So let’s review the story so far:

The SEC Report blames Waddell Reed, a mutual fund company; although they were not named there is widespread agreement that it was their order to sell 75,000 eMini contracts as a market order that swamped the liquidity available on a nervous day.

CFTC Chairman Gary Gensler takes this as an indication the executing broker should have refused or adjusted the trade and is musing about increased regulation that would force brokers to take responsibility for their clients’ orders. I think this is just craziness.

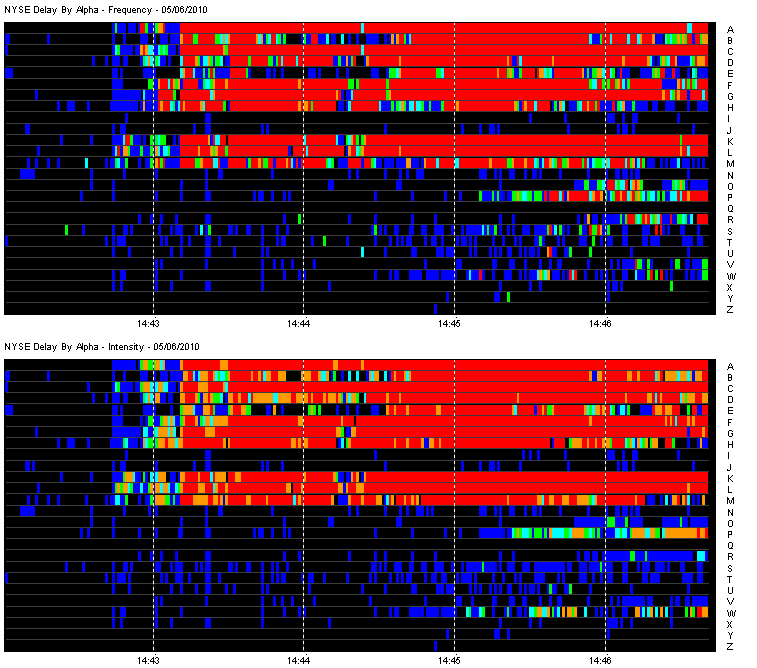

Nanex is sticking to its original hypothesis, that the Flash Crash was caused by malignant quote stuffing. I am prepared to accept that this should be investigated further; not that I think the possible quote-stuffing was the trigger-factor, but it is possible that a predatory algorithm did it in order to make a bad situation worse for its own advantage.

Now there are some new snippets: Dave Cummings, Owner & Chairman, Tradebot Systems, Inc. doesn’t mince words: Waddell Stupidity Caused Crash:

Wow! Who puts in a $4.1 billion order without a limit price? The trader at Waddell & Reed showed historic incompetence.

…

The execution of this sell program resulted in the largest net change in daily position of any trader in the E-Mini since the beginning of the year.

…

The trader could have easily put a price limit on the order, but recklessly chose not to. The Sell Algorithm performed exactly as it was designed. It angers me when people blame technology for what are clearly lapses in human judgment.

…

“We did what our fund shareholders rightly would expect of us. There is no evidence to suggest that our trades disrupted the market on May 6,” the company said in a letter to its financial advisers.

…

Their shareholders probably lost $100 million that day (versus a reasonable execution 3% higher).

…

After the flash crash but before the CFTC/SEC report came out, Waddell executives were unloading stock in their company. According to SEC filings, Waddell CEO Henry Herrmann sold $2,455,000 and Ivy Asset Strategy Fund Manager Michael Avery dumped $273,600.

Themis, however, has singled out the internalizers for special opprobrium:

Internalizers, a term the SEC is using in its Flash Crash Report, handle individual investor retail market orders.

(For example, you can look on Ameritrade’s 606 report for Q2 2010, and see that 83% of market orders are sold to Citadel for about .0015/share on average.)

