Oh, those wacky Europeans and their Risk-Weighted Assets!

Banks in Europe are undercutting regulators’ demands that they boost capital by declaring assets they hold less risky today than they were yesterday.

Banco Santander SA (SAN), Spain’s largest lender, and Banco Bilbao Vizcaya Argentaria SA (BBVA), the second-biggest, say they can go halfway to adding 13.6 billion euros ($18.8 billion) of capital by changing how they calculate risk-weightings, the probability of default lenders assign to loans, mortgages and derivatives. The practice, known as “risk-weighted asset optimization,” allows banks to boost capital ratios without cutting lending, selling assets or tapping shareholders.

…

Spanish banks aren’t alone in using the practice. Unione di Banche Italiane SCPA (UBI), Italy’s fourth-biggest bank, said it will change its risk-weighting model instead of turning to investors for the 1.5 billion euros regulators say it needs. Commerzbank AG (CBK), Germany’s second-biggest lender, said it will do the same. Lloyds Banking Group Plc (LLOY), Britain’s biggest mortgage lender, and HSBC Holdings Plc (HSBA), Europe’s largest bank, both said they cut risk-weighted assets by changing the model.

…

The proportion of risk-weighted assets to total assets at European banks is half that of American banks, according to an April 6 Barclays Capital report written by analysts Simon Samuels and Mike Harrison.

…

Sheila Bair, who stepped down as chairman of the Federal Deposit Insurance Corp. in June, has called Europe’s adoption of risk-weighting “naive.”

…

Some regulators, including Bair, have pushed for a leverage ratio that would require lenders to hold a fixed amount of capital against total assets.

…

Banco Santander, based in Madrid, and BBVA in Bilbao said they’re justified in adjusting risk-weightings because Spanish regulators have held them to higher standards than elsewhere.

Spanish banks have an average ratio of risk-weighted assets to total assets of 52 percent compared with 32 percent for U.K. banks, 31 percent for French and Benelux banks and 35 percent for German banks, analysts at Keefe, Bruyette & Woods Inc., wrote in an Oct. 26 report.

DARPA’s looking for hackers:

At the conference, officials of the Defense Advanced Research Projects Agency pleaded with hackers to help them out and said that the agency plans to boost spending as it battles unnamed adversaries in cyberspace.

Regina Dugan, DARPA director, addressed an audience that comprised what the agency called “visionary hackers,” academics and others, according to a Reuters story.

Ms. Dugan contended that the military needs “more and better options” to meet cyber threats to a growing range of industrial and other systems controlled by computers vulnerable to penetration, including cars with advanced computer diagnostic boards. Of concern are brakes, accelerators, steering and other modern car systems that “we need to worry about” because they could be remotely hacked via such diagnostic controls, said another DARPA program manager.

…

DARPA officials said the country is at risk particularly since the playing field is far from level. Layered security defenses have grown increasingly bloated, according to a recent in-house analysis, while attackers operate with lean, mean malware.

The agency’s analysis reports that some security packages are weighing in at an eye-popping 10 million lines of code, while malicious software on average runs on a whip-thin 125 lines.

To combat such threats, DARPA officials called for both an increase in the development of cyber defensive technologies and of offensive weapon systems.

There’ll be some good money for talented kids in that pot! I presume that Canadian federal government programmers need not apply:

The applications that are not “kicked out” of Service Canada’s automated system at the start cannot be fixed on the computer until a 28-day period has passed, even if the errors are reported to agents in the Service Canada processing office.

These applications then need to be processed manually by agents. The agents have an additional 21 days to do the recalculations, but, because their workforce is shrinking, the time frame is often not met and much longer delays of weeks or months are becoming commonplace.

What’s happening in Greece???

Greece’s critical power-sharing talks have hit a significant hurdle, with political leaders leaving a top-level meeting that had been expected to conclude three days of negotiations without naming a new prime minister to take over from George Papandreou.

