MarketRant has been deleted from the blogroll. There have been only two posts since March 14 and the author’s corporate site is no longer operable.

Category: Miscellaneous News

BCE Wins Supreme Court Appeal

The Supreme Court of Canada, in a unanimous ruling in Ottawa today, overturned a decision of the Quebec Court of Appeal that had derailed BCE’s plan for having ignored the interests of the company’s bondholders.

The decision removes one hurdle to closing the purchase of Montreal-based BCE, Canada’s biggest phone company, by Ontario Teachers’ Pension Plan and U.S. private-equity firms. Completion isn’t certain, as banks have sought to renegotiate terms of debt in LBOs amid a contraction in credit markets, seeking higher interest rates and tighter loan restrictions, and derailing more than 60 buyout plans since last year.

DBRS has announced:

its current ratings on BCE Inc. (BCE or the Company) and Bell Canada continue to remain Under Review with Negative Implications following today’s unanimous judgment by the Supreme Court of Canada which will allow the planned privatization to proceed.

The ratings were originally placed Under Review with Negative Implications on April 17, 2007. This was maintained after the privatization plan was announced on June 30, 2007. The plan is led by an investor group that includes Teachers’ Private Capital, a division of the Ontario Teachers’ Pension Plan Board, and includes Providence Equity Partners Inc. and Madison Dearborn Partners, LLC. Subsequently, Merrill Lynch took up an equity commitment. Collectively the sponsors have committed to invest $7.75 billion in equity to fund this transaction.

DBRS will maintain its review while it continues its discussions with BCE and the investor group. As a closing date approaches, DBRS will resolve this status with rating guidance based on the final terms of the transaction and its new Leveraged Finance rating methodology.

DBRS’s new methodology uses the default rating and a new Recovery Ratings scale to determine an instrument rating for each piece of new and existing indebtedness. The resulting ratings will likely cover multiple notches, ranging well above and below an Issuer Rating that could be in the lower end of the BB range.

Critchley Credits Desjardins for Fixed-Reset Issues

Barry Critchley of the Financial Post today wrote (hat tip: Financial Webring Forum) a column titled Rate Reset Preferreds Catch On, in which he claims:

Given that there are only about four moving parts on any product, Desjardins worked on the yield and came up with a product that saw the yield set at a spread above the yield on five-year Canada bonds. And that spread would remain throughout the life of the issue. At the end of five years, investors were given a choice: another fixed-rate pref or a floating-rate pref. That repricing meant the prefs would be brought back to trading at par, given that investors were being offered a new “market” rate.

This is not correct. Have a look at Chart #1 in my recent article Analysis of Perpetual Resets for a ten year graph of the market spread of PerpetualDiscount issues vs. the five year Canada. It not only varies significantly, but the Credit Crunch has, not surprisingly, brought these spreads to a peak.

It is my belief that the current enormous spreads are being used to sell these issues to retail … “Look at this! 5-Year GOC +XXX bp! Widest in years and there’s a FIXED RESET!”.

However, one must remember that the issuer has options and that one of these options is to call the issue. If, in five years, the rate on a given issue is reset to a specific yield, the issuer will compare this specific yield to the yield at which new preferreds (from that issuer!) could be issued.

- If the reset yield is greater than the market yield (for that issuer!), investors should assume the issue will be called (which could, I suppose, be construed as “trading around par”, but the investor won’t [or shouldn’t] be too happy about it).

- If the reset yield is approximately equal to the market yield (for that issuer!), then the investor is happy and the issue will – probably – remain outstanding and trade around par

- If the reset yield is significantly less than the market yield (for that issuer!) then the issue will – probably – remain outstanding and trade below par.

There is some mitigation of interest rate risk with this structure, but the issues are perpetual. Investors are taking on perpetual credit risk while hoping for – at best – 5-year-money rewards.

Because the rate will not be good enough in bad times, investors must demand a rate that is more than good enough in good times.

One very good example of how attempts to keep perpetual money trading at par can blow up is the Nortel Ratchet Rate issues (NTL.PR.F & NTL.PR.G). The “ratcheting” mechanism was supposed to keep the issue priced around par. It hasn’t done that very well. Same thing for all the BCE issues.

Mr. Critchley goes on to point out that Desjardins takes credit for the structure – I scooped him on that ages ago.

Mr. Critchley is writing a lot about this structure lately – his prior column quoted an unimpressed ex-capital-markets guy.

And … just to make sure nobody missed it … there was yet another new issue with this structure today (number five in a continuing series): National Bank 5.375%+205.

