Jobs, jobs … whoopsy!:

The labor market appears to be stalling.

The economy added only 22,000 jobs in August, well below the number that forecasters had expected. That suggests employers’ appetite for new recruits has faded markedly in the last several months.

The unemployment rate rose very slightly to 4.3 percent, and wages grew at 3.7 percent over the past year, the lowest growth since July 2024.

…

With revisions, the labor market now appears to have lost 13,000 jobs in June, the first negative number since December 2020. In total, numbers for the previous two months were revised down by 21,000 jobs.

Meanwhile, in the frozen north:

The Canadian economy shed 66,000 jobs in August and the unemployment rate jumped to 7.1 per cent, the latest signs that the labour market is reeling from prohibitive U.S. tariffs.

Outside of the pandemic, the unemployment rate now resides at the highest level since 2016, Statistics Canada said Friday in a report, rising from 6.9 per cent in July. The numbers show that the bulk of job losses in August were in part-time work.

…

The data also suggested a more concerning trend: that employment decreases have spread beyond manufacturing and resources – directly hit by tariffs – to the broader service sector. In particular, the professional and scientific sectors saw 26,000 job losses, or a 1.3-per-cent decline in employment.

…

Returning students are facing the worst job market in 16 years (excluding the pandemic), according to youth unemployment data from Statscan. Between May and August this year, the unemployment rate for that demographic stood at 17.9 per cent. It was 18 per cent in the summer of 2009.

The market responded:

Market-implied odds of a quarter-point rate cut by the Bank of Canada this month surged to about 90% in the wake of weaker-than-expected jobs reports this morning in both Canada and the U.S. Most economists are also now expressing confidence a rate cut is coming.

…

Implied interest rate probabilities in overnight swaps markets now show about a 90% probability of a 25 basis point BoC cut on Sept. 17, up from about 75% prior to the data and about 65% on Thursday. Those market bets for a rate cut have been trending higher throughout this week, and were only at about 40% last week before a sluggish GDP reading was released for the second quarter on Friday. A series of dovish remarks from Federal Reserve officials and weak U.S. economic readings earlier this week had already been persuading traders to raise their bets for a rate cut in both the U.S. and Canada.

Market-based odds of a Federal Reserve rate cut on Sept. 17 (both central banks will make their policy decisions that day) also further rose following the release of the U.S. jobs data. Three Fed rate cuts are now priced into the market by the end of this year.

…

Meanwhile, U.S. and Canadian bond yields moved sharply lower across the curve. The U.S. 10-year bond yield was down about 10 basis points to 4.079% after the jobs reports, and the 2-year was also down by about 10 basis points.

Canada’s five-year yield, which is particularly closely watched because of its influence on fixed mortgage rates, was down about 9 basis points at 2.805% – its lowest level since the start of June.

…

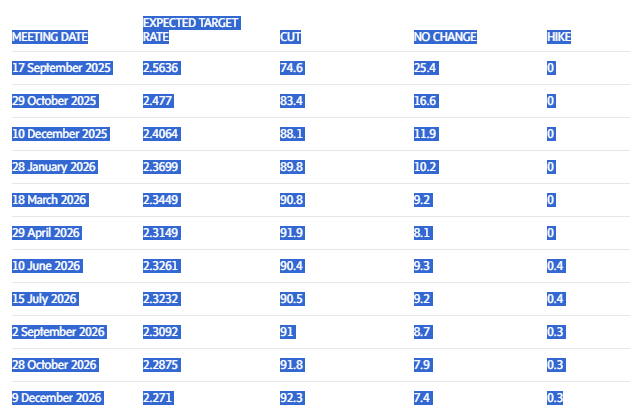

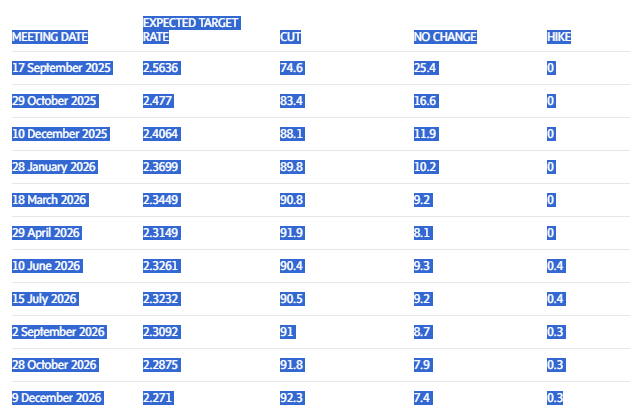

Here, in detail, is how implied probabilities of future interest rate moves stood in swaps markets moments for Canada after the jobs report Friday. The current overnight rate is 2.75 per cent. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves. As shown, markets are nearly fully pricing in 50 basis points of monetary easing by next spring.