The president’s office said Wednesday the meeting would reconvene on Thursday morning. It gave no reason. Earlier, Giorgos Karatzaferis, the head of a small right-wing party, had stormed out of the meeting, accusing the heads of the two main parties of using “trickery” but not giving any details.

I’ve already expressed doubts as to whether the population will permit the “paying back” part of the bail-out plan – but will the politicians even get as far as the “taking the money” part? Bloomberg reports:

Negotiations on a government between Papandreou and Samaras dragged on for a third day today as the two sides disagreed on a prime minister and the opposition balked at European Union demands for written commitments to secure a bailout package.

The new government must implement budget measures and decisions related to an Oct. 26 European bailout package that’s worth 130 billion euros ($177 billion), including a debt swap, before holding elections.

Immediately at stake is the fate of an 8 billion-euro loan installment under an earlier aid package, a 110 billion-euro EU- led bailout agreed in May 2010. The tranche must be paid before the middle of December to prevent a collapse of the country’s financial system.

Italy’s not having much fun either:

The euro-region’s defenses are being breached.

Investors today propelled Italy’s 10-year bond yield to close at a euro-era high of 7.25 percent after the promised exit of Prime Minister Silvio Berlusconi failed to convince them that his country can slash Europe’s second-largest debt burden.

This sounds like dealers are setting up for a lousy auction:

Italy may struggle to sell 5 billion euros ($6.8 billion) of Treasury bills tomorrow, after bond yields surged to euro-era records on Prime Minister Silvio Berlusconi’s resignation offer and LCH Clearnet SA demanded more collateral on the country’s bonds.

Italy auctions one-year bills tomorrow at 11:00 a.m. in Rome, followed by a sale of five-year bonds on Nov. 14. The auction comes after the country’s 10-year bond yield jumped 57 basis points to 7.33 percent, crossing the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts. Italy paid 3.57 percent the last time it sold one-year bills on Oct. 11. Similar maturity debt currently yields about 8.41 percent.

DBRS downgraded Italy a notch:

DBRS Ratings Limited (DBRS) has today downgraded the ratings on the Republic of Italy’s long-term foreign and local currency debt to A (high) from AA (low). The trend on both ratings remains Negative. The downgrade reflects: (1) persistent stress in market funding conditions; (2) fiscal consolidation implementation risks due to economic and political uncertainties; and, (3) structural economic growth challenges.

European difficulties are having effects in the Antipodes:

New Zealand’s central bank deferred plans to tighten bank lending rules as global turmoil increases the risks for the nation’s economy and financial system.

The Reserve Bank will delay an increase in the core funding ratio to 75 percent from 70 percent by about six months to Jan. 1, 2013, according to its Financial Stability Report released in Wellington today. The ratio sets the minimum share of bank loans that must be funded from local deposits or wholesale borrowings of one year or longer.

“Conditions in global funding markets have deteriorated,” the central bank said in the report. “It would have been very difficult to place new longer-term unsecured debt issues over the past three months as the sovereign debt crisis played out.”

The central bank introduced the ratio in July to reduce local banks’ reliance on short-term debt raised overseas, intending to counter the impact of that funding getting frozen.

Jefferson County’s gone bust:

Jefferson County, Alabama, commissioners voted 4-1 to file the largest U.S. municipal bankruptcy after reaching an impasse over concessions with holders of $3.14 billion of bonds.

JPMorgan Chase & Co. (JPM), which arranged most of the debt to fund a sewer renovation, will likely take the biggest loss.

A provisional agreement with creditors that commissioners approved in September included $1.1 billion in concessions and called for sewer-rate increases of as much as 8.2 percent for the first three years. The county was unable to get signed commitments from creditors, Commission PresidentDavid Carrington said today

…

The vote by officials in Alabama’s most populous county occurred about a month after Pennsylvania’s capital of Harrisburg sought court protection citing millions in overdue bond payments tied to a trash-to-energy incinerator. A Jefferson filing would eclipse that of California’s Orange County in 1994.

