The IIAC has issued its 1Q08 Review of Equity New Issues and Trading, noting:

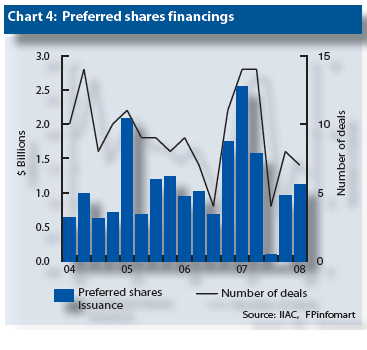

Preferred share issues were one of the brighter spots in the quarter – increasing by 17% from last quarter and raising $1.1 billion in capital on just seven offerings. This is attributed to financial institutions re-strengthening their capital base (Chart 4).

They report that the $1.1-billion in seven issues is down 56.5% by dollar value and 50% by number from 1Q07. I have previously suggested that heavy issuance in 1H07 was at least partly responsible for 2007’s horrible performance.

Hat tip: Streetwise Blog.