Pre-Jobs Swaps Market

Post-Jobs Swaps Market

Bessent has floated the idea of taking regulatory authority away from the Fed:

Bessent wrote in the Wall Street Journal that the central bank has veered away from what he described as its core mission of promoting full employment, stable prices and moderate long-term interest rates.

President Donald Trump’s top economic official is doubling down on an idea he has trumpeted for months: The Fed has overstepped its bounds by taking on banking regulation, and that must stop.

“The Fed now regulates, lends to and sets the profitability calculus for the banks it oversees, an unavoidable conflict that blurs accountability and jeopardizes independence,” Bessent wrote. “There must also be an honest, independent, nonpartisan review of the entire institution, including monetary policy, regulation, communications, staffing and research.”

…

Though Powell has been critical of bank supervision and regulation all being under the purview of one member on the Fed’s Board of Governors designated as a vice chair.

“You’ve got a group of seven people on the board, and as appointments change, there’ll be some changes in the approach to regulation,” Powell told lawmakers during a hearing in February. “Putting it all in a single person, admittedly, just to recommend to the board can lead to some volatility … and that’s not great for the institutions we want to regulate.”

Fed Vice Chair for Supervision Michelle Bowman is currently the person at the central bank with that responsibility. Trump elevated her to that post earlier this year, and she has kicked off a comprehensive review of the capital requirements for the nation’s largest banks.

There will be, of course, a political angle to this suggestion, but this idea has been floating around for quite some time. I’ve previously written about it on PrefBlog … somewhere! … and while keeping an open mind am inclined to support the idea of separation of powers, simply on the grounds that a single institution shouldn’t have so much power.

As an example of the debate, I suggest The Supervisory Role of the Central Bank by PIERRE DUQUESNE:

It is quite naturally assumed nowadays that responsibility for monetary policy devolves upon the central bank. The question of who should be responsible for banking supervision, however, is much more controversial despite the historical backdrop concerning institutional responsibility. As Paul Volcker, former chairman of the Federal Reserve System, pointed out on the occasion of the one hundredth anniversary of the Banca d’ltalia, some central banks, like those of the United States and Italy, were “founded much more out of concern about banking stability than out of ideas about monetary policy as we know it today.”

…

The controversy over the role of the central bank centers on a basic question: is it preferable, for the effectiveness of monetary policy and banking supervision, that the institutions responsible for monetary policy and banking supervision be independent or come under the same joint authority, even be one and the same institution? The many different systems in existence reflect the history of individual institutions and the particular circumstances in each country. Neither economic theory nor an analysis of the institutional arrangements suggests that one particular model is objectively more effective than all others.

If one looks at the special features of the French system and compares them with the general principles underlying other countries’ arrangements, the wide range of possible approaches becomes apparent. But the French system seems to mix the advantages of having a banking supervisory function closely related to the central bank with those of it having a legal independent status. A further model (the planned European System of Central Banks, or ESCB) will add another element to this already complex picture.

Theoretical Issues in Banking Supervision

Theoretical analysis does not suggest that one institutional model for banking supervision is superior to all others.

And Miran proceeded along the confirmation process:

But Democrats questioned Miran’s ability to distance himself from Trump, should he be confirmed to become a Fed governor. Miran said Thursday he plans to technically remain an employee of the White House if he becomes Fed governor on a temporary basis.

He told lawmakers he would take a leave of absence from his current role as chair of the Council of Economic Advisers if his Fed term lasts only through January, but said he would resign if he remains for longer. He said he was advised to take that approach by legal counsel.

