Greece will probably be forced to request a financial rescue after a European Union aid pledge failed to stop Greek borrowing costs from surging, said economists at AXA Group and Nomura International Plc.

Greek bonds dropped for a seventh day today, driving up the yield on the 10-year security to 7.5 percent, with Prime Minister George Papandreou’s government needing to sell 11.6 billion euros ($15.4 billion) of debt by the end of May. The yield premium over benchmark German bonds widened to the most since the euro’s debut in 1999, based on Bloomberg generic data.

Let’s have a big hand for the newly Assiduous Reader mega56. Only been studying the pref market for twenty minutes and he’s already on the right track!

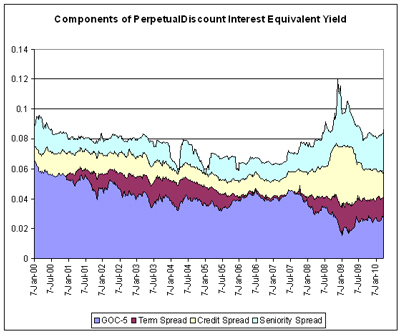

Regarding perpetuals and rising interest rates. I’ve read in many places that perpetuals are risky during a phase where rates are rising, stay away. When I’m looking at the numbers, I don’t see it.

Example: CM.PR.E currently sits at 22.43 @$1.40

a. if it gets called (worst), you’ve got a nice gain @25.00

b. if price drops with rising rates, you still get the dividendI’m missing the downside here.

Geez, at this rate he’ll be my competition in a few weeks!

There was some testimony to the Crisis Committee regarding Citigroup and CDOs:

Nobody could have predicted that the bank’s highest-rated collateralized debt obligations — created by repackaging mortgage bonds into new securities — would lose so much money, Prince said. The chief risk officer didn’t understand the risks, nor did Citigroup’s senior traders and bankers, he said.

“Everyone, including our risk managers, other banks and CDO structurers, all believed that these securities held virtually no risk,” Prince, 60, said. “It is hard for me to fault the traders who made the decisions to retain these positions on Citi’s books.”

Not so hard for me! Assiduous Readers will know that CDOs have been in the news quite a lot lately:Tranche Retention in the sub-prime CDO Market, The Story of the CDO Market Meltdown and Hull & White on AAA Tranches of Subprime. In the last paper, Hull & White demonstrated that CDO risk evaluation was faulty as the distributions of the risks of the securities held in the CDO were significantly different from the distributions of the risks of more normal instruments.

But it doesn’t matter. It really doesn’t matter. It happened this time and it will happen next time. Traders are business school smiley-boys, who have the job of quoting securities, rolling over their inventory, making the spread each time and telling the customer whatever he wants to hear. Whenever they suffer from delusions of intelligence, trouble ensues. Trading is different from investing and the two simply don’t mix very well. The key mistake at Citigroup – and elsewhere – was allowing traders to accumulate aged inventory, and not to impose a capital charge on this aged inventory.

The Ontario government’s plan to reduce generic drug costs has led DBRS to put Shoppers’ Drug Mart on review negative. With respect to the plan itself, I’m amused by the existence of trailer fees in the drug business:

Eliminating abuse of the system by ending so-called ‘professional allowances’ – payments generic drug companies make to pharmacy owners intended to fund patient services, but are instead being used by many pharmacies as rebates to fund fringe benefits, bonuses, overhead costs and boost profits

… but perplexed by …

Lowering the cost of generic drugs by at least 50%, to 25% of the cost of the original brand name drug for Ontario’s public drug system, private employer drug plans, and people who pay for drugs out-of-pocket, saving taxpayers millions

How is this possible? Is there no competition for generic drugs? Has the drug plan been run with no attempt to lower the price to whatever the manufacturers will bear? Or has the price been supported by a dispensing oligopoly? How on earth is it even possible to reduce costs by 50% by simple government fiat? Shoppers’ response to the plan has the amusing phrase:

Key tenants of these proposals included:

… indicating illiteracy, but no real arguments about the economics of the Ontario drug plan paying for, you know, drugs.

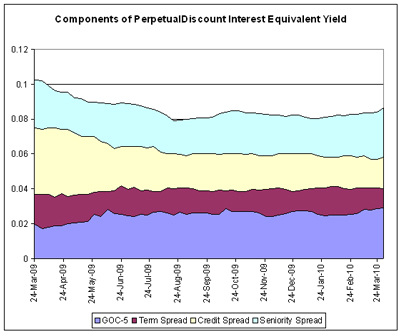

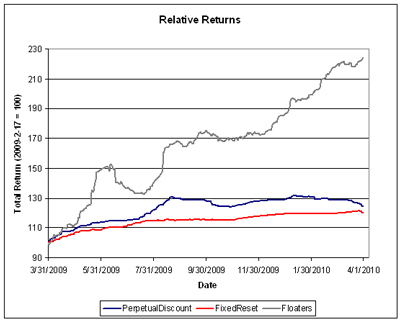

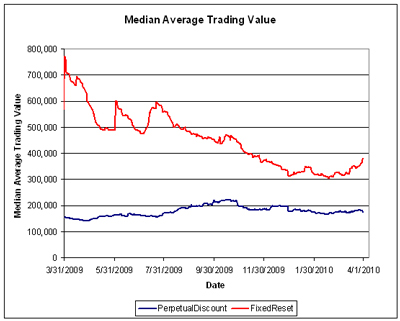

The Canadian preferred share market continued to see heavy trading today and, in a sharp reversal of recent experience, PerpetualDiscounts gained 50bp while FixedResets fell 25bp, bringing yields on the latter up to 3.83%. Good volatility is evident on the Performance highlights table; FixedResets continue to dominate volume.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.63 % | 2.67 % | 55,159 | 20.77 | 1 | 0.0000 % | 2,105.2 |

