American real estate agents are going hungry:

Purchases of U.S. new homes fell in May to the lowest level on record after a tax credit expired, showing the market remains dependent on government support.

Sales collapsed an unprecedented 33 percent from April to an annual pace of 300,000, less than the median estimate of economists surveyed by Bloomberg News and the fewest in data going back to 1963, figures from the Commerce Department showed today in Washington. Demand in prior months was revised down.

Like the Fed says:

Business spending on equipment and software has risen significantly; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months.

…

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

But fear not! Fannie Mae is tightening standards:

Borrowers who have the means to make mortgage payments and don’t work with lenders to restructure loans will be banned from obtaining new mortgages backed by Fannie Mae for seven years from the date of foreclosure, the company said today in a statement.

…

Homeowners walking away from mortgages they can afford accounted for about 12 percent of U.S. mortgage defaults in February, New York-based Morgan Stanley said in an April report.

It would be much more to the point if non-recourse mortgages carried a penalty rate; but that would be too logical.

Argentina is showing Greece how it’s done:

The results of Argentina’s debt swap offer exceeded the government’s expectations and will help close a chapter on the country’s record $95 billion default in 2001, Economy Minister Amado Boudou said.

Creditors holding about $12.1 billion of $18.3 billion in defaulted debt tendered their securities in the restructuring, which Boudou said was the result of “hard” negotiating on the part of Argentina. Combined with the results of a 2005 restructuring, a total of 92.4 percent of the defaulted debt has been swapped for a mix of new bonds, he said.

…

The government has no fiscal need to issue debt and can wait until it is able to sell bonds that yield less than 10 percent, Boudou said.Yields on the country’s benchmark dollar bonds due in 2015 rose 11 basis points, or 0.11 percentage point, to 12.86 percent at 10:59 a.m. New York time.

The question is … will a serial defaulter ever be able to issue bonds at less than 10%?

All the money that’s being dropped on the G-20 is having an effect.

PerpetualDiscounts kept the streak alive in the Canadian preferred share market, gaining 11bp, while FixedResets were down 11bp. Volume was moderate.

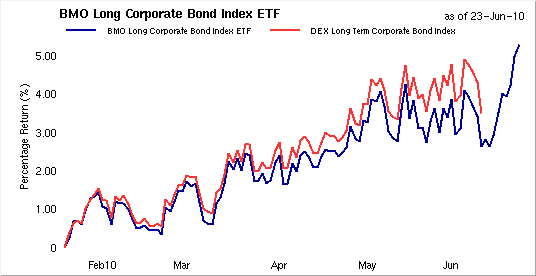

PerpetualDiscounts now yield 6.02%, equivalent to 8.43% interest at the standard equivalency factor of 1.4x. Long Corporates are now at about 5.55% so the pre-tax interest equivalent spread (also called the Seniority Spread) is now about 290bp, a significant widening from the +270bp reported on June 16 due to the sharp decline in long yields.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.72 % | 2.78 % | 32,522 | 20.51 | 1 | -0.9302 % | 2,097.6 |

| FixedFloater | 5.14 % | 3.29 % | 21,636 | 19.84 | 1 | 0.2369 % | 3,114.3 |

| Floater | 2.42 % | 2.79 % | 76,717 | 20.26 | 3 | -0.2939 % | 2,243.9 |

| OpRet | 4.86 % | 2.45 % | 89,246 | 0.08 | 11 | 0.2081 % | 2,337.5 |

| SplitShare | 6.30 % | 6.25 % | 95,689 | 3.49 | 2 | 0.1088 % | 2,200.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2081 % | 2,137.4 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1109 % | 1,911.0 |

| Perpetual-Discount | 5.94 % | 6.02 % | 196,645 | 13.88 | 77 | 0.1109 % | 1,808.9 |

| FixedReset | 5.42 % | 4.01 % | 331,957 | 3.46 | 45 | -0.1098 % | 2,182.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.B | Perpetual-Discount | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 19.21 Evaluated at bid price : 19.21 Bid-YTW : 6.10 % |

| BAM.PR.R | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 23.22 Evaluated at bid price : 25.35 Bid-YTW : 4.92 % |

| BAM.PR.N | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 17.95 Evaluated at bid price : 17.95 Bid-YTW : 6.66 % |

| GWO.PR.M | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 24.20 Evaluated at bid price : 24.40 Bid-YTW : 5.97 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.D | Perpetual-Discount | 87,336 | RBC crossed 72,200 at 18.35. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 18.34 Evaluated at bid price : 18.34 Bid-YTW : 6.10 % |

| BMO.PR.J | Perpetual-Discount | 57,838 | Desjardins crossed 30,200 at 19.88. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 19.82 Evaluated at bid price : 19.82 Bid-YTW : 5.75 % |

| BNS.PR.T | FixedReset | 42,768 | TD bought 13,100 from Nesbitt at 27.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.28 Bid-YTW : 4.04 % |

| CM.PR.K | FixedReset | 38,545 | RBC crossed 30,000 at 26.48. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 3.88 % |

| IAG.PR.E | Perpetual-Discount | 37,730 | Desjardins crossed 20,000 at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-06-23 Maturity Price : 24.78 Evaluated at bid price : 25.00 Bid-YTW : 6.03 % |

| BNA.PR.C | SplitShare | 32,700 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 20.00 Bid-YTW : 7.65 % |

| There were 27 other index-included issues trading in excess of 10,000 shares. | |||

[…] spread (also called the Seniority Spread) now stands at about 290bp, the same level reported on June 23, but a narrowing of 25bp from the 315bp spread reported on May […]