…

The crisis in Alabama arose when investors dumped Jefferson county’s bonds as the subprime mortgage-market meltdown sent ripples through Wall Street. Jefferson’s floating-rate securities were coupled with interest-rate swaps, a money-saving strategy pitched by banks that backfired. As credit markets convulsed in 2008, the county’s interest costs soared. When banks demanded early payoffs of the bonds, the county defaulted.

The debt deals also were rife with political corruption, leading the cost of the sewer project to soar as it was built during the 1990s. Former commission president and Birmingham Mayor Larry Langford, a Democrat, was convicted of accepting bribes in connection with the financing.

Two former JPMorgan bankers are fighting Securities and Exchange Commission charges that they made $8 million in undisclosed payments to friends of commissioners to secure the bank’s role in the deals. In 2009, JPMorgan agreed to a $722 million settlement with the SEC.

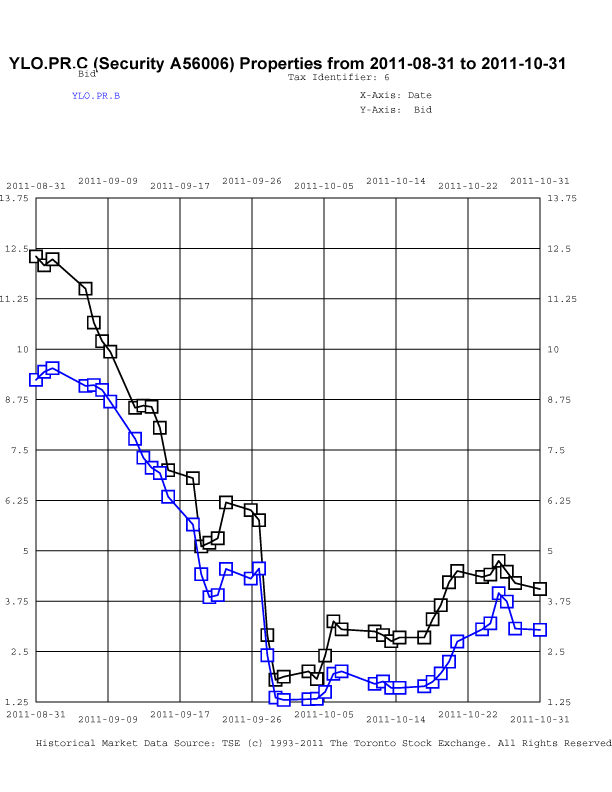

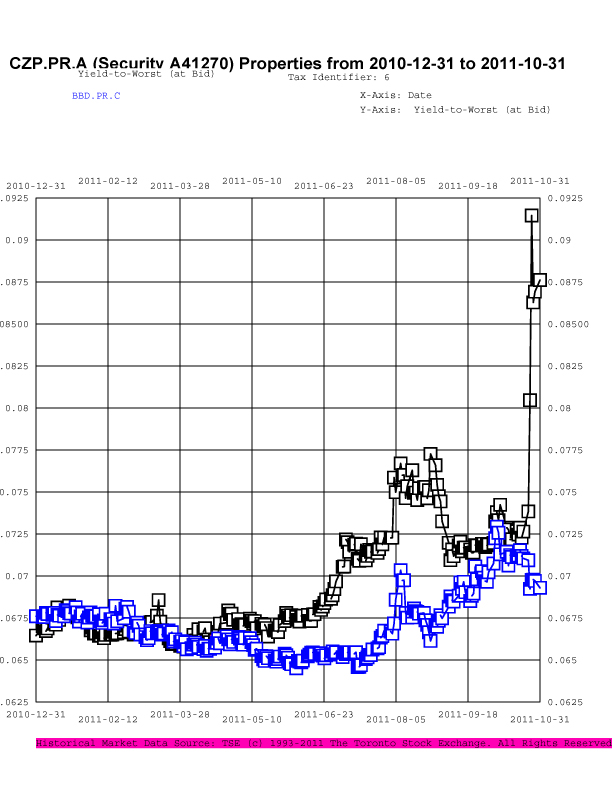

Be careful doing business in Ontario! Don’t sell securities that go down; only sell securities that go up, OK? Companies are now required to report on changes in the analytical methodology of third parties, and to guess how liquid the market for their securities is going to be.

