If Dealbreaker is anything to go by – and I think it is – the latest plan to stimulate an artificial market for highly illiquid and distressed securities will go the way of all the others:

Is it not enough that we are already providing what are effectively failed institutions unbearably low cost capital while the likes of Berkshire Hathaway must wallow in high rates?

It is more than despicable that, now that the PPIP looks like it may be an abject failure even before bids have hit the screens, we should see the attempt to throw the problem onto the “dumb money” of the retail investor, while collecting fees, we might add.

Dealbreaker also brings to my attention an adulatory piece on Bernanke’s management style. Bernanke amazes me. There he was, an academic with experience on the board of the Fed, quietly doing his research on the Depression … normally he could look forward to a life of rewarding work and the the respect of a few dozen of his colleagues who knew and understood what he was talking about. Suddenly, he’s in the hotseat, doing the job he’s been training to do all his life, knowing that every decision he makes will be fodder for academia for the next hundred years … lucky man! And we’re lucky to have him.

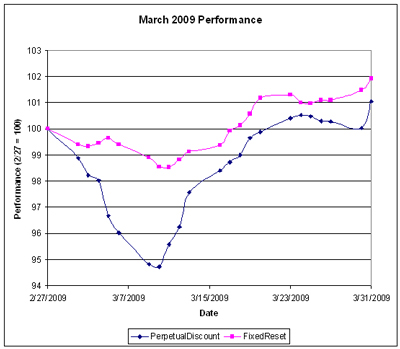

Another strong day on the market with increasing volume, particularly among the Fixed-Resets. PerpetualDiscounts are now up 4.26% on the month, while FixedResets are up 2.40%. Average Trading Volume of the former continues its gradual decline, but I see no reason to panic as yet. Who knows, maybe some people simply gave up trading for Lent!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.8015 % | 911.5 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.8015 % | 1,474.1 |

| Floater | 5.35 % | 5.31 % | 67,900 | 15.01 | 2 | 0.8015 % | 1,138.7 |

| OpRet | 5.17 % | 4.70 % | 143,609 | 3.89 | 15 | 0.4171 % | 2,103.9 |

| SplitShare | 6.83 % | 11.72 % | 46,430 | 5.66 | 3 | 0.5836 % | 1,691.3 |

| Interest-Bearing | 6.11 % | 8.52 % | 29,038 | 0.70 | 1 | 0.2041 % | 1,951.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5891 % | 1,581.0 |

| Perpetual-Discount | 6.90 % | 7.02 % | 148,852 | 12.61 | 71 | 0.5891 % | 1,456.1 |

| FixedReset | 6.03 % | 5.58 % | 677,712 | 13.43 | 35 | 0.3419 % | 1,868.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BMO.PR.H | Perpetual-Discount | -1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 6.83 % |

| TCA.PR.Y | Perpetual-Discount | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 44.57 Evaluated at bid price : 46.02 Bid-YTW : 6.06 % |

| POW.PR.C | Perpetual-Discount | -1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 19.63 Evaluated at bid price : 19.63 Bid-YTW : 7.45 % |

| HSB.PR.C | Perpetual-Discount | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 7.16 % |

| CM.PR.I | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 16.71 Evaluated at bid price : 16.71 Bid-YTW : 7.06 % |

| TD.PR.A | FixedReset | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 22.82 Evaluated at bid price : 22.86 Bid-YTW : 4.41 % |

| SLF.PR.B | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 16.83 Evaluated at bid price : 16.83 Bid-YTW : 7.21 % |

| TD.PR.C | FixedReset | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 24.49 Evaluated at bid price : 24.54 Bid-YTW : 4.87 % |

| IAG.PR.C | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 22.74 Evaluated at bid price : 22.79 Bid-YTW : 5.99 % |

| TD.PR.S | FixedReset | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 22.24 Evaluated at bid price : 22.31 Bid-YTW : 4.16 % |

| CM.PR.D | Perpetual-Discount | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 20.55 Evaluated at bid price : 20.55 Bid-YTW : 7.02 % |

