Greece is kicking against the pricks:

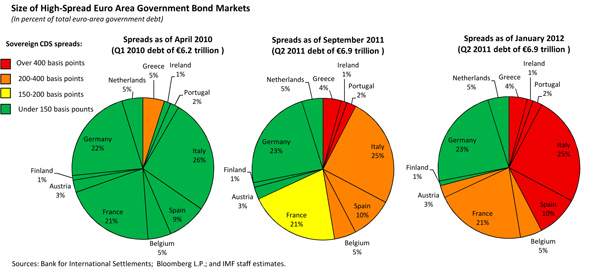

European leaders sparred with Greece over a second rescue program, clouding progress toward a permanent aid fund and tougher budget rules designed to stabilize the euro.

Greece faced criticism that its economic makeover is faltering, and it fended off German and Dutch calls for a European overseer to take command of its budget after its deficits surpassed targets for two years.

…

Greece is making progress on one component of the package, nearing an agreement for bondholders to accept deeper losses on a 50 percent cut in the face value of more than 200 billion euros of debt.European concerns that Greece can deliver budget cuts and economic reforms are holding up other parts of the package, which Greece needs to meet a 14.5 billion-euro bond payment due on March 20.

However, it is beginning to dawn on the Europeans that when the party’s over, somebody has to pay the bills:

Euro leaders left a Brussels summit late yesterday with no accord over how to plug Greece’s widening budget hole and German Chancellor Angela Merkel voicing frustration with the Athens government’s failure to carry out an economic makeover.

“Greece’s debt sustainability is especially bad,” Merkel told reporters. “You have to find a way through more action by the Greek government, more contributions by private creditors, for example, in order to close this gap.”

DBRS, Inc. (DBRS) has downgraded the Republic of Portugal’s long-term foreign and local currency debt to BBB (low) from BBB. The trend on both ratings remains Negative. The downgrade reflects weaker growth prospects in Portugal, which are likely to make achieving ambitious deficit-reduction targets very challenging. Moreover, the unstable economic environment in Europe, uncertainty over the Greek debt exchange, and ongoing tensions in financial markets intensify downside risks to Portugal’s growth outlook and prospects for debt stabilisation.

The Negative trends reflect our assessment that the ratings have yet to stabilise and that further deterioration in the growth or fiscal outlook could result in a further ratings downgrade. Growth prospects are particularly important to debt stabilisation in Portugal, given the size of the fiscal consolidation programme and the high and rising public debt burden.

The outlook for the Portuguese economy has deteriorated since DBRS’s last review in October 2011. The Bank of Portugal estimates that the economy will contract by 3.1% in 2012 – the second consecutive year of recession – and expand by just 0.3% in 2013.

…

It is not clear when Portugal will be able to reenter the long-term debt markets. According to the EU-IMF programme, Portugal is expected to return to the markets in time to cover a EUR 9.7 billion bond redemption in September 2013.

Sarkozy had some good news for the City:

France plans to unilaterally impose a 0.1 percent tax on financial transactions starting in August, President Nicolas Sarkozy said, brushing aside opposition from the nation’s banks.

“What we want to do is provoke a shock, to set an example,” Sarkozy said late yesterday on French television from Paris. “There’s no reason why deregulated finance, which brought us to the current situation, can’t participate in the restoration of our accounts.”

A France-only levy is opposed by the country’s financial community and its feasibility has been questioned by the Bank of France.

…

The financial transactions tax is among measures Sarkozy unveiled to shrink the French budget deficit and spur growth. He’s also increasing sales taxes and levies on financial incomes to fund a 13 billion-euro cut in payroll charges aimed at reducing labor costs and making France more competitive.

S&P downgraded Encana, which has no preferreds outstanding:

- On Jan. 18, 2012, Standard & Poor’s revised its natural gas price assumptions following a decline in spot and forward North American natural gas prices. Notably, we lowered our long-term price assumptions based on our view that although prices will likely stabilize or modestly

improve in 2012 due to production curtailment, fundamental supply characteristics will constrain pricing.- As a result, we are lowering our long-term corporate credit and senior unsecured debt ratings on Calgary, Alta.-based Encana Corp. to ‘BBB’ from ‘BBB+’.

- We are also lowering our senior unsecured debt rating on subsidiary Encana Holdings Finance Corp. to ‘BBB’ from ‘BBB+’.

- We are affirming our ‘A-2’ Canada scale commercial paper rating on Encana.

- The ratings reflect our assessment of the company’s strong internal growth prospects from its large reserve base and undeveloped land holdings, low operating-cost structure, and strong liquidity.

- The stable outlook reflects our view that Encana’s cash flow from asset sales combined with its increasing liquids production while maintaining competitive operating costs will allow the company to maintain its funds from operations-to-debt at more than 30% through 2013.