There is renewed speculation that the TMX / Maple deal will close:

TMX, owner of the Toronto Stock Exchange, rose to C$44.70 this month, shrinking the gap to Maple Group Acquisition Corp.’s C$50-a-share offer to the narrowest since it became the sole bidder in June, according to data compiled by Bloomberg.

…

“The deal will get done and the regulators will probably do a little tinkering around the edges,” Thomas Caldwell, Toronto-based chief executive officer of Caldwell Securities Ltd., which oversees about $1 billion including TMX shares, said in a telephone interview. “At the end of the day, Maple Group’s offering C$50 a share. Price is going to decide this.”

…

The Competition Bureau is reviewing the C$3.73 billion ($3.64 billion) TMX transaction. Quebec’s Autorite des Marches Financiers scheduled hearings on Nov. 24 and Nov. 25 and the Ontario Securities Commission has hearings Dec. 1 and Dec. 2.

“Regulatory approval is more likely with the board and management supporting the transaction,” Edward Ditmire, an analyst at Macquarie in New York, said in a telephone interview. He says there’s a better than 50 percent chance the deal closes.

It will be a black day for Canada if the banks succeed in cementing a bit more of the Old-boy Club hegemony in the financial landscape. A foreign buyer for the TMX is greatly desirable.

Just in time for the Christmas shopping season comes this insurance news:

Should you be burdened with a particular fear of the supernatural, then you are well looked after when it comes to unusual insurance policies. Ghost, werewolf and vampire insurance can also be procured very easily, with each policy redeemable in the event of an attack by these creatures of the night.

Bell Aliant, proud guarantor of BAF.PR.A, was confirmed by DBRS:

DBRS has today confirmed the short- and long-term ratings of Bell Aliant Regional Communications, Limited Partnership (Bell Aliant or the Company) at R-1 (low) and BBB (high), respectively, along with the preferred share rating at Pfd-3 (high). The trends are Stable. The confirmation reflects a business risk profile that, while undergoing a transition from legacy voice services to focusing on growth areas such as data and video, has to-date been manageable. The ratings also incorporate Bell Aliant’s relatively stable financial risk profile, which remains slightly higher than its Canadian peers but within an acceptable range. DBRS believes that for Bell Aliant, the successful transition to providing new services – both in terms of investment and execution – remains more acute than for other telcos that typically have wireless services throughout their territory to provide growth while this fixed-line transition occurs.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts winning 11bp, FixedResets down 3bp and DeemedRetractibles gaining 6bp. Volatility was average. Volume was light.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0967 % |

