Bob Eisenbeis, Chief Monetary Economist at Cumberland Advisors, has posted a good commentary on Contingent Capital.

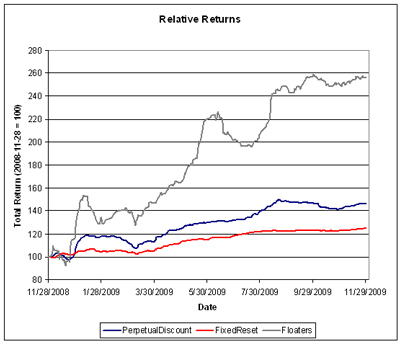

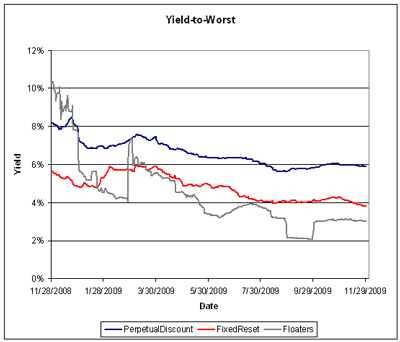

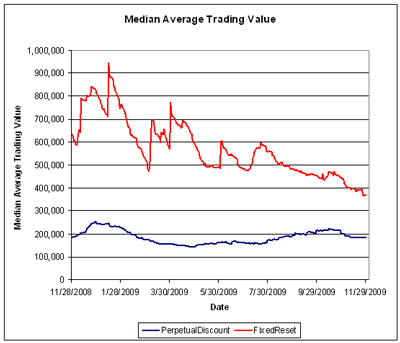

It was a mixed day for preferred shares, with PerpetualDiscounts down 10bp and FixedResets up 11bp – which took the weighted median yield-to-worst of the latter class down to 3.75%. How low can it go? The five lowest yields recorded on the FixedReset index have been observed on the last five trading days. Volume returned to normal levels.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1538 % | 1,504.4 |

| FixedFloater | 6.04 % | 4.16 % | 37,390 | 18.59 | 1 | 0.1669 % | 2,578.8 |

| Floater | 2.59 % | 3.04 % | 97,849 | 19.55 | 3 | 0.1538 % | 1,879.5 |

| OpRet | 4.87 % | -3.81 % | 140,288 | 0.08 | 15 | -0.1555 % | 2,306.9 |

| SplitShare | 6.37 % | -6.89 % | 271,118 | 0.08 | 2 | -0.3067 % | 2,108.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1555 % | 2,109.4 |

| Perpetual-Premium | 5.88 % | 5.83 % | 60,931 | 6.00 | 7 | -0.3065 % | 1,874.6 |

| Perpetual-Discount | 5.81 % | 5.88 % | 184,910 | 14.03 | 67 | -0.1012 % | 1,788.1 |

| FixedReset | 5.42 % | 3.75 % | 366,983 | 3.90 | 41 | 0.1056 % | 2,155.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BMO.PR.H | Perpetual-Discount | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 22.61 Evaluated at bid price : 23.36 Bid-YTW : 5.68 % |

| BAM.PR.J | OpRet | -1.46 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 26.41 Bid-YTW : 4.75 % |

| MFC.PR.B | Perpetual-Discount | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 6.02 % |

| CM.PR.R | OpRet | -1.37 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-01-06 Maturity Price : 25.60 Evaluated at bid price : 25.94 Bid-YTW : -5.24 % |

| GWO.PR.I | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 18.98 Evaluated at bid price : 18.98 Bid-YTW : 5.94 % |

| BMO.PR.K | Perpetual-Discount | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 23.33 Evaluated at bid price : 23.51 Bid-YTW : 5.62 % |

| PWF.PR.K | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 21.07 Evaluated at bid price : 21.07 Bid-YTW : 5.96 % |

| HSB.PR.D | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 22.21 Evaluated at bid price : 22.35 Bid-YTW : 5.70 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| PWF.PR.M | FixedReset | 212,750 | National Bank crossed two blocks at 27.25, of 200,000 and 10,000 shares. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 27.18 Bid-YTW : 3.90 % |

| SLF.PR.B | Perpetual-Discount | 79,596 | RBC crossed 60,000 at 20.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 20.02 Evaluated at bid price : 20.02 Bid-YTW : 6.01 % |

| TRI.PR.B | Floater | 75,000 | RBC crossed two blocks at 19.75, of 50,000 and 25,000 shares. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 2.01 % |

| TRP.PR.A | FixedReset | 73,585 | Scotia crossed 50,000 at 25.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.86 Bid-YTW : 3.80 % |

| SLF.PR.D | Perpetual-Discount | 62,748 | RBC crossed 60,000 at 18.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 5.96 % |

| BAM.PR.B | Floater | 56,648 | RBC crossed 50,000 at 13.06. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-07 Maturity Price : 13.06 Evaluated at bid price : 13.06 Bid-YTW : 3.04 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. | |||