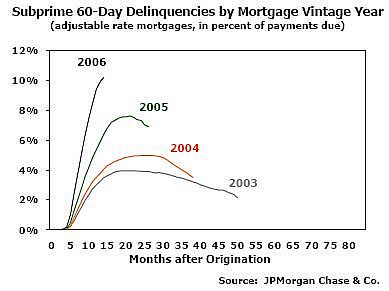

There was a hint that much the same thing might be happening in the States, with Countrywide Financial stock plunging when Merrill Lynch changed its recommendation from “Buy” to “Sell” based on liquidity concerns. The analyst’s track-record was not disclosed. As in many such cases, this accellerated concerns to the point of becoming a self-fulfilling prophecy:

Countrywide credit-default swaps soared 225 basis points to 600 basis points, according to broker Phoenix Partners Group. That means it costs $600,000 a year to protect $10 million of Countrywide bonds from default for five years. The contracts have risen more than sixfold in the past month.

The rout intensified after CNBC reported that Countrywide’s 30-day asset-backed commercial paper was being quoted by dealers at a 12.54 percent yield. The company previously borrowed at 15 basis points, or 0.15 percentage point, over the London interbank offered rate, which currently is about 5.57 percent for 30-day borrowings, the cable-television network reported

Even one of the bond market’s golden boys is affected, though admittedly the damage is largely self-inflicted: Nestle lost its triple-A status:

Nestle’s was cut one level to AA+ by Fitch and to Aa1 by Moody’s after the Vevey, Switzerland-based company said it plans to repurchase 25 billion Swiss francs ($21 billion) of stock, its biggest-ever share buyback. The downgrade leaves only Johnson & Johnson, Toyota Motor Corp. and Exxon Mobil Corp. holding AAA ratings from both Moody’s and Standard & Poor’s as well as Fitch.

In late news that might broil the markets tomorrow:

Australia’s Rams Home Loans Group Ltd. has been unable to refinance A$6.17 billion ($5 billion) of short-term U.S. loans because of a “lack of market liquidity” caused by the global credit rout.

Rams cited the “tightening of the global credit markets” for failing to sell the so-called extendable commercial paper, the company’s largest source of funding for its loans, it said in a statement today.

The lender has been given temporary funding of A$1 billion by two of its providers, Rams said.

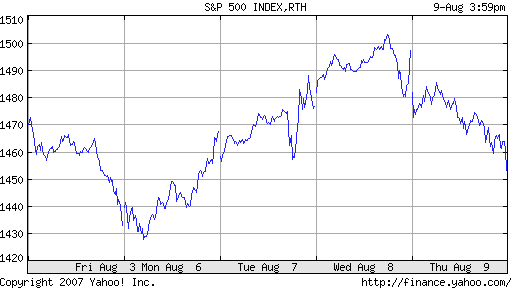

In turn, both American and Canadian equities tanked. Today’s fearless prediction: pundits in tomorrow’s paper will note that the Canadian index is now more than 10% off its peak, meeting the generally accepted definition of a “correction”.

Reminds me of my back-office days back in 1987. I was asked quite seriously if I thought the 502-point drop in the Dow was a “crash” or a “correction”. I said I thought it meant the Dow was down 502 points, which wasn’t considered a particularly penetrating answer.

All the angst got the central banks moving. The Bank of Canada lowered its standards for repurchase agreements and the current month Fed Futures are now showing an expectation of an average Fed Funds rate for August (this month! August!) of 4.99%, twenty-six bps below target. This follows disclosure that the dollar-weighted average of actual Fed Funds transactions yesterday was 4.54%, with a low of half a point. We can be thankful that inflation numbers were benign and were met with cheers. A Fed governor, Poole, reminded the markets not to take anything for granted – the Fed cares about the real economy, not bit of Wall Street paper.

Given the de facto easing, it is not surpising that Treasuries had a really good day, with the two-year yield declining six basis points, although the spoil-sports trading ten-years took yield up 1bp, for a marked steeping. Canadas did not behave in anywhere near so dramatic a fashion, but 2-10 still steepened 2.3bp.

Rotten day in the preferred market, with all but one of the indices down on the day – and that one (FixFloat) was due to exceptional performance by BCE.PR.T, which accomplished this feat on zero volume. It’s very tempting to try to read something into this performance; but then again, in such a retail dominated market, strange things can happen.

Again, lack of interest in the lower rated credits was noticable, with the following performance stand-outs: YLD.PR.B, -4.55%; IQW.PR.D, -4.43%; HPF.PR.B, -4.26%; STQ.E, -3.01%; IQW.PR.C, -2.83%; DC.PR.A, -2.29%; GT.PR.A, -2.15%; NTL.PR.F, -2.07%; BBD.PR.C, -1.40%; BBD.PR.B, -1.32%; BPO.PR.J, -1.22%; and YPG.PR.A, -1.09%. Some of the lower rated credits bounced, but not many: WN.PR.C, +1.06%; WN.PR.D, +1.41%.