CPD Portfolio Composition: May 2008

I thought I’d spend a little time looking at CPD in more than usual detail this month, so that it’s major characteristics could be compared with the MAPF Portfolio Composition.

| CPD Sectoral Analysis 2008-5-30 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0.9% | 3.86% | 0.08 |

| FixFloat | 5.1% | 4.62% | 15.9 |

| Floater | 3.0% | 4.09% | 17.2 |

| OpRet | 20.3% | 2.56% | 2.55 |

| SplitShare | 0.0% | N/A | N/A |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 0.0% | N/A | N/A |

| PerpetualDiscount | 53.6% | 5.60% | 14.20 |

| Scraps | 12.4% | 6.07% | 5.89 |

| Cash | 0.0% | 0.00% | 0.00 |

| Total | 95.3% | 4.90% | 10.69 |

| The 2.50% holding in BCE.PR.F, 1.39% in “Brookfield Ser ___” and 0.77% in “Fortis 4.9% Series ___” have been ignored.

The totals for yield and duration consider only the 95.3% known holdings. |

|||

Credit distribution is:

| CPD Credit Analysis 2008-5-30 | |

| DBRS Rating | Weighting |

| Pfd-1 | 34.4% |

| Pfd-1(low) | 27.9% |

| Pfd-2(high) | 7.6% |

| Pfd-2 | 0.0% |

| Pfd-2(low) | 15.5% |

| Pfd-3(high) | 9.2% |

| Pfd-3 | 5.4% |

| All issues included – even those three issues excluded from the totals above. | |

Liquidity Distribution is:

| CPD Liquidity Analysis 2008-5-30 | |

| Average Daily Trading | Weighting |

| <$50,000 | 2.9% |

| $50,000 – $100,000 | 28.0% |

| $100,000 – $200,000 | 34.8% |

| $200,000 – $300,000 | 16.7% |

| >$300,000 | 12.9% |

| Unknown | 4.7% |

| Unknown issues as specified above. | |

A spreadsheet has been uploaded.

Fixed-Resets : Critchley Likes, Ruggins Doesn't

Barry Critchley of the Financial Post has written another column, reiterating his earlier praise of the structure. In the current column, BNS Offers Investors Better Deal he states:

But in five years, investors know that the yield on the new fixed-rate pref will be set at the same spread over Canada bonds as was the original pref share. (Every five years, investors have the ability to move in and out of fixed or floating pref shares.)

In this way, the issuer won’t benefit from any improvement in credit spreads over the five-year period.

This is not correct. If credit spreads improve significantly, the issue will be called. One of the Big Black Marks against this structure is the 5-year call at par; the standard provisions for a normal fixed rate issues are a 5-year-call at a premium, declining to a 9-year call at par. Those extra four years are very important.

Of more interest are the reported comments of Len Ruggins … but I might just be saying that because I agree with him!

In response to an earlier column that focused on Scotia’s original deal, Ruggins called and gave his thoughts. In short, he didn’t like the earlier deal because the issuer is paying a yield that is lower than what it would have paid had it chosen to issue a perpetual pref share.

“The bank has issued a Tier 1 security that will most likely be redeemed in five years’ time [because] a regular bank perpetual [issued today] would require a dividend in excess of 5%.

“If market interest rates and dividend yields return to a more normal level in 2013 it is unlikely that the banks will reset the rate on these prefs. I would have bought this issue, if the bank had said that it would not be callable for, say, 20 years, thereby paying a very good dividend which is reset every five years. I’ll bet that during the last year of this issue, the pref will trade on the assumption that it is going to be called regardless of where the Canada bond is trading,” said Ruggins.

Hat tip to Assiduous Reader tobyone who brought the column to my attention.

Newly Assiduous Reader meander likes the structure, as he explains in his comment on the new issue TD+160. As for myself, I will stick to my previously published analysis: these issues, at these rates, are trading as pretend-five-year money. If they actually WERE five year money, I’d be scooping them up by the hatfull. If there was a 20-year no-call period and I could actually be assured of receiving these headline spreads for a lengthy period … back up the truck!

But since the credit risk is actually perpetual and my absolute best case scenario is that it’s five year money … I’ll wait until I’m actually paid to take on that credit risk.

Or, to put it another way … look at Table #1 in my previously published analysis: would you have bought this structure in February ’07 if the fixed rate had been 4.0% with a +60bp reset? If so, how would you feel?

