The Bank for International Settlements has announced the release of its Quarterly review, chock full of heartwarming stories:

- Overview: Investors ponder depth and duration of global recession

- Highlights of international banking and financial market activity

- Assessing the risk of banking crises – revisited

- The US dollar shortage in global banking

- US dollar money market funds and non-US banks

- Execution methods in foreign exchange markets

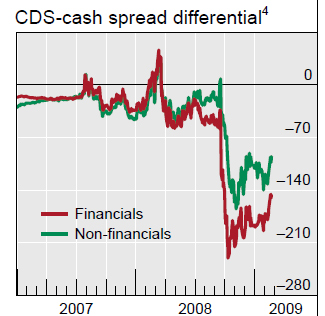

One sign of dysfunctionality, which has been highlighted but not quantified by PrefBlog, is the CDS Basis:

At the same time, signs of dysfunction continued, highlighting the fragile state of market conditions and investor sentiment. The fragility was apparent, for example, in measures such as the CDS-cash basis, which reflects the pricing differential between CDS contracts and corresponding cash market bonds. Though not as pronounced as in the aftermath of the Lehman Brothers bankruptcy, the basis remained unusually wide in the new year, suggesting that arbitrage activities that would usually tend to compress the price differential continued to be constrained by elevated capital and financing costs for leveraged investors (Graph 2, right-hand panel). Similar effects were observed elsewhere, as evident from high and variable liquidity premia in the markets for government bonds and swaps (see bond market section below).

In a normal world (subject to caveats about creditor status, a la Lyondell), one should be relatively indifferent as to whether one holds a cash bond or a BA+CDS package. This is not a normal world.

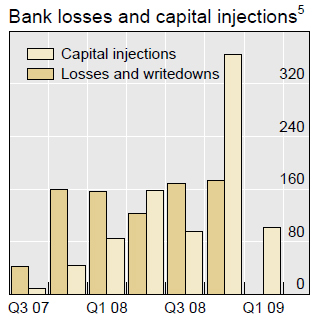

Also of interest is the relative size of writedowns vs. capital injections:

We talk about sub-debt and Innovative Tier 1 Capital a lot on this blog … BIS notes:

Subordinated bank CDS spreads, in turn, remained under pressure from uncertainties about the implications of government interventions for investors in lower-seniority debt instruments, including the treatment of hybrid securities issued to bolster banks’ capital positions. Earlier investor concerns over a large issuer’s decision not to call outstanding hybrid securities at the contractual redemption date, in contrast, eased after other borrowers decided to redeem their issues. Related fears about extension risk (ie the risk of maturities on similar securities being extended beyond the agreed call dates) had fed into the markets for subordinated CDS, which are widely used to hedge hybrid instruments

… and TIPS are also of interest:

Technical factors also continued to influence break-even inflation rates in major industrialised countries. While expected rapid disinflation contributed to falling break-even rates at shorter horizons, much of the recent movement in long-term break-even rates seemed to be due to factors not directly linked to inflation expectations. These included rapid unwinding of positions, intense safe haven demand for the liquidity of nominal Treasuries and rising liquidity premia in index-linked bonds, all of which helped push break-even rates to unusually low levels (see box). However, with some of these forces easing in early 2009, break-even inflation rates began to edge upwards from their lows.

The box discusses the importance of technical factors and – again! – the differing behaviour of swap instruments that do not tie up cash:

Linked to these liquidity effects, and to some extent indistinguishable from them, are technical market factors, which also appear to have been important drivers of break-even rates recently. Such factors include sell-side pressures from leveraged investors that were forced to unwind inflation-linked bond positions in adverse market conditions, which in turn resulted in rising real yields and hence falling break-even rates.

Evidence from inflation swap markets can shed some light on the importance of these effects. An inflation swap is a derivative instrument that is similar to a regular interest rate swap. However, instead of exchanging a fixed payment for a variable payment linked to a short-term interest rate, the inflation swap links the variable payment to a measure of inflation, typically the accrued inflation over the life of the swap. The fixed leg of the inflation swap therefore provides a direct break-even inflation “price”, which is unaffected by any differential liquidity conditions in nominal and real bond markets or by flight-to-liquidity flows.

The paper on the US dollar in international banking has some great graphs showing the gross up of the non-domestic-currency balance sheets of various banks:

The analysis suggests that many European banking systems built up long US dollar positions vis-à-vis non-banks and funded them by interbank borrowing and via FX swaps, exposing them to funding risk. When heightened credit risk concerns crippled these sources of short-term funding, the chronic US dollar funding needs became acute. The resulting stresses on banks’ balance sheets have persisted, resulting in tighter credit standards and reduced lending as banks struggle to repair their balance sheets.

On a related note, the paper on Money Market Funds claims:

In sum, the run on US dollar money market funds after the Lehman failure stressed global interbank markets because the funds bulked so large as suppliers of US dollars to non-US banks. Public policies stopped the run and replaced the reduced private supply of dollars with public funding.

… and …

Records of the mid-2008 holdings of the 15 largest prime funds (Table 1), accounting for over 40% of prime funds’ assets, show that the funds placed half of their portfolios with non-US banks. Thus, such US money market funds’ investment in non-US banks reached an estimated $1 trillion in mid-2008 out of total assets of over $2 trillion. To this can be added one half of the assets of European US dollar funds represented by the Institutional Money Market Fund Association, about $180 billion out of $360 billion in early September 2008.

Overall, European banks appear to have relied on money market funds for about an eighth of their $8 trillion in dollar funding. By contrast, central banks, which invest 10–15% of US dollar reserves in banks (McCauley (2007)), provided only $500 billion to European banks at the peak of their holdings in the third quarter of 2007. Given these patterns, any run on dollar money market funds was bound to make trouble for European banks.

… and …

As investors in short-term debt, MMFs are important providers of liquidity to financial intermediaries through purchases of certificates of deposit (CDs) and commercial paper (CP) issued by banks, and through repo transactions. For example, MMFs held nearly 40% of the outstanding volume of CP in the first half of 2008. Consequently, when MMFs shift away from these assets into safer ones, funding liquidity for financial institutions can be affected.

The run focussed on non-bank-sponsored MMFs:

The largest redemptions occurred at institutional prime funds managed by the remaining securities firms and small independent managers, which investors doubted could support their funds. Two-day redemptions at the largest institutional prime fund managed by the three largest securities firms were 20%, 36% and 38% of assets, well above the 16% average. By contrast, the largest such funds managed by affiliates of seven large banks met two-day calls of 2%, 5%, 5%, 7%, 10%, 10% and 17% of assets (Graph 4, right-hand panel). On 21 September, Goldman Sachs and Morgan Stanley announced plans to become bank holding companies; Bank of America had announced its purchase of Merrill Lynch on 15 September. American Beacon, an independent money fund spun off by American Airlines, faced two-day redemptions of 46% of its assets and resorted to in-kind redemption.

The authors refer to the Volker report (that I enthusiastically endorse, at least the MMF parts):

Some former policymakers and current market participants, however, have called for money market funds that offer transaction services, withdrawal on demand and a stable net asset value to be organised and supervised as banks with access to last resort lending (Group of 30 (2009)). Further, they would require any short-term funds that were not thus organised and supervised to have a floating net asset value.

Also, as I wrote in an essay, bank sponsored MMFs should be consolidated with bank assets for risk-weight and leverage purposes.