It was another mixed day for the Canadian preferred share market as PerpetualDiscounts – those few that are left – continue to bounce around like mad. PerpetualDiscounts won 66bp, FixedResets gained 8bp and DeemedRetractibles were down 3bp. Volatility was skewed to the upside. Volume was average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.7328 % | 2,389.0 |

| FixedFloater | 4.69 % | 4.06 % | 41,901 | 17.27 | 1 | 0.3469 % | 3,323.9 |

| Floater | 2.79 % | 2.96 % | 63,143 | 19.81 | 3 | 0.7328 % | 2,579.5 |

| OpRet | 4.90 % | 0.42 % | 67,093 | 1.29 | 7 | 0.4912 % | 2,521.2 |

| SplitShare | 5.33 % | -0.39 % | 72,758 | 0.86 | 4 | -0.2956 % | 2,626.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4912 % | 2,305.4 |

| Perpetual-Premium | 5.40 % | -5.12 % | 101,778 | 0.09 | 23 | 0.0506 % | 2,213.9 |

| Perpetual-Discount | 4.96 % | 4.93 % | 181,383 | 14.82 | 7 | 0.6558 % | 2,442.8 |

| FixedReset | 5.04 % | 2.69 % | 209,811 | 2.33 | 65 | 0.0779 % | 2,385.2 |

| Deemed-Retractible | 4.90 % | 3.50 % | 205,499 | 1.68 | 46 | -0.0276 % | 2,308.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNA.PR.D | SplitShare | -1.16 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-29 Maturity Price : 26.00 Evaluated at bid price : 26.50 Bid-YTW : -3.79 % |

| FTS.PR.E | OpRet | 1.14 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-01 Maturity Price : 25.75 Evaluated at bid price : 27.44 Bid-YTW : 0.42 % |

| ELF.PR.F | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-30 Maturity Price : 24.48 Evaluated at bid price : 24.71 Bid-YTW : 5.40 % |

| BAM.PR.K | Floater | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-30 Maturity Price : 17.44 Evaluated at bid price : 17.44 Bid-YTW : 3.03 % |

| BMO.PR.Q | FixedReset | 1.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.64 Bid-YTW : 2.82 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.O | Deemed-Retractible | 70,711 | Nesbitt crossed blocks of 18,000 and 30,000, both at 27.13. Desjardins bought 15,900 from TD at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-04-26 Maturity Price : 26.00 Evaluated at bid price : 27.14 Bid-YTW : 1.77 % |

| RY.PR.F | Deemed-Retractible | 66,792 | TD crossed blocks of 22,100 and 27,500, both at 25.79. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-24 Maturity Price : 25.25 Evaluated at bid price : 25.78 Bid-YTW : 3.65 % |

| RY.PR.E | Deemed-Retractible | 53,675 | Desjardins crossed 23,400 at 25.85; TD crossed 20,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-24 Maturity Price : 25.25 Evaluated at bid price : 25.83 Bid-YTW : 3.58 % |

| GWO.PR.M | Deemed-Retractible | 39,360 | Nesbitt crossed 30,000 at 26.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-31 Maturity Price : 26.00 Evaluated at bid price : 26.60 Bid-YTW : 4.97 % |

| PWF.PR.L | Perpetual-Premium | 37,504 | Nesbitt crossed 18,000 at 25.20; RBC crossed 13,800 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-31 Maturity Price : 25.25 Evaluated at bid price : 25.32 Bid-YTW : 4.97 % |

| HSE.PR.A | FixedReset | 30,771 | RBC crossed 19,900 at 25.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-30 Maturity Price : 23.52 Evaluated at bid price : 25.95 Bid-YTW : 2.99 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| FTS.PR.C | OpRet | Quote: 26.25 – 27.25 Spot Rate : 1.0000 Average : 0.6650 YTW SCENARIO |

| PWF.PR.A | Floater | Quote: 21.10 – 22.10 Spot Rate : 1.0000 Average : 0.8620 YTW SCENARIO |

| BNA.PR.D | SplitShare | Quote: 26.50 – 26.90 Spot Rate : 0.4000 Average : 0.2641 YTW SCENARIO |

| BMO.PR.H | Deemed-Retractible | Quote: 25.76 – 26.04 Spot Rate : 0.2800 Average : 0.1685 YTW SCENARIO |

| BNS.PR.M | Deemed-Retractible | Quote: 26.17 – 26.44 Spot Rate : 0.2700 Average : 0.1942 YTW SCENARIO |

| TCA.PR.Y | Perpetual-Premium | Quote: 52.10 – 52.55 Spot Rate : 0.4500 Average : 0.3777 YTW SCENARIO |