“You are going to be technically an employee of the President of United States, but an independent member of the board of the Federal Reserve. That’s ridiculous,” Democratic Sen. Jack Reed of Rhode Island said.

…

Before doing a complete 180 on his views about Fed independence, Miran, a Harvard-trained PhD economist, had challenged it in the recent past.

Last year, Miran co-authored a Manhattan Institute report that called the Fed’s independence an outdated “shibboleth,” and he called for shorter terms for Fed governors to give the president more power to hold sway over the agency.

The paper also criticized the revolving door of leaders between the White House and the Fed. Some senators characterized Miran’s nomination as ironic.

Sen. Tina Smith of Minnesota said “given the nature of your current role and your expressed concern in mind for insulating the Fed board members from the day-to-day political process, I just don’t understand how your nomination doesn’t break the rule or the goal that you’ve set out yourself.”

In response, Miran said his paper simply laid out proposals to reform the Fed and that “it’s important that we have democratic oversight.”

…

In response to a question posed by Sen. Andy Kim of New Jersey, Miran said he hasn’t been asked by Trump or anyone in the administration to vote for lower interest rates if he’s confirmed.

Sen. Elizabeth Warren of Massachusetts, the committee’s Democratic ranking member, also criticized Miran for coming “from a highly political role to a non-political role.” At one point, she pressed him to state that Trump lost the 2020 election, which he refused to state outright.

Miran is also one of the main architects of Trump’s aggressive trade policy. In a November 2024 paper, Miran detailed how a tariff-centric approach, aimed at weakening the dollar, could reshape the global trading system in favor of the United States. But if confirmed to be a Fed governor, Miran would no longer play a role in shaping the administration’s fiscal and trade policy.

Today, let’s have a special shout-out for LCS.PR.A! This issue was down 5.33% today … I guess that somebody noticed that it pays $0.70 p.a. and is set to mature 2029-4-27 at par. It almost certainly won’t actually mature, of course, it will just be extended at a new dividend rate – but you can’t really count on a 2029-4-27 price of more than about 10.25 or so, depending on how well the managers gauge the market. So it closed yesterday at 12.20, meaning that it had an expected capital loss slightly in excess of three years dividends, and only has a term of a little over 3.5 years. The close today was 11.55 … but even at a bid of 11.05, the yield to maturity ($10.00) is only 4.02%.

Drives me nuts. I can’t stand it. But nobody ever listens to me.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

6.69 % |

7.11 % |

37,882 |

13.34 |

1 |

0.0000 % |

2,459.7 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1002 % |

4,672.2 |

| Floater |

6.50 % |

6.87 % |

50,015 |

12.61 |

3 |

0.1002 % |

2,692.6 |

| OpRet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1786 % |

3,633.4 |

| SplitShare |

4.82 % |

4.59 % |

61,657 |

3.42 |

6 |

-0.1786 % |

4,339.0 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1786 % |

3,385.5 |

| Perpetual-Premium |

5.49 % |

3.46 % |

66,667 |

0.08 |

3 |

0.2253 % |

3,076.8 |

| Perpetual-Discount |

5.57 % |

5.68 % |

44,768 |

14.33 |

28 |

0.0941 % |

3,372.1 |

| FixedReset Disc |

5.91 % |

6.20 % |

114,676 |

13.33 |

32 |

-0.0209 % |

3,031.7 |

| Insurance Straight |

5.46 % |

5.45 % |

54,466 |

14.66 |

18 |

0.0196 % |

3,315.2 |

| FloatingReset |

5.15 % |

4.34 % |

43,812 |

0.15 |

1 |

0.0000 % |

3,811.0 |

| FixedReset Prem |

5.66 % |

5.03 % |

120,961 |

2.43 |

21 |

-0.0074 % |

2,628.0 |

| FixedReset Bank Non |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0209 % |