Typically, the internalizer then takes the other side of the trade for “a very large percentage” of this flow. On May 6th, the SEC found that there was a departure from this practice (see page 58 of the SEC Report). As the market was falling dramatically, the internalizers (we don’t know which internalization firms the SEC is referring to) continued to short stock to retail market buy orders, but they dramatically stopped internalizing retail market sell orders, and instead flooded the public market with those orders. When the market stopped falling, and rose dramatically almost as quickly as it fell, the internalizers reversed that pattern, and internalized retail sell market orders, and flooded the public market with retail market buy orders. To restate this plainly, the internalizers used their speed advantages to pick and choose for its P/L which orders it wanted to take the other side of. For the ones they did not wish to take the other side of, they routed them to the markets as riskless-principal trades. The practice not only strikes us as patently unfair, but the number of orders that flooded the marketplace was massive. As such it caused data integrity issues (widening the difference between speeds of the CQS public data and the co-located data), further perpetuating the downward cycle in the marketplace.

So let’s take a look at page 58 of the report:

For instance, some OTC internalizers reduced their internalization on sell-orders but continued to internalize buy-orders, as their position limit parameters were triggered. Other internalizers halted their internalization altogether. Among the rationales for lower rates of internalization were: very heavy sell pressure due to retail market and stop-loss orders, an unwillingness to further buy against those sells, data integrity questions due to rapid prices moves (and in some cases data latencies), and intra-day changes in P&L that triggered predefined limits.

Themis’ argument is not only unsupported by the facts as we know them, but reflects a rather bizarre view of the role of internalizers. It is not the responsibility of internalizers to sterilize the market impact of their clients’ orders. It is not the responsibility of internalizers to buy whatever’s thrown at them in a crisis situation. Internalizers exist to make money for their shareholders, full stop.

Even if they had been picking and choosing which orders to satisfy to execute their view of the market – what of it? Nothing illegal with that and nothing wrong with that.

Themis closes by squaring its rot for a good boo-hoo-hoo:

Retail investors were clearly the biggest loser on May 6th. They trusted that their brokers would execute their orders in a fair and efficient manner. However, considering that half of all broken trades were retail trades, and that the arbitrary cutoff was 60% away from pre flash crash levels, the retail investor ended up paying the highest price for the structural failings of our market.

The brokers did, in fact, execute their orders in a fair and eficient manner. These were market orders, the internalizers could not, or would not, equal or beat the external public markets, so they passed them on. While I may be incorrect, I don’t believe the internalizers offer any advice at all: they simply execute orders. Their clients – whether they are direct retail clients of the internalizer, or small brokerages that have contracted for execution services – have explicitly decided they don’t want costly advice.

The “structural failings of our market” is just another bang at the Themis drum. There is no evidence whatsoever that structural failings had anything to do with the Flash Crash – there was simply a large market order that swamped available liquidity. Additionally, it was the clients themselves who decided to put in Stop-Loss orders, as I assume most of these things were. If these clients want to put in the World’s Dumbest Order Type, because they read about “protecting your profits” on the Internet, they have only themselves to blame.

Not satisfied with blaming internalizers, Themis continues with Another May 6th Villain – “Hot Potato” Volume:

Chairman Gensler is acknowledging what we have said repeatedly: volume does not equal liquidity. Our marketplace has become addicted to “hot potato volume”; in fact, we have become hostage to it.

…

Were HFT firms churning and playing “hot potato” to such an extreme extent, such that they were skewing volume statistics and unnecessarily (and harmfully) driving up volume? In the May 6th E-mini contract example, much has been made about the size of the trade. While it may be true that this was a large trade, shouldn’t the market have been able to absorb a 9% participation rate? In addition, let us dissect the 75,000 contract E-Mini sell order. Only 35,000 of those contracts were sold on the way down; the remaining 40,000 were sold in the rebounding tape. Also, of the 35,000 contracts sold in the down tape, only 18,000 of them were executed aggressively and the remaining 17,000 contracts were executed passively (see footnote 14 on page 16 of the CFTC/SEC report).

…

This “hot potato” volume is also very similar to what is known as “circular trading”. Circular trading is rampant in India and their regulators have been grappling with it for years. Circular trades happen when a closely knit set of market participants, mainly brokers, buy and sell shares frequently among themselves to effect a security price. These trades do not represent a change in ownership of the security. They are simply being passed back and forth to create the illusion of price movement and volume. “Hot potato” volume is not something that should be just overlooked as harmless since it is only HFT’s trading with each other. Their volume drives institutional decisions, albeit less so going forward, we hope. Most damaging though, is that hot potato volume lulls everyone into an illusion of healthy markets possessing liquidity, when in fact the markets have become shelled out and hollow.