| CIU.PR.B | FixedReset | 1.44 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 26.79 Bid-YTW : 5.21 % |

| NA.PR.L | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 17.61 Evaluated at bid price : 17.61 Bid-YTW : 6.89 % |

| RY.PR.I | FixedReset | 1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 23.31 Evaluated at bid price : 23.35 Bid-YTW : 4.34 % |

| CM.PR.A | OpRet | 1.57 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-05-09 Maturity Price : 25.50 Evaluated at bid price : 25.92 Bid-YTW : -17.52 % |

| RY.PR.A | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 18.06 Evaluated at bid price : 18.06 Bid-YTW : 6.27 % |

| TD.PR.Y | FixedReset | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 22.44 Evaluated at bid price : 22.50 Bid-YTW : 4.25 % |

| BAM.PR.K | Floater | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 8.04 Evaluated at bid price : 8.04 Bid-YTW : 5.49 % |

| ELF.PR.F | Perpetual-Discount | 1.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 15.40 Evaluated at bid price : 15.40 Bid-YTW : 8.68 % |

| BAM.PR.N | Perpetual-Discount | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 13.85 Evaluated at bid price : 13.85 Bid-YTW : 8.68 % |

| CM.PR.H | Perpetual-Discount | 1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 17.24 Evaluated at bid price : 17.24 Bid-YTW : 6.99 % |

| RY.PR.W | Perpetual-Discount | 1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 19.19 Evaluated at bid price : 19.19 Bid-YTW : 6.50 % |

| PWF.PR.G | Perpetual-Discount | 1.95 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 7.07 % |

| BNA.PR.C | SplitShare | 2.12 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 12.51 Bid-YTW : 14.07 % |

| MFC.PR.C | Perpetual-Discount | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 7.04 % |

| W.PR.J | Perpetual-Discount | 2.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 20.45 Evaluated at bid price : 20.45 Bid-YTW : 6.90 % |

| NA.PR.M | Perpetual-Discount | 2.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 21.91 Evaluated at bid price : 22.00 Bid-YTW : 6.82 % |

| POW.PR.B | Perpetual-Discount | 2.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 7.20 % |

| PWF.PR.F | Perpetual-Discount | 2.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 18.95 Evaluated at bid price : 18.95 Bid-YTW : 6.95 % |

| IAG.PR.A | Perpetual-Discount | 2.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 15.20 Evaluated at bid price : 15.20 Bid-YTW : 7.65 % |

| MFC.PR.B | Perpetual-Discount | 2.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 16.81 Evaluated at bid price : 16.81 Bid-YTW : 7.01 % |

| BAM.PR.M | Perpetual-Discount | 3.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 14.06 Evaluated at bid price : 14.06 Bid-YTW : 8.55 % |

| BAM.PR.J | OpRet | 3.73 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 20.02 Bid-YTW : 8.72 % |

| POW.PR.D | Perpetual-Discount | 4.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 17.85 Evaluated at bid price : 17.85 Bid-YTW : 7.06 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSB.PR.E | FixedReset | 129,912 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : 6.51 % |

| MFC.PR.D | FixedReset | 104,139 | TD bought 19,800 from National Bank at 25.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 6.47 % |

| GWO.PR.J | FixedReset | 95,400 | TD crossed 75,000 at 24.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-09 Maturity Price : 24.96 Evaluated at bid price : 25.01 Bid-YTW : 5.15 % |

| TD.PR.K | FixedReset | 93,535 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.36 Bid-YTW : 5.99 % |

| BNS.PR.X | FixedReset | 88,800 | RBC crossed 20,000 at 25.72, then another 10,000 at the same price. National crossed 10,000 at 25.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 25.53 Bid-YTW : 5.74 % |

| RY.PR.X | FixedReset | 82,370 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.41 Bid-YTW : 5.96 % |

| There were 35 other index-included issues trading in excess of 10,000 shares. | |||