Covered bonds are seeing increased issuance:

About $5.7 billion of the securities have been sold or are being marketed this week worldwide, almost double last week’s volume, data compiled by Bloomberg show. Bank of Montreal, Canada’s fourth-largest bank, sold $2 billion of the bonds due in 2015.

…

The increase in covered bond sales contrasts with a decline in issuance for corporate debt, which fell to $70 billion last month, less than half April’s tally and the least since 2003.

It’s a nice trend, one that I hope continues and widens. It would be very nice if, for instance, long bonds secured by long lived assets (real-estate, etc.) were more available. The pendulum has swung too far in favour of companies’ equity holders.

The BMO Covered Bonds were USD, private placement, five-year, 2.85% coupon. Sounds good? Tough luck, Charlie, the regulators are protecting you from them.

Despite the above strengths, the Covered Bonds have the following challenges. First, a weakened housing market in Canada could result in higher defaults and loss severities than the assumptions used for credit protection assessment. This risk is significantly mitigated by the mortgage insurance covering principal and interest provided by AAA-rated CMHC. Second, BMO may be required to add mortgages to maintain the Cover Pool, incurring substitution and potential credit deterioration risk. These risks are mitigated by the mortgage insurance provided by CMHC and the ongoing monitoring of the Cover Pool to ensure the overcollateralization available (at least 3% as of May 31, 2010) is commensurate with the AAA rating assigned. Third, there is an inherent liquidity gap between the scheduled repayments of the Covered Bonds and the repayment of underlying mortgage loans over time. This risk is mitigated by the overcollateralized Cover Pool, the buildup of a reserve fund if BMO’s rating falls below A (low) or R-1 (middle) and the extendible maturity date for 12 months upon a default by BMO. Lastly, there is no specific covered bond legislative framework in Canada. This risk is mitigated by the contractual obligations of the transaction parties, supported by the well developed commercial and bankruptcy laws in Canada, satisfactory opinions provided by legal counsel to BMO and a generally creditor-friendly legal environment in Canada.

The legal framework problem is alleged to be under review, as discussed on PrefBlog on March 9 and by Ogilvy Renault, inter alia.

The SEC’s Market Structure Roundtable kicked off with a speech by Mary Shapiro:

Our roundtable is also informed by a more recent event: the severe, albeit brief, market disruption of May 6. For 20 minutes that afternoon, U.S. financial markets failed to execute their essential price discovery function, experiencing a decline and recovery that was unprecedented in its speed and scope. That period of fluctuating prices both directly harmed investors who traded based on flawed price discovery signals and undermined investors’ faith in the integrity and fairness of the markets

Her first conclusion – of direct harm – is a little hard to follow. There were two types of traders who traded during that period: value investors and idiots. The former made money. Shouldn’t we consider harm to idiots to be a good thing? I haven’t seen many signs of undermined faith, either. Meanwhile, Luis Aguilar appears to be lobbying for a post-SEC job as “investor advocate”.

On February 5 I discussed a form of solar power that actually has a chance of being more than a feel-good exercise; now, another method is attracting attention:

“We’ve produced tens of thousands of gallons, and by the end of 2010, I hope I can say we’ve produced hundreds of thousands,” [Solazyme cofounder] Wolfson, 39, says. “In the next two years, we should get the cost down to the $60 to $80-a-barrel range.”

At that price, Solazyme’s algae fuel would compete with $80-a-barrel oil.

…

Algae proponents differ on growing methods. Open ponds, the choice of most researchers, rely on photosynthesis. Algae grow and fill with oil as they use sunlight to convert carbon dioxide into sugar and chemical energy. Ponds, though, can get infested by pesky, low-oil native organisms or become the targets of microscopic aquatic creatures.Solazyme is trying fermentation, producing its algae without light in metal vats. This requires adding sugar or other feedstock before the algae are dried and the oil extracted.

There’s hope for the world yet, evidenced by attitudes towards greenwashing:

When asked for their reasons for not living more greenly, 46 per cent of Canadians cited their belief that companies are “greenwashing,” lying about or exaggerating their products’ environmental sustainability. This cynicism beat out cost and inconvenience as reasons for not helping the environment.

… smoking …:

In the new survey, 13 per cent of people in Grades 10 to 12 called themselves current smokers, up from 11 per cent during the previous survey period. While only 3 per cent of those in Grades 6 to 9 called themselves current smokers, unchanged from 2006-2007, that number rose from 2 per cent in 2004-2005.

“It is a troubling development,” [senior policy analyst at the Canadian Cancer Society] Mr. [Rob] Cunningham said. “The overwhelming majority of smokers begin as teens or preteens.”

… and Facebook …:

Privacy concerns don’t seem to have scared Canadians off Facebook.

…

More than 912,000 Canadians signed up for the site last month, a six-per-cent increase in membership.

Good, bad, indifferent … diversity of views and rejection of preaching platitudes can only be a good thing.

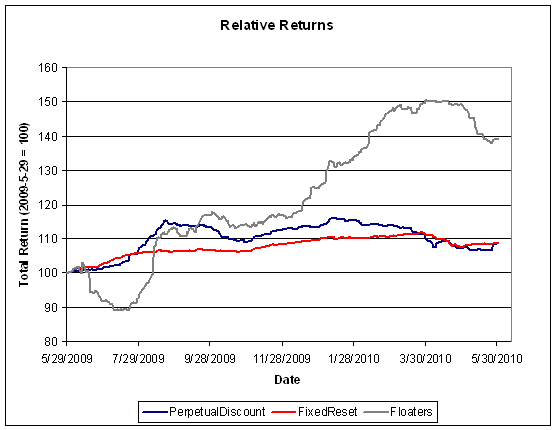

There was another strong advance in the Canadian preferred share market, this time on moderate volume, as PerpetualDiscounts gained 50bp and FixedResets were up 6bp. There were no losers on the performance table and PerpetualDiscounts dominated the volume highlights.