Fixed-Resets – according to me – share the sales and investment philosophy of Principal Protected Notes:

- Yes, in bad times there is a degree of risk mitigation

- At all other times, you pay through the nose for it

Toronto Life Article on David Berry

As mentioned briefly yesterday, Toronto Life has a cover story on the David Berry Affair [Link updated 2013-1-16], which has been the topic of many posts on PrefBlog, the most recent dedicated post being David Berry Wins a Round.

There are many details of his personal life, but some information that is new to me.

For instance, it would appear that Cecilia Williams, head of Scotia Capital’s compliance department is somewhat unfamiliar with institutional trading.

She wanted to know why he’d sold the stock to the client at a price that was about a dollar more than the closing price the day before.

The article does not indicate Berry’s reply. However, all Assiduous Readers of PrefBlog will know that the correct answer is: “Because I could.” Berry was not a retail stockbroker, buying 100 shares for Granny Oakum with a fiduciary obligation to get the client the best price. Berry was an institutional trader, trading with institutions as principal, with the objective of sweeping every available penny off the table and into his own P&L.

There’s more about Ms. Williams – apparently she purported to be upset about Berry’s referring to himself in the third person when explaining why his price was so awful, and was surprised to learn that this is standard industry practice.

Now, this is interesting, but not really too surprising. Regulation has nothing to do with protecting anybody; the purpose of regulation is to ensure that everybody is guilty of something.

Of more interest is that one of the former bosses is willing to testify on Berry’s behalf:

One is Andrew Cumming, who, until 2002, was Berry’s direct supervisor under Jim Mountain in his role as managing director and head of equity-related products at Scotia, and today is a consultant to a money management firm. Last summer, Cumming swore an affidavit in support of Berry’s lawsuit, claiming that he saw nothing wrong with how Berry was ticketing new issue shares.

Cumming is willing to testify that senior executives at Scotia had divulged the bank’s desire to catch Berry in “something like a securities violation so Scotia could use it against him”, to either severely reduce his compensation package or fire him.

Update, 2008-5-29: According to her Scotia Capital biography:

Cecilia holds an LL.B. from Osgoode Hall Law School and has spent most of her career in various aspects of compliance and regulation in the financial services industry. She joined Scotia Capital from CIBC where she was Vice-President of Business Controls for the Imperial Service and Private Wealth Management businesses. Prior to that, Cecilia was Executive Director, Head of Legal and Compliance for UBS Bank/UBS Trust (Canada). Cecilia also previously held the positions of Director of Regulatory and Market Policy for The Toronto Stock Exchange and Senior Counsel, Derivatives with the Ontario Securities Commission.

Dates are a little hard to come by, but on 1999-2-26, she was Director of Regulatory and Market Policy at the TSX. On March 1, 2002, the Regulatory and Market Policy division was transferred holus-bolus to Regulation Services.

By 2005-4-22 she was with Scotia.

She currently sits on the RS Rules Advisory Committee.

I will emphasize that, in the incestuous world of finance (and I assume that the world of finance regulation is even more incestuous: David Berry’s lawyer, Linda Fuerst (who has also acted for me), got her start with the OSC) mere previous employment with an organization does not imply any conflict of interest or special influence afterwards; and mere conflict of interest or special influence does not imply any material conflict of interest or special influence. But this sort of thing doesn’t look good – particularly if Ms. Williams is in a position to influence hiring and compensation decisions. Revolving Door Regulation!

Update, 2008-6-5: An Assiduous Reader sends me a link to the on-line story.

Critchley of Financial Post: Fixed-Resets Good!

Barry Critchley of the Financial Post had a piece in today’s Financial Post – Ruggins a Master of Tier 1, in which he comes out in favour of the currently fashionable fixed-reset structure:

If a bank was interested in raising Tier 1 capital and wanted to demonstrate that it was investor friendly, a useful starting point would be to call Len Ruggins, the former executive in charge of capital market funding for BCE and Bell Canada.

During his career, Ruggins raised more than $30-billion of capital, or more than any other non-bank executive in the country. Ruggins, now based in Calgary, had a rule: Don’t bag investors. He interpreted that rule by opting never to issue fixedrate perpetual preferred shares. The reason: They aren’t in the best interests of investors. Instead, they serve the interests of issuers that have all the power to let the prefs stay out there forever — and forever is a long time.

…

In five years when the so-called subsequent fixed-rate period comes around, investors have a choice: They can opt to receive other fixedrate pref shares that have a yield equal to the rate on five-year Canada bonds plus 205 basis points. In this way, the spread becomes a permanent part of the formula and means investors won’t be harmed by any improvement in Scotiabank’s credit spread over the period. If in five years the yield on Canada bonds is above 2.95%, then investors will receive a higher nominal yield; if the yield is lower, investors will receive a lower nominal yield.In five years, investors have another choice: They can opt to convert to non-cumulative floating-rate preferred shares. The floating-rate pref shares will pay a dividend equal to the three-month T-bill rate plus 2.05%. However, the floating-rate pref is available only if there is a minimum-sized float.