3,099.0 |

| FixedReset Ins Non |

5.25 % |

5.55 % |

71,718 |

14.33 |

15 |

2.2624 % |

3,053.6 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| SLF.PR.E |

Insurance Straight |

-3.66 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 20.81

Evaluated at bid price : 20.81

Bid-YTW : 5.42 % |

| BN.PR.R |

FixedReset Disc |

-3.54 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 19.60

Evaluated at bid price : 19.60

Bid-YTW : 6.63 % |

| CU.PR.G |

Perpetual-Discount |

-2.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 20.52

Evaluated at bid price : 20.52

Bid-YTW : 5.52 % |

| CU.PR.F |

Perpetual-Discount |

-1.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 20.80

Evaluated at bid price : 20.80

Bid-YTW : 5.45 % |

| BN.PF.I |

FixedReset Prem |

-1.22 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2027-03-31

Maturity Price : 25.00

Evaluated at bid price : 25.01

Bid-YTW : 6.07 % |

| MFC.PR.J |

FixedReset Ins Non |

1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 23.43

Evaluated at bid price : 24.90

Bid-YTW : 5.61 % |

| PWF.PR.L |

Perpetual-Discount |

1.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.35

Evaluated at bid price : 22.62

Bid-YTW : 5.70 % |

| SLF.PR.G |

FixedReset Ins Non |

2.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 18.42

Evaluated at bid price : 18.42

Bid-YTW : 5.86 % |

| BN.PF.E |

FixedReset Disc |

2.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 21.66

Evaluated at bid price : 22.00

Bid-YTW : 6.24 % |

| GWO.PR.G |

Insurance Straight |

2.58 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 23.58

Evaluated at bid price : 23.85

Bid-YTW : 5.45 % |

| GWO.PR.N |

FixedReset Ins Non |

11.88 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 17.90

Evaluated at bid price : 17.90

Bid-YTW : 5.86 % |

| IFC.PR.A |

FixedReset Ins Non |

31.22 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.06

Evaluated at bid price : 22.32

Bid-YTW : 5.32 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| FTS.PR.M |

FixedReset Disc |

89,610 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.65

Evaluated at bid price : 23.61

Bid-YTW : 5.74 % |

| FTS.PR.K |

FixedReset Disc |

77,400 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.24

Evaluated at bid price : 22.76

Bid-YTW : 5.60 % |

| BN.PF.H |

FixedReset Prem |

75,500 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2025-12-31

Maturity Price : 25.00

Evaluated at bid price : 25.31

Bid-YTW : 3.94 % |

| BN.PF.B |

FixedReset Disc |

67,200 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.69

Evaluated at bid price : 23.56

Bid-YTW : 6.13 % |

| MFC.PR.N |

FixedReset Ins Non |

42,214 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.56

Evaluated at bid price : 23.48

Bid-YTW : 5.52 % |

| TD.PF.E |

FixedReset Prem |

39,400 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2025-10-31

Maturity Price : 25.00

Evaluated at bid price : 25.03

Bid-YTW : 4.53 % |

| There were 10 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. |

| Issue |

Index |

Quote Data and Yield Notes |

| BN.PR.R |

FixedReset Disc |

Quote: 19.60 – 20.47

Spot Rate : 0.8700

Average : 0.5513

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 19.60

Evaluated at bid price : 19.60

Bid-YTW : 6.63 % |

| SLF.PR.E |

Insurance Straight |

Quote: 20.81 – 21.80

Spot Rate : 0.9900

Average : 0.7146

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 20.81

Evaluated at bid price : 20.81

Bid-YTW : 5.42 % |

| BN.PF.I |

FixedReset Prem |

Quote: 25.01 – 26.50

Spot Rate : 1.4900

Average : 1.2261

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2027-03-31

Maturity Price : 25.00

Evaluated at bid price : 25.01

Bid-YTW : 6.07 % |

| CU.PR.E |

Perpetual-Discount |

Quote: 22.18 – 23.50

Spot Rate : 1.3200

Average : 1.0741

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 21.94

Evaluated at bid price : 22.18

Bid-YTW : 5.55 % |

| MFC.PR.N |

FixedReset Ins Non |

Quote: 23.48 – 24.00

Spot Rate : 0.5200

Average : 0.2970

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.56

Evaluated at bid price : 23.48

Bid-YTW : 5.52 % |

| GWO.PR.Q |

Insurance Straight |

Quote: 23.15 – 24.36

Spot Rate : 1.2100

Average : 0.9920

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-09-05

Maturity Price : 22.88

Evaluated at bid price : 23.15

Bid-YTW : 5.56 % |