Great-West Lifeco has announced that it:

has today entered into an agreement with a syndicate of underwriters led by BMO Capital Markets, RBC Capital Markets, and Scotia Capital Inc. and including CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc. and Desjardins Securities Inc. under which the underwriters have agreed to buy, on a bought deal basis, 10,000,000 Non-Cumulative 5-Year Rate Reset First Preferred Shares, Series N (the “Series N Shares”) from Lifeco for sale to the public at a price of $25.00 per Series N Share, representing aggregate gross proceeds of $250 million.

Lifeco has granted the underwriters an option to purchase an additional 2 million Series N Shares at the offering price. Should the underwriters’ over-allotment option be fully exercised, the total gross proceeds of the Series N Share offering will be $300 million.

The Series N Shares will yield 3.65% per annum, payable quarterly, as and when declared by the Board of Directors of the Company, for an initial period ending December 31, 2015. On December 31, 2015 and on December 31 every five years thereafter, the dividend rate will reset to be equal to the then current five-year Government of Canada bond yield plus 1.30%. Holders of the Series N Shares will have the right to convert their shares into Non-Cumulative Floating Rate First Preferred Shares, Series O of the Company (the “Series O Shares”), subject to certain conditions and the Company’s right to redeem the Series N Shares as described below, on December 31, 2015 and on December 31 every five years thereafter. Holders of the Series O Shares will be entitled to receive a quarterly floating rate dividend, as and when declared by the Board of Directors of the Company, equal to the three-month Government of Canada Treasury Bill yield plus 1.30%. Holders of the Series O Shares may convert their Series O Shares into Series N Shares, subject to certain conditions and the Company’s right to redeem the Series O Shares as described below, on December 31, 2020 and on December 31 every five years thereafter.

The Series N Shares will not be redeemable prior to December 31, 2015. On December 31, 2015 and on December 31 every five years thereafter, the Company may, subject to certain conditions, redeem all or any part of the Series N Shares at a cash redemption price per share of $25.00 together with all declared and unpaid dividends. The Company may redeem all or any part of the Series O Shares at a cash redemption price per share of $25.00 together with all declared and unpaid dividends in the case of redemptions on December 31, 2020 and on December 31 every five years thereafter or $25.50 together with all declared and unpaid dividends in the case of redemptions on any other date after December 31, 2015.

The Series N Share offering is expected to close on November 23, 2010. The net proceeds will be used for general corporate purposes to augment Lifeco’s current liquidity position.

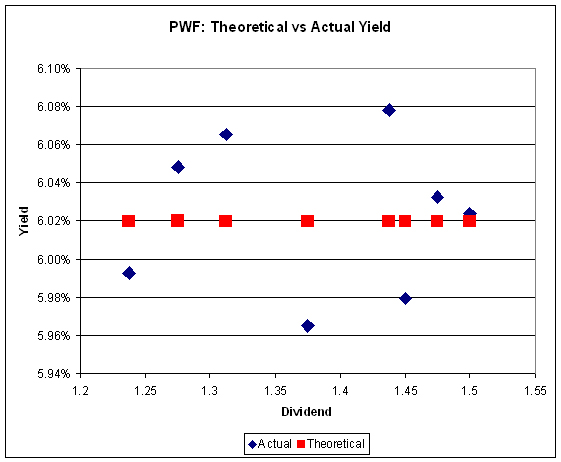

It’s very nice to see an investment-grade FixedReset with a current coupon! However, if we look at GWO’s PerpetualDiscounts as of Friday’s close:

| GWO PerpetualDiscounts 2010-11-12 |

|||

| Ticker | Dividend | Quote 2010-11-12 |

Bid-side Yield |

| GWO.PR.G | 1.30 | 24.00-12 | 5.48% |

| GWO.PR.H | 1.2125 | 23.41-54 | 5.24% |

| GWO.PR.I | 1.125 | 21.45-54 | 5.32% |

We’ll throw out the data point for GWO.PR.H because only morons would choose to buy them given the other prices. So we’ll estimate an average YTW of 5.40% for GWO PerpetualDiscounts.

So we’ll plug the following into the Break Even Rate Shock Calculator: PD Yield 5.40%, FR Spread -1.75%, Term 5 Years and come up with a Break Even Rate Shock of 257bp, which seems pretty high.

Note that we can’t use GWO.PR.J as a comparable, because it has an Issue Reset Spread of 307bp and is therefore very likely to be called on its first exchange date, 2013-12-31. But for those who are interested, it was quoted at 27.75-99 on Friday, to yield 2.66-36% to call.

Update: Some entertaining commentary from the Globe:

Monday’s issue yields 3.65 per cent, a spread of 130 basis points over the 5-year Government of Canada bonds. In February, the company brought a series of preferred shares that yielded 5.8 per cent. That’s a 215 basis point gap, which new investors may not be aware of.

…

The difference likely stems from the types of preferred shares offered. The February issue, Series M, were non-cumulative preferred shares, while Monday’s issue, Series N, were non-cumulative rate reset preferred shares.