2,127.6 |

| FixedFloater |

4.83 % |

4.53 % |

26,123 |

17.25 |

1 |

-0.1015 % |

3,192.4 |

| Floater |

3.38 % |

3.40 % |

161,266 |

18.72 |

2 |

0.0967 % |

2,297.3 |

| OpRet |

4.95 % |

0.96 % |

55,181 |

1.51 |

7 |

0.1845 % |

2,483.3 |

| SplitShare |

5.78 % |

6.77 % |

60,433 |

5.12 |

3 |

-0.2525 % |

2,501.6 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1845 % |

2,270.7 |

| Perpetual-Premium |

5.57 % |

2.54 % |

106,033 |

0.15 |

13 |

0.1653 % |

2,156.0 |

| Perpetual-Discount |

5.32 % |

5.43 % |

108,968 |

14.74 |

17 |

0.1115 % |

2,290.3 |

| FixedReset |

5.13 % |

3.07 % |

208,077 |

2.52 |

62 |

-0.0299 % |

2,343.6 |

| Deemed-Retractible |

5.04 % |

4.33 % |

207,277 |

3.46 |

46 |

0.0575 % |

2,217.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| SLF.PR.H |

FixedReset |

-2.37 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.90

Bid-YTW : 4.40 % |

| ELF.PR.F |

Perpetual-Discount |

-1.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 22.17

Evaluated at bid price : 22.45

Bid-YTW : 5.96 % |

| CM.PR.P |

Deemed-Retractible |

-1.12 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-10-29

Maturity Price : 25.00

Evaluated at bid price : 25.62

Bid-YTW : 3.04 % |

| POW.PR.D |

Perpetual-Discount |

1.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 24.25

Evaluated at bid price : 24.55

Bid-YTW : 5.13 % |

| BNS.PR.L |

Deemed-Retractible |

1.18 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-04-28

Maturity Price : 25.25

Evaluated at bid price : 25.70

Bid-YTW : 3.95 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| ENB.PR.B |

FixedReset |

69,654 |

TD crossed 15,000 at 25.60; RBC crossed 25,000 at the same price.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 23.27

Evaluated at bid price : 25.45

Bid-YTW : 3.64 % |

| CM.PR.G |

Perpetual-Discount |

59,975 |

Scotia crossed blocks of 10,000 and 25,000, both at 24.95.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 24.59

Evaluated at bid price : 24.91

Bid-YTW : 5.45 % |

| GWO.PR.I |

Deemed-Retractible |

59,574 |

RBC crossed 49,900 at 22.64.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 22.56

Bid-YTW : 5.88 % |

| MFC.PR.C |

Deemed-Retractible |

43,693 |

rBC crossed 28,600 at 21.60.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.52

Bid-YTW : 6.51 % |

| BAM.PR.Z |

FixedReset |

34,065 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 23.11

Evaluated at bid price : 25.02

Bid-YTW : 4.38 % |

| CM.PR.E |

Perpetual-Discount |

32,383 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 24.68

Evaluated at bid price : 24.98

Bid-YTW : 5.64 % |

| There were 21 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| BAM.PR.H |

OpRet |

Quote: 25.36 – 26.83

Spot Rate : 1.4700

Average : 0.9090

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-12-09

Maturity Price : 25.00

Evaluated at bid price : 25.36

Bid-YTW : -4.02 % |

| W.PR.H |

Perpetual-Discount |

Quote: 25.08 – 25.47

Spot Rate : 0.3900

Average : 0.2390

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-11-09

Maturity Price : 23.88

Evaluated at bid price : 25.08

Bid-YTW : 5.48 % |

| RY.PR.F |

Deemed-Retractible |

Quote: 25.15 – 25.50

Spot Rate : 0.3500

Average : 0.2263

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2016-05-24

Maturity Price : 25.00

Evaluated at bid price : 25.15

Bid-YTW : 4.28 % |

| CU.PR.B |

Perpetual-Premium |

Quote: 25.55 – 25.90

Spot Rate : 0.3500

Average : 0.2323

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-12-09

Maturity Price : 25.25

Evaluated at bid price : 25.55

Bid-YTW : -12.40 % |

| CM.PR.M |

FixedReset |

Quote: 27.32 – 27.73

Spot Rate : 0.4100

Average : 0.3018

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-31

Maturity Price : 25.00

Evaluated at bid price : 27.32

Bid-YTW : 3.01 % |

| TD.PR.G |

FixedReset |

Quote: 27.15 – 27.34

Spot Rate : 0.1900

Average : 0.1125

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-04-30

Maturity Price : 25.00

Evaluated at bid price : 27.15

Bid-YTW : 2.70 % |