From Scotia’s perspective, the issue was attractive: It gets Tier 1 capital, given that OSFI, the federal regulator, signed off on the transaction, and it still gets to control most of the shots. As well, the structure allowed the bank to raise more capital — at a lower yield — than a traditional perpetual.

Since Scotia’s deal — on which it’s understood Desjardins Securities played a key structuring role — Fortis raised $200-million via a similar offering.

The Fortis new issue and the Scotia new issue have both been previously discussed.

There are some critical flaws in Mr. Critchley’s analysis:

- Credit risk has a high degree of importance in fixed income investing … particularly with instruments that won’t ever just run off the books. Due to the risk that bad times may come, investors must increase their expected returns in the event that good times continue.

- Contrary to If in five years the yield on Canada bonds is above 2.95%, then investors will receive a higher nominal yield, there is no assurance that the bonds will not be called at such a time.

- There is an inherent contradiction within As well, the structure allowed the bank to raise more capital — at a lower yield — than a traditional perpetual. Issuers and investors are at war with each other. A lower yield – good for the issuer – can be justified only to the extent that risk is transferred … in this case, there is some show of transferring interest rate risk. The fact that these issues are callable in five years at par means that the transfer inherent in these prefs is minimal.

Incidentally … the portfolio strategy of one major dealer advises investors to retain cash for investment in new, “defensive”, fixed-reset issues … so I suspect that there are a lot of deals in the pipeline waiting for an opportune moment.

Blogroll Clean-up: macroblog Deleted

Two moribund blogs have been removed from the “Interesting External Blogs” category of links:

macroblog … Unfortunately (for us, anyway!) Dave Altig started a new job just as the fun began. Whether the cessation of posts is due to his time committments or his employer’s policy … it looks dead.

Home-made Indices with Intra-Day Updating

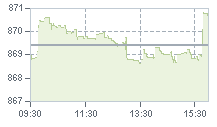

Assiduous Reader kaspu has complained about the volatility of the S&P/TSX Preferred Share Index (TXPR on Bloomberg) – or, at least, the reported volatility.

The problem is that this index is based on actual trades; hence, it can bounce around a lot when 100 shares trade at the ask, $1 above the bid. For instance, today:

This sort of behaviour is endemic to indices created by small shops without much market knowledge or experience. Readers in need of indices with more precision may wish to use the HIMIPref™ Indices, which are, of course, based on much less volatile bid prices.

“Gummy” has announced a new spreadsheet, available from his website. This spreadsheet allows the download of bid and ask prices – and lots of other information – for stocks reported (with a 20 minute delay) by Yahoo. It strikes me that with minimal effort, one could reproduce TXPR (using the defined basket of CPD) and update the index at the touch of a button, with minimal set-up time required.

The Gummy Stuff website, by the way, is reliable AS FAR AS IT GOES. Dr. Ponzo is math-oriented to a much greater degree than investment-oriented and does not always respect hallowed fixed income market conventions. In other words, I have found that things are properly calculated in accordance with the (usually stated) assumptions, but these assumptions are not necessarily the ones I might make when performing a calculation with the same purpose.

With respect to Kaspu‘s question about other indices … the latest CPD literature references the “Desjardins Preferred Share Universe Index”, which is new to me … and I have no further information. Claymore may be preparing for a showdown with the TSX about licensing fees (you should find out what they want for DEX bond data … it’s a scandal).

Additionally, there is the BMO Capital Markets “50” index, but that is available only to Nesbitt clients … maybe at a library, if you have a really good one nearby that gets their preferred share reports.

Update, 2008-5-1: “Gummy” has announced a spreadsheet that does exactly this! Just watch out for dividend ex-Dates!

TD Securities Analysis Link Added to Blogroll

I’ve made a few additions to the blogroll lately – usually I don’t mention them – and there’s one that needs to be explained.

I’ve added TD Securities Public Currency and Research to the list, largely in the hopes that more of this research will be made public.

Read it, don’t read it, your choice, but remember the basic rules about dealer research:

- The data is excellent

- The ideas are interesting

- The actual value of specific trade recommendations is dubious

I’ve also added a link to the Gummy Stuff website, which contains a plethora of utilities that are very useful for retail investors.