Naturally, if the hot-potato volume was actually the result of collusion between the HFTs, they would be guilty of market manipulation. But there is no evidence that they colluded – as far as is known, each one was trading as principal, trying to squeeze a profit out of a wild marketplace. Themis has been banging its drum for so long they’ve started “lawyering” the markets, rather than “judging” them – lawyers, of course, being paid to find any scrap of possibility that would help their case.

Update: Meanwhile the SEC ponders regulating trading decisions:

Although regulators have rolled out a program to help give a company’s stock a reprieve if it is in freefall, Schapiro said that more needed to be done.

“We really need to do a deeper dive,” Schapiro said at Fortune’s Most Powerful Women Summit. “We are looking at whether these algos ought to have some kind of risk management controls.”

Scott Cleland blames automated index trading:

Simply, automated index trading technology inherently makes financial markets much more crash/crisis-prone than less, because it inherently creates disastrously inefficient market outcomes, where in certain conditions, markets can not possibly clear in a fair and orderly manner.

- That’s because systemic automated index trading technology by design creates near-instantaneous one-way feedback loops, that when done by enough traders naturally concentrates market momentum in only one direction, creating the disastrous conditions where there is no one else in the market capable or willing to take the other side of all these systemic out-for control automated index trades.

That sounds very fishy. Details, please!

He also blames mass indexing:

Regulators and Congress have yet to confront sufficiently the dark side of systemic automated index trading which is highly prone in certain conditions, to create a huge automated “falling-knife-dynamic” which no one can possibly catch on the way down.

- Unfortunately, regulators continue to have a crash-prone bias for maximizing trade transactional speed efficiency, rather than focusing first and foremost on the critical importance of true market efficiency, which is ensuring that markets can clear in an orderly manner and not be manipulated by speculation like automated index trading.

- This regulator blind spot that mass indexing is largely benign, “efficient” and productive, ignores increasing evidence that it is destructive and a predictable recipe for contributing to market failure, like it did in both the Financial Crisis and the Flash Crash.

The link has a provocative abstract, anyway:

Trillions of dollars are invested through index funds, exchange-traded funds, and other index derivatives. The benefits of index-linked investing are well-known, but the possible broader economic consequences are unstudied. I review research which suggests that index-linked investing is distorting stock prices and risk-return tradeoffs, which in turn may be distorting corporate investment and financing decisions, investor portfolio allocation decisions, fund manager skill assessments, and other choices and measures. These effects may intensify as index-linked investing continues to grow in popularity.

Well, sure. It’s well known that correlations are increasing. I think it’s wonderful! If ABC goes up 1% for no other reason than DEF went up 1% … that’s a trading opportunity! As indexing proportions go up, the profitability of the little known technique of “thinking about what you’re doing” goes up, attracting new entrants and driving the indexing proportion down.

But as Mr. Cleland states:

- At core, all the major trends are concentrating more and more financial resources in the market in fewer and fewer hands, with shorter and shorter time horizons, with more and more automation, and predicated on fewer and fewer core inputs.

- In other words, information technology efficiencies create unprecedented concentration of money flows that now try to pirouette immediately around on an unprecedented concentration of key external variables.

- Simply, more people and more money are betting on fewer and fewer core market variables so the automated efficiencies of information technology are blurring the distinction between the indexing “herd” and the “market” itself.

- The out-of-control use of indexing, means the index herd is a bigger and dumber herd of lemmings that collectively can run off a cliff faster and more efficiently than any supposed market-efficient counter-force that could possibly bring the market into equilibrium.

…

It is worth noting that John Bogle, Vanguard’s Founder, and the “father’ of index investing, called my 6-11-09 thesis that indexing was one of the root causes of the Financial Crisis — “nuts.”

…

At some point in the not too distant future, regulators and Congress will have to confront the unpleasant and increasingly undeniable reality that the capital markets that everyone depends on for capital formation, wealth creation, economic growth and job creation are no longer working as designed and as necessary, but have been hijacked by the mindless lemming herd of automated indexers that somehow all blindly still believe that others can still carry them all to value creation long term.

- Arbitrage can work when a few do it, but not when the arbitrageurs collectively and effectively become the market itself.