Gregg Berman of the SEC has contradicted Nanex:

There is no indication thus far that “one or more parties flooded the market with quotes” to cause delays in exchange feeds that list stock prices,Gregg Berman, a senior adviser to the SEC’s trading and markets division, said today at a Washington meeting to discuss the May 6 plunge.

Berman’s comments were at odds with speculation by Nanex LLC, a market-data provider, which said high-frequency traders destabilized New York Stock Exchange trading by submitting and then canceling thousands of rapid-fire orders.

OK, Mr. Berman, you say there’s no evidence that there was quote-stuffing to destabilize the markets. Fair enough. But (a) do you agree that a very high volume of orders led to delays in the tape? and (b) If so, what is your explanation?

And, of course, the booHooHoo brigade is fighting for the rights of twerps from good schools to make a fat living:

Brooksley Born, a former CFTC chairman serving on the panel advising the agencies, said investor confidence has been eroded by concerns that high-frequency traders have better access to markets and information.

Born said she sees “major problems” with the level of order cancellations by high-frequency traders. She said she’s worried that some firms submit “fraudulent” quotes to get a sense of where asset prices are heading.

…

Regulators should consider placing restrictions on algorithmic transactions and limiting how many contracts a single firm can trade, said CFTC Commissioner Bart Chilton. Permitting high-frequency traders to buy and sell 10 percent of a market 10 times in 10 seconds doesn’t seem to provide any benefit to financial markets, he said.“It seems there is a good argument that this type of trading is, in essence, parasitical trading,” Chilton said. “Given what we saw on May 6th, appropriate limits on financial futures and robotic algos seems warranted.”

Um … why should you care whether any benefit is provided to financial markets? Isn’t your job to ensure there is no harm done to the financial markets? It’s a totally different mind-set. It’s too bad Chilton didn’t let the rest of us know what the “good argument” is. And by the way, Ms. Born, in what way are the quotes submitted “fraudulent”?

One semi-legitimate worry is the idea that momentum trading causes negative convexity:

Robert Cook, director of the SEC’s trading and markets unit, said regulators are examining how brokers and other firms create algorithms, how they test the computer programs and what information is disclosed to customers about how they work. An SEC task force began looking at algorithm use before the crash, and it is an area of “further inquiry,” Cook said.

Regulators are also examining whether a firm’s algorithm could “cascade,” causing executions to affect market prices in ways that trigger further action by the computerized-trading system, said Andrei Kirilenko, a senior economist at the CFTC.

… but frankly I don’t see how that becomes an SEC problem. The Nanex critique of the SEC report has been discussed on PrefBlog.

It was another hot day on heavy volume for the Canadian preferred share market, with PerpetualDiscounts gaining 24bp and FixedResets up 3bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2961 % | 2,208.8 |

| FixedFloater | 4.89 % | 3.48 % | 25,289 | 19.22 | 1 | 1.2762 % | 3,436.9 |

| Floater | 2.70 % | 2.37 % | 57,000 | 21.32 | 4 | 0.2961 % | 2,384.9 |

| OpRet | 4.79 % | 2.85 % | 81,355 | 1.88 | 9 | -0.0297 % | 2,392.4 |

| SplitShare | 5.84 % | -13.63 % | 66,403 | 0.09 | 2 | 0.1614 % | 2,410.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0297 % | 2,187.6 |

| Perpetual-Premium | 5.62 % | 5.03 % | 166,311 | 3.09 | 24 | 0.1132 % | 2,025.0 |

| Perpetual-Discount | 5.32 % | 5.34 % | 258,068 | 14.87 | 53 | 0.2447 % | 2,048.7 |

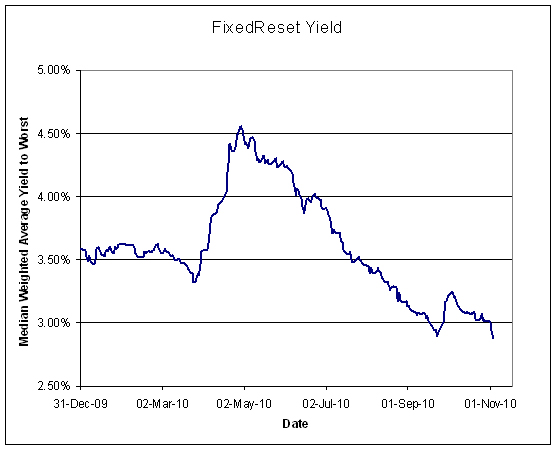

| FixedReset | 5.19 % | 2.86 % | 340,951 | 3.22 | 50 | 0.0272 % | 2,293.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -1.08 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-12-05 Maturity Price : 25.50 Evaluated at bid price : 26.52 Bid-YTW : -32.90 % |

| SLF.PR.A | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 21.97 Evaluated at bid price : 22.35 Bid-YTW : 5.36 % |

| BAM.PR.G | FixedFloater | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 25.00 Evaluated at bid price : 22.22 Bid-YTW : 3.48 % |

| SLF.PR.B | Perpetual-Discount | 2.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 22.62 Evaluated at bid price : 22.81 Bid-YTW : 5.32 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.P | FixedReset | 224,830 | Nesbitt crossed blocks of 112,700 and 100,000, both at 26.59. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-25 Maturity Price : 25.00 Evaluated at bid price : 26.59 Bid-YTW : 2.37 % |

| RY.PR.I | FixedReset | 104,625 | TD crossed 97,700 at 26.62. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 2.79 % |

| SLF.PR.D | Perpetual-Discount | 65,456 | Nesbitt crossed two blocks of 25,000 each, both at 21.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 5.37 % |

| BAM.PR.T | FixedReset | 65,435 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 23.09 Evaluated at bid price : 25.00 Bid-YTW : 4.17 % |

| MFC.PR.B | Perpetual-Discount | 50,784 | TD crossed 25,000 at 21.41. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 21.35 Evaluated at bid price : 21.35 Bid-YTW : 5.53 % |

| BMO.PR.K | Perpetual-Discount | 46,345 | TD crossed 25,000 at 24.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-05 Maturity Price : 24.58 Evaluated at bid price : 24.82 Bid-YTW : 5.29 % |

| There were 54 other index-included issues trading in excess of 10,000 shares. | |||