The Financial Post’s block trade reporter continues to be inoperable.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

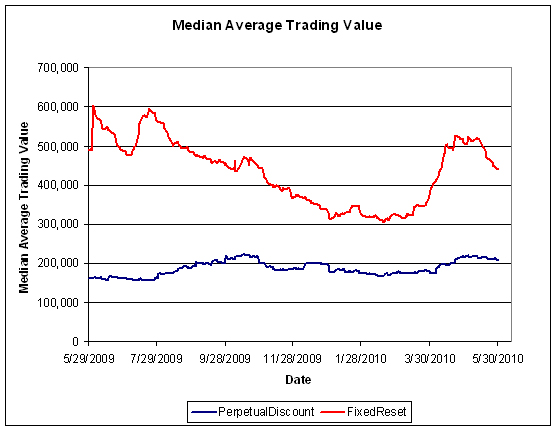

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.62 % | 2.75 % | 44,240 | 20.87 | 1 | 0.2326 % | 2,122.2 |

| FixedFloater | 5.19 % | 3.26 % | 29,101 | 19.98 | 1 | 0.9634 % | 3,084.9 |

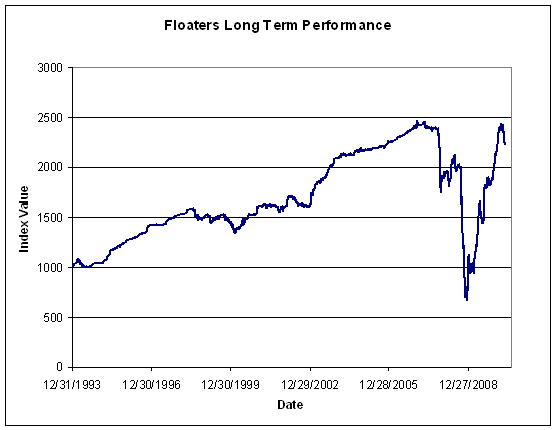

| Floater | 2.41 % | 2.80 % | 92,327 | 20.18 | 3 | 0.0734 % | 2,241.3 |

| OpRet | 4.89 % | 3.86 % | 96,796 | 2.82 | 11 | 0.1561 % | 2,310.7 |

| SplitShare | 6.45 % | 5.64 % | 106,497 | 0.08 | 2 | -0.0667 % | 2,150.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1561 % | 2,112.9 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4975 % | 1,843.0 |

| Perpetual-Discount | 6.15 % | 6.22 % | 206,512 | 13.61 | 77 | 0.4975 % | 1,744.5 |

| FixedReset | 5.47 % | 4.25 % | 424,071 | 3.52 | 45 | 0.0580 % | 2,160.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNS.PR.L | Perpetual-Discount | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 19.13 Evaluated at bid price : 19.13 Bid-YTW : 5.97 % |

| CM.PR.D | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 23.45 Evaluated at bid price : 23.75 Bid-YTW : 6.13 % |

| PWF.PR.L | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 20.41 Evaluated at bid price : 20.41 Bid-YTW : 6.34 % |

| CM.PR.G | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 21.71 Evaluated at bid price : 22.04 Bid-YTW : 6.20 % |

| CM.PR.P | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 22.37 Evaluated at bid price : 22.80 Bid-YTW : 6.09 % |

| SLF.PR.E | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 18.08 Evaluated at bid price : 18.08 Bid-YTW : 6.24 % |

| W.PR.H | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 6.51 % |

| SLF.PR.C | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 17.86 Evaluated at bid price : 17.86 Bid-YTW : 6.24 % |

| PWF.PR.G | Perpetual-Discount | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 23.44 Evaluated at bid price : 23.70 Bid-YTW : 6.30 % |

| PWF.PR.E | Perpetual-Discount | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 21.85 Evaluated at bid price : 22.10 Bid-YTW : 6.30 % |

| POW.PR.A | Perpetual-Discount | 1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 22.60 Evaluated at bid price : 22.85 Bid-YTW : 6.22 % |

| PWF.PR.F | Perpetual-Discount | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.31 % |

| ENB.PR.A | Perpetual-Discount | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 23.36 Evaluated at bid price : 23.65 Bid-YTW : 5.84 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.S | FixedReset | 111,335 | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.71 Bid-YTW : 4.23 % |

| CM.PR.J | Perpetual-Discount | 101,612 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 18.40 Evaluated at bid price : 18.40 Bid-YTW : 6.20 % |

| ELF.PR.F | Perpetual-Discount | 84,200 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 19.30 Evaluated at bid price : 19.30 Bid-YTW : 7.00 % |

| CM.PR.H | Perpetual-Discount | 71,310 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 19.53 Evaluated at bid price : 19.53 Bid-YTW : 6.23 % |

| SLF.PR.A | Perpetual-Discount | 57,925 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 18.94 Evaluated at bid price : 18.94 Bid-YTW : 6.28 % |

| CM.PR.I | Perpetual-Discount | 54,470 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-03 Maturity Price : 19.24 Evaluated at bid price : 19.24 Bid-YTW : 6.20 % |

| There were 26 other index-included issues trading in excess of 10,000 shares. | |||