| FixedFloater | 4.89 % | 3.01 % | 46,671 | 20.15 | 1 | 0.6787 % | 3,234.8 |

| Floater | 1.91 % | 1.66 % | 45,775 | 23.43 | 4 | -0.0847 % | 2,419.1 |

| OpRet | 4.88 % | 3.58 % | 104,919 | 1.11 | 10 | 0.1050 % | 2,314.7 |

| SplitShare | 6.36 % | -2.41 % | 134,956 | 0.08 | 2 | 0.2197 % | 2,146.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1050 % | 2,116.5 |

| Perpetual-Premium | 5.86 % | 4.76 % | 33,713 | 15.90 | 2 | -0.1014 % | 1,838.8 |

| Perpetual-Discount | 6.23 % | 6.26 % | 190,379 | 13.57 | 76 | 0.4964 % | 1,709.4 |

| FixedReset | 5.45 % | 3.83 % | 433,559 | 3.67 | 43 | -0.2519 % | 2,176.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| RY.PR.L | FixedReset | -1.74 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 4.04 % |

| IAG.PR.F | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 23.12 Evaluated at bid price : 23.27 Bid-YTW : 6.44 % |

| RY.PR.I | FixedReset | -1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 25.96 Bid-YTW : 4.11 % |

| GWL.PR.O | Perpetual-Premium | -1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 24.56 Evaluated at bid price : 25.00 Bid-YTW : 4.76 % |

| GWO.PR.F | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 23.44 Evaluated at bid price : 23.75 Bid-YTW : 6.25 % |

| BAM.PR.B | Floater | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 17.57 Evaluated at bid price : 17.57 Bid-YTW : 2.25 % |

| CM.PR.H | Perpetual-Discount | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 19.12 Evaluated at bid price : 19.12 Bid-YTW : 6.30 % |

| PWF.PR.O | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 22.44 Evaluated at bid price : 22.55 Bid-YTW : 6.45 % |

| PWF.PR.H | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 22.23 Evaluated at bid price : 22.51 Bid-YTW : 6.39 % |

| NA.PR.M | Perpetual-Premium | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 24.04 Evaluated at bid price : 24.25 Bid-YTW : 6.18 % |

| TD.PR.O | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 20.21 Evaluated at bid price : 20.21 Bid-YTW : 6.02 % |

| POW.PR.A | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 21.63 Evaluated at bid price : 21.88 Bid-YTW : 6.43 % |

| BMO.PR.L | Perpetual-Discount | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 23.95 Evaluated at bid price : 24.16 Bid-YTW : 6.09 % |

| CM.PR.J | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 6.22 % |

| TD.PR.P | Perpetual-Discount | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 21.27 Evaluated at bid price : 21.55 Bid-YTW : 6.09 % |

| BMO.PR.H | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 21.90 Evaluated at bid price : 21.90 Bid-YTW : 6.15 % |

| CM.PR.G | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 21.60 Evaluated at bid price : 21.60 Bid-YTW : 6.27 % |

| IAG.PR.E | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 23.62 Evaluated at bid price : 23.80 Bid-YTW : 6.35 % |

| ELF.PR.F | Perpetual-Discount | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 19.20 Evaluated at bid price : 19.20 Bid-YTW : 6.95 % |

| PWF.PR.L | Perpetual-Discount | 1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 20.01 Evaluated at bid price : 20.01 Bid-YTW : 6.39 % |

| BNS.PR.J | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 21.60 Evaluated at bid price : 21.60 Bid-YTW : 6.10 % |

| RY.PR.B | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 6.09 % |

| CM.PR.I | Perpetual-Discount | 1.95 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 18.86 Evaluated at bid price : 18.86 Bid-YTW : 6.25 % |

| BNS.PR.O | Perpetual-Discount | 2.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 22.85 Evaluated at bid price : 23.00 Bid-YTW : 6.10 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.K | FixedReset | 112,275 | National bought blocks of 12,000 and 10,000 from GMP at 27.61; Nesbitt bought blocks of 25,000 and 23,000 from GMP at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 3.80 % |

| MFC.PR.D | FixedReset | 80,115 | Desjardins crossed two blocks of 25,000 shares, one at 27.85, the other at 27.84. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 27.77 Bid-YTW : 3.93 % |

| RY.PR.Y | FixedReset | 76,932 | RBC crossed 15,000 and 30,000, both at 27.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 27.61 Bid-YTW : 3.90 % |

| RY.PR.A | Perpetual-Discount | 76,810 | Nesbitt crossed 50,000 at 18.65. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-08 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 6.06 % |

| TD.PR.I | FixedReset | 72,985 | Nesbitt bought 25,200 from Raymond James at 27.65; anonymous crossed (?) 10,000 at 27.51. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.36 Bid-YTW : 3.83 % |

| BNS.PR.X | FixedReset | 70,160 | RBC crossed 50,000 at 27.40; Desjardins crossed 10,000 at 27.42. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 3.72 % |

| There were 55 other index-included issues trading in excess of 10,000 shares. | |||