Power Financial Corporation has announced:

that it has agreed to issue, on a bought deal basis, 8,000,000 4.40% Non-Cumulative 5-Year Rate Reset First Preferred Shares, Series P (the “Series P Shares”) at a price of $25.00 per Series P Share, representing aggregate gross proceeds of $200 million. The issue will be underwritten by a syndicate of underwriters co-led by BMO Capital Markets, RBC Capital Markets and Scotia Capital Inc. Power Financial has also granted the underwriters an option to purchase an additional 4,000,000 Series P Shares at the same offering price. Should the underwriters’ option be exercised fully, the total gross proceeds of the Series P Share offering will be $300 million.

The Series P Shares will yield 4.40% per annum, payable quarterly, as and when declared by the Board of Directors of the Corporation, for an initial period ending January 31, 2016. On January 31, 2016 and on January 31 every five years thereafter, the dividend rate will reset to be equal to the then current five-year Government of Canada bond yield plus 1.60%. Holders of the Series P Shares will have the right to convert their shares into Non-Cumulative Floating Rate First Preferred Shares, Series Q of the Corporation (the “Series Q Shares”), subject to certain conditions and the Corporation’s right to redeem the Series P shares as described below, on January 31, 2016 and on January 31 every five years thereafter. Holders of the Series Q Shares will be entitled to receive a quarterly floating rate dividend, as and when declared by the Board of Directors of the Corporation, equal to the three-month Government of Canada Treasury Bill yield plus 1.60%.

Holders of the Series Q Shares may convert their Series Q Shares into Series P Shares, subject to certain conditions and the Corporation’s right to redeem the Series Q Shares as described below, on January 31, 2021 and on January 31 every five years thereafter.

The Series P Shares will not be redeemable prior to January 31, 2016. On January 31, 2016 and on January 31 every five years thereafter, the Corporation may, subject to certain conditions, redeem all or any part of the Series P Shares at a cash redemption price per share of $25.00 together with all declared and unpaid dividends.

The Corporation may redeem all or any part of the Series Q Shares at a cash redemption price per share of $25.00 together with all declared and unpaid dividends in the case of redemptions on January 31, 2021 and on January 31 every five years thereafter or $25.50 together with all declared and unpaid dividends in the case of redemptions on any other date after January 31, 2016.

The Series P Share offering is expected to close on or about June 29, 2010. The net proceeds will be used to supplement the Corporation’s financial resources and for general corporate purposes.

The company also announced that PWF.PR.D will be redeemed on October 31.

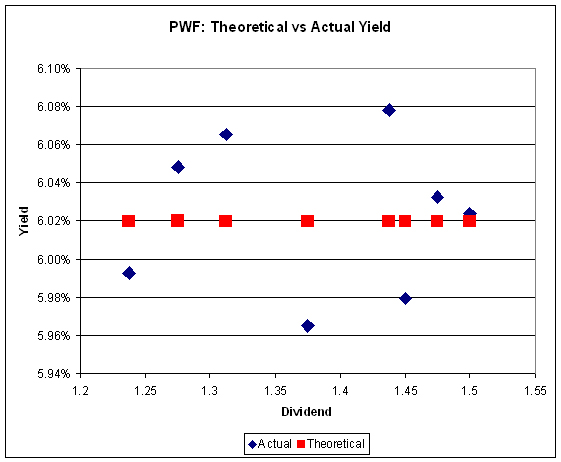

As showin in the following graph prepared by the Straight Perpetual Implied Volatility Calculator, PWF PerpetualDiscounts closed today yielding an average of about 6.02%, with no sign of any allowance for the embedded issuer call.

Plugging these numbers into the Break Even Rate Shock Calculator results in an indication of 255bp, making this yet another very expensive issue.

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « New Issue: PWF FixedReset 4.40%+160 […]

[…] is a FixedReset, 4.40%+160, announced June 17. It traded 563,942 shares today in a range of 24.85-02 before closing at […]

[…] was issued as a a FixedReset, 4.40%+160 that commenced trading 2010-6-29 after being announced 2010-6-17. It reset to 2.306% in 2016; I recommended against conversion but there was a 20% conversion to […]

[…] was issued as a a FixedReset, 4.40%+160 that commenced trading 2010-6-29 after being announced 2010-6-17. It reset to 2.306% in 2016; I recommended against conversion but there was a 20% conversion to […]

[…] was issued as a a FixedReset, 4.40%+160 that commenced trading 2010-6-29 after being announced 2010-6-17. It reset to 2.306% in 2016; I recommended against conversion but there was a 20% conversion to […]