Just for fun, I’ll update the ‘Junky but not quite junk’ list (and remember, this is not representative! While the selections were not entirely random, they’re not entirely representative, either!).

| Pfd-3 Comparables | |||

| Issue | EPP.PR.A | WN.PR.E | YPG.PR.B |

| Quote, 7/25 | 20.80-20 | 20.31-68 | 23.05-15 |

| Quote, 8/15 | 20.20-70 | 19.91-07 | 22.40-50 |

| Return (b/b) for period | -2.88% | -1.97% | -2.82% |

| Pre-Tax Bid-YTW, 8/15 | 6.15% | 6.06% | 6.62% |

| Note: None of these issues has had an ex-Date in the period. | |||

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.75% | 4.79% | 25,177 | 15.96 | 1 | -0.0411% | 1,040.3 |

| Fixed-Floater | 5.01% | 4.94% | 121,361 | 15.69 | 8 | +0.0877% | 1,017.3 |

| Floater | 4.92% | 2.12% | 74,048 | 8.07 | 4 | -0.2299% | 1,040.1 |

| Op. Retract | 4.83% | 4.13% | 81,197 | 3.20 | 16 | -0.1687% | 1,023.4 |

| Split-Share | 5.09% | 4.90% | 99,536 | 3.88 | 15 | -0.3190% | 1,037.4 |

| Interest Bearing | 6.25% | 6.76% | 64,462 | 4.61 | 3 | -0.3389% | 1,031.6 |

| Perpetual-Premium | 5.56% | 5.29% | 99,078 | 6.60 | 24 | -0.1247% | 1,019.1 |

| Perpetual-Discount | 5.11% | 5.15% | 296,980 | 15.23 | 39 | -0.4558% | 969.9 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| PWF.PR.K | PerpetualDiscount | -2.2186% | Now with a pre-tax bid-YTW of 5.24% based on a bid of 23.80 and a limitMaturity. |

| CM.PR.H | PerpetualDiscount | -2.0877% | Now with a pre-tax bid-YTW of 5.16% based on a bid of 23.45 and a limitMaturity. |

| BAM.PR.N | PerpetualDiscount | -1.4181% | Closed at 20.16-29, which is rather odd, I think, given that BAM.PR.M closed at 20.85-00. These issues are identical except for the start of the redemption schedule – BAM.PR.N starts six months later, which is better. However, BAM.PR.N is still attempting to cope with a horrible reception at issue time. MAPF has a position. Now with a pre-tax bid-YTW of 5.99% based on a bid of 20.16 and a limitMaturity. |

| RY.PR.D | PerpetualDiscount | -1.4172% | Now with a pre-tax bid-YTW of 5.07% based on a bid of 22.26 and a limitMaturity. |

| CM.PR.R | PerpetualPremium | -1.2476% | Now with a pre-tax bid-YTW of 4.59% based on a bid of 25.66 and a softMaturity 2013-4-29 at 25.00. |

| LBS.PR.A | SplitShare | -1.2476% | Asset coverage of a little over 2.4:1 as of August 9, according to Brompton Group. Now with a pre-tax bid-YTW of 4.82% based on a bid of 10.29 and a hardMaturity 2013-11-29 at 10.00. |

| BAM.PR.G | FixFloat | -1.2422% | |

| BAM.PR.B | Floater | -1.1885% | |

| BSD.PR.A | InterestBearing | -1.0672% | Asset coverage of slightly over 1.8:1 as of August 10, according to Brookfield Funds. Now with a pre-tax bid-YTW of 7.51% (mostly as interest) based on a bid of 9.27 and a hardMaturity 2015-3-31 at 10.00. |

| BCE.PR.T | FixFloat | +1.2129% | On ZERO volume, but enough to keep the FixFloat index from negativity! |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| MFC.PR.C | PerpetualDiscount | 61,290 | Now with a pre-tax bid-YTW of 4.94% based on a bid of 23.10 and a limitMaturity. |

| GWO.PR.F | PerpetualPremium | 51,688 | Now with a pre-tax bid-YTW of 3.52% based on a bid of 26.85 and a call 2008-10-30 at 26.00. There are some, obviously, who are willing to bet it won’t be called! |

| NA.PR.L | PerpetualDiscount | 43,100 | Nesbitt crossed 25,000 at 24.10. Now with a pre-tax bid-YTW of 5.05% based on a bid of 24.10 and a limitMaturity. |

| BNS.PR.M | PerpetualDiscount | 41,175 | National Bank bought a total of 29,000 in the late afternoon, including a cross of 25,000 at 22.99. Now with a pre-tax bid-YTW of 4.93% based on a bid of 23.00 and a limitMaturity. |

| GWO.PR.I | PerpetualDiscount | 37,400 | Now with a pre-tax bid-YTW of 5.08% based on a bid of 22.45 and a limitMaturity. |

There were fifteen other $25-equivalent index-included issues trading over 10,000 shares today.